Your Ultimate Guide to Sourcing Curad Xeroform Petrolatum

Guide to Curad Xeroform Petrolatum Dressing

- Introduction: Navigating the Global Market for curad xeroform petrolatum dressing

- Understanding curad xeroform petrolatum dressing Types and Variations

- Key Industrial Applications of curad xeroform petrolatum dressing

- Strategic Material Selection Guide for curad xeroform petrolatum dressing

- In-depth Look: Manufacturing Processes and Quality Assurance for curad xeroform petrolatum dressing

- Comprehensive Cost and Pricing Analysis for curad xeroform petrolatum dressing Sourcing

- Spotlight on Potential curad xeroform petrolatum dressing Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for curad xeroform petrolatum dressing

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the curad xeroform petrolatum dressing Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of curad xeroform petrolatum dressing

- Strategic Sourcing Conclusion and Outlook for curad xeroform petrolatum dressing

Introduction: Navigating the Global Market for curad xeroform petrolatum dressing

The global demand for advanced wound care solutions continues to surge, driven by increasing healthcare awareness and the need for effective, reliable products. Among these, Curad Xeroform Petrolatum Dressing stands out as a critical asset for medical facilities and distributors worldwide, especially in regions such as Africa, South America, the Middle East, and Europe. This petrolatum-based dressing is renowned for its ability to maintain a moist wound environment, accelerate healing, and reduce infection risks—features that are indispensable in diverse clinical settings from urban hospitals in France to rural clinics in Nigeria.

For B2B buyers operating across international markets, sourcing Curad Xeroform Petrolatum Dressing involves navigating a complex landscape of product variations, manufacturing standards, regulatory requirements, and supplier credibility. This guide offers a comprehensive overview, covering key aspects such as:

- Types and material composition of Curad Xeroform dressings to ensure optimal fit for various wound types

- Manufacturing processes and quality control protocols that guarantee consistent product performance and safety

- Global supplier networks and distribution channels tailored to meet the logistical challenges of different regions

- Pricing structures and cost-efficiency analysis to support budget-conscious procurement decisions

- Market trends and demand forecasts highlighting growth opportunities and potential challenges

- Frequently asked questions addressing common concerns related to product application, storage, and compatibility

By delving into these facets, this guide empowers international B2B buyers to make well-informed, strategic sourcing decisions. Whether you represent a healthcare provider or a medical supply distributor, understanding the nuances of Curad Xeroform Petrolatum Dressing is essential to delivering superior wound care solutions and achieving competitive advantage in your market.

Understanding curad xeroform petrolatum dressing Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Xeroform Petrolatum | Thin petrolatum-impregnated gauze, non-adherent | General wound care, burns, abrasions, surgical incisions | Pros: Versatile, promotes moist healing; Cons: Limited for heavy exudate wounds |

| Xeroform Occlusive Strips | Narrow strips with petrolatum coating, occlusive seal | Small wounds, linear cuts, donor sites | Pros: Easy application on narrow wounds; Cons: Less suitable for large wounds |

| Sterile Pre-cut Pads | Pre-sized sterile petrolatum dressings in various dimensions | Hospitals, clinics requiring quick dressing changes | Pros: Convenience and sterility; Cons: Inventory complexity for multiple sizes |

| Xeroform with Antimicrobial Additive | Petrolatum gauze combined with antimicrobial agents (e.g., iodine) | Infected wounds, high infection risk environments | Pros: Infection control; Cons: Higher cost, potential allergen concerns |

| Bulk Roll Form | Large rolls of petrolatum dressing for custom sizing | High-volume users, surgical centers, wound care suppliers | Pros: Cost-effective for large orders; Cons: Requires cutting and handling |

The Standard Xeroform Petrolatum Dressing is the most widely used variation, offering a thin, petrolatum-impregnated gauze that creates a moist wound environment. It is ideal for a broad range of wound types, including burns and surgical incisions. B2B buyers should consider its versatility and ease of use, but note it is not optimal for wounds with heavy exudate, which may require more absorbent alternatives.

Xeroform Occlusive Strips are designed for precise application on small or linear wounds. Their narrow, occlusive nature makes them suitable for donor sites or minor cuts, often favored by clinics and specialized care providers. Buyers should evaluate these for targeted wound care needs, balancing ease of use against limited coverage.

The Sterile Pre-cut Pads variation addresses the need for speed and sterility in clinical settings. Available in multiple sizes, these pads reduce dressing time and contamination risk. B2B purchasers must manage inventory carefully to ensure availability of appropriate sizes while considering slightly higher costs due to packaging.

For environments with elevated infection risks, Xeroform with Antimicrobial Additive offers enhanced protection by integrating antimicrobial agents into the petrolatum dressing. This type is particularly valuable in hospitals and regions with higher infection rates. Buyers should weigh the benefits of infection control against increased costs and potential sensitivity issues among patients.

