Your Ultimate Guide to Sourcing The Circle Graph Above

Guide to The Circle Graph Above Gives The Distribution Of Salad Dressing

- Introduction: Navigating the Global Market for the circle graph above gives the distribution of salad dressing

- Understanding the circle graph above gives the distribution of salad dressing Types and Variations

- Key Industrial Applications of the circle graph above gives the distribution of salad dressing

- Strategic Material Selection Guide for the circle graph above gives the distribution of salad dressing

- In-depth Look: Manufacturing Processes and Quality Assurance for the circle graph above gives the distribution of salad dressing

- Comprehensive Cost and Pricing Analysis for the circle graph above gives the distribution of salad dressing Sourcing

- Spotlight on Potential the circle graph above gives the distribution of salad dressing Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for the circle graph above gives the distribution of salad dressing

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the the circle graph above gives the distribution of salad dressing Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of the circle graph above gives the distribution of salad dressing

- Strategic Sourcing Conclusion and Outlook for the circle graph above gives the distribution of salad dressing

Introduction: Navigating the Global Market for the circle graph above gives the distribution of salad dressing

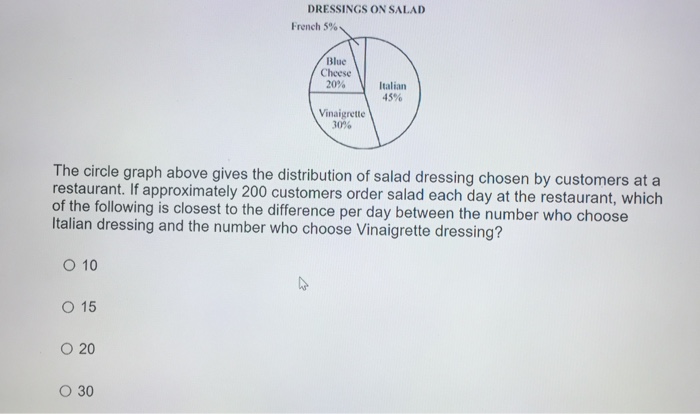

Understanding the global distribution of salad dressings is crucial for B2B buyers aiming to optimize sourcing strategies in an increasingly competitive marketplace. The circle graph illustrating the distribution of salad dressing types provides invaluable insights into market segmentation, consumer preferences, and production trends worldwide. For international buyers, especially those in Africa, South America, the Middle East, and Europe, leveraging this data enables targeted procurement that aligns with regional demand and supply dynamics.

This comprehensive guide delves into the diverse categories of salad dressings, highlighting key ingredients, packaging materials, and manufacturing processes that influence quality and cost. It offers a detailed examination of quality control standards and certifications essential for ensuring product safety and consistency across borders. Moreover, the guide profiles reputable suppliers and manufacturers, providing actionable intelligence on pricing structures and market accessibility tailored to varied economic landscapes such as South Africa and Argentina.

By integrating market analysis with practical sourcing considerations, this resource empowers buyers to make informed decisions that mitigate risks and enhance supply chain efficiency. It also addresses frequently asked questions regarding import regulations, shelf life, and customization options, fostering transparency and confidence in international transactions. Whether negotiating contracts or evaluating new product lines, buyers will find strategic value in understanding how the salad dressing market is distributed globally and what factors drive success in different regions. This knowledge foundation is indispensable for cultivating sustainable partnerships and capitalizing on emerging opportunities in the global food industry.

Understanding the circle graph above gives the distribution of salad dressing Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Vinaigrette | Oil and vinegar base, often with herbs and spices | Food service, retail salad dressing production | Pros: Versatile, widely accepted flavor; Cons: Shorter shelf life |

| Creamy Dressings | Mayonnaise or dairy-based, thicker texture | Ready-to-eat meals, deli counters, food manufacturers | Pros: Rich flavor, preferred in Western markets; Cons: Higher cost, refrigeration needed |

| Low-Fat/Reduced-Calorie | Modified recipes with lower fat content | Health-conscious product lines, diet-specific markets | Pros: Growing demand, appeals to health trends; Cons: May compromise taste and texture |

| Specialty/Flavored | Unique ingredients like balsamic glaze, citrus, or exotic spices | Gourmet food markets, premium product lines | Pros: Differentiation, premium pricing; Cons: Niche appeal, higher ingredient costs |

| Organic/Natural | Made with certified organic ingredients, no artificial additives | Organic retail chains, export markets focused on clean labels | Pros: High market growth potential, premium segment; Cons: Supply chain complexity, certification costs |

Vinaigrette:

Vinaigrettes are the most traditional and widely used salad dressings, characterized by their simple oil and vinegar base, often enhanced with herbs and spices. For B2B buyers, vinaigrettes offer versatility and broad consumer acceptance across diverse regions, including Africa and South America. They are suitable for food service providers and retail manufacturers aiming for cost-effective, shelf-stable products. However, their shorter shelf life compared to creamy dressings requires efficient inventory management and cold chain logistics, especially in warmer climates.

