Your Ultimate Guide to Sourcing Dress Purple Dresses

Guide to Dress Purple Dresses

- Introduction: Navigating the Global Market for dress purple dresses

- Understanding dress purple dresses Types and Variations

- Key Industrial Applications of dress purple dresses

- Strategic Material Selection Guide for dress purple dresses

- In-depth Look: Manufacturing Processes and Quality Assurance for dress purple dresses

- Comprehensive Cost and Pricing Analysis for dress purple dresses Sourcing

- Spotlight on Potential dress purple dresses Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for dress purple dresses

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dress purple dresses Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of dress purple dresses

- Strategic Sourcing Conclusion and Outlook for dress purple dresses

Introduction: Navigating the Global Market for dress purple dresses

The global demand for purple dresses is surging, driven by their timeless appeal and versatility across diverse markets. For international B2B buyers—especially those operating in dynamic regions such as Africa, South America, the Middle East, and Europe—understanding this segment is crucial to capitalizing on emerging opportunities and meeting evolving consumer preferences. Purple dresses embody a unique blend of elegance and cultural resonance, making them a strategic product for wholesalers, retailers, and fashion distributors aiming to differentiate their offerings.

This comprehensive guide delivers an authoritative roadmap to sourcing purple dresses with confidence and precision. It explores various dress styles—from maxi and midi to mini cuts—highlighting how each aligns with regional tastes and occasions. The guide also delves into material selection, emphasizing fabric quality and sustainability factors that influence durability and customer satisfaction.

Beyond design and fabrics, the guide covers manufacturing standards and quality control practices essential for maintaining consistency and reducing risks in supply chains. It profiles trusted suppliers and manufacturers, offering insights into their capabilities and compliance with international trade norms. To support budget planning, detailed analyses of cost structures and pricing trends are included, tailored to the unique economic landscapes of target markets like France and South Africa.

Additionally, this resource answers frequently asked questions that B2B buyers commonly face, from logistics to customs regulations, empowering decision-makers with practical solutions. By synthesizing market intelligence and operational expertise, the guide equips buyers to navigate complexities, optimize sourcing strategies, and unlock growth potential in the purple dress market worldwide.

Understanding dress purple dresses Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Evening Purple Gown | Floor-length, luxurious fabrics (silk, satin), elegant cuts | Formal events, luxury retail, bridal boutiques | Pros: High perceived value, premium market appeal; Cons: Higher cost, seasonal demand |

| Casual Purple Dress | Comfortable fabrics (cotton, jersey), relaxed fit, versatile | Mass retail, online marketplaces, everyday wear | Pros: Broad appeal, high volume sales potential; Cons: Lower margins, trend-sensitive |

| Cocktail Purple Dress | Knee-length, stylish designs, embellishments (lace, sequins) | Partywear retailers, fashion boutiques | Pros: Popular for social occasions, moderate pricing; Cons: Trend-dependent, inventory risk |

| Traditional Purple Attire | Ethnic patterns, region-specific styles (e.g., African prints, Middle Eastern embroidery) | Cultural events, ethnic fashion stores | Pros: Niche market, cultural authenticity; Cons: Limited global appeal, sourcing complexity |

| Plus-Size Purple Dress | Inclusive sizing, flattering cuts, adaptive designs | Inclusive fashion brands, specialized retailers | Pros: Growing market segment, customer loyalty; Cons: Sizing complexity, inventory management |

Evening Purple Gown

These gowns are characterized by their floor-length designs and use of luxurious fabrics such as silk and satin. They often feature elegant cuts and embellishments suitable for formal occasions like galas and weddings. For B2B buyers, evening gowns represent a premium segment with higher price points and margins. Key considerations include sourcing quality materials and aligning with luxury market trends, particularly in European and Middle Eastern markets where formal events are prominent.

Casual Purple Dress

Casual purple dresses prioritize comfort and versatility, typically made from cotton, jersey, or blends with relaxed fits. They cater to everyday wear and appeal to a broad demographic, making them ideal for mass-market retailers and e-commerce platforms across Africa and South America. Buyers should focus on volume purchasing, trend responsiveness, and competitive pricing to maximize sales in this highly competitive segment.

Cocktail Purple Dress

Cocktail dresses are typically knee-length and incorporate stylish details such as lace or sequins, targeting social occasions and partywear. This category suits fashion boutiques and specialty retailers looking to capitalize on mid-tier pricing. B2B buyers should monitor emerging fashion trends closely and manage inventory carefully due to the trend-sensitive nature of cocktail dresses.

Traditional Purple Attire

Traditional dresses incorporate ethnic patterns and region-specific designs, such as African prints or Middle Eastern embroidery. These dresses serve cultural events and ethnic fashion stores, offering a unique niche with strong local appeal. Buyers must consider sourcing authenticity and cultural relevance, which can be complex but rewarding in markets with strong cultural identity like South Africa and parts of the Middle East.