Lastly, the Bulk Roll Form caters to high-volume users such as hospitals and wound care suppliers. It provides cost efficiency and flexibility, allowing custom sizing per wound requirements. However, it demands additional labor for cutting and handling, which buyers should factor into operational workflows and staffing considerations.

For B2B buyers across Africa, South America, the Middle East, and Europe, understanding these variations enables tailored procurement strategies that align with clinical demands, budget constraints, and regional healthcare infrastructure. Selecting the appropriate Curad Xeroform Petrolatum Dressing type ensures optimal patient outcomes and supply chain efficiency.

Related Video: 🌟 Discover the Healing Power of Xeroform Petrolatum Dressing 5 x 9 Bx/50 🌟

Key Industrial Applications of curad xeroform petrolatum dressing

| Industry/Sector | Specific Application of Curad Xeroform Petrolatum Dressing | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Healthcare & Hospitals | Post-surgical wound management and burn care | Accelerates healing, reduces infection risk, and minimizes tissue damage | Sterility assurance, regulatory compliance (CE, FDA), consistent supply chain |

| Pharmaceutical Manufacturing | Protective dressing for sensitive skin post-procedures | Enhances patient outcomes, reduces complications, and supports clinical trial protocols | Quality certifications, batch traceability, compatibility with clinical standards |

| Veterinary Medicine | Treatment of animal wounds and surgical sites | Promotes faster healing in animals, reduces risk of contamination | Product adaptability to animal skin, packaging for transport, regulatory approvals |

| Military & Emergency Services | Field wound care for trauma and burns | Provides reliable, easy-to-apply wound protection under challenging conditions | Robust packaging, ease of use in remote environments, shelf life stability |

| Medical Supply Distribution | Bulk supply for clinics and health centers in emerging markets | Cost-effective, trusted dressing improves wound care standards and patient satisfaction | Competitive pricing, import/export compliance, local regulatory approvals |

The Healthcare & Hospitals sector extensively uses Curad Xeroform Petrolatum Dressing for managing post-surgical wounds and burns. This dressing maintains a moist healing environment, reducing infection rates and minimizing tissue trauma during dressing changes. For international buyers in regions such as France, Nigeria, or South America, sourcing sterile, regulatory-approved dressings that comply with local medical device standards is critical. Reliable supply chains and product consistency ensure uninterrupted patient care in hospitals and clinics.

In Pharmaceutical Manufacturing, this dressing is employed during clinical trials or post-procedural care to protect sensitive skin areas. It supports enhanced patient outcomes by preventing wound desiccation and infection. Buyers from Africa or the Middle East should prioritize products with rigorous quality certifications and batch traceability to meet stringent clinical and regulatory requirements, ensuring safety and efficacy in pharmaceutical settings.

The Veterinary Medicine industry relies on Curad Xeroform Petrolatum Dressing for treating wounds in animals, including surgical sites and abrasions. Its non-adherent nature reduces pain and tissue damage during dressing changes, critical for animal welfare. B2B buyers from emerging markets must consider product adaptability to different animal skin types and ensure packaging is suitable for transport and storage in varying climates.

For Military & Emergency Services, this dressing provides essential wound care in field conditions, where rapid application and effective protection against contaminants are vital. Its ease of use and ability to maintain a moist wound environment under harsh conditions make it invaluable. Buyers, especially in regions prone to conflict or natural disasters, need to assess packaging robustness, ease of application, and shelf life to guarantee readiness for emergency deployment.

Finally, Medical Supply Distribution companies serving clinics and health centers in Africa, South America, and the Middle East benefit from stocking Curad Xeroform Petrolatum Dressing due to its cost-effectiveness and proven clinical benefits. These distributors must focus on competitive pricing, compliance with import/export regulations, and securing local approvals to facilitate smooth market entry and sustained supply to healthcare providers.

Related Video: Xeroform Petrolatum Gauze Dressing.

Strategic Material Selection Guide for curad xeroform petrolatum dressing

Material Analysis for Curad Xeroform Petrolatum Dressing

1. Petrolatum-Impregnated Gauze (Base Material)

The core material in Curad Xeroform Petrolatum Dressings is petrolatum-impregnated gauze, typically composed of fine cotton gauze coated with a petrolatum blend. This material provides a hydrophobic barrier that maintains a moist wound environment critical for healing. It exhibits excellent biocompatibility and low adherence to wounds, minimizing trauma during dressing changes. However, it has limited absorption capacity, making it unsuitable for wounds with heavy exudate. For international buyers, especially in regions like Africa and South America where ambient temperatures can be high, petrolatum’s stability under moderate heat is advantageous, but storage conditions should avoid extreme heat to prevent melting or degradation.

2. Cotton Gauze Substrate

The cotton gauze substrate serves as the structural backbone of the dressing. Cotton is chosen for its breathability, softness, and biodegradability. It allows for air permeability while supporting the petrolatum coating. Cotton is cost-effective and widely available globally, which benefits buyers in emerging markets such as Nigeria and Brazil. However, cotton can be prone to microbial contamination if not sterilized properly and may absorb moisture if exposed to fluids beyond the petrolatum barrier’s capacity. Compliance with international standards like ASTM F2100 (for medical textiles) and ISO 10993 (biocompatibility) is critical for buyers in Europe and the Middle East to ensure safety and regulatory acceptance.

