Your Ultimate Guide to Sourcing Peplum Dress Dress

Guide to Peplum Dress Dress

- Introduction: Navigating the Global Market for peplum dress dress

- Understanding peplum dress dress Types and Variations

- Key Industrial Applications of peplum dress dress

- Strategic Material Selection Guide for peplum dress dress

- In-depth Look: Manufacturing Processes and Quality Assurance for peplum dress dress

- Comprehensive Cost and Pricing Analysis for peplum dress dress Sourcing

- Spotlight on Potential peplum dress dress Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for peplum dress dress

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the peplum dress dress Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of peplum dress dress

- Strategic Sourcing Conclusion and Outlook for peplum dress dress

Introduction: Navigating the Global Market for peplum dress dress

The peplum dress has emerged as a versatile and stylish staple within the global fashion landscape, combining elegance with a flattering silhouette that appeals to diverse markets. For international B2B buyers, particularly those operating in dynamic regions such as Africa, South America, the Middle East, and Europe, understanding the nuances of sourcing peplum dresses is crucial to capitalizing on growing consumer demand and differentiating product offerings.

This guide serves as an authoritative resource designed to equip buyers with comprehensive insights into the peplum dress market. It covers essential aspects including various styles and fabric options, manufacturing best practices, stringent quality control measures, and strategic supplier selection. Additionally, it provides an in-depth analysis of cost structures and market trends, tailored to meet the unique challenges and opportunities faced by buyers in emerging and established markets like Colombia and Thailand.

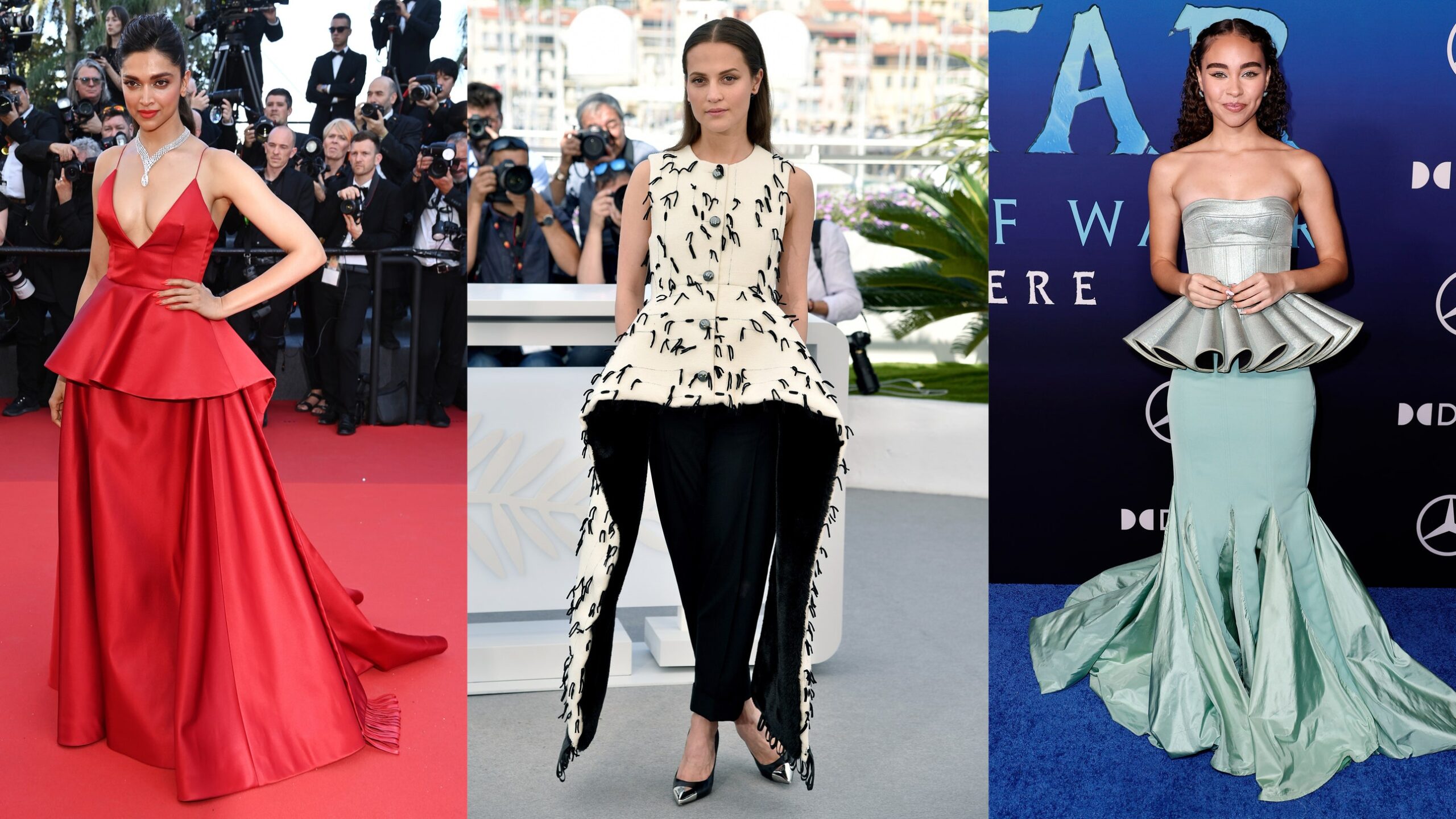

Illustrative Image (Source: Google Search)

