Your Ultimate Guide to Sourcing French Dress

Guide to French Dress

- Introduction: Navigating the Global Market for french dress

- Understanding french dress Types and Variations

- Key Industrial Applications of french dress

- Strategic Material Selection Guide for french dress

- In-depth Look: Manufacturing Processes and Quality Assurance for french dress

- Comprehensive Cost and Pricing Analysis for french dress Sourcing

- Spotlight on Potential french dress Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for french dress

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the french dress Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of french dress

- Strategic Sourcing Conclusion and Outlook for french dress

Introduction: Navigating the Global Market for french dress

The global market for French dresses represents a unique intersection of timeless elegance and evolving fashion innovation, making it a pivotal category for international B2B buyers seeking to diversify and elevate their apparel portfolios. For buyers across Africa, South America, the Middle East, and Europe—regions marked by distinct cultural tastes and rising consumer demand—understanding the nuances of sourcing French dresses is essential to capitalize on this sophisticated market segment.

French dresses are synonymous with quality craftsmanship, premium materials, and design excellence. However, navigating the complexities of global supply chains, from fabric sourcing and manufacturing to quality control and cost management, requires a strategic approach. This guide offers a comprehensive roadmap tailored specifically for B2B buyers aiming to make informed, efficient, and ethical sourcing decisions.

Inside, you will find detailed insights on:

- Types and styles of French dresses catering to diverse markets and preferences

- Material selection, emphasizing sustainable and high-quality fabrics

- Manufacturing processes and quality assurance protocols to ensure product excellence

- Supplier evaluation criteria including ethical sourcing and compliance standards

- Cost structures and pricing strategies for competitive yet profitable procurement

- Market trends and demand forecasts relevant to key international regions

- Answers to frequently asked questions that address common sourcing challenges

By leveraging this guide, B2B buyers will gain actionable knowledge to optimize their supply chains, enhance product offerings, and meet the sophisticated expectations of customers worldwide. Whether you are establishing new supplier relationships or expanding your existing portfolio, this resource empowers you to confidently navigate the dynamic and rewarding global market for French dresses.

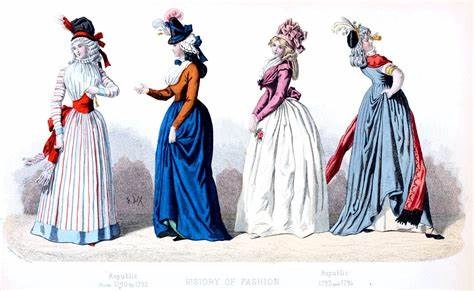

Illustrative Image (Source: Google Search)

Understanding french dress Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Classic French Dress | Elegant, tailored silhouette with structured bodice and flowing skirt; often incorporates lace and fine fabrics | Formal wear, luxury retail, boutique collections | Pros: Timeless appeal, high-end market fit; Cons: Higher production costs, longer lead times |

| Bohemian French Dress | Loose, flowing design with floral prints and lightweight fabrics like chiffon and cotton | Casual wear, resort collections, seasonal lines | Pros: Versatile and popular globally; Cons: May require frequent restocking due to trend sensitivity |

| Modern Minimalist French Dress | Clean lines, solid colors, minimal embellishments emphasizing fabric quality | Corporate wear, upscale casual, online retail | Pros: Broad market appeal, easier to produce at scale; Cons: Less differentiation in saturated markets |

| Vintage-Inspired French Dress | Retro cuts, polka dots or gingham patterns, often midi-length with cinched waists | Specialty boutiques, heritage collections | Pros: Appeals to niche markets, strong brand storytelling; Cons: Limited mass-market appeal |

| Luxury Evening French Dress | High-end materials like silk and satin, intricate detailing such as embroidery or beadwork | Couture houses, exclusive events, high-end department stores | Pros: High margins, brand prestige; Cons: Requires skilled craftsmanship, longer production cycles |

Classic French Dress

The Classic French Dress is characterized by its refined tailoring and elegant silhouette, often featuring structured bodices and flowing skirts crafted from premium fabrics such as silk, satin, and lace. This type suits formal occasions and luxury retail sectors, appealing to buyers targeting high-end markets. B2B buyers should consider the higher production costs and extended lead times due to detailed craftsmanship. However, its timeless appeal ensures sustained demand in luxury segments, making it a worthwhile investment for boutique retailers and upscale distributors.

Bohemian French Dress

Bohemian French Dresses embrace a relaxed, free-spirited aesthetic with loose fits, floral patterns, and airy fabrics like chiffon and cotton. This style is highly favored for casual wear and resort collections, particularly in warmer climates found in regions like South America and the Middle East. For B2B buyers, the key is to balance inventory levels carefully, as this style is trend-sensitive and may require frequent restocking. Its versatility and broad appeal make it an attractive option for mass-market retailers seeking to capture seasonal demand.