Plus-Size Purple Dress

This category focuses on inclusive sizing and adaptive designs that flatter diverse body types. With the global push for inclusivity, plus-size purple dresses are gaining traction, especially in Europe and South America. B2B buyers should prioritize accurate sizing standards, diverse styles, and inventory management to meet the growing demand and foster customer loyalty in this expanding segment.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of dress purple dresses

| Industry/Sector | Specific Application of dress purple dresses | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Fashion Retail & Wholesale | Seasonal collections and event-specific product lines | Enhances brand differentiation and attracts niche markets | Fabric quality, colorfastness, trend alignment, and supplier reliability |

| Hospitality & Event Management | Uniforms for staff and thematic event attire | Creates cohesive brand image and elevates guest experience | Durability, comfort, ease of maintenance, and cultural appropriateness |

| Corporate & Professional Wear | Corporate gifting and employee uniforms with color branding | Strengthens corporate identity and employee morale | Consistent color matching, sizing options, and ethical sourcing |

| Entertainment & Media | Costumes for productions, promotional appearances, and photo shoots | Delivers visual impact and supports creative storytelling | Custom design capabilities, fabric texture, and delivery timelines |

| Export & International Trade | Bulk supply for boutique stores and distributors in diverse markets | Expands market reach and leverages unique color appeal | Compliance with import regulations, packaging standards, and logistics |

Fashion Retail & Wholesale

Purple dresses are a strategic choice in seasonal and event-specific collections, appealing to consumers seeking unique, sophisticated attire. For B2B buyers in Africa, South America, the Middle East, and Europe, sourcing purple dresses allows retailers to cater to evolving fashion trends and cultural preferences. High-quality fabrics and colorfastness are critical to maintain the vibrancy of purple hues, which can be challenging under intense sunlight or washing conditions common in some regions. Buyers should prioritize suppliers with proven reliability and trend responsiveness to maintain competitive product assortments.

Hospitality & Event Management

In the hospitality sector, purple dresses serve as uniforms or thematic attire that reinforce brand identity during events or daily operations. Hotels, event planners, and cruise lines benefit from using purple dresses to convey luxury and exclusivity. For international buyers, especially in Europe and the Middle East, the focus should be on durability and comfort, ensuring staff can perform efficiently while maintaining a polished appearance. Additionally, cultural sensitivity in design and fabric choice is essential to respect regional dress codes and preferences.

Corporate & Professional Wear

Purple dresses are increasingly popular in corporate gifting and employee uniforms, symbolizing creativity and leadership. Companies in diverse markets use these dresses to enhance brand cohesion and boost employee pride. International B2B buyers must ensure precise color matching to corporate branding guidelines and offer a broad range of sizes to accommodate diverse workforces. Ethical sourcing and sustainability are also growing considerations, particularly for European clients seeking to align procurement with corporate social responsibility goals.

Entertainment & Media

Costume designers and production houses frequently use purple dresses to create striking visuals for theater, film, and promotional events. The rich color provides a dramatic effect that supports storytelling and brand messaging. Buyers from South America and Africa should emphasize suppliers capable of custom designs and rapid turnaround times to meet tight production schedules. Fabric texture and finish are crucial to ensure on-camera appeal and comfort during long shoots or performances.

Export & International Trade

Purple dresses represent a niche product with strong export potential to boutique stores and distributors targeting fashion-conscious consumers globally. For B2B buyers engaged in international trade, understanding import regulations, packaging standards, and efficient logistics is paramount to maintain product integrity and customer satisfaction. Markets like France and South Africa value authenticity and quality, so sourcing partners must demonstrate compliance with international quality certifications and provide transparent supply chain information.

Related Video: LABORATORY APPARATUS AND THEIR USES

Strategic Material Selection Guide for dress purple dresses

Analysis of Common Materials for Purple Dresses from a B2B Perspective

When selecting materials for purple dresses, international B2B buyers must consider fabric performance, cost, manufacturing complexity, and regional market preferences. The choice of material affects not only the aesthetic appeal but also the durability, comfort, and suitability for various climates and cultural contexts. Below is a detailed analysis of four common materials used in purple dresses: Polyester, Cotton, Silk, and Rayon.

1. Polyester

Key Properties:

Polyester is a synthetic fiber known for its high tensile strength, excellent wrinkle resistance, and quick-drying properties. It maintains color vibrancy well, which is crucial for purple hues. Polyester is resistant to shrinking and stretching, and it performs well under a wide range of temperatures without degradation.

Pros & Cons:

– Pros: Durable, low-cost, easy to care for, and retains color intensity. It is also resistant to mildew and abrasion.

– Cons: Less breathable compared to natural fibers, which can affect comfort in hot climates. It may also have a synthetic feel that some consumers find less luxurious.

Impact on Application:

Polyester is ideal for mass production and suits markets where affordability and durability are priorities. It is favored in regions with humid climates (e.g., parts of Africa and South America) because it dries quickly and resists mildew.

Considerations for International Buyers:

Buyers in Europe and the Middle East should verify compliance with OEKO-TEX and REACH standards to ensure chemical safety and environmental compliance. In South Africa and France, polyester blends are popular but must meet local textile labeling regulations. Polyester’s colorfastness is a significant advantage for vibrant purple dresses targeted at fashion-conscious markets.

2. Cotton

Key Properties:

Cotton is a natural fiber prized for its breathability, softness, and moisture absorption. It is comfortable in warm climates and hypoallergenic, making it suitable for sensitive skin.

Pros & Cons:

– Pros: Comfortable, biodegradable, widely accepted by consumers globally, and easy to dye in rich purple shades.

– Cons: Prone to wrinkling and shrinking, less durable than synthetics, and susceptible to mildew if not properly treated.