Creamy Dressings:

Creamy dressings typically use mayonnaise or dairy bases, delivering a rich, thick texture favored in many European and Middle Eastern markets. These are ideal for ready-to-eat meals, deli counters, and food manufacturers targeting consumers who prefer indulgent flavors. Buyers should consider the higher production costs and the necessity for refrigeration, which impacts storage and transportation expenses. Creamy dressings also cater well to premium product lines but require attention to regional taste preferences.

Low-Fat/Reduced-Calorie:

This category caters to the rising global demand for healthier food options. Low-fat or reduced-calorie dressings modify traditional recipes to reduce fat content while maintaining flavor. These are increasingly popular in urban markets across Europe and South America where health consciousness is growing. B2B buyers should evaluate the balance between nutritional claims and taste quality, as some formulations may sacrifice flavor or texture, potentially affecting consumer acceptance.

Specialty/Flavored Dressings:

Specialty dressings incorporate unique ingredients like balsamic glazes, citrus infusions, or exotic spices, targeting gourmet and premium segments. These products appeal to niche markets and upscale retailers in regions with diverse culinary traditions such as South Africa and the Middle East. Buyers benefit from the ability to differentiate their offerings and command higher prices but must manage higher ingredient costs and variable demand. Supply chain reliability for exotic components is also a critical consideration.

Organic/Natural Dressings:

Organic and natural dressings are made from certified organic ingredients without artificial additives, aligning with the global clean label trend. These dressings are highly sought after in European and Middle Eastern markets where organic certification drives consumer trust. For international B2B buyers, investing in organic salad dressings can open premium export opportunities but demands rigorous supplier vetting, certification compliance, and potentially higher raw material costs. The growing consumer preference for transparency and sustainability supports long-term market growth.

Related Video: Denoising Diffusion Probabilistic Models | DDPM Explained

Key Industrial Applications of the circle graph above gives the distribution of salad dressing

| Industry/Sector | Specific Application of the circle graph above gives the distribution of salad dressing | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Food Manufacturing | Product portfolio optimization based on market share of salad dressing types | Aligns production with consumer demand, reduces waste | Ingredient quality, supplier reliability, compliance with food safety standards (e.g., EU, FDA) |

| Retail & Wholesale | Inventory and supply chain planning using salad dressing distribution data | Improves stock turnover, reduces overstock/out-of-stock | Packaging standards, shelf life, regional taste preferences |

| Foodservice & Catering | Menu development and procurement strategies informed by dressing popularity | Enhances customer satisfaction, streamlines purchasing | Bulk packaging options, cost efficiency, supplier lead times |

| Export & Import Trading | Market entry strategy and product mix decisions based on salad dressing distribution | Targets high-demand products, optimizes export volumes | Regulatory compliance, import tariffs, logistics capabilities |

| Consumer Analytics | Consumer trend analysis leveraging dressing distribution proportions | Drives marketing strategies and new product innovation | Data accuracy, cultural preferences, regional consumption patterns |

Food Manufacturing

In food manufacturing, the distribution data from the salad dressing circle graph is critical for optimizing product portfolios. Manufacturers can prioritize the production of salad dressing types with the largest market share, ensuring alignment with consumer preferences in target regions such as South Africa and Argentina. This reduces inventory waste and improves profitability. Buyers should focus on sourcing high-quality ingredients that meet international food safety standards, such as those required in Europe and the Middle East, to maintain product consistency and regulatory compliance.

Retail & Wholesale

Retailers and wholesalers utilize the salad dressing distribution data to fine-tune inventory and supply chain operations. Understanding which dressing types dominate the market helps avoid overstocking less popular varieties and prevents stockouts of high-demand products. This insight is particularly valuable in diverse markets across Africa and Europe, where consumer tastes vary. Key sourcing considerations include selecting packaging that maintains product freshness during long supply chains and adapting to local consumer preferences to maximize sales.

Foodservice & Catering

For foodservice providers and caterers, the distribution insights inform menu planning and procurement strategies. Knowing the relative popularity of salad dressings allows these businesses to stock appropriate quantities, improving customer satisfaction and operational efficiency. International buyers, especially in the Middle East and South America, should prioritize suppliers offering bulk packaging and reliable delivery schedules to handle large-volume orders while controlling costs.

Export & Import Trading

Exporters and importers rely on salad dressing distribution data to shape market entry strategies and product mixes. By focusing on dressing types with proven demand, businesses can optimize export volumes and minimize financial risk. B2B buyers from regions like Europe and Africa must carefully evaluate regulatory requirements, import tariffs, and logistics capabilities to ensure smooth cross-border transactions and timely delivery.