Modern Minimalist French Dress

Focused on simplicity, the Modern Minimalist French Dress features clean lines, solid colors, and minimal embellishments, placing emphasis on fabric quality and cut. This type is ideal for corporate wear and upscale casual markets, making it suitable for online retail platforms targeting professional demographics across Europe and Africa. Buyers benefit from easier scalability and lower production complexity, but should be mindful of the intense competition in minimalist fashion, which demands strong branding and quality assurance to differentiate products.

Vintage-Inspired French Dress

Vintage-Inspired French Dresses draw on retro fashion elements like polka dots, gingham prints, and midi-length cuts with cinched waists. These dresses cater to niche markets and specialty boutiques that focus on heritage and storytelling. For B2B buyers, this category offers strong differentiation opportunities but may have limited mass-market appeal. It is essential to target the right distribution channels and invest in marketing that highlights the nostalgic and artisanal qualities of the product to maximize returns.

Luxury Evening French Dress

Luxury Evening French Dresses are crafted from exquisite materials such as silk and satin and often feature intricate embroidery, beadwork, or lace detailing. This category is highly suited for couture houses, exclusive events, and high-end department stores. B2B buyers should anticipate longer production cycles and the need for skilled artisans, which can increase costs and complexity. However, the high margins and brand prestige associated with luxury eveningwear make it a lucrative segment for premium fashion distributors and retailers aiming to capture affluent clientele.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of french dress

| Industry/Sector | Specific Application of french dress | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Fashion & Apparel | High-end garment production and design | Enhances garment aesthetics and market differentiation | Authenticity of fabric, craftsmanship quality, and sustainable sourcing |

| Textile Manufacturing | Premium fabric finishing and embellishment | Adds value through unique textures and patterns | Supplier reliability, fabric origin traceability, and compliance with labor standards |

| Luxury Retail | Exclusive ready-to-wear collections | Drives brand prestige and customer loyalty | Consistent quality, ethical production, and timely delivery |

| Event & Hospitality | Uniforms and costumes for upscale events | Creates a distinctive brand image and elevates guest experience | Durability, comfort, and customization options |

| Export & Wholesale | Bulk supply to international markets | Expands market reach with culturally adaptable designs | Compliance with international trade regulations and competitive pricing |

Fashion & Apparel Industry

In the fashion and apparel sector, the french dress is predominantly used for crafting high-end garments that demand superior aesthetics and refined finishes. It addresses the need for exclusive designs that stand out in competitive markets such as Europe and the Middle East. International B2B buyers from these regions seek suppliers who can guarantee authentic fabric sources and impeccable craftsmanship. The french dress’s versatility in adapting to seasonal trends also supports designers in delivering timely collections, which is critical for fast-moving fashion cycles.

Textile Manufacturing

Within textile manufacturing, french dress fabrics serve as premium materials for finishing and embellishing products. They add unique textures and intricate patterns that appeal to discerning customers in markets like South America and Africa. Buyers in this industry prioritize suppliers who offer traceability of fabric origins and adherence to ethical labor practices. Ensuring supplier reliability mitigates risks related to production delays and quality inconsistencies, which are crucial for maintaining brand reputation.

Luxury Retail

Luxury retail brands leverage french dress in exclusive ready-to-wear collections to enhance brand prestige and foster customer loyalty. This application is particularly relevant for markets in Europe and the Middle East, where consumers value exclusivity and craftsmanship. Businesses benefit from sourcing french dress materials that meet strict quality standards and ethical production processes. Timely delivery and consistent quality assurance are essential for sustaining customer trust and meeting seasonal demand peaks.

Event & Hospitality

The event and hospitality sector utilizes french dress fabrics for creating uniforms and costumes that convey sophistication and elegance during upscale events. This application is important in regions like Saudi Arabia and South Africa, where luxury event experiences are growing. B2B buyers require materials that balance durability with comfort, alongside customization options to reflect brand identity. Sourcing partners must ensure fabrics meet these functional and aesthetic criteria while supporting sustainable practices.

Export & Wholesale

For export and wholesale businesses, french dress fabrics provide an opportunity to supply bulk orders to international markets with culturally adaptable designs. This is valuable for buyers in Africa, South America, and Europe aiming to diversify their product portfolios. Key sourcing considerations include compliance with international trade regulations, competitive pricing, and the ability to scale production without compromising quality. Reliable supply chains and transparent documentation are critical to successful cross-border transactions.

Related Video: Introduction to Uses and Gratifications Theory

Strategic Material Selection Guide for french dress

When selecting materials for French dresses, international B2B buyers must consider a range of factors including fabric performance, manufacturing complexity, cost, and regional preferences or compliance standards. The choice of material not only affects the garment’s aesthetic and comfort but also its durability and suitability for different climates and markets. Below is a detailed analysis of four common materials used in French dresses, tailored for buyers from Africa, South America, the Middle East, and Europe.

1. Cotton

Key Properties:

Cotton is a natural fiber known for its breathability, moisture absorption, and softness. It performs well in warm climates due to its excellent temperature regulation and hypoallergenic nature. Cotton fabrics vary widely in weave and finish, influencing durability and texture.