Impact on Application:

Cotton is preferred for casual and semi-formal purple dresses where comfort is essential. It performs well in diverse climates but may require special finishing treatments for durability in humid regions like parts of South America and Africa.

Considerations for International Buyers:

Compliance with global standards such as ASTM D123 for cotton fiber quality and GOTS certification for organic cotton is critical, especially for European markets focused on sustainability. Buyers in the Middle East should consider cotton blends to improve wrinkle resistance and durability under hot, dry conditions.

3. Silk

Key Properties:

Silk is a natural protein fiber known for its luxurious sheen, softness, and excellent drape. It has moderate strength but is sensitive to heat and moisture.

Pros & Cons:

– Pros: Luxurious appearance, excellent dye affinity for deep purples, and lightweight comfort.

– Cons: High cost, delicate care requirements, and lower durability compared to synthetic fabrics.

Impact on Application:

Silk is ideal for premium, high-end purple dresses targeted at luxury markets in Europe and the Middle East. Its delicate nature requires careful handling during manufacturing and distribution.

Considerations for International Buyers:

Buyers should ensure silk complies with international textile standards like ISO 105 for colorfastness and ASTM D2251 for fiber strength. Import regulations in South Africa and France might impose tariffs or require certifications for natural silk imports. Silk’s exclusivity and price point make it less suitable for mass-market applications in price-sensitive regions.

4. Rayon (Viscose)

Key Properties:

Rayon is a semi-synthetic fiber made from regenerated cellulose, offering a silk-like feel with good breathability. It drapes well and absorbs dyes efficiently, producing vibrant purple colors.

Pros & Cons:

– Pros: Soft texture, excellent drape, and cost-effective alternative to silk.

– Cons: Lower durability, prone to shrinking and wrinkling, and sensitive to moisture.

Impact on Application:

Rayon is suitable for mid-range purple dresses that balance luxury feel and affordability. It is popular in markets seeking stylish yet affordable options, such as South America and parts of Europe.

Considerations for International Buyers:

Buyers should verify compliance with environmental regulations related to rayon production, especially in Europe where sustainability is a priority. The fabric’s moisture sensitivity requires careful handling in humid climates like those in Africa and South America. Certification to standards such as OEKO-TEX helps assure buyers of chemical safety.

Summary Table of Materials for Purple Dresses

| Material | Typical Use Case for dress purple dresses | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyester | Mass-market, durable purple dresses for humid and diverse climates | High durability and color retention | Less breathable, synthetic feel | Low |

| Cotton | Casual and semi-formal purple dresses prioritizing comfort | Breathable and comfortable, easy to dye | Prone to wrinkling and mildew | Medium |

| Silk | Luxury purple dresses with premium appearance and feel | Luxurious sheen and excellent dye affinity | High cost and delicate care | High |

| Rayon (Viscose) | Mid-range purple dresses balancing luxury and affordability | Soft, silk-like texture with good drape | Sensitive to moisture and less durable | Medium |

This strategic material selection guide equips international B2B buyers with critical insights to optimize product offerings for purple dresses across diverse markets, ensuring alignment with regional preferences, compliance requirements, and cost considerations.

In-depth Look: Manufacturing Processes and Quality Assurance for dress purple dresses

Manufacturing Processes for Purple Dresses

The production of purple dresses, particularly for international B2B markets, involves a sequence of well-defined stages designed to ensure quality, consistency, and adherence to design specifications. Understanding these stages helps buyers evaluate supplier capabilities and product reliability.

1. Material Preparation

- Fabric Sourcing: The process begins with sourcing high-quality fabrics, often polyester blends, silk, cotton, or rayon, dyed precisely to achieve the desired purple hue. Dye consistency and colorfastness are critical, especially for markets with strong consumer expectations such as Europe and South Africa.

- Inspection and Testing: Incoming fabric undergoes inspection for defects (tears, color irregularities) and testing for shrinkage, tensile strength, and colorfastness, ensuring raw materials meet buyer specifications.

- Cutting Preparation: Fabrics are pre-treated (e.g., steaming, pressing) to stabilize material before cutting.

2. Forming (Cutting and Shaping)

- Pattern Making: Patterns are created based on design specifications, considering regional sizing standards for target markets (e.g., European vs. South American sizing).

- Cutting: Fabrics are cut using automated cutting machines or manual methods for precision. For purple dresses, care is taken to align fabric grain and maintain color uniformity across pieces.

- Embroidery/Printing: If the dress design includes prints or embroidery, these are applied at this stage using digital printing or embroidery machines with rigorous color matching to the base purple fabric.

3. Assembly (Sewing and Construction)

- Sewing: Skilled operators assemble the cut pieces using industrial sewing machines, ensuring seam strength and minimal puckering, especially important for delicate purple fabrics.

- Fitting and Adjustments: Prototypes undergo fitting to check for drape and silhouette accuracy. Adjustments are made to accommodate different body shapes prevalent in target regions.

- Incorporation of Accessories: Zippers, buttons, lining, and embellishments are added. These components are also sourced to match quality standards and color coordination.

4. Finishing

- Pressing and Shaping: Dresses are pressed to remove wrinkles and shape the garment, enhancing the final look.

- Quality Inspection: Final inspection ensures no defects such as loose threads, stains, or stitching errors.

