Your Ultimate Guide to Sourcing Foaming Dressing

Guide to Foaming Dressing

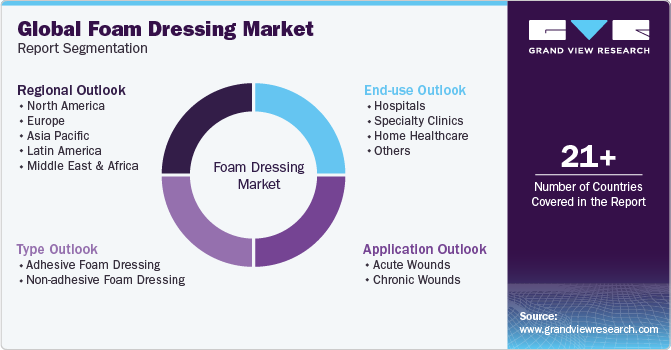

- Introduction: Navigating the Global Market for foaming dressing

- Understanding foaming dressing Types and Variations

- Key Industrial Applications of foaming dressing

- Strategic Material Selection Guide for foaming dressing

- In-depth Look: Manufacturing Processes and Quality Assurance for foaming dressing

- Comprehensive Cost and Pricing Analysis for foaming dressing Sourcing

- Spotlight on Potential foaming dressing Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for foaming dressing

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the foaming dressing Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of foaming dressing

- Strategic Sourcing Conclusion and Outlook for foaming dressing

Introduction: Navigating the Global Market for foaming dressing

Foaming dressings represent a pivotal advancement in wound care management, combining superior absorption, cushioning, and breathability to accelerate healing and reduce infection risks. For international B2B buyers operating across Africa, South America, the Middle East, and Europe, understanding the nuances of foaming dressings is essential to sourcing products that meet diverse clinical needs and regulatory standards. Whether supplying hospitals in Cairo, clinics in Buenos Aires, or distributors in Riyadh, making informed procurement decisions directly impacts patient outcomes and operational efficiency.

This comprehensive guide delves deeply into the global foaming dressing landscape, providing actionable insights across key dimensions:

- Types and Materials: Explore the distinctions between adhesive and non-adhesive foam dressings, along with innovations in silicone and non-silicone variants to match specific wound types such as chronic wounds, burns, and diabetic ulcers.

- Manufacturing and Quality Control: Understand critical production standards and certifications that ensure product reliability and compliance with international healthcare regulations.

- Supplier Landscape: Gain clarity on sourcing from established manufacturers and emerging players, with a focus on regional market dynamics influencing supply chains in target regions.

- Cost Structures and Market Trends: Analyze pricing drivers and forecast demand trends shaped by demographic shifts, healthcare infrastructure development, and emerging wound care protocols.

- FAQs and Buyer Tips: Address common procurement challenges, including logistics, storage, and product compatibility to streamline purchasing processes.

By integrating these insights, this guide empowers B2B buyers to navigate complexities confidently, optimize supplier selection, and secure high-quality foaming dressings tailored to their market’s clinical and economic realities. This strategic approach is vital for stakeholders aiming to foster sustainable growth and deliver superior healthcare solutions worldwide.

Understanding foaming dressing Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Adhesive Foam Dressing | Integrated adhesive layer for self-attachment | Chronic wounds, surgical wounds, diabetic ulcers | Easy to apply and secure; risk of skin irritation or residue |

| Non-Adhesive Foam Dressing | Requires secondary fixation (e.g., tape or bandage) | Burns, acute wounds, trauma wounds | Flexible use on sensitive skin; needs additional securing |

| Silicone Foam Dressing | Silicone-based adhesive, gentle on skin | Fragile or sensitive skin, burns, post-operative care | Minimizes skin trauma on removal; typically higher cost |

| Hydrophilic Foam Dressing | Enhanced fluid absorption capacity | Highly exuding wounds, chronic wounds | Superior exudate management; may require frequent changes |

| Antimicrobial Foam Dressing | Infused with antimicrobial agents (e.g., silver, iodine) | Infected wounds, high-risk environments | Reduces infection risk; higher price and regulatory considerations |

Adhesive Foam Dressings are widely used for their convenience in wound care, featuring an integrated adhesive layer that simplifies application. They are ideal for chronic wounds, surgical sites, and diabetic ulcers where secure fixation is essential. B2B buyers should evaluate the adhesive quality and hypoallergenic properties to minimize patient skin reactions, especially in diverse climatic conditions such as those found in Africa and South America.

Non-Adhesive Foam Dressings lack a built-in adhesive, requiring secondary fixation methods like tapes or bandages. This type suits burns, acute wounds, and trauma cases where skin sensitivity or irregular wound sites demand flexibility. For B2B procurement, consider the availability and compatibility of fixation accessories and the dressing’s conformability to different wound shapes.

