Definitive Guide to Top Dresser Rental for International

Guide to Top Dresser Rental

- Introduction: Navigating the Global Market for top dresser rental

- Understanding top dresser rental Types and Variations

- Key Industrial Applications of top dresser rental

- Strategic Material Selection Guide for top dresser rental

- In-depth Look: Manufacturing Processes and Quality Assurance for top dresser rental

- Manufacturing Processes for Top Dresser Rental Equipment

- Quality Assurance (QA) and Quality Control (QC) Framework

- Ensuring Supplier Quality: Practical Guidance for B2B Buyers

- Conclusion

- Comprehensive Cost and Pricing Analysis for top dresser rental Sourcing

- Spotlight on Potential top dresser rental Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for top dresser rental

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the top dresser rental Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of top dresser rental

- Strategic Sourcing Conclusion and Outlook for top dresser rental

Introduction: Navigating the Global Market for top dresser rental

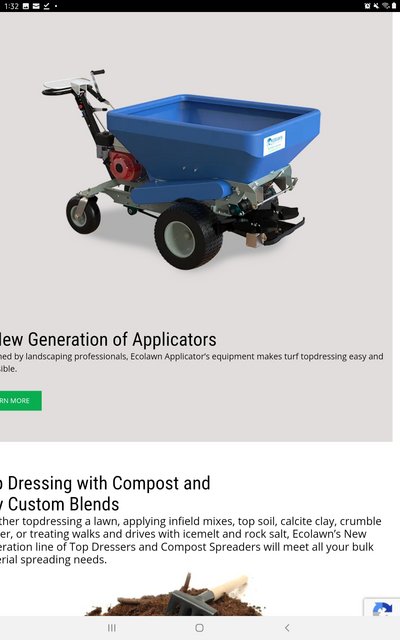

The global demand for top dresser rental services is growing rapidly, driven by industries such as agriculture, landscaping, and turf management that require precision soil conditioning and surface refinement. For international B2B buyers—especially those operating in diverse regions like Africa, South America, the Middle East, and Europe—the ability to source the right top dresser rental solutions is a strategic advantage. These markets present unique operational challenges and cost considerations, making informed decision-making essential to optimize productivity and control expenses.

This comprehensive guide is designed to equip procurement professionals and business leaders with a deep understanding of the top dresser rental landscape. It covers critical aspects including:

- Types of top dressers and their specific applications to match varied operational needs

- Material choices and manufacturing quality controls that impact durability and performance

- Leading suppliers and regional market dynamics to identify reliable partners and cost-effective options

- Cost structures and budgeting considerations tailored for international transactions and logistics

- Frequently asked questions addressing common concerns from equipment compatibility to rental terms

By synthesizing industry insights and practical sourcing strategies, this guide empowers buyers from countries like Argentina, Egypt, and beyond to navigate vendor selection confidently, mitigate supply chain risks, and secure competitive rental agreements. Leveraging this knowledge will help organizations enhance operational efficiency while adapting to the distinct market realities of their regions. Ultimately, this resource serves as a definitive tool to transform top dresser rental procurement from a transactional process into a strategic value driver.

Understanding top dresser rental Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Trailer-Mounted Top Dresser | Towable unit with adjustable spreading mechanisms | Golf courses, sports fields, large turf areas | High mobility and ease of transport; may require tractor compatibility |

| Walk-Behind Top Dresser | Compact, pedestrian-operated with manual or motorized drive | Small to medium-sized landscaping projects, nurseries | Precise control and maneuverability; limited coverage and slower operation |

| PTO-Driven Top Dresser | Power Take-Off driven, attached to tractors or mowers | Agricultural fields, large-scale turf management | Efficient for extensive areas; dependency on tractor availability and power |

| Self-Propelled Top Dresser | Integrated engine and spreading system, independent unit | Municipal parks, commercial landscaping, large estates | High productivity and operator comfort; higher rental costs and maintenance |

| Box Spreader Top Dresser | Simple hopper design with gravity or mechanical spreaders | Soil amendment, compost application in landscaping | Cost-effective and versatile; less uniform spreading compared to advanced models |

Trailer-Mounted Top Dresser

Trailer-mounted top dressers are designed for towing behind tractors or utility vehicles, offering adjustable spreading widths and depths. They are ideal for large turf areas such as golf courses and sports fields where mobility across varied terrain is essential. For B2B buyers, compatibility with existing towing equipment and ease of maintenance are critical. These units provide cost-effective coverage but require operational expertise to optimize spreading uniformity.