- Packaging: Dresses are carefully folded or hung, often with protective covers, to preserve fabric integrity during shipping. Packaging is tailored to buyer requirements and international shipping standards.

Quality Assurance Frameworks and Standards

For B2B buyers, particularly those operating across Africa, South America, the Middle East, and Europe, understanding and verifying quality assurance (QA) practices is essential to mitigate risks and ensure compliance.

Relevant International and Industry Standards

- ISO 9001: The globally recognized standard for quality management systems. Suppliers adhering to ISO 9001 demonstrate a systematic approach to quality control, continuous improvement, and customer satisfaction.

- OEKO-TEX Standard 100: Important for textiles, this certification ensures the fabric is free from harmful substances, critical for health-conscious markets in Europe and increasingly in Middle Eastern countries.

- REACH Compliance (EU): Ensures chemical safety in textiles, crucial for buyers in France and the broader EU market.

- SA8000: Social accountability standard ensuring ethical manufacturing practices, increasingly demanded by European and South African buyers.

- Local Certifications: Depending on the buyer’s country, additional certifications such as South Africa’s SABS mark or Brazil’s INMETRO certification may be relevant.

Quality Control Checkpoints

Quality control (QC) is embedded throughout the manufacturing process with distinct checkpoints:

- Incoming Quality Control (IQC): Inspection of raw materials (fabric, accessories) for defects, color accuracy, and compliance with specifications before production begins.

- In-Process Quality Control (IPQC): Continuous monitoring during sewing and assembly stages to detect issues early such as seam strength, alignment, and dimensional accuracy.

- Final Quality Control (FQC): Comprehensive inspection of finished dresses for defects, color consistency, measurements, and packaging quality before shipment.

Common Testing Methods for Purple Dresses

- Colorfastness Testing: Evaluates resistance to washing, rubbing, light, and perspiration to ensure the purple dye remains vibrant and does not bleed.

- Fabric Strength Tests: Tensile and tear strength tests confirm durability, particularly important for dresses intended for frequent wear.

- Dimensional Stability: Shrinkage tests post-washing confirm that the dress maintains its size and shape.

- Visual Inspection: Detailed checks for defects such as loose threads, holes, stains, or uneven stitching.

- Fit Testing: Sample garments are tried on models or mannequins to verify sizing accuracy and silhouette conformity.

How B2B Buyers Can Verify Supplier Quality Controls

For international buyers sourcing purple dresses, especially from regions with diverse manufacturing standards, verifying supplier quality control is critical. Buyers should consider the following:

- Factory Audits: Conduct or commission on-site audits to assess manufacturing practices, adherence to standards, labor conditions, and QC procedures. Third-party audit firms specializing in textile and apparel manufacturing can provide impartial evaluations.

- Review of QC Reports: Request detailed inspection reports from suppliers, including IQC, IPQC, and FQC documentation with photographic evidence where possible.

- Third-Party Inspections: Engage independent inspection agencies (e.g., SGS, Bureau Veritas) to perform random quality checks before shipment.

- Sample Approvals: Require pre-production and production samples for approval to verify color, fabric quality, and construction.

- Certification Verification: Validate supplier claims of ISO 9001, OEKO-TEX, or other certifications by requesting copies of certificates and confirming their authenticity with issuing bodies.

Quality Assurance Considerations for Different International Markets

- Africa: Buyers in countries like South Africa often prioritize a balance between cost-effectiveness and compliance with ethical manufacturing standards (e.g., SA8000). Local regulations may require additional customs documentation and quality certification.

- South America: Markets such as Brazil and Argentina emphasize compliance with local textile regulations and sustainability certifications. Buyers should ensure suppliers meet INMETRO or equivalent standards.

- Middle East: Buyers from GCC countries often require OEKO-TEX certification and adherence to modesty norms reflected in dress design and fabric opacity. Compliance with Islamic ethical sourcing may also be requested.

- Europe: Buyers in France and broader EU markets demand strict adherence to REACH chemical regulations, environmental sustainability, and social compliance. Transparency in supply chain and full traceability are often prerequisites.

Summary for B2B Buyers

Purchasing purple dresses at the B2B level requires a thorough understanding of manufacturing processes and quality assurance frameworks. Buyers must evaluate suppliers based on their ability to maintain stringent material standards, precise color matching, and robust QC systems aligned with international certifications. Employing factory audits, third-party inspections, and verifying certifications are essential steps to secure high-quality products that meet the diverse regulatory and consumer expectations across Africa, South America, the Middle East, and Europe. This strategic approach reduces risks, enhances supplier reliability, and ultimately supports sustainable business partnerships in the global dress market.

Related Video: Clothing Factory Tour–Garment Production Process

Comprehensive Cost and Pricing Analysis for dress purple dresses Sourcing

Cost Components in Sourcing Purple Dresses

When sourcing purple dresses for B2B purposes, understanding the detailed cost structure is essential to optimize procurement and pricing strategies. The primary cost components include:

- Materials: Fabric choice (e.g., silk, chiffon, polyester blends), dyes (especially for rich purple hues), trims, and accessories directly impact raw material costs. Sourcing sustainable or certified materials (e.g., OEKO-TEX, GOTS) may increase costs but enhance market appeal in Europe and South Africa.

