Master Sourcing White Homecoming Dresses: Quality, Trends &

Guide to White Homecoming Dress

- Introduction: Navigating the Global Market for white homecoming dress

- Understanding white homecoming dress Types and Variations

- Key Industrial Applications of white homecoming dress

- Strategic Material Selection Guide for white homecoming dress

- In-depth Look: Manufacturing Processes and Quality Assurance for white homecoming dress

- Comprehensive Cost and Pricing Analysis for white homecoming dress Sourcing

- Spotlight on Potential white homecoming dress Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for white homecoming dress

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the white homecoming dress Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of white homecoming dress

- Strategic Sourcing Conclusion and Outlook for white homecoming dress

Introduction: Navigating the Global Market for white homecoming dress

The global market for white homecoming dresses represents a dynamic opportunity for international B2B buyers aiming to capitalize on a timeless and versatile fashion segment. As a staple in formal and semi-formal events, the white homecoming dress commands significant demand across diverse regions including Africa, South America, the Middle East, and Europe. Its universal appeal stems from its classic elegance and adaptability to various cultural aesthetics and event styles, making it a critical product category for wholesalers, retailers, and distributors seeking to expand their portfolios.

This comprehensive guide delves deeply into every facet essential for informed sourcing and successful market entry. Buyers will gain expert insights into the varieties of white homecoming dresses, ranging from short, midi, to maxi lengths, and from minimalist designs to embellished couture styles. An in-depth overview of fabric types and material quality will aid in selecting products that meet regional preferences and climate considerations. The guide further explores manufacturing processes and quality control standards, highlighting best practices to ensure product consistency and compliance with international regulations.

Additionally, it profiles reliable suppliers and manufacturers with proven track records in delivering competitive pricing without compromising quality. Market trends and cost analysis across key regions will equip buyers with actionable intelligence to negotiate effectively and forecast demand. Finally, a dedicated FAQ section addresses common challenges and clarifies critical terms, empowering buyers to navigate complexities confidently.

By leveraging this guide, international B2B buyers—from emerging markets in Africa and South America to established hubs in Europe and the Middle East—will be well-positioned to make strategic, data-driven decisions that maximize profitability and foster long-term supplier partnerships in the white homecoming dress market.

Understanding white homecoming dress Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| A-Line White Dress | Fitted bodice with flared skirt, versatile length options | Retail boutiques, event wear suppliers | + Universally flattering, broad appeal – Inventory variety needed for sizing |