Silicone Foam Dressings employ a silicone-based adhesive that is gentle on fragile or sensitive skin, making them preferable for post-operative care and burn wounds. Their skin-friendly adhesion reduces trauma during dressing changes, an important factor for markets with aging populations or sensitive skin demographics. Buyers should weigh the premium cost against long-term patient comfort and reduced wound disruption.

Hydrophilic Foam Dressings are designed with enhanced absorption capabilities to manage wounds with heavy exudate, such as chronic ulcers or heavily draining surgical wounds. These dressings help maintain a moist wound environment while preventing maceration. International buyers must consider the dressing’s absorption rate and frequency of change, balancing cost-effectiveness with clinical needs.

Antimicrobial Foam Dressings are impregnated with agents like silver or iodine to combat infection, making them suitable for infected wounds or high-risk environments such as hospitals or conflict zones. While offering significant clinical benefits, these dressings often come at a higher cost and may face regulatory scrutiny in some regions. B2B buyers should carefully assess supplier certifications and compliance to ensure safe and effective use.

Related Video: CS 198-126: Lecture 12 – Diffusion Models

Key Industrial Applications of foaming dressing

| Industry/Sector | Specific Application of Foaming Dressing | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Healthcare | Management of chronic and acute wounds | Accelerates healing, reduces infection risk, improves patient outcomes | Sterility, biocompatibility, absorption capacity, regulatory compliance (e.g., CE, FDA) |

| Medical Supplies Distribution | Surgical and traumatic wound care | Enhances wound protection, reduces dressing change frequency | Shelf life, packaging integrity, ease of application, supplier reliability |

| Burn Treatment Centers | Treatment of burns | Maintains moist wound environment, minimizes pain and scarring | Moisture retention, hypoallergenic properties, conformability to irregular wounds |

| Diabetic Care Clinics | Diabetic foot ulcer management | Prevents infection, promotes faster healing, reduces amputation risk | High absorbency, antimicrobial properties, cost-effectiveness |

| Veterinary Medicine | Wound care in animals | Supports healing in diverse animal wounds, reduces complications | Durability, non-toxicity, adaptability to animal movement |

Foaming dressings play a pivotal role in healthcare, particularly in managing chronic and acute wounds. These dressings provide a moist environment conducive to healing while absorbing exudates and minimizing infection risk. For international B2B buyers from regions such as Africa and South America, sourcing foaming dressings with proven biocompatibility and compliance with international medical standards (CE marking, FDA approval) is critical to ensure patient safety and regulatory acceptance.

In medical supplies distribution, foaming dressings are essential for surgical and traumatic wound care, offering enhanced protection and reducing the frequency of dressing changes. Buyers from Europe and the Middle East should prioritize suppliers who guarantee product sterility, long shelf life, and robust packaging to withstand global shipping demands, especially for markets like Egypt and Argentina where supply chain reliability is paramount.

For burn treatment centers, foaming dressings maintain a moist wound environment that helps reduce pain and scarring. Their conformability to irregular wound shapes is a key requirement. Businesses in these regions must evaluate moisture retention capabilities and hypoallergenic properties to meet the needs of sensitive patient populations, ensuring optimal therapeutic outcomes.

Illustrative Image (Source: Google Search)

In diabetic care clinics, foaming dressings are crucial for managing diabetic foot ulcers, a common and costly complication. These dressings help prevent infection and promote faster healing, thereby reducing the risk of amputation. International buyers should focus on high absorbency and antimicrobial features while balancing cost-effectiveness to serve large diabetic populations in emerging markets effectively.

Finally, in veterinary medicine, foaming dressings are increasingly used for wound care in animals, supporting healing across diverse wound types while minimizing complications. Buyers should consider product durability and non-toxicity, as well as adaptability to animal movement, which is essential for maintaining dressing integrity in dynamic environments common in farms and clinics across Africa and South America.

These applications highlight the diverse industrial uses of foaming dressings and emphasize the importance of tailored sourcing strategies to meet regional healthcare needs and regulatory landscapes.

Related Video: ARDEX CD™ Concrete Dressing – Demonstration

Strategic Material Selection Guide for foaming dressing

Key Materials for Foaming Dressing: Analysis and Selection Criteria

1. Polyurethane Foam

Key Properties:

Polyurethane foam is widely used in foaming dressings due to its excellent absorbency, flexibility, and cushioning. It typically exhibits good thermal stability within a moderate temperature range (up to ~80°C) and moderate resistance to moisture and chemicals. Its open-cell structure allows for effective exudate management in wound care.