- Labor: Skilled labor costs vary widely by region. Manufacturing hubs in Asia typically offer lower labor costs compared to Europe. However, labor quality and compliance with labor laws (e.g., fair wages) must be considered to avoid reputational risks.

- Manufacturing Overhead: This includes factory utilities, machine depreciation, and indirect labor. Efficient factories with modern equipment can reduce overhead per unit.

- Tooling and Setup: Initial costs for molds, patterns, and dyeing processes are often amortized over large production runs. Custom designs or intricate embroidery increase tooling expenses.

- Quality Control (QC): Rigorous inspection protocols are necessary to maintain consistent color fastness and garment quality, especially for international markets with strict import standards.

- Logistics: Freight costs (air, sea, or land), customs duties, insurance, and handling fees significantly influence landed costs. Volatility in fuel prices and geopolitical factors affect logistics pricing, particularly for shipments to Africa and South America.

- Margin: Suppliers factor in profit margins which can vary based on brand positioning, order volume, and market demand.

Key Price Influencers for Purple Dress Procurement

Several factors influence the final pricing of purple dresses in B2B transactions:

- Order Volume and Minimum Order Quantity (MOQ): Larger orders typically secure lower unit prices due to economies of scale. Buyers from emerging markets like Africa and South America should negotiate MOQs that balance inventory risk and cost efficiency.

- Specifications and Customization: Custom color matching, unique designs, and bespoke sizing increase production complexity and cost. Standardized SKUs reduce expenses and simplify supply chain management.

- Material Quality and Certifications: Premium fabrics and certifications (e.g., organic cotton, sustainable dyes) command higher prices but can unlock access to premium retail channels in Europe and the Middle East.

- Supplier Capabilities and Location: Established suppliers with advanced manufacturing capabilities may charge premiums but offer better quality assurance and reliability. Proximity to ports and trade hubs can reduce logistics costs.

- Incoterms: Terms like FOB, CIF, or DDP define responsibility for shipping and customs clearance. Buyers should understand these to accurately estimate total landed costs and avoid unexpected fees.

Strategic Buyer Tips for Cost Efficiency and Negotiation

To maximize value when sourcing purple dresses internationally, buyers should consider the following:

- Negotiate Beyond Price: Engage suppliers on payment terms, lead times, packaging options, and after-sales support. Flexible terms can improve cash flow and reduce inventory holding costs.

- Assess Total Cost of Ownership (TCO): Factor in hidden costs such as customs delays, quality rejections, and returns. A low unit price may not translate into overall savings if logistics or quality issues arise.

- Leverage Volume Aggregation: Buyers from smaller markets (e.g., South Africa or certain South American countries) can collaborate with regional partners to consolidate orders and negotiate better pricing.

- Understand Regional Market Nuances: For example, Middle Eastern buyers often require specific certifications and prefer certain dress styles, impacting sourcing costs. European buyers may prioritize sustainability and compliance, influencing material choices.

- Plan for Currency Fluctuations: Exchange rate volatility can affect pricing, especially for long-term contracts. Consider currency hedging or contracts in stable currencies to mitigate risks.

- Verify Supplier Credentials: Ensure suppliers comply with international quality standards and ethical manufacturing practices. This is critical for buyers targeting premium markets like France or the EU.

Indicative Pricing Disclaimer

Due to the dynamic nature of raw material costs, labor rates, and logistics fees, all pricing information should be considered indicative. Buyers are advised to obtain multiple quotations and conduct thorough due diligence before finalizing sourcing decisions.

By carefully analyzing these cost components and price influencers, and adopting strategic negotiation and procurement practices, international B2B buyers can source purple dresses that meet quality expectations while optimizing cost efficiency across diverse markets.

Spotlight on Potential dress purple dresses Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘dress purple dresses’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for dress purple dresses

Key Technical Properties for Purple Dresses in B2B Trade

When sourcing purple dresses internationally, understanding the essential technical properties ensures product quality, consistency, and buyer satisfaction across diverse markets such as Africa, South America, the Middle East, and Europe.

-

Fabric Composition and Grade

The fabric type (e.g., cotton, polyester, silk blends) and its grade determine the dress’s feel, durability, and color retention. For purple dresses, fabric quality affects dye uptake and colorfastness, critical for vibrant, consistent purple hues. B2B buyers must specify fabric standards to avoid variations that can impact brand reputation and customer satisfaction. -

Color Fastness and Shade Consistency

Color fastness measures how resistant the purple dye is to washing, light exposure, and rubbing. Shade consistency ensures each batch matches the agreed purple tone, vital for uniformity across multiple shipments. This is especially important when targeting fashion-conscious markets like France or South Africa, where consumers expect precise color fidelity. -

Sizing and Tolerance Standards

Dress sizing follows international or regional standards (e.g., EU, UK, US sizing charts). Tolerances define acceptable variations in measurements such as bust, waist, and length, typically ±1-2 cm. Clear sizing specs reduce returns and improve customer satisfaction, especially in cross-border sales where fitting trials are limited. -

Stitching Quality and Seam Strength

The type of stitching (e.g., lock stitch, overlock) and seam strength affect durability and garment finish. High seam strength reduces defects during wear and transportation. For wholesale buyers, consistent stitching quality minimizes product returns and enhances brand reliability. -

Fabric Weight and Drape

Fabric weight (grams per square meter – GSM) influences the dress’s drape and suitability for different climates. Lightweight fabrics suit warmer regions (Middle East, South America), while heavier fabrics may appeal to cooler European markets. Specifying fabric weight helps tailor product assortments to regional preferences. -

Care Label and Compliance Information

Proper care instructions (washing, ironing, dry cleaning) and compliance with regional textile regulations (e.g., REACH in Europe) are essential. Including this info on labels supports end consumers and ensures legal market entry, reducing customs or regulatory issues for importers.