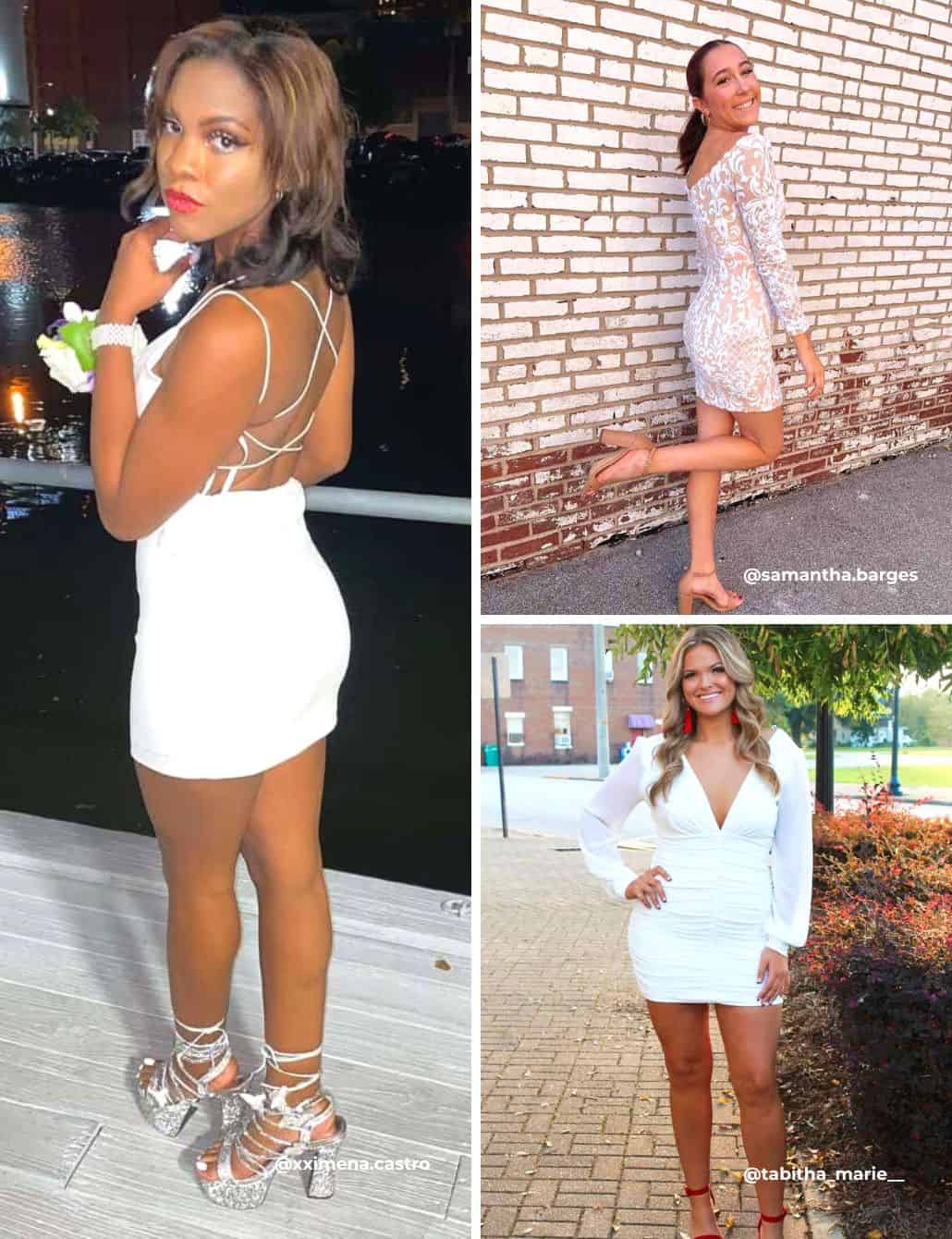

| Bodycon White Dress | Tight-fitting silhouette emphasizing curves | Fashion-forward retailers, online platforms | + Trendy, high demand in youth markets – Limited comfort, sizing challenges |

| Lace-Embellished | Intricate lace overlays, often with sheer elements | Premium fashion stores, bridal/homecoming mix | + Elegant, premium feel – Higher cost, delicate handling required |

| Off-Shoulder Dress | Exposed shoulders, often paired with ruffles or sleeves | Trendy fashion outlets, seasonal collections | + Fashionable, seasonal bestseller – May require careful size fittings |

| Midi/Maxi Length | Longer hemline options, from mid-calf to floor-length | Formal wear suppliers, international markets | + Suitable for formal events, diverse markets – Larger fabric costs, storage |

A-Line White Dress

The A-Line white dress is characterized by a fitted bodice that gently flares out from the waist, making it flattering for a wide range of body types. Its versatility in length—from mini to midi—makes it suitable for various homecoming styles and cultural preferences. For B2B buyers, stocking A-Line dresses offers broad market appeal and easier turnover. However, maintaining a wide size range is essential to meet diverse international customer needs, especially in regions like Europe and South America where sizing standards vary.

Bodycon White Dress

Bodycon dresses are designed to hug the body closely, accentuating the wearer’s silhouette. This style is particularly popular among younger demographics and in markets with a preference for trendy, figure-enhancing attire, such as urban areas in the Middle East and Europe. B2B buyers should note the demand for precise sizing and quality stretch fabrics to ensure comfort and fit. While this style commands higher margins, returns can increase if size variations are not well managed.

Lace-Embellished White Dress

Featuring delicate lace overlays and often sheer panels, lace-embellished white dresses cater to the premium segment of the homecoming dress market. These dresses appeal to buyers seeking elegance and sophistication, often crossing over into bridal wear. For international B2B buyers, especially in markets like Turkey and South America, sourcing high-quality lace and ensuring durable craftsmanship is critical. The higher price point demands careful inventory management and marketing to justify the cost to end consumers.

Off-Shoulder White Dress

Off-shoulder styles highlight the neckline and shoulders, frequently enhanced with ruffles or fitted sleeves. This variation is trendy and sees spikes in demand during peak homecoming seasons. B2B suppliers should consider the fit complexity and the need for adjustable sizing options to accommodate different shoulder widths, which vary by region. This style performs well in fashion-conscious markets but may require investment in detailed size guides and customer education.

Midi/Maxi Length White Dress

Midi and maxi length dresses provide formal and modest options favored in diverse cultural contexts, including Middle Eastern and African markets. These longer hemlines are suitable for formal homecoming events and can be adapted with various fabric choices and embellishments. B2B buyers should anticipate higher fabric and shipping costs due to larger material use. However, these styles open access to a wider international clientele seeking elegance combined with modesty, making them valuable for diverse retail portfolios.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of white homecoming dress

| Industry/Sector | Specific Application of White Homecoming Dress | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Fashion Retail & Wholesale | Seasonal Homecoming Dress Collections | Drives sales with trendy, culturally relevant products | Trend alignment, quality of fabric, sizing diversity |

| Event Management & Hospitality | Uniforms or Special Event Attire for Themed Homecoming Events | Enhances event branding and guest experience | Customization options, durability, comfort for extended wear |

| Textile & Apparel Manufacturing | Production of White Homecoming Dresses for Export Markets | Access to growing international demand, especially in youth fashion | Compliance with international standards, fabric sourcing, cost-efficiency |

| Online Fashion Marketplaces | Curated White Homecoming Dress Listings | Expands product range, attracts young buyers | Reliable supply chain, timely delivery, competitive pricing |

| Cultural & Educational Institutions | Uniform or Dress Code Implementation for Homecoming Ceremonies | Standardizes event appearance, fosters tradition and unity | Consistent quality, adaptability to local climate and customs |

Fashion Retail & Wholesale

In fashion retail, white homecoming dresses represent a significant seasonal product line that appeals to young consumers celebrating homecoming events. Retailers in Africa, South America, the Middle East, and Europe can capitalize on this trend by offering diverse styles that cater to regional tastes and sizing needs. Quality fabrics and contemporary designs that reflect local cultural nuances help retailers differentiate their offerings and boost sales during peak homecoming seasons.