By leveraging this guide, B2B buyers will gain actionable knowledge to streamline their sourcing strategies, mitigate risks associated with supply chain disruptions, and ensure compliance with international standards. Whether scaling operations or introducing new collections, the information provided empowers buyers to make informed decisions that enhance competitiveness and profitability in the fast-evolving fashion sector. Ultimately, this resource is a vital tool for those committed to sourcing peplum dresses that resonate with global consumers while maintaining operational excellence.

Understanding peplum dress dress Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Classic Peplum Dress | Fitted bodice with a flared, ruffled waist layer | Corporate wear, formal events, boutique retail | Timeless appeal; versatile but may require precise sizing |

| Asymmetric Peplum | Peplum hem with uneven or angled cuts | Fashion-forward retail, high-end boutiques | Trendy and unique; higher production complexity and cost |

| Double-layered Peplum | Two-tiered peplum layers for added volume | Evening wear, luxury markets, special occasions | Dramatic silhouette; may limit mass-market appeal |

| Peplum Dress with Belt | Peplum accent combined with a cinching belt | Casual and semi-formal markets, department stores | Adjustable fit; added accessory cost and inventory management |

| Minimalist Peplum | Subtle, streamlined peplum detail | Contemporary fashion lines, export-oriented brands | Modern aesthetic; may not suit traditional markets |

Classic Peplum Dress

The classic peplum dress features a fitted bodice with a structured, flared waist ruffle that accentuates the silhouette. This style is highly versatile, appealing to formal and corporate sectors worldwide, including African and European markets where professional attire is key. For B2B buyers, sourcing this type requires attention to fabric quality and sizing accuracy to ensure consistent fit across diverse body types. Its timeless nature ensures steady demand, making it a reliable staple for wholesale portfolios.

Asymmetric Peplum

Characterized by an uneven or angled peplum hem, this variation caters to trend-conscious consumers, often found in high-end boutiques and fashion-forward retailers. Buyers targeting markets such as South America and the Middle East can leverage this style to differentiate their offerings. However, the complexity of asymmetric patterns demands skilled manufacturing, potentially increasing lead times and costs. B2B buyers should evaluate supplier capabilities closely to maintain quality and design integrity.

Double-layered Peplum

This style incorporates two tiers of peplum layers, creating a voluminous and dramatic effect suitable for evening wear and luxury segments. It appeals to niche markets looking for statement pieces, especially in upscale European and Middle Eastern markets. While visually striking, the double-layered design requires more fabric and intricate construction, impacting pricing and inventory management. Buyers must balance exclusivity with scalability when including this variation in their product mix.

Peplum Dress with Belt

Combining the peplum silhouette with a cinching belt offers an adjustable fit and added styling versatility. This type performs well in casual and semi-formal segments, popular in department stores and mass-market channels across Africa and South America. The inclusion of belts introduces additional SKUs and accessory inventory considerations. Buyers should factor in accessory sourcing and bundling strategies to optimize supply chain efficiency.

Minimalist Peplum

Featuring a subtle and streamlined peplum detail, this variation aligns with contemporary fashion trends emphasizing simplicity and elegance. It suits export-oriented brands targeting modern consumers in Europe and emerging markets like Thailand. The minimalist approach reduces production complexity and material usage, offering cost advantages. However, buyers should assess market preferences carefully, as minimalist styles may not resonate in regions favoring more ornate designs.

Related Video: HOW TO MAKE A FLOUNCE PEPLUM DRESS | PENCIL DRESS | PRINCESS DART DRESS | FULLY LINED DRESS

Key Industrial Applications of peplum dress dress

| Industry/Sector | Specific Application of Peplum Dress Dress | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Fashion Retail & Wholesale | Seasonal and Trend-Driven Collections | Enhances product diversity, meets evolving consumer trends | Quality fabric sourcing, trend alignment, reliable supplier lead times |

| Corporate Uniform Suppliers | Professional attire for female staff in corporate sectors | Balances style and formality, promotes brand identity | Consistent sizing, durable materials, customization capabilities |

| Event Management & Hospitality | Staff uniforms for upscale events and hotel staff | Elevates brand image, comfortable for long wear | Fabric breathability, ease of maintenance, supplier flexibility |

| Export & International Trade | Bulk orders for global fashion markets | Access to diverse markets, economies of scale | Compliance with regional regulations, ethical sourcing, logistics efficiency |

| Boutique & Specialty Fashion | Custom-designed peplum dresses for niche markets | Unique product offerings, premium pricing potential | Fabric exclusivity, craftsmanship quality, small batch production |

The Fashion Retail & Wholesale sector heavily utilizes peplum dresses in seasonal collections to capture the latest trends. For international buyers, especially from regions like South America and Europe, sourcing suppliers who can quickly adapt to fashion cycles is critical. Buyers must prioritize suppliers offering high-quality fabrics and timely deliveries to avoid stockouts and meet consumer demand shifts efficiently.