Pros & Cons:

Cotton is highly durable and comfortable, making it a preferred choice for casual and semi-formal French dresses. It is easy to dye, allowing vibrant colors and prints. However, cotton wrinkles easily and can shrink if not pre-treated. It also requires more water and pesticides in cultivation, which may raise sustainability concerns.

Impact on Application:

Cotton is ideal for everyday wear and summer collections, especially in hot and humid regions like parts of Africa and South America. It is less suitable for formal or structured dresses that require stiffness or sheen.

International Buyer Considerations:

Buyers should verify compliance with standards like Oeko-Tex and GOTS for organic cotton, especially in Europe and the Middle East where sustainability is increasingly mandated. Cotton sourced from regions with ethical labor practices will align with global due diligence expectations. Importers in Saudi Arabia and South Africa should also consider local customs regulations and certifications to avoid delays.

2. Silk

Key Properties:

Silk is a natural protein fiber prized for its lustrous sheen, smooth texture, and excellent drape. It offers moderate thermal insulation, keeping wearers cool in warm weather and warm in cooler climates. Silk’s natural elasticity provides comfort and shape retention.

Pros & Cons:

Silk’s luxurious appearance makes it a top choice for high-end French dresses and formal wear. It is lightweight and breathable but delicate, prone to snagging and requires careful handling and dry cleaning. Its cost is significantly higher than cotton or synthetic fabrics.

Impact on Application:

Silk is perfect for premium collections targeting affluent markets in Europe and the Middle East, where luxury textiles are highly valued. It is less practical for everyday wear or hot, humid climates unless blended with other fibers.

International Buyer Considerations:

Buyers should ensure traceability and authenticity, as silk is often subject to counterfeiting. Compliance with international textile standards such as ASTM D3990 (silk tensile testing) and certifications on animal welfare (for silk farming) may be required. Import regulations in South America and Africa may include specific tariffs or restrictions on luxury textiles.

3. Polyester

Key Properties:

Polyester is a synthetic fiber known for its strength, wrinkle resistance, and quick-drying properties. It maintains shape well and resists shrinking and stretching. Polyester is also resistant to many chemicals and environmental factors.

Pros & Cons:

Polyester is cost-effective and easy to manufacture in large volumes, making it suitable for mass production. It is less breathable than natural fibers and can retain odors, which may reduce comfort in hot climates. Its environmental impact is a concern due to reliance on petrochemicals and microplastic pollution.

Impact on Application:

Polyester suits budget-friendly French dresses and fast fashion lines where durability and ease of care are prioritized. It is widely used in blends to improve wrinkle resistance and reduce costs.

International Buyer Considerations:

Buyers in regions with hot climates (e.g., Middle East, Africa) should consider fabric blends to enhance breathability. Compliance with REACH (Europe) and other chemical safety regulations is critical. Buyers should also assess supplier sustainability practices due to increasing regulatory scrutiny on synthetic textiles.

4. Linen

Key Properties:

Linen, derived from flax fibers, is highly breathable and has excellent moisture-wicking properties. It is stronger than cotton but wrinkles easily. Linen’s natural texture provides a distinctive, slightly coarse hand feel and a matte finish.

Pros & Cons:

Linen is ideal for summer dresses due to its cooling effect and durability. However, it is prone to creasing and can be more expensive than cotton. Manufacturing complexity is moderate, requiring skilled weaving and finishing.

Impact on Application:

Linen is favored in European and South American markets for casual, artisanal French dresses. Its natural aesthetic appeals to consumers seeking sustainable and natural fibers.

International Buyer Considerations:

Buyers should verify compliance with sustainability certifications such as European Flax certification and ensure traceability in the supply chain. Linen’s suitability for warm climates makes it attractive in Africa and the Middle East, but buyers must consider consumer preferences for wrinkle resistance.

| Material | Typical Use Case for french dress | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Cotton | Casual and semi-formal dresses for warm climates | Breathable, comfortable, versatile | Prone to wrinkling and shrinkage; sustainability concerns | Medium |

| Silk | Luxury, formal, and high-end dresses | Luxurious sheen and drape; lightweight | Delicate, expensive, requires special care | High |

| Polyester | Budget-friendly and mass-produced dresses | Durable, wrinkle-resistant, cost-effective | Less breathable, environmental concerns | Low |

| Linen | Summer and artisanal casual dresses | Highly breathable and strong; natural texture | Wrinkles easily; higher cost than cotton | Medium |

This guide equips international B2B buyers with critical insights to make informed material choices for French dresses, balancing performance, cost, and regional market demands.

In-depth Look: Manufacturing Processes and Quality Assurance for french dress

Manufacturing Processes for French Dress: Key Stages and Techniques

The manufacturing of a French dress, known for its elegance, refined tailoring, and high-quality fabric, involves a series of meticulous stages. Each phase is designed to uphold the traditional aesthetics while integrating modern production efficiencies. For international B2B buyers, understanding these stages provides clarity on product quality, lead times, and supplier capabilities.