Consumer Analytics

Consumer analytics firms leverage the distribution proportions of salad dressings to identify emerging trends and inform marketing campaigns. This data supports the development of innovative products tailored to regional tastes and consumption habits. For international buyers, especially in multicultural markets such as Europe and the Middle East, accurate data collection and interpretation are essential to crafting effective promotional strategies that resonate with local consumers.

Related Video: Uses of Soil | Science | iKen | iKenEdu | iKenApp

Strategic Material Selection Guide for the circle graph above gives the distribution of salad dressing

When selecting materials for packaging or processing equipment related to salad dressing distribution, international B2B buyers must consider multiple factors including chemical compatibility, durability, cost, and regulatory compliance. The salad dressing industry often involves acidic, oil-based, or emulsified products that require materials resistant to corrosion and contamination while maintaining product integrity. Below is an analysis of four common materials used in this sector, tailored for buyers from Africa, South America, the Middle East, and Europe.

Stainless Steel (Typically 304 or 316 Grades)

Key Properties: Stainless steel offers excellent corrosion resistance, especially grade 316 which is resistant to acids and oils commonly found in salad dressings. It withstands a wide temperature range (-200°C to 870°C) and can handle moderate pressure, making it ideal for both storage and processing equipment.

Pros & Cons: Stainless steel is highly durable, easy to clean, and compliant with international food safety standards such as FDA, EU regulations, and often meets ASTM and DIN standards. However, it has a higher upfront cost and requires skilled manufacturing processes. Its weight can increase logistics costs, especially for export markets.

Impact on Application: It prevents contamination and maintains product freshness, critical for dressings with vinegar or citrus bases. Its resistance to corrosion ensures longevity in acidic environments, reducing maintenance frequency.

Considerations for International Buyers: Buyers in regions like South Africa and Argentina should verify compliance with local food-grade certifications and consider import tariffs on stainless steel. European buyers benefit from harmonized standards (e.g., EN 10088 for stainless steel), easing procurement. Middle Eastern buyers should assess compatibility with local halal certification requirements and regional supply chain capabilities.

High-Density Polyethylene (HDPE)

Key Properties: HDPE is a thermoplastic polymer known for its chemical resistance, especially against acids and oils, and excellent moisture barrier properties. It performs well at temperatures up to about 120°C but is not suitable for high-pressure applications.

Pros & Cons: HDPE is cost-effective, lightweight, and easy to mold into various packaging shapes. It is recyclable and widely accepted in food packaging. However, it has lower mechanical strength compared to metals and can degrade under prolonged UV exposure unless stabilized.

Impact on Application: HDPE is ideal for bottles and containers for salad dressings, especially for markets requiring lightweight, cost-efficient packaging. Its chemical resistance ensures product safety without leaching, essential for acidic dressings.

Considerations for International Buyers: In Africa and South America, HDPE is popular due to local manufacturing capabilities and cost constraints. Buyers should ensure the grade used complies with food contact regulations such as FDA or EU directives. In the Middle East, climate considerations may necessitate UV-stabilized HDPE variants. European buyers often demand high-recycled content compliance and certification for sustainability.

Glass

Key Properties: Glass is inert, non-porous, and impermeable, providing excellent preservation of flavor and freshness. It withstands a wide temperature range and is highly resistant to chemical attack.

Pros & Cons: Glass offers premium product presentation and is fully recyclable without quality loss. However, it is heavy, fragile, and more expensive to transport and manufacture compared to plastics. Breakage risk is a significant consideration.

Impact on Application: Glass is preferred for premium salad dressings where consumer perception of quality is paramount. It does not interact with acidic or oil-based dressings, ensuring product integrity.

Considerations for International Buyers: European markets have strong demand for glass due to sustainability trends and consumer preferences. In South America and Africa, glass may be less common due to higher costs and logistical challenges. Compliance with standards such as ISO 719 or ASTM C glass standards is important. Middle Eastern buyers should consider local packaging regulations and consumer preferences.

Polyethylene Terephthalate (PET)

Key Properties: PET is a lightweight, strong thermoplastic with good chemical resistance and excellent clarity, making it suitable for transparent salad dressing bottles. It withstands temperatures up to about 60°C.

Pros & Cons: PET is cost-effective, recyclable, and widely used in food packaging. It offers good barrier properties against oxygen but is less resistant to strong acids compared to HDPE or stainless steel. Manufacturing processes are well-established globally.

Impact on Application: PET is ideal for salad dressings requiring visibility to consumers and moderate shelf life. It balances cost and performance, especially for oil and vinegar-based dressings.