In Corporate Uniform Suppliers, peplum dresses serve as stylish yet professional attire for female employees in banks, airlines, and corporate offices. This application requires garments that maintain a formal look while offering comfort. B2B buyers in the Middle East and Africa should focus on suppliers who provide consistent sizing, durable fabrics, and customization options to incorporate company branding seamlessly.

The Event Management & Hospitality industry adopts peplum dresses for staff uniforms at luxury hotels, conferences, and upscale events. Here, the emphasis is on garment comfort for long shifts and maintaining an elegant appearance that aligns with the brand’s prestige. Sourcing considerations include breathable, easy-care fabrics and suppliers capable of flexible order volumes, which is vital for buyers in regions with fluctuating event calendars like Thailand and Colombia.

For Export & International Trade, peplum dresses are sourced in bulk to supply global fashion markets. Buyers targeting diverse regions must ensure compliance with local regulations such as textile safety standards and ethical labor practices. Efficient logistics and reliable supplier partnerships are crucial to manage shipping timelines and reduce costs, especially for African and European importers.

Lastly, in Boutique & Specialty Fashion, peplum dresses are crafted for niche markets seeking unique, high-end designs. Buyers must prioritize exclusivity in fabric choices and superior craftsmanship, often requiring small batch production runs. This application appeals to discerning markets in Europe and South America, where premium pricing is justified by quality and design differentiation.

Related Video: How to Cut and Sew a Stylish Peplum Dress: Easy Cutting and sewing tutorial.

Strategic Material Selection Guide for peplum dress dress

When selecting materials for peplum dresses in a B2B context, understanding the fabric properties, manufacturing implications, and regional preferences is essential for sourcing decisions. The following analysis covers four common materials widely used for peplum dress production: Cotton, Polyester, Silk, and Linen. Each material offers distinct advantages and challenges that impact product performance, cost, and market acceptance across Africa, South America, the Middle East, and Europe.

Cotton

Key Properties:

Cotton is a natural fiber known for its breathability, softness, and moisture absorption. It performs well in warm climates due to its temperature regulation properties and is relatively durable under normal wear conditions.

Pros & Cons:

Cotton is widely favored for its comfort and hypoallergenic nature, making it suitable for everyday and casual peplum dresses. It is cost-effective and easy to dye, supporting vibrant colors and patterns. However, cotton wrinkles easily and can shrink if not pre-treated, which may increase manufacturing complexity. It also has moderate durability compared to synthetic fibers.

Impact on Application:

Cotton’s high breathability makes it ideal for hot and humid regions like parts of Africa and South America. However, it may not perform well in high-moisture environments without treatment. Its natural fiber status aligns well with sustainability trends, appealing to European and Middle Eastern markets with growing demand for eco-friendly textiles.

International B2B Considerations:

Buyers should verify compliance with global standards such as OEKO-TEX and GOTS certification to ensure organic and chemical-free cotton sourcing. African and South American suppliers often provide competitively priced cotton fabrics, but quality consistency can vary. European buyers may prioritize certified organic cotton, while Middle Eastern markets may focus on blends that reduce transparency and enhance modesty.

Polyester

Key Properties:

Polyester is a synthetic fiber known for its strength, wrinkle resistance, and quick-drying properties. It has excellent dimensional stability and resistance to shrinking and stretching.

Pros & Cons:

Polyester is highly durable, cost-effective, and easy to maintain, making it a popular choice for mass production of peplum dresses. It retains shape well and resists mildew and abrasion. However, it is less breathable than natural fibers and can feel less comfortable in hot climates. Polyester production has a higher environmental impact, which may affect buyer preference in sustainability-conscious markets.

Impact on Application:

Polyester suits peplum dresses intended for formal or office wear due to its crisp appearance and low maintenance. It performs well in varied climates but may require blending with natural fibers to improve comfort in tropical regions like Thailand or Colombia.

International B2B Considerations:

Compliance with standards such as ASTM D123 or ISO 2076 for synthetic fibers is important. Buyers in Europe and the Middle East often seek recycled polyester to meet sustainability goals. African and South American markets may prioritize cost and availability, making polyester a pragmatic choice for volume orders.

Silk

Key Properties:

Silk is a natural protein fiber prized for its luxurious sheen, softness, and excellent drape. It has moderate tensile strength and good moisture-wicking properties but is sensitive to sunlight and abrasion.

Pros & Cons:

Silk offers a premium look and feel, ideal for high-end peplum dresses and special occasions. It is lightweight and breathable but expensive and requires delicate handling during manufacturing. Silk garments demand careful care and have limited durability compared to synthetic alternatives.

Impact on Application:

Silk is preferred in markets valuing luxury and exclusivity, such as Europe and the Middle East. It suits climates with moderate temperatures but may be less practical in humid or rough-use environments common in parts of Africa and South America.