Event Management & Hospitality

Event planners and hospitality businesses use white homecoming dresses to create themed uniforms or special attire for staff and participants during homecoming events. These dresses enhance the visual appeal and branding of the event, contributing to a memorable guest experience. Buyers should prioritize dresses that offer customization, durability, and comfort to accommodate long hours and active participation, especially in warm climates common in many African and Middle Eastern markets.

Illustrative Image (Source: Google Search)

Textile & Apparel Manufacturing

Manufacturers focusing on white homecoming dresses for export benefit from tapping into growing international youth fashion markets. These businesses must ensure compliance with international quality standards and ethical sourcing practices to meet the expectations of buyers from Europe, Turkey, Vietnam, and South America. Cost-effective production combined with high-quality materials enables manufacturers to compete globally while maintaining profitability.

Online Fashion Marketplaces

E-commerce platforms use white homecoming dresses to diversify their product catalogs and attract young consumers globally. For online sellers, reliable sourcing and timely delivery are critical to maintaining customer satisfaction and competitive edge. Marketplaces targeting emerging economies in Africa and South America should focus on affordable pricing and varied style options to meet local demand while ensuring consistent stock availability.

Cultural & Educational Institutions

Schools and cultural organizations often implement dress codes or uniforms featuring white homecoming dresses to uphold tradition and unify event participants. Buyers from educational sectors in Europe and the Middle East require dresses that maintain consistent quality, are adaptable to local climate conditions, and respect cultural dress norms. This application emphasizes durability and ease of maintenance to support repeated use across multiple academic years.

Related Video: LABORATORY APPARATUS AND THEIR USES

Strategic Material Selection Guide for white homecoming dress

Fabric Options for White Homecoming Dresses: A Strategic Material Selection

When sourcing white homecoming dresses for international B2B markets, selecting the appropriate fabric is critical to balancing aesthetics, comfort, durability, and cost-efficiency. The choice of material impacts the dress’s appeal in different climates, cultural preferences, and manufacturing capabilities, especially for buyers in Africa, South America, the Middle East, and Europe. Below is an in-depth analysis of four common materials used in white homecoming dresses from a B2B perspective.

1. Polyester

Key Properties:

Polyester is a synthetic fiber known for its high tensile strength, wrinkle resistance, and color retention. It is moisture-wicking but less breathable than natural fibers, with excellent resistance to shrinking and stretching.

Pros & Cons:

– Pros: Durable, easy to care for, cost-effective, and resistant to mildew and abrasion. Polyester fabrics maintain their shape well, making them ideal for structured dress designs.

– Cons: Lower breathability can be uncomfortable in hot climates. It may have a synthetic feel, which can reduce perceived luxury. Environmental concerns around polyester’s non-biodegradability are growing.

Impact on Application:

Polyester suits mass production and export due to its durability and ease of maintenance. It performs well in humid or variable climates common in parts of Africa and South America, where wrinkle resistance and colorfastness are valued.

International Buyer Considerations:

Buyers should verify compliance with international textile standards such as OEKO-TEX® and REACH for chemical safety. In Europe and Turkey, sustainability certifications are increasingly important. Polyester sourced from Vietnam often meets global standards and offers competitive pricing.

2. Cotton

Key Properties:

Cotton is a natural fiber prized for its softness, breathability, and moisture absorption. It is comfortable in warm climates but wrinkles easily and can shrink if not treated properly.

Pros & Cons:

– Pros: Highly breathable and comfortable, hypoallergenic, and biodegradable. Cotton’s natural feel is often preferred in regions with hot weather, such as the Middle East and parts of Africa.

– Cons: Prone to wrinkling and shrinkage, less durable than synthetics, and may require more care in washing and ironing.

Impact on Application:

Cotton dresses are ideal for markets where comfort and natural fibers are prioritized. However, cotton blends are often preferred to improve durability and reduce maintenance.

International Buyer Considerations:

Buyers should ensure cotton fabrics meet standards like ASTM D123 for fiber content and shrinkage control. Organic cotton is gaining traction in Europe and South America due to sustainability trends. Cotton from Turkey is known for high quality and compliance with EU textile regulations.

3. Satin (Polyester or Silk Blend)

Key Properties:

Satin is characterized by its glossy surface and smooth texture, achieved through a specific weave rather than fiber content. Polyester satin offers durability, while silk satin provides luxury and breathability.

Pros & Cons:

– Pros: Elegant sheen and drape, suitable for formal occasions. Polyester satin is affordable and durable; silk satin offers premium softness and breathability.