3. Mineral Oil and Wax Blend (Petrolatum Composition)

The petrolatum component is a semi-synthetic blend of mineral oils and waxes, providing the dressing’s characteristic occlusive and moisture-retentive properties. This blend offers excellent chemical stability, resistance to oxidation, and hypoallergenic potential, which is important for patient safety across diverse populations. However, the sourcing and purity of mineral oils can vary, impacting consistency and regulatory compliance. Buyers in Europe and the Middle East should verify compliance with REACH and FDA guidelines to avoid supply chain disruptions. Additionally, the blend’s hydrophobic nature restricts use in wounds with high exudate, limiting its application in certain clinical scenarios.

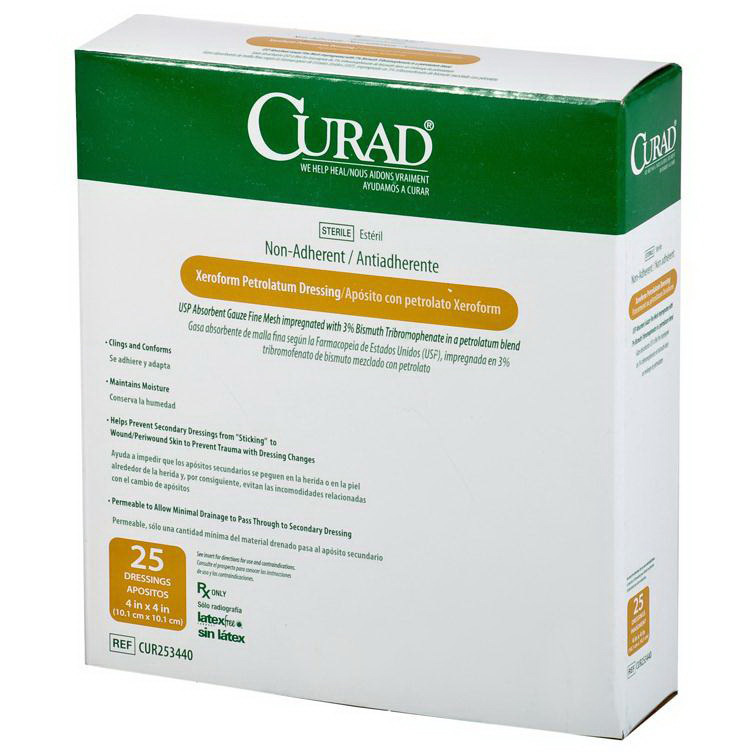

4. Optional Antimicrobial Additives (e.g., Bismuth Tribromophenate)

Some Curad Xeroform variants incorporate antimicrobial agents such as bismuth tribromophenate to reduce infection risk. These additives enhance the dressing’s protective function against bacterial contamination, which is crucial in regions with higher infection rates or limited sterile environments, such as parts of Africa and South America. However, antimicrobial additives can increase manufacturing complexity and cost, and may raise concerns about allergic reactions or regulatory hurdles in strict markets like the EU. Buyers must assess local regulatory frameworks (e.g., CE marking in Europe) and patient population sensitivities before selecting antimicrobial-enhanced dressings.

Summary Table of Material Options for Curad Xeroform Petrolatum Dressing

| Material | Typical Use Case for Curad Xeroform Petrolatum Dressing | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Petrolatum-Impregnated Gauze | Standard wound care for burns, abrasions, surgical incisions | Maintains moist wound environment, non-adherent | Limited absorption, not suitable for heavy exudate | Medium |

| Cotton Gauze Substrate | Base fabric for dressing providing breathability and softness | Cost-effective, widely available, breathable | Can absorb moisture if petrolatum barrier compromised | Low |

| Mineral Oil and Wax Blend | Provides occlusive, moisture-retentive barrier in dressing | Chemically stable, hypoallergenic, moisture retention | Not suitable for high exudate wounds, variable purity | Medium |

| Antimicrobial Additives (e.g., Bismuth Tribromophenate) | Enhanced infection control in contaminated or high-risk wounds | Reduces bacterial contamination, improves safety | Increased cost, potential allergic reactions, regulatory complexity | High |

Key Considerations for International B2B Buyers

-

Regulatory Compliance: Buyers in Europe (e.g., France) must ensure materials meet CE marking requirements and ISO standards for medical devices. Middle Eastern markets often require SFDA or local health authority approvals. African and South American buyers should verify compliance with WHO prequalification or local regulatory bodies to facilitate import and distribution.

-

Climate and Storage: High ambient temperatures and humidity common in many African and South American regions necessitate materials with thermal stability and proper packaging to prevent petrolatum melting or microbial contamination.