Pros & Cons:

– Pros: High absorbency, soft texture for patient comfort, customizable density and thickness, and cost-effective manufacturing.

– Cons: Limited chemical resistance to strong oxidizers or solvents, potential for degradation under prolonged UV exposure, and moderate durability under mechanical stress.

Impact on Application:

Ideal for managing moderate to heavily exuding wounds such as diabetic foot ulcers and burns. Its moisture-retentive properties support a moist wound environment conducive to healing but require careful selection for highly infected wounds.

International B2B Considerations:

Buyers in Africa, South America, the Middle East, and Europe should verify compliance with ISO 10993 biocompatibility standards and regional medical device regulations (e.g., CE marking in Europe). Polyurethane foam suppliers often provide materials conforming to ASTM standards for medical foams. Cost sensitivity in emerging markets (e.g., Egypt, Argentina) favors polyurethane due to its balance of performance and affordability.

2. Silicone Foam

Key Properties:

Silicone foam dressings incorporate a silicone adhesive layer that is gentle on skin, hypoallergenic, and maintains excellent breathability. Silicone foams typically withstand temperatures up to 150°C and show excellent chemical inertness and biocompatibility.

Pros & Cons:

– Pros: Superior skin adhesion without trauma, high moisture vapor transmission rate (MVTR), hypoallergenic, and effective for fragile or sensitive skin.

– Cons: Higher raw material and manufacturing costs, sometimes less absorbent than polyurethane, and more complex production processes.

Impact on Application:

Best suited for delicate skin applications, such as elderly or pediatric patients, and for chronic wounds where minimal pain during dressing changes is critical. Silicone foam is also preferred in surgical and traumatic wound care due to its gentle adherence.

International B2B Considerations:

European buyers often require compliance with stringent MDR (Medical Device Regulation) standards, while Middle Eastern and South American markets may prioritize ISO certification and FDA equivalence. The higher cost may limit adoption in price-sensitive African markets unless justified by clinical benefits.

3. Hydrocellular Foam (Hydrophilic Polyurethane Foam)

Key Properties:

Hydrocellular foam is a hydrophilic polyurethane variant that swells upon absorbing wound exudate, maintaining a moist environment while preventing maceration. It offers moderate temperature resistance and enhanced fluid handling capabilities.

Pros & Cons:

– Pros: Superior exudate management, reduces risk of wound maceration, and provides cushioning and protection.

– Cons: Slightly higher cost than standard polyurethane foam, potential for reduced mechanical strength when saturated, and requires precise manufacturing controls.

Impact on Application:

Highly effective for chronic wounds and burns with moderate to heavy exudate. Its hydrophilic nature makes it suitable for wounds prone to fluid accumulation, improving healing outcomes.

International B2B Considerations:

Buyers should ensure that hydrocellular foam dressings meet ASTM F1980-16 accelerated aging standards and local regulatory requirements. In emerging markets, education on the clinical advantages can drive adoption despite higher costs. European and Middle Eastern markets may demand extensive clinical data to support claims.

4. Non-Silicone Adhesive Foam

Key Properties:

Non-silicone adhesive foams use acrylic or hydrocolloid adhesives for skin fixation. They typically have good adhesion strength and moderate breathability, with temperature tolerance around 70-90°C depending on formulation.

Pros & Cons:

– Pros: Lower cost than silicone-based adhesives, strong adhesion suitable for active patients, and easier manufacturing processes.

– Cons: Higher risk of skin irritation or trauma upon removal, less suitable for sensitive skin, and variable moisture vapor transmission.

Impact on Application:

Commonly used in acute wounds and surgical dressings where secure fixation is necessary. Less ideal for fragile skin or chronic wounds requiring frequent dressing changes.

International B2B Considerations:

Compliance with ASTM D3330 for adhesive strength and ISO 10993 for biocompatibility is essential. African and South American buyers may prefer non-silicone adhesives due to cost constraints, while European buyers might limit use to specific indications due to skin sensitivity concerns.

Summary Table of Materials for Foaming Dressing

| Material | Typical Use Case for foaming dressing | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyurethane Foam | Moderate to heavily exuding wounds (diabetic ulcers, burns) | High absorbency, cost-effective, customizable | Limited chemical resistance, moderate durability | Low |

| Silicone Foam | Delicate skin, chronic wounds, surgical & traumatic wounds | Gentle adhesion, hypoallergenic, breathable | Higher cost, less absorbent, complex production | High |

| Hydrocellular Foam | Chronic wounds with heavy exudate, burns | Superior fluid management, reduces maceration | Higher cost, reduced strength when saturated | Medium |

| Non-Silicone Adhesive Foam | Acute wounds, surgical dressings requiring strong fixation | Strong adhesion, lower cost | Skin irritation risk, less suitable for sensitive skin | Low |

In-depth Look: Manufacturing Processes and Quality Assurance for foaming dressing

Overview of Manufacturing Processes for Foaming Dressings

Foaming dressings, widely used in wound care for their superior absorption and cushioning properties, require meticulous manufacturing processes to ensure product efficacy and safety. For international B2B buyers, especially from regions such as Africa, South America, the Middle East, and Europe, understanding these processes is critical for selecting reliable suppliers and ensuring compliance with regional regulatory requirements.