– Cons: Polyester satin can trap heat and cause discomfort in warm climates. Silk satin is expensive and requires delicate care.

Impact on Application:

Satin is favored for high-end homecoming dresses where appearance is paramount. Polyester satin is suitable for markets prioritizing cost, while silk satin targets premium segments, particularly in Europe and the Middle East.

International Buyer Considerations:

Compliance with textile safety and labeling standards (e.g., EU Textile Regulation 1007/2011) is essential. Buyers in Vietnam and Turkey can access both polyester and silk satin, with Vietnam focusing more on synthetics and Turkey on silk blends.

4. Chiffon

Key Properties:

Chiffon is a lightweight, sheer fabric typically made from silk, nylon, or polyester. It has a soft drape and slightly rough texture, offering a delicate and ethereal look.

Pros & Cons:

– Pros: Provides elegance and flow, excellent for layering and overlays. Polyester chiffon is durable and affordable; silk chiffon is luxurious but fragile.

– Cons: Sheerness requires lining or layering, which can increase production complexity and cost. Silk chiffon demands careful handling and is less durable.

Impact on Application:

Chiffon is ideal for buyers targeting sophisticated designs with flowing silhouettes. It is popular in warmer climates due to its lightness but requires skilled manufacturing to handle delicate fabrics.

International Buyer Considerations:

Buyers should consider local preferences for fabric transparency and layering. Compliance with ASTM D3512 for chiffon fabrics and certifications for chemical treatments is important. Vietnam is a strong supplier of polyester chiffon, while Turkey offers premium silk chiffon options.

Summary Table

| Material | Typical Use Case for white homecoming dress | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyester | Durable, wrinkle-resistant dresses for mass market | Cost-effective, easy care, durable | Less breathable, synthetic feel | Low |

| Cotton | Comfortable, breathable dresses for warm climates | Natural, breathable, hypoallergenic | Prone to wrinkles and shrinkage | Medium |

| Satin (Polyester/Silk) | Formal, elegant dresses with glossy finish | Luxurious sheen and drape | Polyester satin traps heat; silk satin costly | Medium (polyester) / High (silk) |

| Chiffon (Polyester/Silk) | Flowing, layered dresses with delicate appearance | Lightweight, elegant drape | Sheer, requires lining; silk chiffon fragile | Medium (polyester) / High (silk) |

This guide equips international B2B buyers with actionable insights to select the optimal fabric for white homecoming dresses, tailored to their target markets’ climatic conditions, cultural preferences, and regulatory environments. Understanding these material nuances supports strategic sourcing decisions that balance quality, cost, and consumer appeal.

In-depth Look: Manufacturing Processes and Quality Assurance for white homecoming dress

The manufacturing of white homecoming dresses involves a series of precise and quality-driven processes to ensure that the final product meets the aesthetic and durability expectations of the target market. For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, understanding these processes and the quality assurance frameworks is crucial for selecting reliable suppliers and maintaining competitive standards.

Manufacturing Process Overview

1. Material Preparation

The process begins with sourcing high-quality fabrics, commonly satin, chiffon, lace, or tulle, which are essential for the signature look of white homecoming dresses. Fabric inspection for color consistency, texture, and defects is performed to ensure uniformity. Materials are pre-treated—washed or steamed—to stabilize shrinkage and enhance fabric performance.

2. Pattern Making and Cutting

Using CAD (Computer-Aided Design) systems, patterns are created based on design specifications. This stage is critical for fit and style accuracy. Fabric is then laid out and cut with precision cutting machines, often automated to minimize waste and improve efficiency. For white dresses, extra care is taken to prevent fabric contamination during cutting.

3. Assembly and Sewing

Skilled workers or industrial sewing machines assemble the dress components. Techniques include flat sewing, overlock stitching, and hand-sewn embellishments such as beading or lace appliques. Seam strength and stitch density are closely monitored to ensure durability and appearance. Special attention is given to linings and zippers to maintain comfort and functionality.

4. Finishing and Detailing

Finishing involves pressing, adding trims, buttons, and final quality touches. White dresses undergo careful cleaning to remove marks or loose threads. Packaging is designed to prevent yellowing or damage during transit. This stage often includes adding branded tags or labels as per buyer requirements.

Quality Assurance (QA) and Control (QC) Frameworks

For B2B buyers, comprehensive QC is vital to ensure consistency, compliance, and customer satisfaction. The following frameworks and checkpoints are common in the white homecoming dress industry:

International and Industry Standards

– ISO 9001: The global benchmark for quality management systems, ISO 9001 certification indicates a supplier’s commitment to continuous quality improvement and customer focus.

– OEKO-TEX Standard 100: Relevant for textile safety, this certification ensures the fabric is free from harmful substances, critical for garments worn close to skin.

– REACH Compliance: Particularly important for European buyers, ensuring chemicals used in dyes and finishes meet strict environmental and health regulations.

– Consumer Safety Standards: Some markets require compliance with flammability standards or labeling laws.