Considerations for International Buyers: Buyers in Africa and South America benefit from local PET production facilities, reducing lead times. European buyers focus on recycled PET (rPET) content and compliance with EU food contact regulations. Middle Eastern markets may require PET grades with UV protection due to intense sunlight exposure.

| Material | Typical Use Case for the circle graph above gives the distribution of salad dressing | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel (304/316) | Processing tanks, valves, and premium packaging components | Excellent corrosion resistance and durability | High upfront cost and heavier weight | High |

| High-Density Polyethylene (HDPE) | Bottles and containers for acidic and oil-based dressings | Cost-effective, chemical resistant, lightweight | Lower mechanical strength, UV degradation risk | Low |

| Glass | Premium salad dressing bottles | Inert, preserves flavor, fully recyclable | Fragile, heavy, higher transport costs | High |

| Polyethylene Terephthalate (PET) | Transparent bottles for consumer visibility and moderate shelf-life products | Lightweight, recyclable, good clarity | Limited acid resistance, moderate temperature tolerance | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for the circle graph above gives the distribution of salad dressing

Manufacturing Processes for Salad Dressing Production

The production of salad dressing, as reflected in the distribution shown in the circle graph, involves several critical manufacturing stages designed to ensure product consistency, safety, and quality. Understanding these stages allows B2B buyers, especially from diverse international markets such as Africa, South America, the Middle East, and Europe, to evaluate suppliers effectively.

1. Raw Material Preparation

This initial stage involves sourcing and preparing ingredients like oils, vinegars, emulsifiers, spices, and preservatives. Suppliers must ensure raw materials meet food-grade standards and are free from contaminants. Ingredient batching is carefully controlled to maintain the intended flavor profiles and consistency across different dressing varieties (e.g., vinaigrettes, creamy dressings).

2. Mixing and Emulsification

The core production step where ingredients are blended using high-shear mixers or homogenizers to create stable emulsions. Techniques vary depending on dressing type; for example, oil-in-water emulsions for creamy dressings require precise control of shear forces and temperature to avoid phase separation. Automated inline mixing systems enhance uniformity and scalability.

3. Heat Treatment and Pasteurization

Many dressings undergo pasteurization or heat treatment to extend shelf life and ensure microbiological safety. This may involve batch or continuous flow thermal processes, carefully monitored to preserve flavor and nutritional quality while eliminating pathogens.

4. Filling and Packaging

Fillers use volumetric or weight-based dosing systems to ensure accurate portioning into bottles, pouches, or jars. Packaging lines often include capping, labeling, and sealing stations. Packaging materials are selected for compatibility with the dressing type, shelf stability, and regional regulatory compliance.

5. Storage and Distribution Preparation

Finished products are stored under controlled conditions (temperature, humidity) before shipment. Proper cold chain management is critical for dressings with perishable ingredients, especially for export markets.

Quality Assurance Framework in Salad Dressing Manufacturing

For international B2B buyers, verifying a supplier’s quality assurance (QA) system is essential to mitigate risks associated with product recalls, regulatory non-compliance, and reputational damage. The QA framework typically aligns with international and industry-specific standards.

Key International Standards:

-

ISO 9001 (Quality Management Systems): This globally recognized standard ensures consistent product quality through documented processes, continual improvement, and customer focus. B2B buyers should request ISO 9001 certification as a baseline for supplier quality systems.

-

ISO 22000 / FSSC 22000 (Food Safety Management): Critical for food products like salad dressings, these standards focus on hazard analysis and critical control points (HACCP), ensuring food safety from raw materials through distribution.

-

Industry-Specific Certifications: Depending on the export destination, certifications such as CE marking (European markets) or compliance with Codex Alimentarius standards may be required. For markets in the Middle East, Halal certification might be crucial, while South American buyers may prioritize compliance with local sanitary regulations.

Quality Control (QC) Checkpoints and Testing Methods

Robust QC checkpoints are embedded throughout the manufacturing process to ensure product integrity:

-

Incoming Quality Control (IQC): Inspection and testing of raw materials for purity, moisture content, and microbiological contamination. Suppliers often provide certificates of analysis (CoA) from raw material vendors.

-

In-Process Quality Control (IPQC): Monitoring critical parameters during mixing, emulsification, and pasteurization, including viscosity, pH, temperature, and microbial load. Inline sensors and automated sampling improve real-time control.

-

Final Quality Control (FQC): Testing finished products for sensory attributes (taste, texture, appearance), chemical composition (fat content, acidity), microbiological safety (pathogens, spoilage organisms), and packaging integrity.

Common Testing Methods:

- Viscosity Measurement: Using viscometers or rheometers to ensure consistent texture.

- Microbiological Testing: Plate counts and rapid PCR methods to detect pathogens.

- Chemical Analysis: Gas chromatography for oil composition, titration for acidity.

- Sensory Panels: Trained experts evaluate flavor and mouthfeel consistency.