1. Material Preparation

The manufacturing journey begins with the preparation of raw materials, primarily specialized polyurethane or other polymeric foams designed for medical use. These materials must be biocompatible, non-toxic, and free from contaminants. Suppliers typically source medical-grade raw polymers that comply with regulatory standards such as USP Class VI or ISO 10993 for biocompatibility.

Illustrative Image (Source: Google Search)

- Key Considerations:

- Ensuring raw materials come with Certificates of Analysis (CoA).

- Verifying material properties like porosity, density, and moisture vapor transmission rate (MVTR) critical to dressing performance.

- Suppliers often pre-treat foams to enhance absorption and antimicrobial properties.

2. Foaming and Forming

The next stage involves the controlled foaming process where raw polymers are transformed into the desired foam structure. This is typically done through chemical foaming or physical blowing agents under carefully controlled temperature and pressure conditions.

- Techniques:

- Chemical Foaming: Incorporation of foaming agents that release gases during polymerization.

- Physical Foaming: Use of inert gases to form uniform pores.

- Molding & Cutting: Post-foaming, the foam is molded or cut into specific shapes and sizes suitable for various wound types.

Consistency in pore size and foam density is critical for optimal absorption and patient comfort, requiring precise control during this stage.

3. Assembly and Lamination

Foaming dressings often include additional layers such as backing films, adhesive borders (for adhesive types), and release liners. Assembly involves laminating these layers using medical-grade adhesives that do not interfere with skin or wound healing.

- Key Techniques:

- Hot melt or solvent-based adhesive lamination.

- Ultrasonic welding or heat sealing for non-adhesive variants.

- Integration of antimicrobial agents or additives during lamination for enhanced protection.

This stage demands strict cleanroom conditions to prevent contamination.

4. Finishing and Packaging

After assembly, dressings undergo finishing processes including trimming, inspection, and sterilization. Packaging is designed to maintain sterility and integrity during transportation and storage.

- Common Finishing Steps:

- Edge trimming to remove excess material ensuring patient comfort.

- Application of sterilization indicators on packaging.

- Sealing in sterile pouches or blister packs using barrier films.

Packaging materials must meet international standards for medical device packaging, such as ISO 11607.

Quality Assurance and Control Frameworks

Quality assurance (QA) and quality control (QC) are paramount in foaming dressing manufacturing to guarantee product safety, consistency, and regulatory compliance. For international B2B buyers, understanding QC checkpoints and certification nuances helps in supplier evaluation and risk mitigation.

Key International Standards and Certifications

- ISO 9001: The foundational quality management system (QMS) standard for manufacturing organizations, ensuring systematic process control and continuous improvement.

- ISO 13485: Specific to medical devices, including wound dressings, emphasizing risk management and regulatory compliance.

- CE Marking: Mandatory for marketing in the European Economic Area, demonstrating conformity with EU Medical Device Regulation (MDR).

- FDA 510(k) Clearance: Relevant for suppliers targeting the US market; may be requested by buyers seeking globally compliant products.

- Other Certifications: Depending on the region, certifications like ANVISA (Brazil), SFDA (Saudi Arabia), or Egyptian Ministry of Health approvals may be required.

Quality Control Checkpoints

-

Incoming Quality Control (IQC):

– Inspection and testing of raw materials (foam, adhesives, films).

– Verification of supplier documentation, CoAs, and compliance certificates.

– Physical tests on raw materials for parameters like density and tensile strength. -

In-Process Quality Control (IPQC):

– Monitoring foaming parameters (temperature, pressure, curing time).

– Visual and dimensional inspection during cutting and assembly.

– Adhesive layer integrity and lamination quality checks. -

Final Quality Control (FQC):

– Sterility assurance testing post-packaging (e.g., biological indicators).

– Absorption capacity and fluid retention tests simulating wound exudate.

– Biocompatibility and cytotoxicity tests per ISO 10993.

– Packaging integrity and seal strength assessments.

Common Testing Methods

- Physical Tests: Tensile strength, elongation, compression resilience, and thickness uniformity.