-

Cost Sensitivity: Emerging markets like Nigeria and parts of South America prioritize cost-effective materials without compromising safety. Cotton gauze and standard petrolatum blends offer balance, while antimicrobial variants may be reserved for specialized applications.

-

Supply Chain and Sourcing: Preference for materials with stable supply chains and local or regional availability can reduce lead times and costs. Buyers should evaluate suppliers’ certifications and traceability to ensure consistent quality.

By carefully evaluating these material properties and market-specific considerations, international B2B buyers can strategically select Curad Xeroform Petrolatum Dressings that optimize clinical outcomes, regulatory compliance, and cost-efficiency.

In-depth Look: Manufacturing Processes and Quality Assurance for curad xeroform petrolatum dressing

The manufacturing of Curad Xeroform Petrolatum Dressing involves a series of precise and controlled processes designed to ensure product safety, efficacy, and consistent quality. For international B2B buyers—especially those sourcing from or distributing within Africa, South America, the Middle East, and Europe—it is critical to understand these manufacturing stages and quality assurance protocols to make informed procurement decisions and maintain compliance with regulatory frameworks.

Manufacturing Process Overview

The production of Curad Xeroform Petrolatum Dressing can be broadly divided into four key stages:

1. Raw Material Preparation

- Petrolatum Base: The primary component is petrolatum, a semi-synthetic blend of mineral oils and waxes. It undergoes rigorous purification and standardization to meet pharmaceutical-grade specifications.

- Gauze Substrate: Medical-grade gauze, typically woven cotton, is sourced with strict adherence to fiber purity, tensile strength, and biocompatibility.

- Additives & Packaging Materials: All supplementary materials such as sterilization wraps and packaging films are vetted for chemical inertness and barrier properties.

2. Forming and Impregnation

- The gauze is uniformly impregnated with the petrolatum mixture using controlled coating equipment. Precision in application thickness (commonly around 0.25 mm) is essential to ensure non-adherence and moisture retention.

- Automated rollers or dip-coating machines maintain consistency and reduce contamination risks.

- The impregnated dressings are then dried or conditioned under controlled temperature and humidity to stabilize the petrolatum layer.

3. Assembly and Cutting

- The petrolatum-impregnated gauze is cut into standard sizes (e.g., 2×6 inches or 5×15 cm) using precision cutting tools.

- Edges may be sealed or hemmed to prevent fraying.

- Individual dressings are assembled with sterile backing papers or liners, facilitating ease of use and maintaining sterility.

4. Finishing and Sterilization

- Dressings undergo final inspection before sterilization.

- Common sterilization methods include gamma irradiation or ethylene oxide (EtO) treatment, chosen based on compatibility with petrolatum and gauze materials.

- Sterilized dressings are sealed in medical-grade pouches with tamper-evident features.

Quality Assurance and Control Measures

Quality assurance (QA) and quality control (QC) are integral throughout the manufacturing lifecycle. International B2B buyers must prioritize suppliers who operate under stringent QA/QC frameworks aligned with recognized standards.

Key International and Industry Standards

- ISO 9001: The global benchmark for quality management systems, ensuring consistent process control and continuous improvement.

- ISO 13485: Specific to medical devices, this standard governs design, production, and distribution quality requirements.

- CE Marking: Mandatory for medical devices sold within the European Economic Area, demonstrating compliance with EU Medical Device Regulation (MDR).

- FDA Compliance (for US Market): Though not always mandatory for non-US buyers, FDA registration and compliance can be an indicator of high-quality manufacturing practices.

- Other Regional Certifications: Depending on the market, certifications such as ANVISA (Brazil), NAFDAC (Nigeria), or SFDA (Saudi Arabia) may apply.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Verification of raw materials for purity, contamination, and compliance with material specifications.

- In-Process Quality Control (IPQC): Monitoring critical parameters during impregnation, cutting, and assembly, including thickness uniformity, dimensions, and impregnation consistency.

- Final Quality Control (FQC): Comprehensive testing of finished dressings, including sterility, packaging integrity, and physical properties.

Common Testing Methods

- Microbiological Testing: Sterility assurance via culture methods or rapid microbial detection.

- Physical Testing: Tensile strength and flexibility of gauze substrate; petrolatum adhesion and non-stick properties.

- Chemical Analysis: Verification of petrolatum composition and absence of harmful contaminants.

- Biocompatibility Testing: Skin irritation and sensitization assessments in accordance with ISO 10993 standards.

- Shelf-Life Stability: Accelerated aging tests to confirm product integrity over time.

Verifying Supplier Quality for B2B Buyers

For buyers across diverse regions, verifying the supplier’s QC capabilities and compliance is essential to mitigate risks associated with product recalls, regulatory non-compliance, or substandard performance.

- Factory Audits: Conduct on-site or virtual audits focusing on manufacturing practices, cleanliness, staff training, and documentation controls.

- Review of Quality Documentation: Request detailed QC reports, Certificates of Analysis (CoA), sterilization validation, and batch traceability records.