1. Material Preparation

- Fabric Selection: French dresses typically utilize natural fibers like silk, cotton, or fine wool blends. The selection prioritizes fabric hand feel, drape, and durability.

- Inspection & Testing: Incoming fabrics undergo quality checks for colorfastness, tensile strength, and shrinkage potential.

- Cutting Preparation: Fabrics are conditioned (e.g., steamed or relaxed) to prevent post-cut distortion. Marking patterns on fabric layers uses precision tools or automated cutting machines to reduce waste and ensure dimensional accuracy.

2. Forming (Cutting and Shaping)

- Pattern Making: Skilled pattern makers create templates that reflect French dress silhouettes, including fitted bodices, flared skirts, or pleats.

- Cutting Techniques: Both manual and computer-aided cutting (CNC) are employed to achieve precise edges. Layer cutting ensures batch consistency.

- Shaping Components: Elements like darts, pleats, and gathers are formed at this stage, often by hand or using specialized machinery to maintain design integrity.

3. Assembly

- Sewing: Expert seamstresses use industrial sewing machines tailored for delicate fabrics. Stitch types vary, including French seams for a neat finish and reinforced stitching at stress points.

- Interfacing & Lining: To maintain structure, interfacings are applied to collars, cuffs, and waistbands. Linings are sewn in to enhance comfort and garment longevity.

- Embroidery or Detailing: If present, embellishments such as lace trims or appliqués are carefully attached, often by hand or semi-automated embroidery machines.

4. Finishing

- Pressing & Shaping: Final garment pressing is critical for the crisp, elegant look of a French dress. Steam pressing and hand ironing refine the silhouette.

- Trimming & Inspection: Loose threads, uneven hems, and minor defects are corrected.

- Packaging: Garments are folded or hung with protective covers to prevent creasing during transport.

Quality Assurance Framework for French Dresses

Quality assurance (QA) in French dress manufacturing is integral to maintaining brand reputation and meeting international buyer expectations. QA protocols encompass internationally recognized standards and industry-specific checkpoints.

Relevant International Standards

- ISO 9001: The globally accepted quality management system standard ensures consistent product quality and continuous improvement. Suppliers certified under ISO 9001 demonstrate robust process controls.

- OEKO-TEX Standard 100: Critical for fabric safety, ensuring textiles are free from harmful substances—a key compliance factor for buyers in Europe and the Middle East.

- REACH Compliance: European buyers often require adherence to REACH regulations restricting hazardous chemicals in textiles.

- Other Certifications: Depending on the market, certifications like GOTS (Global Organic Textile Standard) for organic materials or CE marking for safety compliance may be relevant.

Quality Control Checkpoints

- Incoming Quality Control (IQC): Focuses on raw materials inspection — fabric rolls, trims, and accessories are sampled for defects, color uniformity, and compliance with specifications before production.

- In-Process Quality Control (IPQC): Conducted during assembly, this stage checks seam strength, stitch density, sizing accuracy, and adherence to design specifications to catch defects early.

- Final Quality Control (FQC): The completed dress undergoes thorough inspection for overall appearance, fit, finishing details, and packaging standards. Defective items are segregated for rework or rejection.

Common Testing Methods

- Colorfastness Testing: Ensures resistance to washing, rubbing, and light exposure.

- Dimensional Stability: Verifies garment shrinkage or distortion after laundering.

- Tensile and Tear Strength: Assesses fabric durability under stress.

- Seam Strength and Bursting Tests: Confirm the robustness of sewn seams, vital for garment longevity.

- Chemical Testing: Detects restricted substances or allergens in textiles.

Verifying Supplier Quality Control: Practical Guidance for B2B Buyers

For buyers across Africa, South America, the Middle East, and Europe, verifying supplier QC processes is crucial to mitigating risks related to delays, non-compliance, and substandard products.

Audit and Inspection Strategies

- Factory Audits: On-site audits evaluate the supplier’s adherence to quality management systems, process controls, worker skill levels, and equipment maintenance. Buyers often engage third-party audit firms specializing in textile and apparel inspections.

- Quality Reports and Documentation: Request detailed QC reports including material certificates, in-process inspection logs, and final inspection summaries. Suppliers aligned with ISO 9001 typically maintain comprehensive documentation.

- Third-Party Inspection Services: Independent inspection companies can perform random batch inspections, pre-shipment audits, and lab testing of samples to provide objective quality assessments.

- Sample Approvals: Prior to bulk production, buyers should approve samples that reflect final quality standards, ensuring supplier capability to meet specifications.

QC and Certification Nuances for International Buyers

- Regional Compliance Considerations:

- Africa and South America: Buyers should emphasize sustainability certifications and labor compliance due to growing regulatory focus and consumer awareness. Local import regulations may also require specific textile certifications or customs documentation.

- Middle East (e.g., Saudi Arabia): Compliance with Gulf Standards Organization (GSO) textile regulations and halal product considerations may be relevant. Additionally, certifications ensuring non-toxicity and modesty standards can influence buyer requirements.