Walk-Behind Top Dresser

This type is pedestrian-operated, often featuring motorized or manual drives for precise spreading control. Best suited for smaller landscaping projects or nurseries, walk-behind dressers enable detailed application in tight or delicate areas. B2B buyers should consider the trade-off between maneuverability and operational speed, as these units cover less ground per hour but offer superior accuracy and lower rental costs.

PTO-Driven Top Dresser

PTO-driven models attach to tractors or mowers and use the vehicle’s power to operate spreading mechanisms. They excel in agricultural and large turf environments requiring rapid, uniform application of materials. Buyers must ensure compatibility with their tractor PTO systems and consider fuel and maintenance costs. PTO dressers deliver efficiency for high-volume jobs but depend heavily on the availability of suitable tractors.

Self-Propelled Top Dresser

Self-propelled top dressers combine an onboard engine with spreading mechanisms, allowing independent operation without external towing. These units are tailored for municipal parks, commercial landscaping, and large estates where productivity and operator comfort are priorities. While rental costs are higher, the enhanced efficiency and reduced labor requirements can justify the investment for large-scale B2B projects.

Box Spreader Top Dresser

Box spreaders feature a straightforward hopper that releases material via gravity or mechanical means. They are versatile for soil amendments and compost distribution in landscaping and horticulture. B2B buyers benefit from the low rental cost and operational simplicity, though the spreading uniformity may be inferior to more technologically advanced models. This type suits businesses prioritizing budget and basic functionality over precision.

Related Video: Top dresser rental demonstration from A to Z rentall Madiso

Key Industrial Applications of top dresser rental

| Industry/Sector | Specific Application of top dresser rental | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Agriculture & Horticulture | Soil amendment and turf enhancement | Improves soil health and crop yield; cost-effective soil coverage | Equipment suitability for local soil types, rental duration flexibility, availability of technical support |

| Landscaping & Groundskeeping | Golf course and sports field maintenance | Enhances turf quality and surface uniformity, reduces downtime | Machine size compatibility with field dimensions, ease of transport, local service network |

| Construction & Civil Engineering | Site preparation and erosion control | Stabilizes soil, reduces dust and runoff, accelerates project timelines | Rental terms accommodating project schedules, equipment robustness for rough terrain, compliance with local regulations |

| Municipal & Public Works | Parks and roadside green space maintenance | Maintains aesthetic appeal, supports environmental sustainability | Availability of eco-friendly materials, equipment adaptability to varied public spaces, cost-efficiency |

| Landscaping Supply & Rental Services | Rental fleet augmentation for seasonal demand spikes | Meets fluctuating client demand without capital expenditure | Flexible rental contracts, equipment reliability, rapid delivery options |

Top dresser rental plays a pivotal role in Agriculture & Horticulture by providing a cost-effective solution for spreading soil amendments such as compost, sand, or topsoil over large farm areas. This improves soil structure and nutrient distribution, directly enhancing crop yields. For international buyers from regions like South America and Africa, selecting equipment adaptable to diverse soil types and climates is crucial. Rental flexibility allows farmers to align usage with seasonal cycles without heavy capital investment.

Illustrative Image (Source: Google Search)

In Landscaping & Groundskeeping, particularly for golf courses and sports fields, top dressers are essential for maintaining turf health and surface evenness. Renting equipment enables groundskeepers in Europe and the Middle East to access advanced machinery that might be prohibitively expensive to purchase outright. Key considerations include machine size compatibility to avoid damage to delicate turf and ensuring local technical support to minimize downtime during peak seasons.