- Third-Party Inspection: Engage independent inspection bodies (e.g., SGS, TÜV, Intertek) to perform random batch testing and factory assessments.

- Regulatory Compliance Verification: Confirm validity of certifications such as CE marking or ISO 13485 through official registries and notify bodies.

- Sample Testing: Procure and test product samples locally to verify conformity with specifications and suitability for regional use conditions.

QC and Certification Nuances for Key Regions

- Africa (e.g., Nigeria): NAFDAC registration is crucial, with emphasis on product safety and anti-counterfeit measures. Buyers should ensure suppliers understand local regulatory demands and customs clearance procedures.

- South America: ANVISA certification is mandatory for medical devices in Brazil and often accepted regionally. Documentation must be in Portuguese or Spanish and comply with local labeling requirements.

- Middle East: SFDA approval and GCC conformity marks are often required. Buyers should verify halal compliance if relevant and ensure packaging meets regional language and regulatory norms.

- Europe (e.g., France): Compliance with EU MDR and CE marking is non-negotiable. French language labeling and adherence to stringent pharmacovigilance and post-market surveillance rules are expected.

Strategic Recommendations for B2B Buyers

- Prioritize suppliers with integrated quality management systems certified under ISO 13485 and ISO 9001.

- Ensure traceability from raw materials to finished goods, enabling rapid response to quality issues.

- Confirm sterilization methods and validation reports align with international standards to guarantee product safety.

- Leverage regional regulatory expertise to navigate certification and import requirements effectively.

- Establish long-term partnerships with manufacturers open to transparency and continuous quality improvement.

By thoroughly understanding the manufacturing processes and quality assurance frameworks behind Curad Xeroform Petrolatum Dressings, international B2B buyers can confidently select suppliers that deliver reliable, compliant, and high-performance wound care solutions tailored to their regional market needs.

Related Video: BMW Car Factory – ROBOTS Fast PRODUCTION Manufacturing

Comprehensive Cost and Pricing Analysis for curad xeroform petrolatum dressing Sourcing

Understanding the cost structure and pricing dynamics of Curad Xeroform Petrolatum Dressings is crucial for international B2B buyers aiming to optimize procurement expenses and ensure supply chain efficiency. This analysis breaks down the primary cost components, key price influencers, and strategic buyer tips tailored to markets in Africa, South America, the Middle East, and Europe.

Key Cost Components

-

Materials: The core raw materials include petrolatum (a semi-synthetic blend of mineral oils and waxes) and gauze substrates. Quality and source of these materials directly impact the unit cost. Pharmaceutical-grade petrolatum and sterile gauze typically command higher prices due to compliance with medical standards.

-

Labor: Skilled labor is required for sterile manufacturing, packaging, and quality control. Labor costs vary significantly by country, influencing the final product price, especially when manufacturing is localized.

-

Manufacturing Overhead: Includes utilities, cleanroom facilities, sterilization processes, and machinery depreciation. Maintaining GMP (Good Manufacturing Practices) standards elevates overhead costs but ensures product safety and regulatory compliance.

-

Tooling and Equipment: Specialized equipment for lamination, cutting, and sterile packaging represents a capital investment that amortizes over production volume.

-

Quality Control (QC): Rigorous QC protocols, including microbiological testing and packaging integrity checks, are essential for medical dressings, adding to operational costs.

-

Logistics and Distribution: International freight, customs duties, warehousing, and last-mile delivery costs vary by region. For example, African and South American markets may incur higher logistics expenses due to infrastructure challenges.

-

Margin: Manufacturers and distributors factor in profit margins that reflect market demand, competitive positioning, and risk.

Price Influencers in B2B Sourcing

-

Order Volume and Minimum Order Quantity (MOQ): Bulk orders significantly reduce per-unit costs. Buyers from regions with fragmented healthcare procurement can negotiate better pricing by consolidating orders or joining purchasing consortia.

-

Product Specifications and Customization: Variations in dressing size, packaging formats, and sterile versus non-sterile options affect pricing. Custom branding or regulatory labeling for specific markets (e.g., CE marking for Europe) may increase costs.

-

Material Quality and Certifications: Dressings with advanced certifications (ISO 13485, FDA approval, CE mark) or enhanced features (e.g., antibacterial additives) command premium prices but reduce long-term risk and liability.

-

Supplier Reputation and Capacity: Established suppliers with proven quality and reliable delivery records may price higher but offer better consistency, crucial for clinical settings.

-

Incoterms and Payment Terms: Shipping terms (FOB, CIF, DDP) influence landed costs. Buyers should understand implications on customs clearance, duties, and risk transfer. Favorable payment terms (e.g., letters of credit, net 30/60) can improve cash flow.

Strategic Buyer Tips for International Markets

-

Negotiate Based on Total Cost of Ownership (TCO): Beyond unit price, consider logistics, import duties, storage, and potential wastage due to shelf-life or improper handling. For example, in humid climates common in parts of Africa or the Middle East, proper packaging to prevent moisture ingress is vital.