-

Europe: Stringent chemical safety, environmental impact, and labor standards necessitate thorough due diligence on supply chain traceability and certifications like OEKO-TEX, REACH, and GOTS.

-

Cultural and Logistical Factors: Time zone differences, language barriers, and transport logistics require robust communication channels and clear quality expectations upfront.

-

Sustainability and Ethical Sourcing: Increasingly, European and South American buyers seek transparency on environmental impact and fair labor practices, pressing suppliers to integrate traceability and social compliance audits.

Summary: Key Takeaways for B2B Buyers of French Dresses

- Understand the detailed manufacturing stages — material prep, forming, assembly, finishing — to better evaluate supplier capabilities and timelines.

- Prioritize suppliers with international quality certifications (ISO 9001, OEKO-TEX, REACH) to ensure compliance with regional and global standards.

- Implement multi-level QC checkpoints (IQC, IPQC, FQC) supported by rigorous testing methods to guarantee product consistency and durability.

- Leverage third-party audits and inspections to independently verify supplier quality claims and mitigate risks.

- Tailor QC expectations to regional market requirements — including sustainability, ethical sourcing, and regulatory compliance — particularly critical for buyers in Africa, South America, the Middle East, and Europe.

- Maintain transparent communication and documentation to streamline quality assurance and foster long-term supplier partnerships.

By embedding these insights into their sourcing strategies, international B2B buyers can confidently navigate the complexities of French dress manufacturing and quality assurance, securing products that meet both aesthetic and regulatory demands in their target markets.

Related Video: Garments Full Production Process | Order receive to Ex-Factory | Episode 2

Comprehensive Cost and Pricing Analysis for french dress Sourcing

Understanding the cost and pricing dynamics behind sourcing French dresses is essential for international B2B buyers aiming to optimize procurement strategies while ensuring quality and compliance. This analysis breaks down key cost components, pricing influencers, and actionable buyer tips tailored for markets in Africa, South America, the Middle East, and Europe.

Key Cost Components in French Dress Sourcing

-

Materials

The raw materials—typically high-quality fabrics such as silk, lace, or fine cotton—constitute a significant portion of the cost. Sustainable or certified organic textiles may command premium prices but add value in markets sensitive to ethical sourcing. -

Labor

Skilled craftsmanship is critical in French dress production, especially for intricate designs and detailing. Labor costs vary widely depending on the manufacturing location, with European facilities generally incurring higher wages than those in other regions.

-

Manufacturing Overhead

Overheads include factory utilities, equipment depreciation, and administrative expenses. Efficient factories with modern technology often have optimized overheads but may charge more upfront for higher quality assurance. -

Tooling and Sampling

Initial tooling for patterns, molds, and prototypes can be a fixed upfront cost, especially for customized or limited-edition collections. Sampling costs are necessary to validate design and quality before bulk production. -

Quality Control (QC)

Rigorous QC processes ensure consistency and compliance with international standards. Costs here cover inspections, testing for fabric durability, colorfastness, and safety certifications, crucial for reducing returns and building brand trust. -

Logistics and Freight

Transportation costs depend on shipment mode (air, sea, land), distance, and Incoterms agreed upon. For buyers in Africa, South America, and the Middle East, freight can be a substantial cost due to longer supply routes and customs handling.

Illustrative Image (Source: Google Search)

- Supplier Margin

Suppliers include a margin to cover profit and risk. This margin varies by supplier reputation, order size, and market demand.

Influential Pricing Factors

-

Order Volume and MOQ (Minimum Order Quantity)

Larger volumes generally lead to lower unit prices due to economies of scale. However, smaller buyers should negotiate flexible MOQs or consider consolidated orders with other buyers to reduce costs. -

Product Specifications and Customization

Complex designs, custom fittings, or use of rare materials increase costs. Standardized models are more cost-effective but may offer less market differentiation. -

Material Quality and Certifications

Premium or certified fabrics (e.g., OEKO-TEX, GOTS) affect pricing but support compliance with international sustainability and safety regulations, increasingly demanded by European and Middle Eastern buyers. -

Supplier Capabilities and Location

Suppliers with advanced technologies and ethical labor practices might charge higher prices but reduce risks related to compliance and delays. Proximity to ports and logistics hubs can also influence pricing. -

Incoterms and Payment Terms

Terms like FOB, CIF, or DDP impact who bears shipping and insurance costs. Buyers should carefully evaluate these to understand their total landed cost and cash flow implications.

Strategic Buyer Tips for International Sourcing

-

Negotiate Beyond Price

Focus negotiations on lead times, quality guarantees, payment terms, and after-sales support. A slightly higher price may be justified by faster delivery or superior product quality. -

Calculate Total Cost of Ownership (TCO)

Include hidden costs such as customs duties, import taxes, warehousing, and potential delays in your cost analysis. This comprehensive view avoids surprises and helps in comparing supplier offers effectively. -

Leverage Technology for Transparency

Use supply chain tracking tools and demand forecasting analytics to minimize inventory holding costs and reduce risks of stockouts or overstock. -

Understand Regional Logistics Nuances

For buyers in regions like Africa or South America, consider local port efficiency, customs clearance times, and inland transport infrastructure when planning orders. -

Build Long-Term Supplier Relationships

Establishing trust with suppliers can lead to better pricing, priority in production scheduling, and collaborative problem-solving during disruptions. -

Stay Informed on Regulatory Compliance

Ensure suppliers adhere to labor laws, environmental standards, and traceability requirements to avoid regulatory penalties and reputational risks in your target markets.