International B2B Considerations:

Buyers should ensure silk sourcing complies with ethical standards and certifications like the Silk Mark (India) or equivalent quality marks. Import regulations and tariffs on luxury textiles vary, so understanding regional trade agreements is critical. Silk blends with synthetic fibers can offer cost-effective alternatives while maintaining aesthetic appeal.

Linen

Key Properties:

Linen, made from flax fibers, is a natural fabric known for its strength, breathability, and moisture-wicking capabilities. It has a crisp texture and natural luster but wrinkles easily.

Pros & Cons:

Linen is highly durable and ideal for warm climates due to its cooling properties. It is biodegradable and aligns with sustainability trends. However, it can be stiff and prone to creasing, which may affect the silhouette of peplum designs. Manufacturing linen requires skilled handling, increasing production complexity.

Impact on Application:

Linen is favored for casual and resort-style peplum dresses, especially in hot regions like Africa and South America. Its natural look appeals to eco-conscious consumers in Europe and the Middle East. However, its tendency to wrinkle may limit use in formal wear.

International B2B Considerations:

Buyers should verify linen fabric certifications such as OEKO-TEX and ensure compliance with regional textile labeling laws. Sourcing from European flax producers offers high-quality linen but at a premium price. African and South American suppliers may offer competitively priced linen with variable quality.

| Material | Typical Use Case for peplum dress dress | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Cotton | Casual and everyday wear, warm climates | Breathable, comfortable, widely available | Prone to wrinkling and shrinking | Low |

| Polyester | Formal and office wear, high durability needs | Durable, wrinkle-resistant, cost-effective | Less breathable, environmental concerns | Low |

| Silk | Luxury and special occasion dresses | Luxurious feel, excellent drape | Expensive, delicate care, less durable | High |

| Linen | Casual, resort wear, hot climates | Strong, breathable, eco-friendly | Wrinkles easily, stiffer hand feel | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for peplum dress dress

Manufacturing Processes for Peplum Dress

The production of peplum dresses involves a series of carefully coordinated stages to ensure the garment’s distinctive silhouette, quality, and durability. For B2B buyers sourcing internationally—especially from regions like Africa, South America, the Middle East, and Europe—it is critical to understand these processes to evaluate supplier capabilities and ensure product consistency.

1. Material Preparation

Material preparation is the foundational step, involving selection, inspection, and pre-treatment of fabrics and trims. Peplum dresses typically use materials like cotton blends, polyester, silk, or stretch fabrics to achieve the desired fit and flare. Suppliers must:

- Source high-quality textiles compliant with environmental and safety standards (e.g., OEKO-TEX, GOTS for organic fabrics).

- Conduct fabric inspection using standardized fabric inspection machines or manual methods to detect defects such as color inconsistencies, weaving faults, or shrinkage.

- Pre-treat fabrics through processes like washing, dyeing, or heat-setting to stabilize the material and enhance color fastness.

This stage is crucial for avoiding downstream defects and ensuring the garment’s shape retention and comfort.

2. Pattern Making and Cutting

The defining element of a peplum dress is the flared, gathered, or pleated ruffle attached at the waist. This complexity requires precise pattern making and cutting:

- Pattern design is created digitally or manually, incorporating the peplum’s flare and body fit.

- Cutting is often performed using automated cutting machines (CNC cutters) for accuracy and efficiency, especially for bulk orders.

- Fabric layers are stacked carefully to maintain alignment, and cutting is optimized to reduce waste—a key consideration for sustainable manufacturing.

Precision here impacts the final garment fit and fabric utilization, directly affecting cost and quality.

3. Sewing and Assembly

Assembly is the most labor-intensive stage, involving multiple specialized sewing techniques:

- Seaming involves joining the bodice, skirt, and peplum flare with reinforced stitching to maintain structure.

- Gathering or pleating the peplum requires skilled operators to create uniform folds, which are then attached to the waistline.

- Inserting zippers, buttons, or hooks for closures, ensuring both aesthetics and functionality.

- Use of overlock machines to finish raw edges, preventing fraying.

Manufacturers with strong technical expertise and quality sewing equipment produce peplum dresses that maintain shape and durability during wear.

4. Finishing

The finishing stage ensures the garment’s presentation and readiness for market:

- Pressing and steaming to shape the peplum and smooth seams.

- Attachment of labels and tags, including care instructions compliant with destination country regulations.

- Final trimming of loose threads and quality touch-ups.

- Packaging adapted for transport, often including folding with protective tissue to preserve shape.

This stage is essential to meet buyer expectations on appearance and brand presentation.

Quality Assurance and Control (QA/QC) for Peplum Dress Production

For B2B buyers, particularly those operating in diverse regulatory environments across Africa, South America, the Middle East, and Europe, understanding quality assurance frameworks and checkpoints is vital to minimize risks and ensure compliance.

International and Industry Standards

- ISO 9001: The global benchmark for quality management systems, ISO 9001 certification indicates that a manufacturer maintains consistent production processes, documentation, and continuous improvement practices.