-

Leverage Regional Distribution Hubs: Sourcing through regional distributors or warehouses in Europe or Middle East can reduce delivery times and logistics costs for African and South American buyers.

-

Assess Compliance and Regulatory Alignment: Ensure suppliers provide all necessary documentation for local regulatory bodies. Non-compliance can lead to costly delays or rejections, especially in markets like France and Nigeria.

-

Explore Supplier Partnerships: Long-term contracts or partnerships may unlock volume discounts, co-development opportunities, or flexible MOQ arrangements tailored to fluctuating demand.

-

Be Mindful of Pricing Nuances: Currency fluctuations, import tariffs, and seasonal demand cycles can affect pricing. Buyers should monitor these factors and consider hedging or timing purchases strategically.

-

Consider Alternative Packaging and Sizes: Smaller packaging units may reduce upfront costs but increase per-unit prices; balance this against inventory turnover and storage constraints.

Indicative Pricing Disclaimer

Prices for Curad Xeroform Petrolatum Dressings can vary widely depending on the above factors, with typical wholesale prices ranging approximately from $0.50 to $2.00 per dressing unit depending on size, certification, and volume. Buyers should request detailed quotations and validate all cost elements in their procurement processes to avoid unforeseen expenses.

By comprehensively understanding these cost and pricing elements, international B2B buyers can make informed decisions, negotiate effectively, and secure reliable, cost-efficient supplies of Curad Xeroform Petrolatum Dressings tailored to their regional market needs.

Spotlight on Potential curad xeroform petrolatum dressing Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘curad xeroform petrolatum dressing’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for curad xeroform petrolatum dressing

Critical Technical Properties of Curad Xeroform Petrolatum Dressing

1. Material Composition

Curad Xeroform Petrolatum Dressing consists primarily of a petrolatum-impregnated gauze. The petrolatum is a semi-synthetic blend of mineral oils and waxes, creating a hydrophobic barrier that retains moisture within the wound. For B2B buyers, understanding this composition is vital as it influences the dressing’s compatibility with different wound types and ensures regulatory compliance for import/export, especially in regions with strict medical material standards like Europe.

2. Thickness and Dimensions

Typical thickness ranges around 0.25 mm (0.01 inches), with widths from 5 to 10 cm and lengths from 5 to 15 cm. These specifications matter in bulk procurement to match clinical needs and packaging requirements. Buyers must verify these dimensions to ensure they align with hospital or clinic protocols, as incorrect sizing can lead to increased waste or insufficient wound coverage.

3. Non-Adherent Property

The dressing’s non-adherent nature means it does not stick to the wound bed, reducing trauma and pain during dressing changes. This property is crucial for patient comfort and can reduce healing complications. For buyers, this translates into a value proposition of lower patient discomfort and fewer dressing changes, impacting overall treatment costs and supply chain efficiency.

4. Sterility and Packaging

Sterility is a mandatory property for wound dressings to prevent infections. Curad Xeroform is typically supplied sterile, often in individual sealed packs. B2B buyers should confirm sterility assurance levels (SAL) and packaging integrity, especially for markets like the Middle East and Africa where shipping conditions can be challenging. Proper packaging also affects shelf life and storage conditions.

5. Absorption and Moisture Retention

While petrolatum dressings are not highly absorbent, their primary function is to maintain a moist wound environment by preventing fluid loss. This balance is critical for wounds prone to dryness but less suitable for heavy exudate wounds. Buyers should assess the typical wound profiles of their target markets to determine if this dressing fits their clinical needs or if supplementary absorbent products are required.

6. Regulatory Compliance and Material Grade

Medical-grade petrolatum used in the dressing must meet international standards such as USP (United States Pharmacopeia) or equivalent European Pharmacopoeia grades. This ensures safety and efficacy. International buyers, particularly in Europe and South America, should verify certifications (e.g., CE marking, FDA approval) to ensure smooth customs clearance and market acceptance.

Key Trade Terminology for International B2B Transactions

1. OEM (Original Equipment Manufacturer)

Refers to companies that manufacture products or components that are purchased by another company and retailed under the purchasing company’s brand. For B2B buyers interested in private labeling or exclusive branding of Curad Xeroform dressings, understanding OEM options is crucial.

2. MOQ (Minimum Order Quantity)

The smallest quantity of a product that a supplier is willing to sell. MOQ affects inventory costs and cash flow, especially for buyers in emerging markets like Nigeria or smaller hospitals in Europe. Negotiating MOQ is a key aspect of procurement strategy to balance supply with demand.

3. RFQ (Request for Quotation)

A formal process where buyers request price and terms from suppliers for specific products or volumes. RFQs help buyers in Africa, South America, and the Middle East compare offers, ensure competitive pricing, and clarify delivery timelines for Curad Xeroform dressings.

4. Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities between buyers and sellers for transportation, insurance, and customs clearance. Common Incoterms for medical dressings include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps buyers manage logistics costs and risks.