Indicative Pricing Disclaimer

Prices for French dresses vary significantly based on design complexity, materials, production scale, and sourcing location. The information provided serves as a strategic framework rather than fixed pricing. Buyers are advised to request detailed quotations and conduct due diligence tailored to their specific procurement contexts.

By dissecting the cost structure and understanding pricing drivers, international B2B buyers can make informed decisions that balance cost-efficiency, quality, and compliance when sourcing French dresses. This strategic approach is particularly vital for navigating diverse market conditions across Africa, South America, the Middle East, and Europe.

Illustrative Image (Source: Google Search)

Spotlight on Potential french dress Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘french dress’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for french dress

Key Technical Properties of French Dress for B2B Buyers

When sourcing French dresses, understanding the critical technical properties ensures product quality, compliance, and customer satisfaction. Here are essential specifications to focus on:

-

Fabric Composition and Grade

French dresses often utilize high-quality natural fibers like cotton, silk, or linen blended with synthetics for durability. The fabric grade indicates the quality level, such as thread count or fiber fineness. For B2B buyers, specifying fabric composition and grade helps guarantee consistency, comfort, and appeal aligned with market expectations. -

Colorfastness and Dye Quality

Colorfastness measures how well the dress fabric resists fading or bleeding when exposed to washing, sunlight, or perspiration. French dresses typically use premium dyeing processes to maintain vibrant colors. Buyers must insist on standardized colorfastness ratings (e.g., ISO 105) to reduce returns and maintain brand reputation. -

Sizing Tolerance and Fit Standards

Sizing tolerance defines allowable deviations in garment dimensions from specified measurements. French fashion emphasizes tailored fits, so tolerances are tight, often within ±1 cm. Clear fit standards help prevent sizing disputes and optimize customer satisfaction, especially important for international markets with varying size norms. -

Seam Strength and Stitch Density

Seam strength reflects the garment’s durability under stress, while stitch density (stitches per inch) affects finish quality and longevity. French dresses typically feature reinforced seams with fine stitch density for elegance and durability. Buyers should request test certificates confirming compliance with industry standards (e.g., ASTM or ISO). -

Finish and Embellishment Quality

Details such as lace, embroidery, or buttons must meet precise quality criteria to reflect the French dress’s aesthetic value. This includes uniformity, attachment security, and material safety. Buyers must specify acceptable finishes and request samples or quality reports to avoid defects. -

Tolerance for Shrinkage and Care Instructions

Fabric shrinkage tolerance indicates expected dimensional changes after washing. French dresses often come with specific care instructions to maintain fabric integrity. Clear communication of shrinkage limits and care requirements helps buyers advise end customers and reduce product returns.

Common Trade Terminology in French Dress Sourcing

Understanding industry jargon facilitates smoother negotiations and clearer communication in international B2B transactions:

-

OEM (Original Equipment Manufacturer)

Refers to a manufacturer who produces dresses based on another company’s design and specifications. Buyers working with OEMs can customize products while leveraging established production expertise, enabling brand differentiation and quality control. -

MOQ (Minimum Order Quantity)

The smallest number of units a supplier is willing to produce or sell per order. MOQs affect inventory planning and cost efficiency. Buyers from emerging markets should negotiate MOQs that balance affordability with supplier requirements to optimize cash flow. -

RFQ (Request for Quotation)

A formal inquiry sent by buyers to suppliers asking for detailed pricing, lead times, and terms. RFQs initiate the procurement process and help buyers compare offers transparently. Including precise technical specs in RFQs ensures accurate and comparable quotes. -

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce defining responsibilities for shipping, insurance, and customs. Common Incoterms for apparel include FOB (Free On Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms helps buyers manage costs and risks effectively. -

Lead Time

The total time from order placement to product delivery. For fashion items like French dresses, lead time affects market responsiveness and inventory turnover. Buyers should clarify lead times upfront and incorporate buffers for customs and logistics delays. -

Bulk Fabric Roll / Cut-Make-Trim (CMT)

Bulk fabric roll refers to the fabric supplied in large continuous lengths before cutting. CMT is a common production model where buyers supply fabric and designs, and the manufacturer cuts, sews, and trims the dresses. Understanding these terms helps buyers control quality and cost allocation.

By mastering these technical properties and trade terms, international B2B buyers—especially in Africa, South America, the Middle East, and Europe—can make informed sourcing decisions, negotiate effectively, and build reliable supplier partnerships for French dresses that meet market demands and quality expectations.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the french dress Sector

Market Overview & Key Trends

The French dress sector holds a distinctive position in the global fashion landscape, celebrated for its blend of timeless elegance and contemporary innovation. For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, understanding the market dynamics in this sector is critical to capitalizing on demand for premium and culturally resonant apparel.