- Shelf-Life Testing: Accelerated aging tests to predict product stability.

Verifying Supplier Quality Assurance for International Buyers

International B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, should adopt a multi-faceted approach to verify supplier QC systems:

-

Factory Audits: Conduct on-site audits to assess compliance with ISO standards, hygiene practices, and process controls. Audits can be performed directly or through trusted third-party inspection agencies.

-

Documentation Review: Request detailed QC reports, CoAs, and certifications. Ensure traceability of raw materials and batch records are maintained.

-

Third-Party Inspections: Engage independent inspection bodies to perform random batch testing or pre-shipment inspections, providing unbiased verification.

-

Sample Testing: Before large-scale procurement, obtain product samples for independent laboratory analysis to confirm quality parameters and compliance with local regulations.

-

Supplier Capability Assessment: Evaluate the supplier’s investment in technology (e.g., automated mixing, inline QC sensors), workforce training, and commitment to continuous improvement.

Quality Assurance Considerations for Different International Markets

-

Africa (e.g., South Africa): Regulatory environments may vary, with increasing emphasis on food safety standards aligned with Codex Alimentarius and ISO 22000. Buyers should verify suppliers’ compliance with local import requirements and consider cold chain logistics due to climatic conditions.

-

South America (e.g., Argentina): Strong national food safety agencies require documentation in Spanish and adherence to Mercosur standards. Buyers benefit from suppliers with bilingual documentation and knowledge of regional regulations.

-

Middle East: Halal certification is often mandatory alongside ISO and HACCP standards. Packaging must comply with local language labeling laws, and suppliers should demonstrate sensitivity to cultural preferences.

-

Europe: The EU imposes strict food safety regulations (e.g., EFSA guidelines) and environmental packaging standards. Buyers should prioritize suppliers with CE marking, REACH compliance, and robust environmental management systems.

Summary for B2B Buyers

For international buyers evaluating salad dressing suppliers:

- Understand the manufacturing stages and ensure suppliers use advanced mixing, emulsification, and pasteurization techniques.

- Verify adherence to international quality standards (ISO 9001, ISO 22000) and relevant industry-specific certifications.

- Ensure presence of comprehensive QC checkpoints (IQC, IPQC, FQC) and request access to detailed testing data.

- Employ a combination of audits, third-party inspections, and independent lab testing to validate supplier claims.

- Consider regional regulatory and cultural requirements to ensure compliance and market acceptance.

This structured approach minimizes risk, supports regulatory compliance, and ensures delivery of high-quality salad dressings tailored to diverse international markets.

Related Video: Business English Vocabulary : VV 47 – Manufacturing & Production Process (1) | English Vocabulary

Comprehensive Cost and Pricing Analysis for the circle graph above gives the distribution of salad dressing Sourcing

Understanding the cost and pricing structure behind salad dressing sourcing is crucial for international B2B buyers aiming to optimize procurement strategies and enhance profitability. The distribution reflected in the circle graph underscores how various cost components and pricing factors interplay to determine final supplier quotes. Below is an in-depth analysis tailored for buyers in Africa, South America, the Middle East, and Europe, with actionable insights for sourcing success.

Key Cost Components in Salad Dressing Sourcing

-

Raw Materials: The primary cost driver includes oils, vinegars, herbs, spices, emulsifiers, and preservatives. Variations in ingredient quality, origin (e.g., organic or conventional), and availability heavily influence pricing. Sourcing from regions with local agricultural advantages can reduce costs.

-

Labor: Labor costs encompass formulation, mixing, filling, and packaging. Countries with lower labor expenses may offer competitive pricing but require scrutiny of labor standards to ensure ethical sourcing.

-

Manufacturing Overhead: This includes utilities, equipment depreciation, and factory maintenance. Efficient manufacturing plants with modern automation can reduce overhead, reflected in better pricing.

-

Tooling and Packaging: Custom molds, bottles, caps, and labeling contribute significantly to initial setup costs. Reusable tooling spreads costs over large volumes, lowering per-unit prices.

-

Quality Control (QC): Rigorous QC processes ensure compliance with food safety standards and certifications (e.g., ISO, HACCP). While adding to cost, QC safeguards brand reputation and regulatory approval, especially important for international markets.

-

Logistics: Freight, warehousing, customs duties, and insurance are essential cost layers. For buyers in Africa and South America, longer shipping routes and port handling fees may increase landed costs.

-

Supplier Margin: Suppliers incorporate profit margins based on market demand, competition, and risk factors. Margins may fluctuate with market volatility or supplier exclusivity.

Influential Pricing Factors for Buyers

-

Volume and Minimum Order Quantity (MOQ): Higher order volumes typically unlock volume discounts. However, buyers should balance MOQ requirements against inventory holding costs, especially where shelf-life is a concern.