Within Construction & Civil Engineering, top dressers are utilized for site preparation tasks such as leveling soil and controlling erosion. This application is critical in fast-paced projects across developing urban areas in Africa and the Middle East, where rapid stabilization of surfaces can prevent costly delays. Buyers should focus on robust equipment capable of handling rough terrain and rental agreements that match project timelines to optimize operational efficiency.

For Municipal & Public Works, top dresser rental supports the upkeep of parks and roadside green spaces, enhancing urban aesthetics and contributing to environmental sustainability efforts. In countries like Egypt and Argentina, where public spaces are expanding, access to rental top dressers allows municipalities to maintain large areas without the burden of ownership costs. Prioritizing eco-friendly materials and equipment adaptability ensures compliance with local environmental regulations.

Finally, companies in the Landscaping Supply & Rental Services sector use top dresser rental to manage seasonal demand fluctuations effectively. By augmenting their fleet with rental equipment, these businesses can serve clients across different regions without long-term capital commitments. For international suppliers, offering flexible rental contracts and ensuring rapid delivery are key to capturing market share in diverse geographic markets.

Related Video: ECOLAWN Top Dresser ECO250

Strategic Material Selection Guide for top dresser rental

When selecting materials for top dresser rental equipment, B2B buyers must carefully evaluate the properties and suitability of each material to ensure durability, performance, and compliance with regional standards. This is especially crucial for buyers in diverse markets such as Africa, South America, the Middle East, and Europe, where environmental conditions and regulatory requirements vary significantly.

Carbon Steel

Key Properties: Carbon steel offers high strength and toughness, with good machinability and weldability. It typically withstands moderate temperature and pressure conditions but has limited corrosion resistance unless coated or treated.

Pros & Cons: Carbon steel is cost-effective and widely available, making it a popular choice for structural components and frames in top dressers. However, it requires protective coatings or regular maintenance to prevent rust, especially in humid or saline environments common in coastal regions of Africa and the Middle East.

Impact on Application: Best suited for non-corrosive environments or where protective measures are feasible. Its mechanical strength supports heavy-duty applications but may be less ideal for exposure to fertilizers or chemicals without proper surface treatment.

International Considerations: Compliance with ASTM A36 or EN 10025 standards is common. Buyers from Argentina and Egypt should verify local availability of certified grades and consider the cost and logistics of applying corrosion protection coatings.

Stainless Steel (e.g., 304 or 316 Grades)

Key Properties: Stainless steel offers excellent corrosion resistance, especially grade 316 which is resistant to chlorides and chemical exposure. It maintains strength at elevated temperatures and has good wear resistance.

Pros & Cons: Stainless steel is highly durable and requires minimal maintenance, making it ideal for harsh environments and chemical exposure. The downside is a higher upfront cost and more complex manufacturing processes, which can increase rental equipment prices.

Impact on Application: Ideal for top dressers used in environments with high moisture, fertilizers, or where sanitation is critical. Its corrosion resistance ensures longevity and reduces downtime for repairs.

International Considerations: Widely accepted standards include ASTM A240 and EN 10088. Buyers in Europe and South America often prefer stainless steel for premium equipment due to long-term cost savings. In Africa and the Middle East, availability and cost may be limiting factors, but the material’s durability often justifies the investment.

Aluminum Alloys

Key Properties: Aluminum alloys are lightweight with good corrosion resistance and moderate strength. They have excellent thermal conductivity but lower wear resistance compared to steel.

Pros & Cons: The lightweight nature of aluminum reduces transportation and handling costs, beneficial for rental fleets. However, aluminum is less durable under heavy mechanical stress and can be prone to surface damage.

Impact on Application: Suitable for components where weight reduction is prioritized, such as hoppers or covers. Not recommended for high-wear parts or where heavy loads are expected.

International Considerations: Compliance with standards such as ASTM B209 or EN 573 is typical. In regions like South America and Africa, aluminum’s corrosion resistance is advantageous in humid or coastal climates. However, buyers should assess the trade-off between weight savings and durability based on local soil types and usage intensity.