Common Trade Terms and Their Significance in Purple Dress Sourcing

Understanding standard trade terminology facilitates smooth communication, contract negotiation, and logistics planning between suppliers and buyers.

-

OEM (Original Equipment Manufacturer)

Refers to suppliers producing dresses based on the buyer’s specifications and branding. OEM partnerships allow buyers to customize purple dresses, control quality, and differentiate their product lines in competitive markets. -

MOQ (Minimum Order Quantity)

The smallest order volume a supplier accepts, often dictated by production efficiency and cost. Buyers must negotiate MOQs that balance inventory investment with market demand, especially when testing new styles or entering new regions. -

RFQ (Request for Quotation)

A formal inquiry sent by buyers to suppliers to obtain pricing, lead times, and terms for specific purple dress models. RFQs enable buyers to compare offers transparently and select the best supplier fit based on cost and capability. -

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities for shipping, insurance, and customs between buyer and seller. Common terms like FOB (Free on Board) or CIF (Cost, Insurance, Freight) clarify logistics and cost allocation, critical for international shipments to Africa, South America, or Europe. -

Lead Time

The total time from order placement to delivery. Accurate lead time estimates help buyers plan inventory and marketing campaigns, especially for seasonal fashion items like purple dresses. -

Bulk Packaging and Labeling

Specifications on how dresses are packed (e.g., individual polybags, cartons) and labeled impact handling efficiency and retail readiness. Clear packaging instructions reduce damage risks and ensure compliance with retailer or regulatory requirements.

By mastering these technical properties and trade terms, international B2B buyers can negotiate confidently, ensure product quality, and streamline supply chain operations for purple dresses tailored to diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the dress purple dresses Sector

Market Overview & Key Trends

The global market for purple dresses is characterized by a dynamic interplay of cultural influences, fashion innovation, and evolving consumer preferences. Purple, traditionally associated with royalty, luxury, and creativity, has surged in popularity across diverse markets due to its versatility and appeal in both casual and formal wear. For B2B buyers from Africa, South America, the Middle East, and Europe, understanding regional nuances is crucial. In Africa and the Middle East, vibrant purple hues often resonate well with traditional and contemporary styles, blending heritage with modern fashion demands. Meanwhile, European markets, such as France, emphasize sophisticated cuts and premium fabrics, reflecting a preference for elegance and sustainability.

Current sourcing trends highlight a growing demand for customization and agility in supply chains. Buyers increasingly seek suppliers who can offer rapid turnaround times and flexible minimum order quantities to adapt to seasonal fluctuations and local market demands. Digitalization plays a pivotal role, with virtual showrooms and AI-driven trend forecasting enabling buyers to preview collections and make data-informed decisions remotely. This is especially advantageous for regions like South America, where logistics challenges can affect lead times.