-

Product Specifications and Customization: Tailoring formulations, flavors, or packaging can escalate costs due to specialized raw materials and tooling. Standardized products usually command lower prices.

-

Material Quality and Certifications: Premium ingredients and certifications such as organic, non-GMO, or allergen-free often lead to price premiums but may justify higher market positioning.

-

Supplier Reliability and Geographic Location: Suppliers closer to buyer markets reduce lead times and logistics costs. Those with established reputations and compliance records may price at a premium but offer risk mitigation.

-

Incoterms: Terms like FOB, CIF, or DDP significantly affect cost responsibility and risk allocation. Buyers must carefully negotiate to optimize cost transparency and control.

Strategic Tips for International B2B Buyers

-

Negotiate Beyond Price: Engage suppliers on payment terms, lead times, packaging options, and after-sales support. Flexibility can add value beyond mere price reductions.

-

Assess Total Cost of Ownership (TCO): Consider hidden costs such as customs delays, quality rejections, and inventory carrying costs to avoid surprises in landed cost calculations.

-

Leverage Local Insights: Buyers in regions like South Africa or Argentina should explore regional suppliers or trade agreements that reduce tariffs and expedite customs clearance.

-

Prioritize Quality and Compliance: For international markets with strict regulations, investing in certified suppliers reduces compliance risks and potential penalties.

-

Monitor Market Trends: Ingredient price volatility, currency fluctuations, and geopolitical risks can impact cost structures. Establishing multi-supplier strategies can provide pricing stability.

Important Disclaimer

The cost and pricing insights provided here are indicative and subject to change based on market dynamics, supplier negotiations, and regional factors. Buyers should conduct thorough due diligence and request detailed quotations reflecting their specific requirements.

By understanding these cost components and pricing influencers, international B2B buyers can make informed decisions, negotiate effectively, and optimize their salad dressing sourcing strategies to achieve competitive advantage in their respective markets.

Spotlight on Potential the circle graph above gives the distribution of salad dressing Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘the circle graph above gives the distribution of salad dressing’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for the circle graph above gives the distribution of salad dressing

Critical Technical Properties for Salad Dressing Distribution

When evaluating salad dressing products through distribution data such as a circle graph, understanding key technical properties is vital for making informed purchasing decisions. These properties affect product quality, regulatory compliance, and supply chain efficiency.

-

Ingredient Quality and Grade

This refers to the standard and purity of raw materials used (e.g., oils, emulsifiers, acids). Higher-grade ingredients ensure consistent flavor and shelf life. For B2B buyers, especially in regulated markets like the EU or South Africa, verifying ingredient quality is essential to meet food safety standards and consumer expectations. -

Viscosity and Texture

Viscosity measures the thickness and flow behavior of the dressing. It impacts packaging choices and consumer usability. For instance, a creamy dressing requires different handling than a vinaigrette. Buyers must ensure viscosity aligns with target market preferences and packaging capabilities. -

Shelf Life and Preservation

The product’s expected shelf life under specified storage conditions is critical for logistics planning. Preservation techniques (e.g., pasteurization, preservatives) affect shelf stability and export viability, particularly for long shipping routes from South America or the Middle East. -

Packaging Specifications

Packaging material, size, and sealing quality directly influence product protection and shelf life. B2B buyers should verify compliance with regional packaging regulations and sustainability goals, as well as compatibility with distribution networks. -

Nutritional and Allergen Information

Accurate labeling of calories, fats, sugars, and potential allergens is mandatory. This information affects market acceptance and regulatory approval across diverse regions, including Europe and the Middle East. -

Tolerance and Consistency Standards

Tolerance defines acceptable variations in product attributes like flavor, color, or viscosity. Maintaining tight tolerances ensures uniformity, crucial for brand reputation and customer satisfaction.

Key Industry and Trade Terminology

Understanding common trade terms and jargon helps streamline communication and negotiation with suppliers and logistics partners.

-

OEM (Original Equipment Manufacturer)

Refers to companies that produce salad dressing products or packaging components for other brands. Working with OEMs can provide customization options and cost efficiencies for buyers targeting niche markets. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. MOQs influence inventory management and pricing. International buyers from smaller markets like some African or Middle Eastern countries should negotiate MOQs that align with their demand forecasts. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers to obtain pricing and terms for specified quantities and product specifications. RFQs are essential for comparing offers across regions and ensuring competitive procurement. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Clear understanding prevents costly misunderstandings in international logistics. -

Batch Traceability

The ability to track product batches from production through distribution. This is vital for quality control, recall management, and compliance with food safety regulations, especially in stringent markets. -

Lead Time

The time between placing an order and receiving the product. Knowing lead times helps buyers plan inventory and marketing strategies effectively, particularly when sourcing from distant regions like South America or Europe.