5. Lead Time

The time period between placing an order and receiving the goods. For medical supplies like petrolatum dressings, shorter lead times are preferred to maintain uninterrupted clinical supply. Buyers should clarify lead times upfront to avoid stockouts, particularly in regions with complex import processes.

6. Shelf Life

Duration for which the product remains effective and safe to use, often indicated in months or years. For wound dressings, shelf life is critical to minimize waste and ensure product efficacy. Buyers in warmer climates such as parts of Africa and the Middle East must consider storage conditions affecting shelf life.

By mastering these technical properties and trade terms, international B2B buyers can make informed purchasing decisions for Curad Xeroform Petrolatum Dressing, ensuring optimal product performance, regulatory compliance, and efficient supply chain management across diverse markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the curad xeroform petrolatum dressing Sector

Market Overview & Key Trends

The global market for Curad Xeroform Petrolatum Dressings is shaped by increasing demand for advanced wound care products that promote faster healing and reduce infection risks. This demand is driven by rising incidences of chronic wounds, burns, and surgical procedures, particularly in emerging economies across Africa, South America, and the Middle East, where healthcare infrastructure is rapidly developing. In Europe, countries like France continue to invest heavily in healthcare innovation, emphasizing high-quality, clinically proven wound care solutions, which benefits well-established products like Curad Xeroform.

For B2B buyers, cost-efficiency and product efficacy remain critical. Buyers from regions such as Nigeria or Brazil prioritize suppliers who can offer reliable supply chains and competitive pricing without compromising product standards. The increasing adoption of digital procurement platforms and e-commerce portals is streamlining sourcing processes, allowing buyers to compare specifications, certifications, and pricing more transparently.

Illustrative Image (Source: Google Search)

Technological advancements in wound care are influencing sourcing trends. Integrations of petrolatum dressings with antimicrobial agents and bioactive compounds are emerging, offering enhanced healing properties. B2B buyers should monitor suppliers investing in R&D to stay ahead of market needs. Additionally, customization and packaging innovations tailored to regional regulatory requirements and patient preferences are becoming differentiators in competitive bids.

Supply chain resilience is a growing concern amid geopolitical uncertainties and logistics disruptions. Buyers in Africa and the Middle East are increasingly prioritizing local or regional distributors to reduce lead times and mitigate risks. Meanwhile, European buyers focus on suppliers who comply with stringent EU medical device regulations and provide robust documentation for quality assurance.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a decisive factor in the procurement of medical dressings globally. The Curad Xeroform Petrolatum Dressing, traditionally petrolatum-based, faces scrutiny due to environmental concerns associated with petroleum-derived materials. B2B buyers are progressively demanding products that minimize ecological footprints without sacrificing clinical performance.

Ethical sourcing in this sector involves ensuring that the raw materials, such as mineral oils and waxes, are obtained from suppliers committed to responsible extraction and processing practices. Transparency in the supply chain is crucial to verify compliance with labor standards and environmental regulations, especially for buyers in regions like Europe, where corporate social responsibility (CSR) is heavily regulated.

Green certifications such as ISO 14001 (Environmental Management) and OEKO-TEX Standard 100 for chemical safety are increasingly sought after by procurement professionals. These certifications provide assurance that the dressings meet environmental and safety standards throughout manufacturing. Additionally, there is a growing interest in biodegradable or bio-based alternatives to petrolatum, although these innovations are still emerging in commercial supply.

Illustrative Image (Source: Google Search)

For B2B buyers in Africa and South America, sustainability also translates into cost-effective waste management and local environmental regulations compliance, which can influence procurement choices. Partnering with suppliers that invest in eco-friendly packaging, reduced plastic use, and energy-efficient production processes can enhance a company’s sustainability profile and appeal to global healthcare partners.

Evolution and Historical Context

Curad Xeroform Petrolatum Dressing has its roots in mid-20th century wound care innovations, where maintaining a moist wound environment was identified as critical to healing. The petrolatum base was adopted for its non-adherent, hydrophobic qualities, which contrasted with traditional dry gauze dressings that often caused wound disruption upon removal.

Over decades, the product evolved from a simple petrolatum-impregnated gauze to more sophisticated formulations that balance moisture retention with breathability and antimicrobial compatibility. The continuous clinical validation, particularly in burn and surgical wound care, has cemented its position as a trusted product in hospitals and clinics worldwide.

For B2B buyers, understanding this evolution highlights the product’s established efficacy and the ongoing innovation potential, ensuring that investments in Curad Xeroform dressings align with long-term healthcare trends and patient care standards across diverse global markets.

Related Video: International Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of curad xeroform petrolatum dressing

-

How can I effectively vet suppliers of Curad Xeroform Petrolatum Dressing for my region (Africa, South America, Middle East, Europe)?