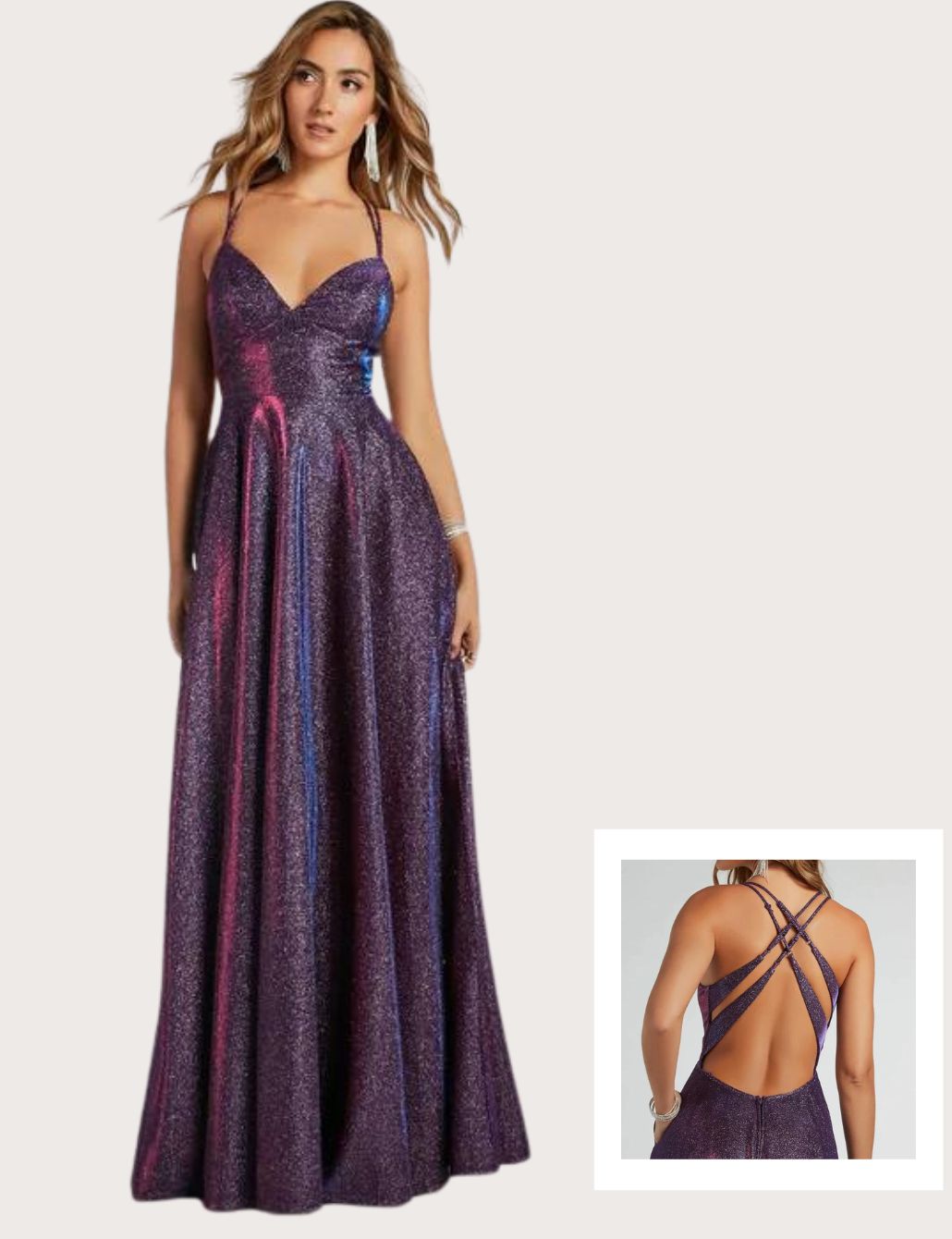

Illustrative Image (Source: Google Search)

Additionally, the rise of direct-to-retailer and online wholesale platforms facilitates access to a broader range of manufacturers, including emerging players from Asia and Africa, offering competitive pricing and diverse design portfolios. Strategic partnerships with manufacturers that prioritize innovation in fabric technology—such as wrinkle-resistant or temperature-regulating textiles—are becoming a differentiator. For international buyers, particularly those targeting premium segments, integrating these value-added features into purple dress offerings can enhance market positioning.

Sustainability & Ethical Sourcing in B2B

Sustainability has shifted from a niche concern to a core component of procurement strategies in the dress sector. For purple dresses, this means sourcing materials and production processes that minimize environmental impact while ensuring social responsibility across the supply chain. Natural fibers like organic cotton, bamboo, and Tencel are gaining traction due to their biodegradability and lower water footprint compared to conventional synthetics. Incorporating such materials can significantly appeal to eco-conscious buyers and end consumers in Europe and South America, where regulatory pressures and consumer activism drive demand for green products.

Ethical sourcing extends beyond materials to encompass fair labor practices, transparency, and supplier certifications. Certifications such as Global Organic Textile Standard (GOTS), OEKO-TEX, and Fair Trade serve as critical validation tools, providing buyers with assurance about the sustainability credentials of purple dress suppliers. For B2B buyers in Africa and the Middle East, partnering with suppliers who demonstrate commitment to ethical labor standards can enhance brand reputation and mitigate risks associated with supply chain disruptions or reputational damage.

Moreover, water and chemical management practices are under increased scrutiny. Sustainable dyeing techniques, including low-impact and natural dyes, are particularly relevant for purple garments, as traditional dyeing processes can involve hazardous chemicals. Buyers should prioritize suppliers who utilize closed-loop water systems and adhere to strict wastewater treatment protocols to comply with international environmental standards.

Brief Evolution & Historical Context

The prominence of purple dresses in fashion traces back centuries, rooted in the historical rarity and cost of purple dye, which was once derived from the murex sea snail and reserved for nobility. Over time, synthetic dyes democratized purple hues, making them accessible to a broader market. In the contemporary B2B context, purple dresses have evolved from symbolic status pieces to versatile wardrobe staples that intersect with trends in gender fluidity, sustainability, and global cultural exchange.

This evolution is reflected in the diversity of purple dress styles available today—from minimalist European designs emphasizing craftsmanship to bold, culturally inspired patterns favored in African and Middle Eastern markets. Understanding this heritage allows B2B buyers to better position purple dress products by aligning them with consumer narratives that celebrate both tradition and innovation.

Actionable Takeaways for B2B Buyers:

- Leverage digital tools and AI trend analytics to anticipate regional style shifts and optimize inventory for purple dresses.

- Prioritize suppliers offering sustainable materials and certified ethical manufacturing to meet growing regulatory and consumer demands.

- Explore partnerships with emerging manufacturers in Africa and Asia that combine traditional dyeing techniques with modern sustainability standards.

- Incorporate value-added textile innovations to differentiate purple dress offerings in competitive European and South American markets.

- Use the rich historical context of purple as a marketing narrative to enhance brand storytelling and consumer engagement.

Related Video: Global trade will never be the same again, says Christine Lagarde | Power & Politics

Frequently Asked Questions (FAQs) for B2B Buyers of dress purple dresses

-

How can I effectively vet suppliers of purple dresses to ensure reliability and quality?