- OEKO-TEX Standard 100: Relevant for textile safety, ensuring fabrics are free from harmful substances—a critical concern for international markets.

- REACH Compliance (Europe): Restricts hazardous chemicals in textiles and accessories, mandatory for EU buyers.

- Fair Labor and Ethical Sourcing Certifications: Such as SA8000 or Fair Trade, increasingly demanded by ethical-conscious buyers.

B2B buyers should verify supplier certifications as part of their due diligence to ensure product safety, regulatory compliance, and social responsibility.

QC Checkpoints and Testing Methods

Quality control is segmented into three main checkpoints during production:

- Incoming Quality Control (IQC): Inspection of raw materials (fabric, trims) for defects, color matching, and compliance with specifications before production begins.

- In-Process Quality Control (IPQC): Ongoing monitoring during sewing and assembly, checking seam strength, stitch density, peplum flare uniformity, and dimensional accuracy.

- Final Quality Control (FQC): Comprehensive checks on finished products, including fit, appearance, color fastness, and functional testing (e.g., zipper functionality, button strength).

Common testing methods include:

- Colorfastness tests to assess resistance to washing, rubbing, and light exposure.

- Tensile and seam strength tests to verify durability.

- Dimensional stability tests for shrinkage after laundering.

- Visual inspections for defects, such as uneven gathers or stitching flaws.

Verifying Supplier QC for International B2B Buyers

To ensure suppliers meet quality expectations, buyers should implement the following strategies:

- Factory Audits: On-site or third-party audits to assess manufacturing capabilities, QC procedures, labor conditions, and compliance with standards. Audits can be tailored for specific regions, considering local regulatory nuances.

- Review of QC Reports: Suppliers should provide detailed inspection reports with photographic evidence at IQC, IPQC, and FQC stages.

- Third-Party Inspections: Independent quality inspection agencies can perform random checks before shipment, providing unbiased quality assessments.

- Sample Approvals: Prior to mass production, buyers should approve prototypes or pre-production samples to confirm design, fit, and material quality.

Buyers from markets like Colombia, Thailand, or the UAE should emphasize documentation and traceability to navigate import regulations and consumer safety laws effectively.

QC and Compliance Nuances for Different Regions

- Africa: Emerging markets often emphasize durability and affordability. Buyers should verify fabric quality and sewing robustness due to harsh climatic conditions and variable consumer preferences.

- South America: Compliance with environmental regulations and sustainable sourcing is growing in importance. Certification like OEKO-TEX and organic labeling may be required.

- Middle East: Stringent import regulations and modest fashion considerations necessitate precise adherence to sizing, fabric opacity, and labeling requirements.

- Europe: The EU’s strict chemical and safety standards demand thorough compliance with REACH and ISO certifications. Ethical labor practices are also heavily scrutinized.

Understanding these regional nuances helps buyers tailor their supplier evaluation criteria and avoid costly compliance failures or market rejections.

Key Takeaways for B2B Buyers

- Assess supplier manufacturing capabilities by reviewing their material sourcing, pattern precision, skilled sewing, and finishing processes.

- Demand comprehensive QC documentation and certifications aligned with your target market’s regulations.

- Engage in factory audits and third-party inspections to independently verify quality and compliance.

- Factor in regional regulatory and consumer expectations when selecting suppliers to ensure smooth market entry and customer satisfaction.

By deeply understanding the manufacturing and quality assurance landscape of peplum dresses, international B2B buyers can confidently source products that meet high standards of quality, compliance, and market relevance.

Related Video: Amazing Garment Manufacturing Process from Fabric to Finished Product Inside the Factory

Comprehensive Cost and Pricing Analysis for peplum dress dress Sourcing

When sourcing peplum dresses on a B2B scale, understanding the intricate cost structure and pricing dynamics is crucial for international buyers aiming to optimize their procurement strategy. The overall cost encompasses multiple components, each influencing the final price and impacting sourcing decisions.

Key Cost Components

- Materials: Fabric quality and type (e.g., cotton, polyester blends, silk) significantly impact costs. Premium or sustainable fabrics command higher prices. Additional materials include zippers, buttons, threads, and embellishments specific to peplum styles.

- Labor: Labor costs vary widely by manufacturing location. Countries with lower wage rates may offer competitive pricing but require scrutiny for ethical labor practices and quality consistency.

- Manufacturing Overhead: Includes factory utilities, equipment depreciation, and indirect labor. Efficient factories with advanced machinery may have higher overhead but deliver better quality and faster turnaround.

- Tooling and Setup: Initial setup costs for patterns, molds, and dies affect pricing, especially for custom designs or small batch runs. These are often amortized over order volume.

- Quality Control (QC): Essential to ensure defect-free products, QC adds cost but reduces returns and reputational risks. Buyers should factor in inspections, testing, and certifications.

- Logistics: Freight charges, customs duties, taxes, and insurance all contribute to landed cost. Air freight is faster but costlier than sea freight, which can delay delivery.

- Supplier Margin: Suppliers add a profit margin to cover business risks and sustain operations. This margin varies by supplier reputation, exclusivity, and service level.