Polyethylene (High-Density Polyethylene – HDPE)

Key Properties: HDPE is a durable plastic with excellent chemical resistance, impact resistance, and low moisture absorption. It performs well across a broad temperature range but has lower mechanical strength than metals.

Pros & Cons: HDPE components are lightweight, corrosion-proof, and often less expensive than metal parts. However, they may deform under high mechanical loads or prolonged UV exposure unless UV-stabilized.

Impact on Application: Commonly used for liners, chutes, or protective covers in top dressers. Ideal for handling abrasive or corrosive materials such as fertilizers and soil amendments.

International Considerations: Buyers should ensure compliance with ISO 9001 manufacturing standards and verify UV resistance for outdoor use, especially in high-sunlight regions like the Middle East and Africa. HDPE’s chemical resistance makes it attractive for South American markets with diverse agricultural chemicals.

Summary Table

| Material | Typical Use Case for top dresser rental | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Carbon Steel | Structural frames, non-corrosive parts | Cost-effective, strong | Requires corrosion protection | Low |

| Stainless Steel (304/316) | Chemical-exposed parts, high-moisture environments | Excellent corrosion resistance | Higher cost, complex manufacturing | High |

| Aluminum Alloys | Lightweight components like hoppers and covers | Lightweight, corrosion-resistant | Lower mechanical strength | Medium |

| High-Density Polyethylene (HDPE) | Liners, chutes, protective covers for abrasive materials | Chemical and corrosion resistant | Lower strength, UV degradation risk | Low to Medium |

This guide provides international B2B buyers with a clear framework to evaluate materials for top dresser rental equipment, balancing performance, cost, and regional considerations to optimize procurement decisions.

In-depth Look: Manufacturing Processes and Quality Assurance for top dresser rental

Manufacturing Processes for Top Dresser Rental Equipment

The production of top dresser rental machinery involves a series of carefully coordinated manufacturing stages that ensure durability, precision, and operational efficiency. Understanding these stages helps international B2B buyers evaluate potential suppliers and ensure product reliability.

1. Material Preparation

- Raw Material Selection: High-grade steel alloys are typically chosen for structural components due to their strength and resistance to wear. Corrosion-resistant metals or treated steel are preferred to withstand outdoor usage.

- Cutting and Shaping: Initial cutting of metal sheets and bars is performed using CNC laser cutters or plasma cutting machines to achieve precise dimensions.

- Surface Treatment: Prior to forming, materials may undergo cleaning, degreasing, or galvanization to improve paint adhesion and corrosion resistance.

2. Forming and Fabrication

- Metal Forming: Processes such as bending, rolling, and stamping are applied to shape chassis parts, hopper bodies, and conveyor components. CNC press brakes and rollers ensure repeatability and accuracy.

- Welding: Automated or manual welding techniques (MIG, TIG) join components, focusing on structural integrity and minimizing distortion. Weld quality is critical for machine durability.

- Machining: Precision machining (turning, milling, drilling) is used for fitting moving parts like augers, spreader plates, and gear housings to tight tolerances.

3. Assembly

- Sub-Assembly: Components such as hydraulic systems, drive mechanisms, and electrical wiring are pre-assembled to facilitate efficient final assembly.

- Final Assembly: Integration of sub-assemblies into the main frame, installation of control panels, safety guards, and attachment points for towing or mounting.

- Lubrication and Adjustment: Critical moving parts are lubricated, and functional adjustments are made to ensure smooth operation.

4. Finishing

- Surface Coating: Powder coating or industrial-grade painting is applied for enhanced corrosion resistance and aesthetic appeal. This step also includes curing to ensure coating durability.

- Labeling and Documentation: Safety labels, operational instructions, and serial numbers are affixed as per regulatory requirements.

- Packaging: Machines are packaged with protective materials to prevent damage during transport, considering the logistical challenges faced by buyers in diverse regions such as Africa and South America.

Quality Assurance (QA) and Quality Control (QC) Framework

Robust quality assurance and control systems are essential to maintain consistent manufacturing standards and meet international market expectations. For top dresser rental equipment, adherence to global and industry-specific standards is a key differentiator.