Quality Control Checkpoints

– Incoming Quality Control (IQC): Inspection of raw materials such as fabric, zippers, and embellishments for defects or deviations before production. This reduces the risk of downstream quality issues.

– In-Process Quality Control (IPQC): Continuous monitoring during cutting, sewing, and assembly stages to detect and correct defects early. This includes seam strength tests, colorfastness checks, and stitch consistency.

– Final Quality Control (FQC): Comprehensive inspection of finished dresses, including visual checks for stains, fit verification, measurement accuracy, and packaging integrity.

Common Testing Methods

– Colorfastness Testing: Ensures the white fabric does not discolor or bleed after washing or exposure to light.

– Tensile and Seam Strength Tests: Verify durability under stress to prevent garment failure during wear.

– Dimensional Stability Testing: Confirms garments maintain shape and size after laundering.

– Chemical Residue Testing: Detects any harmful residues from dyes or finishes.

Verifying Supplier Quality for International B2B Buyers

For buyers sourcing white homecoming dresses internationally, particularly from emerging markets like Vietnam or Turkey, robust verification of supplier QC systems is essential:

- Factory Audits: On-site audits by buyer representatives or third-party agencies assess manufacturing capabilities, quality management systems, labor practices, and environmental compliance. Remote video audits can supplement in-person visits when travel is restricted.

- Quality Reports and Documentation: Request detailed QC reports, including inspection checklists, test certificates (e.g., OEKO-TEX), and production batch records. Transparent documentation indicates a mature quality culture.

- Third-Party Inspections: Independent inspection companies can conduct pre-shipment inspections (PSI) to verify conformity before goods leave the factory. This reduces risks of receiving substandard products.

- Sample Approval Process: Approve prototypes or pre-production samples to ensure design and quality expectations are met before full-scale production.

QC and Certification Nuances for Regional Buyers

- Africa and South America: Buyers often prioritize cost-effective suppliers but should insist on OEKO-TEX certification and ISO 9001 compliance to ensure fabric safety and consistent quality, especially for youth markets. Local import regulations may require additional customs testing or labeling compliance.

- Middle East: Due to climate and cultural factors, buyers may demand higher standards for fabric breathability and modesty design features. Certifications related to chemical safety and flame retardance may be critical. Understanding regional preferences for dress embellishments is also important.

- Europe (including Turkey): European buyers face stringent REACH and environmental regulations. They should emphasize suppliers’ compliance with chemical restrictions and sustainability practices. Buyers from Turkey, a key textile hub, benefit from proximity but must verify that suppliers maintain international quality certifications and audit readiness.

- Vietnam: As a major garment exporter, Vietnamese suppliers often hold ISO 9001 and OEKO-TEX certifications. Buyers should focus on verifying IPQC rigor due to high production volumes and ensure that finishing processes prevent yellowing or fabric damage common with white garments.

In summary, international B2B buyers of white homecoming dresses must adopt a strategic approach to manufacturing and quality assurance. Understanding the key production stages and insisting on internationally recognized certifications and rigorous QC checkpoints will safeguard product quality. Leveraging audits, third-party inspections, and clear quality documentation ensures that buyers can confidently source elegant, durable white homecoming dresses that meet diverse regional market demands.

Related Video: Amazing Garment Manufacturing Process from Fabric to Finished Product Inside the Factory

Comprehensive Cost and Pricing Analysis for white homecoming dress Sourcing

Key Cost Components in White Homecoming Dress Sourcing

When sourcing white homecoming dresses for B2B purposes, understanding the detailed cost structure is crucial for effective budgeting and supplier negotiation:

-

Materials: The primary cost driver includes fabric (commonly chiffon, satin, lace), linings, embellishments (beading, sequins), zippers, and thread. Premium materials or certified sustainable fabrics significantly increase costs but can justify higher retail pricing.

-

Labor: Labor costs vary widely by manufacturing country. Skilled craftsmanship for detailed embroidery or couture finishes commands higher wages. Labor-intensive designs such as hand-sewn embellishments or intricate cuts increase unit costs.

-

Manufacturing Overhead: Includes factory utilities, equipment depreciation, and indirect labor. Efficient factories with modern machinery may offer better economies of scale, reducing overhead per unit.

-

Tooling and Setup: Initial pattern making, sample development, and production line setup involve one-time costs that are amortized over order volumes. Complex designs or customized sizing increase tooling expenses.

-

Quality Control (QC): Rigorous QC processes to ensure color consistency (critical for white dresses), fabric quality, and stitching durability add to costs but reduce returns and increase buyer confidence.

-

Logistics and Import Fees: Costs include shipping (sea freight, air freight), customs duties, taxes, and insurance. White dresses require careful packaging to avoid discoloration or damage, which can add to logistics expenses.

-

Margin: Suppliers typically add a margin that covers profit and risk. Margins vary with supplier reputation, order size, and contract terms.

Influencing Factors on Pricing

Several variables affect the final unit price of white homecoming dresses:

-

Order Volume and Minimum Order Quantities (MOQ): Larger orders benefit from volume discounts, lowering per-unit costs. Buyers from regions with smaller market sizes (e.g., certain African or South American countries) should consider consolidating orders or partnering with distributors to meet MOQs.