By mastering these technical properties and trade terms, international B2B buyers can make strategic decisions that optimize product quality, supply chain reliability, and regulatory compliance in the competitive salad dressing market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the the circle graph above gives the distribution of salad dressing Sector

Market Overview & Key Trends

The global salad dressing sector is experiencing robust growth, driven by increasing consumer demand for convenience, flavor variety, and healthier options. For international B2B buyers, particularly in emerging and diverse markets such as Africa, South America, the Middle East, and Europe, understanding the regional preferences and supply chain nuances is critical. Markets like South Africa and Argentina are witnessing a rising trend in the adoption of dressings that cater to local tastes while aligning with global health trends, such as low-fat, organic, and plant-based formulations.

Key sourcing trends include a shift towards natural and clean-label ingredients, with buyers prioritizing suppliers who can guarantee transparency and traceability. The integration of digital platforms for supply chain management and procurement has enhanced efficiency, enabling faster response to market fluctuations and consumer demand shifts. For example, leveraging data analytics helps predict seasonal demand patterns and optimize inventory management.

Market dynamics are also influenced by trade policies and logistics infrastructure that vary widely across these regions. Buyers must navigate tariffs, import regulations, and transportation challenges, which can affect cost structures and delivery timelines. Establishing strong relationships with local producers and distributors can mitigate these risks and provide competitive advantages.

Moreover, innovation in packaging, such as single-serve sachets and eco-friendly containers, is gaining momentum, responding to consumer preferences for convenience and sustainability. B2B buyers should consider suppliers offering flexible packaging solutions that reduce waste and appeal to environmentally conscious end-users.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone in the salad dressing sector’s supply chain, especially as international buyers increasingly demand products that align with environmental stewardship and social responsibility. The environmental impact of sourcing raw materials—such as oils, herbs, and natural flavorings—can be significant, with concerns around deforestation, water usage, and carbon emissions.

Illustrative Image (Source: Google Search)

Ethical sourcing practices are essential to ensure that suppliers uphold fair labor standards and support local communities, particularly in developing regions. Certifications such as Rainforest Alliance, Fair Trade, and Organic labels serve as credible indicators of responsible sourcing, helping B2B buyers mitigate reputational risks and meet corporate social responsibility (CSR) goals.

Green packaging innovations, including biodegradable bottles and recyclable materials, are becoming industry standards. Buyers should prioritize partnerships with manufacturers who invest in lifecycle assessments and carbon footprint reduction initiatives. Transparency in the supply chain, supported by blockchain or similar technologies, enhances trust and accountability, enabling buyers to verify claims related to sustainability.

For buyers in Africa, South America, and the Middle East, investing in sustainable supplier development programs can foster long-term partnerships that benefit both the environment and local economies. This strategic approach not only aligns with global sustainability mandates but also addresses increasing regulatory pressures and consumer demand for ethical products.

Brief Evolution and Historical Context

The salad dressing industry has evolved from simple, locally crafted sauces to a complex, global sector driven by innovation and health trends. Historically, dressings were predominantly oil-and-vinegar based, reflecting traditional culinary practices in Europe and the Mediterranean. The 20th century introduced mass production and diversification, with mayonnaise and creamy dressings gaining popularity worldwide.

In recent decades, globalization and health consciousness have reshaped the market. The rise of ethnic flavors and functional ingredients—such as probiotics and antioxidants—reflects changing consumer preferences. For B2B buyers, this evolution underscores the importance of agility in sourcing and product development to meet diverse and evolving market demands across continents.

Understanding this historical trajectory helps buyers anticipate future trends, such as the growing interest in plant-based dressings and clean-label formulations, ensuring they remain competitive in a dynamic global marketplace.

Related Video: Crude Oil Prices & Global Trade Market Seen Stabilising After Trump Announced Iran Israel Ceasefire

Frequently Asked Questions (FAQs) for B2B Buyers of the circle graph above gives the distribution of salad dressing

-

How can I effectively vet suppliers of salad dressing based on distribution data like the circle graph?

To vet suppliers, analyze the distribution data to identify which types of salad dressings dominate the market and align with your target demographics. Prioritize suppliers with proven expertise in producing the most demanded varieties. Request detailed product specifications, certifications, and client references. Conduct background checks on supplier reliability, production capacity, and compliance with international food safety standards relevant to your region (e.g., South Africa’s NRCS, EU’s EFSA). Use third-party audits or inspection services to verify claims and ensure supplier credibility before committing. -

Is customization of salad dressing formulations feasible for international B2B buyers?