Influencers on Pricing

- Order Volume / Minimum Order Quantity (MOQ): Larger volumes typically reduce per-unit costs due to economies of scale. Buyers from Africa, South America, the Middle East, and Europe should negotiate MOQs aligned with market demand and storage capacity.

- Specifications and Customization: Unique designs, intricate peplum cuts, embroidery, or custom colorways increase costs. Standardized models are more cost-effective.

- Material Quality and Certifications: Organic or certified sustainable fabrics increase raw material costs but can justify premium pricing in markets valuing ethical fashion.

- Supplier Location and Capability: Suppliers in Asia (e.g., Thailand) may offer competitive pricing but require careful vetting for quality and compliance. European suppliers often have higher costs but offer faster shipping and strict adherence to regulations.

- Incoterms: Terms like FOB (Free On Board), CIF (Cost, Insurance, Freight), or DDP (Delivered Duty Paid) affect who bears logistics and customs costs, influencing total price and risk exposure.

Practical Buyer Tips for Cost-Efficient Sourcing

- Negotiate Beyond Price: Discuss payment terms, lead times, and packaging to unlock hidden value. For example, flexible payment schedules can ease cash flow.

- Consider Total Cost of Ownership (TCO): Evaluate all expenses from production to delivery, including potential tariffs or quality rework costs, rather than focusing solely on unit price.

- Leverage Volume Flexibility: Consolidate orders or collaborate with other buyers to meet MOQs and gain bulk discounts without overstocking.

- Prioritize Supplier Transparency: Request detailed cost breakdowns to identify negotiation levers and avoid unexpected charges.

- Adapt to Regional Nuances: African and South American buyers should account for longer shipping times and customs delays, building buffer periods into procurement plans. Middle Eastern buyers may face specific import regulations requiring compliance checks.

- Validate Quality and Certifications: Insist on samples and certifications to ensure materials and labor standards meet target market expectations, especially in Europe where compliance is stringent.

Indicative Pricing Disclaimer

Pricing for peplum dresses varies widely depending on the factors above. For rough guidance, wholesale prices can range from $10 to $50 per unit based on fabric quality, order size, and production country. Buyers should obtain multiple quotes and conduct thorough due diligence to establish accurate cost estimates tailored to their sourcing scenario.

By dissecting cost components and pricing influencers, international B2B buyers can craft informed sourcing strategies that balance quality, cost-efficiency, and compliance, ultimately strengthening their competitive position in diverse global markets.

Spotlight on Potential peplum dress dress Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘peplum dress dress’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for peplum dress dress

Key Technical Properties for Peplum Dresses

When sourcing peplum dresses, understanding the critical technical specifications ensures product quality and consistency. These properties directly impact manufacturing, pricing, and market suitability, especially for buyers across diverse regions like Africa, South America, the Middle East, and Europe.

-

Fabric Quality and Composition

The material grade—commonly cotton blends, polyester, or silk—determines durability, comfort, and appearance. For B2B buyers, confirming fabric composition (e.g., 60% cotton, 40% polyester) and quality certifications (OEKO-TEX, GOTS) ensures compliance with regional standards and customer expectations. Fabric weight (gsm) also affects drape and structure, crucial for the peplum’s silhouette. -

Colorfastness and Dye Quality

Color retention after washing and exposure to sunlight is vital for maintaining product appeal. Buyers should request colorfastness test results to minimize returns and complaints, especially in regions with strong sunlight or where frequent washing is common. -

Stitching and Seam Tolerance

Precise seam allowances and stitching quality affect the garment’s fit and longevity. Industry-standard tolerance is typically ±0.5 cm on seams. Buyers should specify acceptable tolerance levels to ensure consistent sizing, which reduces quality control issues and returns. -

Peplum Flare and Length Specifications

The peplum detail varies by style—flare angle, length from waist, and volume influence the dress’s fashion appeal. Clear technical drawings or samples with exact measurements help align supplier output with market preferences. -

Trim and Embellishment Standards

Buttons, zippers, and decorative elements must meet durability and safety standards. Buyers should verify that trims are securely attached and comply with regulations such as REACH in Europe or CPSIA in the US to avoid legal complications. -

Packaging Requirements

Proper packaging protects dresses during transit and influences buyer satisfaction. Specifications may include polybag type, folding method, and labeling details tailored to the target market.

Essential Trade Terminology for International Dress Sourcing

Familiarity with common trade terms enhances communication efficiency and reduces misunderstandings in international B2B transactions.

-

OEM (Original Equipment Manufacturer)

Refers to suppliers who manufacture products based on the buyer’s designs and specifications. For peplum dresses, OEM arrangements allow buyers to maintain brand identity while leveraging supplier production capabilities. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce or sell per order. MOQs vary widely by supplier and impact inventory investment and pricing strategies. Buyers from emerging markets should negotiate MOQs aligned with their market size and cash flow. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers requesting detailed pricing, lead times, and terms for specific product requirements. An effective RFQ includes technical specs, quantities, and delivery expectations, enabling accurate supplier comparisons. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyer and seller. Common terms include FOB (Free on Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Understanding Incoterms helps buyers manage logistics risks and costs effectively. -

Lead Time

The total time from order confirmation to product delivery. Accurate lead time estimation is critical to meet seasonal demand and avoid stockouts, particularly in fast-moving fashion categories like peplum dresses. -

Tech Pack

A comprehensive document detailing design, measurements, materials, and construction instructions. A well-prepared tech pack streamlines production and minimizes errors, essential for consistent quality across batches.