- Absorption Tests: Fluid uptake rate, retention capacity, and MVTR.

- Microbiological Tests: Sterility testing, bacterial barrier effectiveness.

- Chemical Tests: Residual solvent analysis, pH, and extractables/leachables.

- Biocompatibility Tests: Cytotoxicity, sensitization, and irritation assessments.

Verifying Supplier Quality Assurance: Best Practices for B2B Buyers

For buyers in Africa, South America, the Middle East, and Europe, evaluating and verifying supplier QC practices is essential to ensure product reliability and regulatory compliance.

Supplier Audits

- On-site Audits: Conduct comprehensive audits focusing on manufacturing processes, QMS implementation (ISO 13485/9001), cleanliness, and employee training.

- Remote/Virtual Audits: Useful when travel restrictions exist; assess documentation, video walkthroughs, and digital interviews.

Documentation Review

- Request complete quality documentation including:

- Certificates of Compliance and Analysis for raw materials.

- Process validation reports.

- Batch production records and QC test results.

- Sterilization validation and packaging integrity reports.

Third-Party Inspections and Certifications

- Engage independent inspection bodies to perform random batch testing and factory inspections.

- Verify certifications through official registries (e.g., NANDO database for CE-marked devices).

- For buyers importing into regulated markets, confirm supplier compliance with local regulatory bodies (e.g., ANVISA in Brazil, SAG in Egypt).

Quality Nuances for International Buyers

- Regulatory Alignment: Buyers should ensure products meet the regulatory requirements of their target markets, which may differ significantly (e.g., CE marking is critical for Europe but not mandatory in many African countries).

- Environmental and Storage Conditions: Consider supplier capability to package and ship dressings under temperature and humidity controls suitable for tropical or arid climates prevalent in regions like the Middle East and parts of Africa.

- After-Sales Support: Quality assurance extends post-purchase; confirm the supplier’s ability to provide batch traceability, complaint handling, and technical support.

- Language and Documentation: Ensure all QC certificates, manuals, and compliance documents are available in languages accessible to your quality and regulatory teams.

Conclusion

For international B2B buyers sourcing foaming dressings, a clear understanding of the manufacturing processes and stringent quality assurance protocols is indispensable. Evaluating suppliers based on their adherence to international standards, robust QC checkpoints, and transparent documentation will mitigate risks and ensure procurement of high-quality wound care products. Tailoring supplier selection to the specific regulatory and environmental needs of regions such as Africa, South America, the Middle East, and Europe further enhances supply chain resilience and compliance.

Comprehensive Cost and Pricing Analysis for foaming dressing Sourcing

Breakdown of Cost Components in Foaming Dressing Sourcing

Understanding the cost structure behind foaming dressings is vital for international B2B buyers aiming to optimize procurement and negotiate effectively.

- Raw Materials: The primary cost driver is the quality and type of foam and backing materials used. Non-silicone foams, polyurethane variants, and breathable membranes vary in price depending on their medical-grade certifications and source origin.

- Labor Costs: These depend on the manufacturing location. Regions with lower labor costs, such as parts of South America and Africa, may offer competitive pricing but require due diligence on quality standards.

- Manufacturing Overhead: Includes utilities, equipment depreciation, and factory management expenses. Highly automated plants in Europe or the Middle East may have higher overhead but benefit from consistent quality.

- Tooling and Equipment: Initial setup costs for molds and cutting dies influence the unit cost, especially for customized shapes or sizes. These are amortized over production runs, so larger volumes lower per-unit tooling costs.

- Quality Control (QC): Rigorous QC, including biocompatibility testing and sterility assurance, adds to costs but is crucial for regulatory compliance, particularly for European and Middle Eastern markets.

- Logistics and Shipping: Freight charges, import duties, and customs clearance vary widely by region. Buyers in Africa or South America should consider additional inland transportation and potential delays that can increase landed costs.

- Supplier Margin: Manufacturers and distributors add margins based on brand reputation, service levels, and exclusivity of technology or certifications.

Key Pricing Influencers for Foaming Dressings

Several factors impact the pricing dynamics in this sector, which B2B buyers must carefully assess:

- Order Volume and Minimum Order Quantities (MOQs): Larger orders typically unlock volume discounts. However, some suppliers impose high MOQs that may not suit smaller healthcare providers or distributors.

- Product Specifications and Customization: Special sizes, adhesive types, or packaging modifications increase costs. Custom formulations or additional features like antimicrobial layers also command premium pricing.

- Material Quality and Certifications: Dressings compliant with ISO 13485, CE marking, or FDA approvals carry higher price tags but reduce risks and enhance marketability in regulated regions.