Yes, many manufacturers accommodate customization to meet specific taste preferences, ingredient standards, or dietary regulations prevalent in Africa, South America, the Middle East, and Europe. When negotiating, clarify your requirements such as flavor profiles, organic certifications, allergen exclusions, or packaging preferences. Customization may affect minimum order quantities (MOQs) and lead times, so confirm these details upfront. Establish clear communication channels and request samples to validate the customized product before large-scale orders. -

What are typical minimum order quantities (MOQs) and lead times for salad dressing in international B2B trade?

MOQs vary widely depending on the supplier, product type, and customization level but generally range from 500 to 5,000 liters or corresponding packaging units. Lead times typically span 4 to 12 weeks, influenced by production schedules, ingredient sourcing, and shipping logistics. Buyers from regions like Argentina or South Africa should factor in potential customs clearance delays and seasonal ingredient availability. Negotiate MOQs and lead times during contract discussions, and consider phased orders or consignment stocks to optimize inventory and cash flow.

Illustrative Image (Source: Google Search)

-

What payment terms and methods are standard for international salad dressing purchases?

International B2B transactions often use Letters of Credit (LC), Telegraphic Transfers (TT), or open account terms with credit insurance. Payment terms typically range from 30 to 90 days post-shipment, but upfront deposits (20-50%) are common, especially for new suppliers or customized orders. For buyers in the Middle East and Africa, consider currency volatility and banking infrastructure when agreeing on payment methods. Always clarify payment milestones and penalties for delays to mitigate financial risks. -

Which quality assurance certifications should I expect from salad dressing suppliers?

Top suppliers should hold internationally recognized certifications such as ISO 22000 (Food Safety Management), HACCP, BRC, or FSSC 22000. Certifications related to organic production, kosher, halal, and non-GMO claims are critical depending on your market’s consumer demands. Verify the authenticity of certificates and ensure they are current. Suppliers should provide batch testing reports for microbial safety, shelf life, and nutritional content. These quality assurances are essential for compliance with import regulations in Europe, South America, and Africa. -

How can I optimize logistics for importing salad dressing internationally?

Salad dressings are typically classified as perishable or semi-perishable food products requiring temperature-controlled storage and transport. Engage freight forwarders experienced in food logistics to manage cold chain integrity, customs clearance, and timely delivery. Use consolidated shipments to reduce costs if MOQs are low. For buyers in landlocked regions like some parts of Africa or South America, plan for extended inland transportation and storage. Additionally, ensure packaging complies with international shipping standards to prevent spoilage or damage. -

What dispute resolution mechanisms should be included in contracts with international salad dressing suppliers?

Contracts should specify clear dispute resolution processes such as mediation or arbitration under recognized international rules (e.g., ICC arbitration). Define governing law and jurisdiction, ideally in a neutral country or the buyer’s home country. Include clauses on product quality disputes, delivery delays, and payment defaults, with timelines for claims and corrective actions. Employ Incoterms to clarify responsibilities for risk and costs during shipping. These provisions protect buyers from costly litigation and ensure smoother resolution in cross-border trade. -

How can I leverage salad dressing distribution data to forecast demand and negotiate better terms?

Use the circle graph’s distribution insights to identify high-demand dressing types and emerging trends within target regions. This data supports demand forecasting, helping you plan order volumes and timing more accurately. Suppliers may offer better pricing, flexible MOQs, or priority production slots when presented with solid market data demonstrating potential sales. Additionally, understanding distribution patterns enables tailored marketing strategies and product mixes, increasing your competitive advantage in diverse markets such as the Middle East or Europe.

Illustrative Image (Source: Google Search)

Strategic Sourcing Conclusion and Outlook for the circle graph above gives the distribution of salad dressing

The distribution of salad dressing types, as illustrated by the circle graph, reveals critical insights for international B2B buyers aiming to optimize their sourcing strategies. Recognizing the dominant categories and their market shares enables buyers to tailor procurement plans that align with consumer preferences and regional demands. For markets in Africa, South America, the Middle East, and Europe, understanding these distribution patterns is essential for selecting suppliers who offer the right product mix, ensuring competitive advantage and market relevance.

Strategic sourcing in this context involves leveraging data-driven insights to balance quality, cost-efficiency, and supply chain resilience. By prioritizing suppliers who demonstrate flexibility across popular dressing varieties, buyers can mitigate risks associated with fluctuating demand and ingredient availability. Furthermore, collaboration with manufacturers that comply with local regulations and cultural tastes enhances product acceptance and long-term partnerships.

Looking ahead, B2B buyers are encouraged to deepen their market analysis by integrating distribution data with evolving consumer trends and sustainability criteria. Embracing digital tools and predictive analytics will further refine sourcing decisions, enabling agile responses to global supply chain dynamics. To capitalize on these opportunities, buyers from diverse regions such as South Africa and Argentina should proactively engage with suppliers who offer transparency, innovation, and scalability—key drivers for success in the competitive salad dressing sector.