By mastering these technical properties and trade terms, international B2B buyers can improve supplier negotiations, ensure product quality, and optimize supply chain operations for peplum dresses tailored to their target markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the peplum dress dress Sector

Market Overview & Key Trends

The global peplum dress market is experiencing dynamic growth driven by evolving fashion preferences, increased digitalization, and expanding international trade. For B2B buyers in regions such as Africa, South America, the Middle East, and Europe, understanding these market drivers is essential to capitalize on sourcing opportunities and meet diverse consumer demands.

Key Market Drivers:

– Rising Demand for Versatile Apparel: The peplum dress, characterized by its flared waist detail, appeals widely due to its flattering silhouette suitable for various occasions, from corporate wear to casual outings. This versatility fuels demand in emerging markets like Colombia and Thailand, where fashion-conscious consumers seek stylish yet adaptable garments.

– Digital Transformation in Sourcing: Adoption of B2B platforms and virtual showrooms has accelerated cross-border transactions. Buyers can now efficiently discover suppliers, negotiate terms, and monitor production progress, reducing lead times and enhancing transparency.

– Customization and Agile Manufacturing: Fast-changing fashion trends require suppliers to offer flexible production runs and customization options. Agile manufacturing processes allow for rapid design adaptations, a critical advantage for buyers targeting markets with seasonal or trend-sensitive demand fluctuations.

– Regional Market Dynamics: In Africa and the Middle East, growing middle-class populations and increased urbanization drive demand for contemporary, modest, and culturally attuned fashion, where peplum dresses fit well. European buyers emphasize quality and sustainability, influencing supplier selection and product specifications.

Emerging Sourcing Trends:

– Nearshoring & Diversified Supply Chains: To mitigate geopolitical risks and shipping delays, buyers are exploring nearshoring options or diversifying supplier bases across Asia, Europe, and Latin America. This approach enhances supply chain resilience and reduces dependency on single regions.

– Technology-Enabled Transparency: Blockchain and AI-powered analytics are gaining traction to ensure traceability, demand forecasting accuracy, and inventory optimization, empowering buyers to make data-driven sourcing decisions.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone of responsible sourcing in the peplum dress sector, reflecting increasing global regulatory pressures and consumer demand for eco-conscious products. For international B2B buyers, integrating sustainability into sourcing strategies is no longer optional but essential for long-term competitiveness and brand reputation.

Environmental Impact Considerations:

– The textile and apparel industry is a significant contributor to water consumption, chemical use, and carbon emissions. Peplum dresses, often made from synthetic or blended fabrics, pose challenges related to microplastic pollution and non-biodegradability. Buyers should prioritize suppliers that use organic cotton, recycled polyester, or innovative low-impact materials to reduce environmental footprints.

– Water-efficient dyeing processes and closed-loop manufacturing systems are increasingly adopted by forward-thinking suppliers, minimizing waste and effluent discharge.

Ethical Supply Chain Practices:

– Ensuring fair labor conditions, safe working environments, and compliance with international labor standards (e.g., SA8000, Fair Trade) is critical, especially when sourcing from developing regions. Buyers should demand transparent audits and certifications to verify ethical compliance.

– Collaborative partnerships that emphasize capacity building and community development enhance supplier relationships and foster social sustainability.

Green Certifications & Materials:

– Certifications such as GOTS (Global Organic Textile Standard), OEKO-TEX, and Bluesign provide credible assurance of environmentally sound and socially responsible production. B2B buyers should prioritize suppliers holding these certifications to meet stringent market requirements in Europe and North America.

– Innovations like biodegradable fabrics, plant-based dyes, and zero-waste pattern making are becoming differentiators in the peplum dress segment, appealing to sustainability-conscious buyers and end consumers alike.

Evolution and Historical Context

The peplum dress traces its roots to classical fashion, with the peplum detail—a short, gathered, or pleated strip of fabric attached at the waist—originating in ancient Greek and Roman garments. This design element was revived periodically in fashion history, notably in the 1940s and 1980s, as a symbol of elegance and femininity.

For B2B buyers, understanding this cyclical nature is valuable as it underscores the peplum dress’s enduring appeal and adaptability. Modern iterations combine traditional silhouettes with contemporary fabrics and sustainability innovations, enabling suppliers to cater to both nostalgic and progressive market segments. This historical resonance adds marketing value and helps buyers position their product lines strategically in diverse international markets.

Related Video: International Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of peplum dress dress

-

How can I effectively vet suppliers of peplum dresses to ensure reliability and quality?