-

Product Specifications and Customization: Custom designs, unique fabric blends, or additional embellishments increase price. Standardized styles cost less and have faster lead times.

-

Material Quality and Certifications: Organic or OEKO-TEX certified fabrics cost more but appeal to eco-conscious markets in Europe and the Middle East. Certification also reduces compliance risks.

-

Supplier Capabilities and Reputation: Established suppliers with strong production capacity and compliance certifications (e.g., ISO, BSCI) may charge a premium but provide reliability and quality assurance.

-

Incoterms and Payment Terms: Prices vary depending on shipping terms (FOB, CIF, DDP). Buyers should understand responsibilities for freight, insurance, and customs clearance to accurately compare supplier quotes.

Strategic Tips for International B2B Buyers

-

Negotiate Beyond Price: Discuss payment terms, lead times, packaging, and after-sales support. Suppliers often have flexibility in non-price factors that impact total cost and buyer satisfaction.

-

Evaluate Total Cost of Ownership (TCO): Consider not only unit price but also shipping time, customs duties, potential quality issues, and inventory carrying costs. For example, faster air freight might increase upfront cost but reduce stock holding expenses.

-

Leverage Local Agents or Sourcing Platforms: In regions like Turkey, Vietnam, or the Middle East, local sourcing agents can help navigate supplier audits and quality control, reducing risks and hidden costs.

-

Understand Regional Market Preferences: Dress styles, sizing standards, and fabric preferences vary. Aligning sourcing decisions with end-market demands avoids costly redesigns or inventory write-offs.

-

Plan for MOQ Flexibility: Negotiate smaller initial runs or sampling orders to test quality before scaling, especially important for new suppliers or untested markets in Africa or South America.

Pricing Disclaimer

The prices for white homecoming dresses can vary significantly depending on design complexity, materials, and sourcing location. The indicative price range for bulk orders typically spans from $15 to $60 per unit, exclusive of shipping and customs fees. Buyers should conduct supplier-specific cost analyses and factor in all logistics and compliance expenses to develop accurate procurement budgets.

By comprehensively analyzing these cost components and pricing influencers, international B2B buyers can optimize sourcing strategies for white homecoming dresses, ensuring competitive pricing while maintaining quality standards tailored to diverse regional markets.

Spotlight on Potential white homecoming dress Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘white homecoming dress’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for white homecoming dress

Critical Technical Properties of White Homecoming Dresses

When sourcing white homecoming dresses for international markets, understanding key technical specifications ensures product quality, compliance, and customer satisfaction. Below are the most critical properties to assess:

-

Fabric Quality and Composition

The fabric is typically a blend of polyester, satin, chiffon, or lace, with variations depending on style and price point. High-grade synthetic fibers ensure durability, wrinkle resistance, and colorfastness—crucial for maintaining the pristine white look. For B2B buyers, verifying fabric composition and origin affects durability and customer appeal. -

Color Consistency and Shade

White dresses can vary subtly in shade, from bright white to ivory. Consistency in color across production batches is essential to meet buyer expectations, especially when combining dresses with accessories or other apparel. Ensure suppliers provide color swatches and use standardized color codes (e.g., Pantone) to avoid shade mismatches. -

Dress Measurements and Tolerances

Precise sizing details—bust, waist, hips, length—are vital. Typical tolerance in garment dimensions ranges from ±1 to ±2 cm to accommodate manufacturing variances. Accurate measurements reduce returns and improve customer satisfaction. Request detailed size charts and confirm tolerance levels with manufacturers. -

Seam and Stitching Quality

Strong, neat stitching using appropriate thread types (e.g., polyester thread for stretch and strength) affects dress durability and finish quality. Look for reinforced seams in high-stress areas like zippers and bust lines. This technical property is a key differentiator in mid to high-end product segments. -

Embellishment and Trim Specifications

Many white homecoming dresses feature beads, sequins, lace appliques, or embroidery. Confirm the type, quality, and attachment method (hand-sewn vs. machine-applied) to ensure durability and compliance with safety standards. Embellishment details also impact lead times and cost. -

Care and Maintenance Instructions

Fabric blends and trims influence cleaning methods—whether machine washable or dry-clean only. Clear labeling and supplier guidance on care extend product life and enhance end-user satisfaction, especially important for export markets with varying consumer habits.