To ensure reliability, start by verifying the supplier’s certifications such as ISO 13485 for medical devices and CE marking for Europe compliance. Request product samples to assess quality firsthand. Check references or customer testimonials, especially from buyers in similar markets. Confirm the supplier’s experience in exporting to your region and their ability to meet local regulatory requirements. Finally, evaluate their financial stability and communication responsiveness to avoid delays or quality issues. -

Is it possible to customize Curad Xeroform Petrolatum Dressings for specific market needs or branding?

Yes, many manufacturers offer customization options including packaging, labeling, and sizing to comply with local regulations or buyer preferences. For international markets, customization can include multilingual instructions or compliance information required by local authorities. Discuss your specific needs upfront during negotiations. Keep in mind that customization might affect minimum order quantities (MOQs) and lead times, so plan accordingly to align with your market launch schedules. -

What are typical minimum order quantities (MOQs), lead times, and payment terms for bulk orders of Curad Xeroform Petrolatum Dressing?

MOQs vary widely depending on the supplier and level of customization but typically start at a few thousand units for standard products. Lead times can range from 3 to 8 weeks, influenced by production schedules and shipping logistics. Payment terms often include a 30-50% deposit upfront with the balance due before shipment or on delivery. For new international buyers, suppliers may request letters of credit or secure payment methods to mitigate risks. -

Which quality assurance certifications and standards should I look for when sourcing Curad Xeroform Petrolatum Dressings?

Ensure suppliers hold ISO 13485 certification, which ensures compliance with medical device quality management systems. For buyers in Europe, CE marking is essential to confirm conformity with EU medical device directives. Additional certifications like FDA approval or compliance with local health authorities (e.g., ANVISA in Brazil, NAFDAC in Nigeria) enhance credibility. Request batch testing certificates and product traceability documents to maintain consistent quality control. -

What are the best logistics practices to ensure timely and safe delivery of Curad Xeroform Petrolatum Dressings internationally?

Partner with logistics providers experienced in handling medical products and customs clearance in your target countries. Use temperature-controlled shipping if required, although petrolatum dressings generally have stable storage conditions. Consolidate shipments to reduce costs and opt for trackable freight options. Early communication with customs brokers can prevent delays. Also, clarify Incoterms (e.g., FOB, CIF) with your supplier to define responsibility for shipping risks and costs. -

How can I manage potential disputes or quality issues with overseas suppliers of Curad Xeroform Petrolatum Dressings?

Establish clear contractual terms including product specifications, inspection criteria, and dispute resolution methods before placing orders. Use third-party inspection services for quality checks pre-shipment. Maintain thorough documentation such as purchase orders, quality reports, and communications. In case of disputes, mediation or arbitration clauses can offer faster resolution than litigation. Building long-term relationships with suppliers through transparent communication helps prevent recurring issues.

Illustrative Image (Source: Google Search)

-

Are there any regulatory or import restrictions I should be aware of when importing Curad Xeroform Petrolatum Dressings into my country?

Yes, each country may have specific import regulations for medical devices, including registration requirements, import licenses, or testing mandates. For example, Nigeria requires NAFDAC registration, while European countries demand CE marking compliance. It is crucial to consult local regulatory agencies or legal experts to ensure full compliance. Non-compliance can lead to shipment rejection or costly delays, so factor regulatory timelines into your procurement planning. -

What payment methods are recommended for international B2B transactions of Curad Xeroform Petrolatum Dressings to minimize risk?

Secure payment methods such as letters of credit (LCs) or escrow accounts are preferred for new or large transactions, as they protect both buyer and seller. For established relationships, wire transfers (T/T) with partial upfront payments are common. Avoid full prepayment without guarantees. Additionally, consider trade credit insurance to safeguard against non-payment risks. Always confirm bank details independently to avoid fraud and maintain transparent financial records.

Strategic Sourcing Conclusion and Outlook for curad xeroform petrolatum dressing

The Curad Xeroform Petrolatum Dressing stands out as a reliable and clinically validated wound care solution that offers critical benefits such as promoting moist wound healing, reducing infection risks, and minimizing trauma during dressing changes. For international B2B buyers—especially from Africa, South America, the Middle East, and Europe—understanding these core advantages is essential for making informed procurement decisions that align with patient care standards and regulatory requirements.

Strategic sourcing of Curad Xeroform Petrolatum Dressing requires careful evaluation of supplier credibility, product authenticity, and logistical efficiency. Buyers should prioritize partnerships with manufacturers and distributors who ensure consistent quality, transparent supply chains, and compliance with international certifications. Leveraging bulk purchasing agreements and exploring regional distribution hubs can optimize costs and reduce lead times, which is particularly valuable in emerging markets like Nigeria or rapidly evolving healthcare sectors in France and the Middle East.

Looking ahead, the wound care market is poised for innovation, but petrolatum-based dressings remain a cornerstone due to their proven efficacy. International buyers are encouraged to stay engaged with evolving clinical evidence and emerging product enhancements. By adopting a strategic, informed sourcing approach today, organizations can secure a competitive advantage while delivering superior patient outcomes tomorrow. Embrace collaboration with trusted suppliers and invest in comprehensive supplier audits to future-proof your wound care inventory.