- Supplier Reputation and Location: Established suppliers with proven track records tend to price higher but offer reliability. Regional suppliers closer to buyers can reduce lead times and shipping costs.

- Incoterms and Payment Terms: The choice of Incoterms (e.g., FOB, CIF, DDP) shifts logistics responsibilities and costs between buyer and seller. Favorable payment terms (e.g., letter of credit, net 30) can improve cash flow but may affect pricing.

Actionable Buyer Tips for Cost-Efficient Sourcing

- Conduct Total Cost of Ownership (TCO) Analysis: Beyond unit price, factor in shipping, customs, warehousing, and potential wastage. For example, a lower-priced product with higher defect rates or longer lead times may increase overall costs.

- Negotiate on Multiple Fronts: Leverage volume commitments, flexible MOQs, and bundled product deals to secure better pricing. Engage suppliers early to explore cost-saving packaging or logistics options tailored for your region.

- Prioritize Quality and Compliance: In markets like Europe and the Middle East, non-compliant products risk rejection and financial losses. Investing in certified products reduces risk and can command better resale pricing.

- Leverage Regional Trade Agreements: Buyers in Africa and South America should explore sourcing from countries with preferential trade agreements to reduce tariffs and import duties.

- Consider Supplier Diversification: Avoid reliance on a single supplier or geography to mitigate risks like geopolitical disruptions or supply chain delays, which are prevalent in volatile regions.

- Understand Pricing Nuances by Region: For instance, in Egypt and Argentina, import restrictions or currency fluctuations can affect landed costs significantly. Work with local agents or freight forwarders knowledgeable about these challenges.

Disclaimer on Pricing Information

Prices for foaming dressings vary widely based on product type, volume, customization, and market conditions. The above analysis provides indicative guidance to assist strategic sourcing decisions but should not substitute direct supplier quotations and due diligence. Buyers are encouraged to request detailed proposals and validate all cost components specific to their procurement scenarios.

Illustrative Image (Source: Google Search)

Spotlight on Potential foaming dressing Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘foaming dressing’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for foaming dressing

Understanding the critical technical properties and common trade terminology associated with foaming dressings is essential for international B2B buyers to make informed procurement decisions, especially across diverse markets such as Africa, South America, the Middle East, and Europe.

Key Technical Properties of Foaming Dressings

-

Material Grade and Composition

Foaming dressings are typically made from polyurethane foam with or without silicone layers. The material grade impacts biocompatibility, absorbency, and patient comfort. For B2B buyers, verifying medical-grade certification ensures compliance with international health standards and reduces risk of adverse reactions. -

Absorption Capacity

This refers to the volume of exudate the dressing can absorb without leakage. It is usually measured in grams per square centimeter or milliliters. High absorption capacity is crucial for managing chronic or highly exuding wounds, minimizing dressing changes, and lowering overall treatment costs. -

Thickness and Size Tolerance

Thickness affects cushioning and protection, while size tolerance defines allowable deviations from specified dimensions. Consistent sizing is vital for compatibility with wound sites and ease of application. Buyers should request tolerance details to ensure uniformity in bulk orders and avoid supply chain disruptions. -

Breathability and Moisture Vapor Transmission Rate (MVTR)

MVTR measures how well the dressing allows moisture vapor to pass through while maintaining a moist wound environment. Proper breathability prevents maceration and supports faster healing. Understanding MVTR helps buyers select dressings suited for specific wound types and climatic conditions. -

Adhesive Properties (for Adhesive Foam Dressings)

The adhesive strength and hypoallergenic nature of the dressing’s border affect patient comfort and dressing retention. Buyers should assess adhesive specifications to ensure the dressing stays securely in place without causing skin damage, especially in sensitive patient populations. -

Sterilization Method and Shelf Life

Sterilization techniques (e.g., gamma irradiation, ethylene oxide) impact product safety and shelf life. Buyers must confirm sterilization compliance with regulatory standards and evaluate shelf life to optimize inventory management and reduce wastage.

Common Trade Terminology in Foaming Dressing Procurement

-

OEM (Original Equipment Manufacturer)

Refers to companies that manufacture products or components that are purchased by another company and retailed under that purchasing company’s brand. For buyers, OEM partnerships can offer customization options and potentially lower costs through direct sourcing. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell in one order. MOQs affect pricing, inventory planning, and market entry strategies. Buyers from emerging markets should negotiate MOQs aligned with their demand forecasts and storage capabilities. -

RFQ (Request for Quotation)

A formal document sent to suppliers to solicit price and delivery terms for a specific product quantity and specification. RFQs enable buyers to compare offers transparently and ensure procurement aligns with budget and quality expectations. -

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities between buyers and sellers for delivery, risk, and costs. Common Incoterms include FOB (Free on Board) and CIF (Cost, Insurance, and Freight). Understanding Incoterms is critical for managing logistics and avoiding unexpected expenses. -

Lead Time

The period between placing an order and receiving the goods. Lead time impacts supply chain reliability and inventory turnover. Buyers should confirm lead times with suppliers to maintain continuous product availability, especially for critical healthcare supplies. -

Batch Number / Lot Number

Identification codes assigned to a specific production batch. These numbers are vital for traceability, quality control, and regulatory compliance. Buyers must ensure suppliers provide batch numbers for effective product tracking and recall management if needed.