Common Trade Terminology for White Homecoming Dress Procurement

Understanding standard trade terms streamlines communication and transaction processes between buyers and suppliers internationally. Here are essential terms every B2B buyer should know:

-

OEM (Original Equipment Manufacturer)

Refers to manufacturers producing white homecoming dresses based on the buyer’s design and specifications. OEM partnerships allow customization and branding flexibility but require clear technical documentation and quality control agreements. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to produce per order. MOQs can vary widely depending on fabric type, embellishments, and production complexity. Buyers should negotiate MOQs that balance cost efficiency with inventory risk, especially when testing new markets. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers requesting detailed pricing, lead times, and terms based on specified dress designs and quantities. An effective RFQ includes technical specs, quality standards, and delivery expectations, facilitating transparent supplier evaluation. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities, costs, and risks between buyer and seller during shipment. Common Incoterms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Selecting appropriate Incoterms impacts logistics, customs clearance, and final landed cost. -

Lead Time

The total time from order confirmation to product delivery. Lead time depends on fabric sourcing, production complexity, and shipping method. Buyers should factor lead times into inventory planning and marketing schedules, especially for seasonal events like homecoming. -

Tech Pack

A detailed specification document including drawings, measurements, materials, trims, and construction notes. Providing a comprehensive tech pack ensures manufacturers clearly understand product requirements, reducing errors and accelerating production.

By mastering these technical properties and trade terms, international B2B buyers can confidently source high-quality white homecoming dresses tailored to diverse market demands across Africa, South America, the Middle East, and Europe. This knowledge enables better supplier negotiations, quality assurance, and supply chain efficiency.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the white homecoming dress Sector

Market Overview & Key Trends

The global white homecoming dress market is experiencing steady growth driven by evolving fashion preferences, increasing youth populations, and rising disposable incomes across regions such as Africa, South America, the Middle East, and Europe. For international B2B buyers, understanding regional nuances is critical. In Africa and South America, there is a growing demand for affordable yet stylish white homecoming dresses that blend Western fashion trends with local cultural aesthetics. Meanwhile, buyers in the Middle East and Europe, including countries like Turkey and Vietnam, seek premium-quality fabrics and intricate designs that cater to both traditional and modern tastes.

Key market drivers include a surge in social media influence, which rapidly disseminates style trends and drives demand for trendy, Instagram-worthy dresses. Additionally, the rise of e-commerce platforms has expanded market reach, allowing wholesalers and retailers to source globally with greater ease and flexibility. Buyers should note an emerging preference for versatile dress designs that can transition from homecoming events to other formal occasions, increasing product value and inventory turnover.

From a sourcing perspective, technology adoption such as AI-driven trend forecasting and virtual sampling tools is enhancing supply chain agility. These innovations enable B2B buyers to anticipate market shifts and customize offerings efficiently. Moreover, nearshoring and diversified supplier bases are gaining traction to mitigate risks associated with global disruptions, particularly for buyers in Europe and the Middle East who prioritize shorter lead times and supply chain resilience.

Illustrative Image (Source: Google Search)

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a pivotal factor in the white homecoming dress sector, with B2B buyers increasingly demanding transparency and eco-conscious practices from suppliers. The environmental impact of textile production—especially the use of water-intensive cotton and synthetic dyes—has prompted a shift towards sustainable materials such as organic cotton, Tencel, and recycled fabrics. These materials not only reduce water and chemical use but also appeal to ethically minded consumers.

Ethical supply chains are equally important, emphasizing fair labor practices and safe working conditions across manufacturing hubs in Asia, Africa, and Latin America. Certifications like GOTS (Global Organic Textile Standard), OEKO-TEX, and Fair Trade serve as key indicators of compliance and credibility for international buyers. Investing in suppliers with these certifications helps mitigate reputational risks and aligns with growing regulatory requirements in Europe and other markets.

For B2B buyers, integrating sustainability into procurement strategies offers competitive advantages, including access to premium retail channels and the ability to meet corporate social responsibility (CSR) goals. Collaborating with suppliers on eco-friendly packaging, waste reduction, and energy-efficient production further enhances sustainability credentials. Ultimately, fostering long-term partnerships with responsible manufacturers supports both environmental stewardship and business resilience.

Brief Evolution and Industry Context

White homecoming dresses have traditionally symbolized purity and celebration, rooted in Western high school and college traditions. Over the past decades, the sector has evolved from classic, modest silhouettes to more diverse and fashion-forward designs featuring varied lengths, cuts, and embellishments. This evolution reflects broader shifts in youth culture and global fashion influences.

For B2B buyers, understanding this transformation is essential to anticipate consumer preferences and stock relevant styles. The incorporation of contemporary fabrics and innovative manufacturing techniques also highlights opportunities for sourcing differentiation. As the market continues to globalize, the white homecoming dress has transcended its original cultural boundaries, becoming a versatile garment with international appeal. This dynamic landscape requires buyers to stay informed and agile, balancing tradition with innovation to capture emerging demand across diverse markets.

Related Video: Global Trends Chapter 1 || Chapter 1 Part 2

Frequently Asked Questions (FAQs) for B2B Buyers of white homecoming dress

-

How can international B2B buyers verify the credibility of white homecoming dress suppliers?

Conduct thorough due diligence by requesting company registration documents, trade licenses, and references from previous international clients. Utilize third-party verification services and inspect supplier certifications such as ISO or industry-specific standards. Visiting manufacturing facilities or hiring local inspection agents can provide additional assurance. Cross-check online reviews and industry reputation, especially for suppliers serving Africa, South America, the Middle East, and Europe. Establishing clear communication channels early on helps assess professionalism and reliability. -

Is it possible to customize white homecoming dresses to meet regional preferences or branding requirements?