Global Drivers:

The demand for French dresses is driven by a growing appreciation for heritage craftsmanship combined with modern aesthetics. Buyers from regions such as Saudi Arabia and South Africa increasingly seek French dresses that reflect sophistication and exclusivity, often linked to French fashion’s iconic status. Additionally, rising disposable incomes and expanding middle classes in emerging markets create fertile ground for growth in premium dress segments.

Current and Emerging Sourcing Trends:

– Digitization of Supply Chains: French dress manufacturers and suppliers are adopting advanced inventory management and supply chain visibility tools. This allows B2B buyers to track orders in real-time, optimize stock levels, and reduce lead times—critical for markets where fashion trends evolve rapidly.

– Nearshoring and Agile Manufacturing: To mitigate risks from global disruptions, suppliers are increasingly incorporating nearshoring strategies, bringing production closer to European hubs or key consumer markets. This approach benefits buyers in South America and the Middle East by reducing transit times and enabling quicker response to fashion cycles.

– Collaborative Design and Customization: There is a rising trend towards co-creation with buyers, allowing for tailored collections that meet specific regional preferences and cultural nuances. This is especially relevant for buyers targeting diverse consumer bases in Africa and the Middle East.

– Omnichannel Integration: Suppliers are enhancing capabilities for seamless fulfillment across physical and digital retail channels, supporting B2B buyers’ multichannel strategies.

Market Dynamics:

Price sensitivity varies significantly across regions; European buyers often prioritize craftsmanship and exclusivity, while African and South American markets may balance quality with affordability. Political and economic stability in sourcing countries, coupled with evolving trade agreements, influence procurement strategies. For instance, preferential trade terms within the EU or between Mercosur countries can create competitive advantages. Buyers must stay attuned to these factors to optimize sourcing decisions and maintain supply chain resilience.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a non-negotiable pillar in the French dress sector, shaping sourcing strategies and supplier evaluations. International B2B buyers are increasingly scrutinizing the environmental footprint and ethical standards of their supply chains to meet regulatory requirements and growing consumer demand for responsible fashion.

Environmental Impact:

The production of French dresses, traditionally reliant on natural fibers like silk, cotton, and wool, entails significant water and energy consumption. Innovations in sustainable textile processing—including low-impact dyes and water recycling technologies—are gaining traction among French manufacturers. B2B buyers should prioritize suppliers who demonstrate measurable reductions in carbon emissions and waste, aligning procurement with global climate goals.

Ethical Supply Chains:

Ethical sourcing extends beyond environmental considerations to include fair labor practices, transparency, and traceability. French dress suppliers increasingly adopt certifications such as GOTS (Global Organic Textile Standard), OEKO-TEX®, and Fair Trade to validate their commitment. For buyers in regions like the Middle East and Africa, partnering with certified suppliers mitigates risks related to labor violations and reputational damage.

Green Certifications & Materials:

– Organic and Regenerative Fibers: Sourcing dresses made from organically grown cotton or regenerative wool supports soil health and biodiversity.

– Recycled Fabrics: Integration of recycled polyester or nylon reduces dependence on virgin materials and aligns with circular economy principles.

– Low-Impact Dyeing: Certifications that guarantee non-toxic dye processes ensure compliance with environmental standards and consumer safety.

By embedding sustainability into sourcing policies, B2B buyers can not only fulfill compliance mandates but also differentiate their offerings in increasingly conscientious markets.

Evolution and Historical Context

The French dress sector’s heritage is rooted in centuries of artisanal expertise and haute couture innovation, which continue to influence contemporary B2B sourcing strategies. Originating in the royal courts of the 17th and 18th centuries, French dressmaking evolved into a symbol of elegance and craftsmanship, laying the foundation for today’s global reputation.

In the post-war era, Paris emerged as the epicenter of fashion, pioneering ready-to-wear collections that made French dresses accessible to international markets. This evolution introduced new production paradigms, blending artisanal techniques with industrial manufacturing processes—a balance that remains crucial for modern B2B buyers seeking both quality and scalability.

Today, the sector is defined by its ability to harmonize tradition with innovation, incorporating sustainable materials and digital supply chain tools while preserving the timeless appeal that defines French dressmaking. Understanding this historical context equips international buyers to appreciate the intrinsic value of French dresses and make informed sourcing decisions that honor both legacy and future trends.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of french dress

-

How can I effectively vet suppliers of French dresses to ensure authenticity and reliability?

To vet suppliers, request detailed documentation such as business licenses, export certifications, and product origin proofs. Utilize third-party verification services that specialize in fashion supply chains to confirm authenticity and ethical sourcing. Conduct virtual or in-person audits where possible, focusing on production capacity, quality control processes, and labor practices. Checking references from other international buyers and reviewing compliance with international trade regulations will further reduce risks. For regions like Africa and the Middle East, ensure suppliers comply with local import regulations and certifications to avoid customs delays. -

Is customization of French dresses feasible for international B2B buyers, and how should I approach it?