By grasping these technical specifications and trade terms, B2B buyers can better evaluate foaming dressing suppliers, negotiate favorable contracts, and ensure consistent product quality tailored to the needs of their regional healthcare markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the foaming dressing Sector

Market Overview & Key Trends

The global foaming dressing market is experiencing robust growth driven by increasing demand for advanced wound care solutions across healthcare systems worldwide. Key market drivers include rising incidences of chronic wounds such as diabetic foot ulcers and pressure ulcers, an aging population, and growing awareness of effective wound management practices. For B2B buyers in regions like Africa, South America, the Middle East, and Europe, this translates into expanding opportunities to source innovative foaming dressings that combine enhanced absorbency with skin-friendly materials.

Emerging trends highlight a shift towards non-silicone foam dressings, which are gaining traction due to their gentle adhesion properties, reducing trauma during dressing changes. This is particularly relevant in markets such as Egypt and Argentina, where patient comfort and wound healing efficiency are prioritized. Additionally, B2B buyers are increasingly seeking suppliers who offer customized product portfolios, including adhesive and non-adhesive foam dressings tailored to specific wound types (acute, chronic, surgical, burns).

Technology integration in sourcing and supply chain management is another critical trend. Digital platforms and AI-driven analytics are enabling buyers to optimize procurement processes, forecast demand more accurately, and ensure timely delivery—crucial for regions with complex logistics like parts of Africa and the Middle East. Furthermore, strategic partnerships and regional manufacturing hubs are emerging to reduce costs and enhance supply chain resilience amid global disruptions such as geopolitical tensions and inflationary pressures.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a cornerstone for procurement decisions in the foaming dressing sector. Environmental concerns related to plastic waste, chemical residues, and carbon footprint are driving buyers to prioritize suppliers committed to eco-friendly manufacturing practices. The adoption of biodegradable or recyclable materials in foam dressings is gaining momentum, aligning with global sustainability goals and regulatory pressures in Europe and increasingly in emerging markets.

Ethical sourcing extends beyond environmental impact to encompass transparent supply chains and fair labor practices. B2B buyers should seek partners who demonstrate compliance with international labor standards and possess certifications such as ISO 14001 (Environmental Management) and OEKO-TEX® (safety of textiles). These certifications ensure that foaming dressings are produced responsibly, minimizing risks related to reputational damage and regulatory non-compliance.

Moreover, the integration of green chemistry principles in raw material selection—favoring bio-based polymers and non-toxic additives—enhances product sustainability without compromising performance. For buyers in regions like South America and Africa, partnering with suppliers who invest in sustainable innovation can also open access to new funding opportunities and governmental incentives focused on environmental stewardship.

Brief Evolution and Historical Context

Foaming dressings have evolved significantly since their inception as basic absorbent pads. Originally developed in the late 20th century to improve moisture management in wound care, these dressings leveraged polyurethane foam technology to provide cushioning and exudate absorption. Over time, advancements have introduced features such as breathable membranes, antimicrobial agents, and silicone or non-silicone adhesive interfaces.

For B2B buyers, understanding this evolution underscores the importance of selecting dressings that reflect the latest innovations tailored to specific clinical needs. This historical progression also highlights the trend towards patient-centric design and minimally invasive dressing changes, which reduce healthcare costs and improve healing outcomes. As the market continues to mature, buyers benefit from suppliers with deep R&D capabilities and proven track records in delivering next-generation foam dressing solutions.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of foaming dressing

-

How can I effectively vet suppliers of foaming dressings for international B2B purchases?

To vet suppliers, start by verifying their certifications such as ISO 13485 for medical devices and CE marking for Europe compliance. Request product samples and test reports to assess quality. Check their track record through client references and online reviews, particularly from buyers in your region (Africa, South America, Middle East, Europe). Evaluate their financial stability and production capacity to ensure reliability. Conduct factory audits or engage third-party inspection agencies to confirm manufacturing standards and compliance with international regulations. -

Is it possible to customize foaming dressings according to specific clinical or packaging requirements?