Yes, many manufacturers offer customization options including fabric choice, dress length, embellishments, and sizing adjustments. For international buyers, clear specifications and design samples should be shared upfront to avoid miscommunication. Some suppliers provide private labeling or exclusive designs, which can strengthen brand identity in diverse markets like Turkey or Vietnam. Confirm customization capabilities and associated costs during contract negotiations to ensure alignment with your target market’s style and quality expectations. -

What are typical minimum order quantities (MOQs) and lead times for white homecoming dress orders from international suppliers?

MOQs vary widely depending on supplier capacity, ranging from 50 to 500 pieces per style or design. Lead times typically span 30 to 90 days, influenced by order size, customization, and seasonal demand. Buyers from emerging markets should account for additional time in shipping and customs clearance. Negotiate MOQs based on your market size and storage capabilities, and consider phased orders or pilot shipments to mitigate risks while establishing new supplier relationships.

-

Which payment terms are common and advisable when sourcing white homecoming dresses internationally?

Standard payment terms include a 30% deposit upfront and 70% balance before shipment or upon receiving a Bill of Lading. For new suppliers, Letters of Credit (LC) or escrow services can reduce payment risk. Wire transfers via secure banking channels are preferred, while PayPal or Alibaba Trade Assurance may be options for smaller transactions. Always clarify payment milestones in contracts and avoid full upfront payments without verified trust and contractual protection, especially when dealing with suppliers in different continents. -

What quality assurance measures should B2B buyers insist on for white homecoming dresses?

Buyers should request detailed product specifications, including fabric type, stitching standards, and finishing details. Pre-shipment inspections by third-party quality control firms are essential to verify compliance with agreed standards. Certifications such as OEKO-TEX or SGS reports can validate material safety and quality. Implementing a quality checklist and sample approval process before mass production helps reduce defects and returns. Clear communication of quality expectations is crucial, especially when serving diverse consumer bases in Africa, Europe, or the Middle East. -

Are there specific certifications or standards that white homecoming dress suppliers should comply with for international trade?

Yes, suppliers should comply with international quality and safety standards such as ISO 9001 for quality management and OEKO-TEX Standard 100 for textile safety. Compliance with REACH regulations is important when exporting to Europe to ensure chemical safety. Ethical manufacturing certifications like SA8000 or WRAP can be valuable for buyers emphasizing corporate social responsibility. Verifying these certifications helps B2B buyers meet import regulations and appeal to socially conscious markets across various regions. -

What logistics and shipping considerations are critical when importing white homecoming dresses from global suppliers?

Choose reliable freight forwarders experienced in handling apparel shipments to your target regions. Consider shipping options such as sea freight for cost efficiency or air freight for faster delivery, balancing cost and urgency. Proper packaging to prevent damage during transit is essential. Understand customs duties, import taxes, and documentation requirements specific to Africa, South America, the Middle East, or Europe to avoid delays. Tracking systems and clear Incoterms (e.g., FOB, CIF) should be agreed upon to clarify responsibilities and reduce risk. -

How should B2B buyers handle disputes or quality issues with international suppliers of white homecoming dresses?

Establish a clear dispute resolution clause in contracts, specifying mediation or arbitration venues and governing law. Maintain detailed records of communications, contracts, and quality inspections. In case of quality issues, request corrective actions such as rework, replacement, or refunds. Engage third-party inspection agencies for objective assessments. Prompt, professional communication helps resolve misunderstandings efficiently. Building long-term partnerships with transparent processes reduces the likelihood of disputes and fosters mutual trust.

Strategic Sourcing Conclusion and Outlook for white homecoming dress

Key Takeaways and Future Directions for Sourcing White Homecoming Dresses

For international B2B buyers across Africa, South America, the Middle East, and Europe, strategic sourcing of white homecoming dresses demands a keen focus on quality, trend responsiveness, and supply chain resilience. Prioritizing suppliers that offer a diverse range of styles—from classic silhouettes to contemporary designs—ensures appeal to varied consumer preferences. Additionally, understanding regional market trends and cultural nuances can significantly enhance product relevance and customer satisfaction.

Illustrative Image (Source: Google Search)

Strategic sourcing benefits include leveraging competitive pricing from emerging manufacturing hubs such as Turkey and Vietnam, while also emphasizing sustainable and ethical production practices that resonate globally. Establishing strong supplier partnerships enables agility in inventory management, faster turnaround times, and customization capabilities critical for seasonal demand spikes.

Looking ahead, the white homecoming dress market will increasingly value innovation in fabrics and finishes, digital integration for seamless ordering, and eco-conscious production methods. Buyers who proactively engage with forward-thinking suppliers and invest in market intelligence will secure a competitive advantage.

Actionable advice: International buyers should deepen collaborations with versatile manufacturers, explore multi-channel sourcing strategies, and continuously monitor fashion trends to adapt quickly. Embracing these approaches will position businesses to thrive in the evolving global white homecoming dress landscape.