Customization is common and often expected in French dress sourcing to meet diverse market tastes. Engage early with suppliers to discuss fabric choices, sizing, embroidery, or branding options. Provide clear, detailed tech packs and samples to minimize miscommunication. Negotiate minimum order quantities (MOQs) for customized orders, as these may differ from standard products. For buyers in South America or Europe, consider cultural preferences and seasonal trends to tailor designs effectively. Confirm lead times upfront since customization typically extends production schedules. -

What are typical MOQs and lead times when ordering French dresses from international suppliers?

MOQs vary widely depending on supplier scale and product complexity but typically range from 100 to 500 units per design or style. Lead times generally span 30 to 90 days, factoring in design finalization, material sourcing, manufacturing, and shipping. Fast fashion suppliers may offer shorter lead times but at higher costs. Buyers should negotiate MOQs based on their market demand and storage capacity. Planning for seasonal fluctuations, especially in markets like Europe and the Middle East, helps optimize inventory turnover and reduce holding costs. -

What payment terms are standard for international B2B transactions involving French dresses?

Common payment terms include a 30% upfront deposit with the balance paid upon shipment or delivery. Letters of credit and escrow services offer additional security for high-value transactions. Some suppliers may accept payment through international platforms like PayPal or bank transfers (SWIFT). To protect cash flow, establish clear payment milestones tied to production stages. Buyers from regions with fluctuating currency values, such as South America or Africa, should consider currency hedging strategies to mitigate exchange rate risks. -

How do I ensure quality assurance and compliance certifications when sourcing French dresses?

Request product samples and conduct third-party lab testing for fabric quality, colorfastness, and durability before bulk orders. Verify that suppliers hold certifications such as OEKO-TEX Standard 100, GOTS (for organic fabrics), and compliance with REACH or other regional chemical safety standards. Implement regular quality inspections during production and pre-shipment audits to identify defects early. For buyers in the Middle East and Europe, confirm that products meet local safety and labeling regulations to avoid import rejections.

-

What are the best logistics practices for shipping French dresses internationally?

Choose suppliers experienced with international shipping and familiar with your destination country’s import regulations. Negotiate Incoterms (e.g., FOB, CIF) clearly to define responsibilities and risks. Opt for consolidated shipments when ordering multiple styles to reduce freight costs. Utilize freight forwarders who provide real-time tracking and customs clearance support. For African and South American markets, anticipate longer customs clearance times and factor this into delivery schedules. Sustainable packaging and optimized container loading can reduce costs and environmental impact. -

How should I handle disputes or quality issues with French dress suppliers?

Establish clear contractual terms outlining product specifications, delivery timelines, and penalties for non-compliance. Use a formal communication channel to report issues promptly and request corrective action. Maintain detailed records of inspections, correspondence, and shipment documents. If disputes escalate, consider mediation or arbitration clauses to avoid costly litigation. Building strong relationships through transparency and regular communication helps resolve conflicts amicably. For international buyers, understanding the supplier’s local legal framework is essential for effective dispute resolution. -

Are there specific trade regulations or import restrictions I should be aware of when importing French dresses?

Yes, import regulations vary by country and may include tariffs, quotas, and labeling requirements. For example, the European Union enforces strict rules on textile labeling and chemical safety, while Saudi Arabia requires conformity certificates and Halal compliance for some materials. South Africa applies import duties and mandates customs documentation accuracy to prevent delays. Stay updated on trade agreements or sanctions that affect apparel imports. Collaborate with customs brokers familiar with your target market to ensure compliance and smooth clearance.

Strategic Sourcing Conclusion and Outlook for french dress

Strategic sourcing of French dresses presents a unique opportunity for international B2B buyers to leverage quality, craftsmanship, and evolving supply chain innovations. Key takeaways emphasize the importance of partnering with suppliers who prioritize transparency, ethical labor practices, and sustainable materials—critical factors that enhance brand reputation and meet growing consumer expectations globally. Efficient supply chain management, including real-time inventory visibility and agile logistics, is vital to navigate fashion’s dynamic trends and seasonal demands.

For buyers in Africa, South America, the Middle East, and Europe, aligning sourcing strategies with these principles can reduce risks, optimize costs, and improve time-to-market. Embracing digital tools for supplier due diligence and traceability ensures compliance with international regulations and safeguards against disruptions. Additionally, investing in collaborative relationships with manufacturers enables customization and innovation tailored to diverse regional preferences.

Looking ahead, the French dress market is poised for growth driven by sustainability trends and technological advancements. International buyers are encouraged to adopt a forward-thinking sourcing approach that balances quality, ethics, and efficiency. By doing so, they will not only secure competitive advantages but also contribute to a resilient, responsible fashion ecosystem. Engage proactively with your supply chain partners today to unlock the full potential of French dress sourcing for your business.