To vet suppliers, start by requesting detailed company profiles, certifications, and production capacity documents. Verify their factory audits and compliance with international standards such as ISO or OEKO-TEX. Ask for samples to assess fabric quality, stitching, and finishing. Utilize third-party inspection services, especially for suppliers in new markets like Africa or South America. Additionally, check references from other B2B buyers and review online feedback. Establishing clear communication channels and visiting the supplier’s facility, if possible, can further ensure transparency and trustworthiness. -

What customization options are typically available for peplum dress orders in B2B sourcing?

Most manufacturers offer extensive customization including fabric type, color, size range, embellishments, and pattern design. Buyers can also request private labeling or custom tags to enhance brand identity. For international buyers, it’s crucial to clarify technical details upfront and provide precise tech packs or design sketches. Confirm the supplier’s capability for small batch customizations if you require varied styles. Discuss lead times and cost implications for custom designs to align expectations and avoid delays. -

What are typical minimum order quantities (MOQs) and lead times for peplum dress wholesale orders?

MOQs vary widely depending on the supplier and product complexity but generally range from 100 to 500 units per style. Suppliers in regions like the Middle East or Europe might offer lower MOQs for premium or niche products. Lead times typically span 30 to 90 days, influenced by order size, customization, and current supply chain conditions. Buyers should negotiate MOQs early and consider buffer times for shipping and customs clearance, especially when sourcing from distant regions such as Thailand or Colombia.

Illustrative Image (Source: Google Search)

-

Which payment terms are common and safest for international B2B transactions in apparel sourcing?

Common payment terms include 30% upfront deposit with the balance paid upon shipment or after passing quality inspection. Letters of Credit (LC) and Escrow services provide added security for both parties. For new suppliers, using secure platforms or third-party escrow can mitigate risks. Buyers from Africa, South America, or the Middle East should also consider currency fluctuations and international banking restrictions. Establish clear terms in contracts and confirm payment schedules to avoid disputes. -

What quality assurance measures should I expect from peplum dress suppliers?

Reliable suppliers implement multiple quality control stages: raw material inspection, in-line production checks, and final product audits. They should provide certifications such as ISO 9001 or compliance with local textile regulations. Request detailed inspection reports and photos before shipment. Some suppliers offer third-party quality inspections or allow buyers to appoint independent auditors. Clear quality benchmarks and defect tolerance levels should be agreed upon contractually to ensure product consistency. -

Are there specific certifications or standards I should require from peplum dress manufacturers?

Yes, certifications such as OEKO-TEX Standard 100 for harmful substances, GOTS for organic textiles, and Fair Trade for ethical labor practices are highly recommended. Compliance with REACH (Europe) or CPSIA (US) chemical regulations ensures product safety for global markets. For buyers focusing on sustainability, certifications confirming eco-friendly dyes and recycled materials add value. Insisting on these certifications helps maintain brand reputation and meet regulatory requirements in different regions. -

What logistical challenges should international buyers anticipate when importing peplum dresses?

Common challenges include customs clearance delays, fluctuating freight costs, and coordination of multimodal transport (sea, air, road). Buyers should verify that suppliers provide accurate documentation such as commercial invoices, packing lists, and certificates of origin. For markets in Africa or South America, port congestion and local infrastructure can add complexity. Partnering with experienced freight forwarders and using shipment tracking tools can improve visibility and minimize delays. -

How should disputes over product quality or delivery delays be managed in international peplum dress sourcing?

First, maintain clear communication and document all agreements and correspondences. Use contracts that specify dispute resolution mechanisms such as arbitration or mediation in a mutually agreed jurisdiction. Engage third-party inspection reports as evidence for quality disputes. For delivery delays, negotiate penalty clauses or partial refunds. Building long-term relationships with suppliers based on transparency and trust reduces conflict likelihood. Promptly addressing issues helps preserve partnerships and ensures supply chain continuity.

Strategic Sourcing Conclusion and Outlook for peplum dress dress

Strategic sourcing of peplum dresses offers international B2B buyers a competitive edge by balancing quality, cost-efficiency, and supply chain resilience. Key takeaways include the importance of partnering with suppliers who demonstrate agility in responding to fashion trend shifts and consumer preferences, especially in dynamic markets like Africa, South America, the Middle East, and Europe. Prioritizing suppliers with strong sustainability credentials and compliance with regional regulations ensures brand integrity and long-term viability.

Illustrative Image (Source: Google Search)

Effective sourcing strategies should emphasize:

- Building transparent supplier relationships with clear communication channels to mitigate risks.

- Leveraging data-driven demand forecasting to align production with market trends and avoid inventory imbalances.

- Integrating ethical and sustainable practices to meet growing consumer expectations and regulatory demands.

Looking ahead, B2B buyers in regions such as Colombia, Thailand, and beyond must adopt flexible, technology-enabled sourcing models that can swiftly adapt to disruptions and evolving market needs. Embracing digital tools for supply chain visibility and supplier collaboration will be crucial in maintaining agility and securing a reliable flow of peplum dress inventory. By investing in strategic sourcing today, buyers can position themselves to capitalize on emerging opportunities, drive sustainable growth, and foster lasting partnerships in the global fashion marketplace.