Yes, many manufacturers offer customization options including size, thickness, adhesive properties, and sterile packaging tailored to your market needs. Discuss your technical specifications upfront and confirm if the supplier can accommodate regional regulatory standards such as ANMAT in Argentina or Egyptian FDA requirements. Custom labeling and private branding are also common for B2B clients. Always request prototypes and validate regulatory compliance before finalizing large orders. -

What are typical Minimum Order Quantities (MOQs) and lead times for foaming dressings in international trade?

MOQs vary widely depending on supplier scale and customization level, typically ranging from 5,000 to 50,000 units per SKU. Lead times generally range from 4 to 12 weeks, influenced by production complexity, raw material availability, and shipping logistics. For buyers in Africa, South America, and the Middle East, factor in additional time for customs clearance and documentation. Negotiate MOQs and lead times early, especially for first orders, to balance inventory costs and market demand. -

What payment terms are common and how can B2B buyers mitigate financial risks when importing foaming dressings?

Standard payment terms include 30%-50% advance payment with balance upon shipment or after inspection. Letters of Credit (LC) are preferred for higher-value orders to secure both parties. For emerging markets, consider escrow services or trade finance solutions to reduce risks. Always verify supplier bank details independently to avoid fraud. Establish clear contractual terms addressing payment milestones, penalties for delays, and dispute resolution mechanisms. -

Which quality assurance certifications and testing standards should I require from foaming dressing suppliers?

Ensure suppliers hold ISO 13485 certification for medical device quality management. Look for CE marking for Europe or FDA approval if exporting to the US market. Request batch-level quality control documentation including microbiological sterility tests, absorbency performance, and biocompatibility reports. Suppliers should comply with ISO 10993 standards for biological evaluation. Regular third-party audits and compliance with Good Manufacturing Practices (GMP) are critical for consistent product quality. -

What logistics considerations are important when importing foaming dressings to regions like Egypt or Argentina?

Choose suppliers experienced with international shipping and familiar with destination country import regulations. Confirm Incoterms clearly (e.g., FOB, CIF) to understand responsibility for freight and customs duties. Consider climate-controlled transport if dressings are sensitive to temperature or humidity. Work with freight forwarders who handle medical device shipments and customs clearance efficiently. Factor in potential delays due to regional customs inspections and ensure all documentation (Certificates of Origin, health certificates) is accurate and complete. -

How should I handle disputes related to product quality or delivery delays in international foaming dressing contracts?

Clearly define dispute resolution procedures in your contract, favoring arbitration or mediation in a neutral jurisdiction. Maintain detailed records of communications, purchase orders, and inspection reports. If quality issues arise, request corrective action plans and consider third-party testing to validate claims. For delivery delays, verify if force majeure clauses apply. Engage legal counsel familiar with international trade law and your supplier’s country regulations to protect your interests. -

Are there regional regulatory differences I should be aware of when sourcing foaming dressings across Africa, South America, the Middle East, and Europe?

Yes, regulatory requirements vary significantly. Europe demands CE marking and MDR compliance, while South American countries like Argentina require ANMAT registration. Middle Eastern markets often require local health authority approvals and sometimes local agent representation. African countries vary widely; some require WHO prequalification or local import permits. It’s crucial to verify each target market’s specific regulations early and ensure suppliers can provide compliant documentation to avoid shipment rejections or market entry delays.

Strategic Sourcing Conclusion and Outlook for foaming dressing

Strategic sourcing of foaming dressings is pivotal for businesses aiming to optimize supply chains while meeting the rising demand for advanced wound care solutions. Key takeaways for international B2B buyers include prioritizing suppliers with proven quality certifications, scalable production capabilities, and innovative product portfolios such as adhesive and non-adhesive foam dressings tailored for diverse clinical applications. Understanding regional market dynamics—especially in emerging markets like Africa, South America, the Middle East, and Europe—enables buyers to leverage competitive pricing and localized support.

Emphasizing strategic partnerships over transactional purchases can drive long-term value, ensuring consistent product availability and access to cutting-edge developments like non-silicone foam dressings that align with evolving healthcare standards. Buyers should also evaluate supplier responsiveness to regulatory changes and geopolitical factors impacting global supply chains.

Looking ahead, the foaming dressing market is poised for robust growth fueled by technological innovation and increasing chronic wound prevalence worldwide. International buyers from regions such as Egypt and Argentina are encouraged to proactively engage with manufacturers and distributors who demonstrate agility and commitment to quality. By integrating strategic sourcing best practices, businesses can not only secure competitive advantages but also contribute to improved patient outcomes globally. Act now to build resilient sourcing networks that anticipate future healthcare needs and market shifts.