Start by requesting detailed company profiles, including business licenses, certifications, and client references. Verify the supplier’s production capabilities by asking for product samples and quality control procedures. Utilize third-party inspection services or sourcing agents familiar with the supplier’s region, especially when dealing with new contacts in Africa, South America, the Middle East, or Europe. Additionally, check for compliance with international standards and certifications relevant to textiles and apparel. Transparent communication and documented quality assurance practices are key indicators of a trustworthy supplier. -

Is customization of purple dresses commonly available, and how should I approach this with suppliers?

Many manufacturers offer customization options including fabric choice, sizing, embellishments, and packaging. When negotiating customization, clearly define your design specifications and request prototypes or samples before bulk production. Be mindful of minimum order quantities (MOQs) that may increase with custom features. For buyers in diverse markets like Europe or South America, ensure that the supplier can adapt designs to local preferences and sizing standards. Establish timelines for prototype approval to avoid delays and confirm any additional costs upfront. -

What are typical MOQ and lead times for bulk orders of purple dresses, and how can these be optimized?

MOQs vary widely depending on the supplier and product complexity, typically ranging from 100 to 500 units per style or color. Lead times generally span 30 to 90 days, influenced by customization and production schedules. Buyers should negotiate MOQs that align with their market demand and storage capacity, especially when importing to regions with longer shipping times like Africa or the Middle East. Consolidating orders or partnering with suppliers offering flexible MOQs can optimize inventory management. Early planning and clear communication help reduce lead-time risks.

Illustrative Image (Source: Google Search)

-

What payment terms are standard in international B2B transactions for dress suppliers, and how can buyers protect themselves?

Common payment terms include 30% upfront deposit with balance paid before shipment or via letter of credit (L/C) for larger orders. Buyers should insist on contracts specifying payment milestones, delivery schedules, and quality standards. Using escrow services or trade finance instruments can add security. For buyers in emerging markets, working with suppliers who accept internationally recognized payment methods (such as PayPal, wire transfers, or L/C) reduces risk. Always verify supplier bank details independently to prevent fraud. -

What quality assurance certifications or standards should I look for when sourcing purple dresses internationally?

Look for certifications such as OEKO-TEX Standard 100, GOTS (Global Organic Textile Standard), ISO 9001 for quality management, and compliance with REACH or CPSIA regulations depending on your market. These certifications ensure safe materials, ethical production, and consistent quality. For buyers in Europe or South Africa, adherence to local import regulations and textile labeling laws is critical. Request documentation and conduct random product inspections before shipment to maintain quality consistency. -

How should I plan logistics and shipping for bulk orders of purple dresses to diverse international markets?

Choose suppliers with experience shipping to your target region and clarify the incoterms (e.g., FOB, CIF, DDP) to understand cost responsibilities. Consider sea freight for cost efficiency on large shipments, but air freight may be necessary for urgent orders. Factor in customs clearance times, import duties, and local regulations, which vary significantly between Africa, South America, the Middle East, and Europe. Partnering with freight forwarders familiar with your destination can streamline the process and minimize delays or unexpected costs. -

What steps can I take to resolve disputes or quality issues with overseas dress suppliers?

Establish clear contractual terms covering product specifications, inspection rights, and remedies for non-compliance. Use third-party quality inspections before shipment to catch defects early. If disputes arise, prioritize communication and documentation, including photos and inspection reports. Mediation or arbitration clauses in contracts can provide neutral resolution paths. For ongoing partnerships, building trust through regular audits and visits helps prevent issues. International trade insurance can also safeguard against financial losses from supplier defaults. -

Are there regional considerations when sourcing purple dresses from different continents?

Yes, each region has unique factors: African suppliers may offer competitive pricing but require careful vetting due to varied infrastructure; South American producers often excel in sustainable textiles but may have longer lead times; Middle Eastern suppliers might focus on luxury or modest fashion niches; European manufacturers often emphasize quality and compliance with strict regulations. Understanding regional trade agreements, tariffs, and cultural preferences is essential. Tailoring sourcing strategies to these nuances improves supply chain resilience and market fit.

Strategic Sourcing Conclusion and Outlook for dress purple dresses

Strategic sourcing of purple dresses presents a unique opportunity for international B2B buyers to align with evolving market trends and consumer preferences. Key takeaways emphasize the importance of leveraging comprehensive market research to understand fabric innovations, style dynamics, and regional demand variations. Buyers from Africa, South America, the Middle East, and Europe should prioritize partnerships with suppliers who demonstrate agility in design adaptation and adherence to quality standards, ensuring competitive advantage and customer satisfaction.

Illustrative Image (Source: Google Search)

The value of strategic sourcing lies in its ability to:

- Mitigate risks by selecting reliable manufacturers with transparent supply chains.

- Optimize costs through volume negotiations and long-term supplier relationships.

- Enhance product differentiation by tapping into niche purple dress styles that resonate with diverse cultural tastes.

- Accelerate time-to-market by collaborating with suppliers who integrate trend insights into production cycles.

Looking ahead, the purple dress market is poised for growth driven by rising demand for vibrant, versatile apparel that caters to both traditional and contemporary fashion sensibilities. International buyers are encouraged to deepen their market intelligence, invest in supplier development, and embrace digital sourcing platforms to unlock new growth avenues. By adopting a strategic sourcing mindset, businesses can confidently navigate complexities and capitalize on emerging opportunities across global markets.