Illustrative Image (Source: Google Search)

International and Industry Standards

- ISO 9001: The foundational international standard for quality management systems, ensuring that suppliers maintain consistent production processes, continuous improvement, and customer satisfaction.

- CE Marking: Mandatory for products sold in the European Economic Area (EEA), indicating compliance with health, safety, and environmental protection standards.

- API and Other Industry Certifications: Although API standards are more common in the oil and gas sector, related certifications may apply to hydraulic or mechanical components used in the machinery.

- Regional Standards: Buyers in regions like Egypt and Argentina should verify compliance with local import regulations and standards, such as INMETRO in Brazil or SASO in Saudi Arabia, to avoid customs clearance issues.

Key Quality Control Checkpoints

- Incoming Quality Control (IQC): Inspection and testing of raw materials and purchased components before production. This includes verifying material certificates, dimensional checks, and visual inspections to prevent defective inputs.

- In-Process Quality Control (IPQC): Continuous monitoring during manufacturing, including weld inspections (visual and ultrasonic), dimensional verifications after forming, and functional checks on assemblies.

- Final Quality Control (FQC): Comprehensive testing of the fully assembled top dresser, covering operational tests (spreader functionality, hydraulic pressure), safety checks, and cosmetic inspections.

Common Testing Methods

- Non-Destructive Testing (NDT): Techniques such as ultrasonic testing, magnetic particle inspection, and dye penetrant testing are employed to detect internal and surface defects in welds and critical components.

- Load and Performance Testing: Simulating operational conditions to verify the machine’s spreading accuracy, capacity, and mechanical endurance.

- Corrosion Resistance Testing: Salt spray tests or similar methods to validate the effectiveness of coatings and treatments, crucial for machines deployed in humid or coastal regions.

Ensuring Supplier Quality: Practical Guidance for B2B Buyers

International buyers from Africa, South America, the Middle East, and Europe often face unique challenges when sourcing top dresser rental equipment. Due diligence in supplier quality verification is vital.

Verification Tools and Techniques

- Supplier Audits: Conduct on-site or third-party audits to assess manufacturing capabilities, quality management systems, and compliance with ISO 9001 and other relevant standards. Remote audits via video conferencing can be an alternative where travel is constrained.

- Review of Quality Documentation: Request detailed QC reports, material certificates, inspection records, and test results. Cross-check these documents against international standards and contractual specifications.

- Third-Party Inspections: Engage independent inspection agencies to perform pre-shipment inspections or witness testing, providing unbiased verification of product quality and compliance.

- Sample Evaluation: Before bulk orders, procure sample units for hands-on evaluation and testing under local operational conditions.

Regional Considerations and Compliance Nuances

- Customs and Regulatory Compliance: Ensure that the supplier’s documentation aligns with the import regulations and certification requirements of the buyer’s country to prevent delays and additional costs.

- Adaptation to Local Conditions: Verify that the manufacturing process considers environmental factors prevalent in the buyer’s region, such as extreme temperatures, dust, or humidity, which impact material choice and protective finishes.

- After-Sales Support and Spare Parts Availability: Quality assurance extends beyond manufacturing; reliable supplier support and availability of spare parts are essential, especially in remote or developing markets.

Conclusion

A thorough understanding of the manufacturing processes and quality assurance protocols for top dresser rental equipment empowers B2B buyers to make informed decisions. Prioritizing suppliers with transparent, internationally recognized quality systems and demonstrated process control mitigates risks and ensures procurement of durable, high-performance machinery suited to diverse regional requirements. Buyers should leverage audits, documentation reviews, and third-party inspections as integral components of their supplier evaluation strategy to achieve optimal value and operational reliability.

Related Video: Most Amazing Factory Manufacturing Process Videos | Factory Mass Production

Comprehensive Cost and Pricing Analysis for top dresser rental Sourcing

Understanding the cost and pricing dynamics of top dresser rental is crucial for international B2B buyers to optimize procurement decisions, especially across diverse regions like Africa, South America, the Middle East, and Europe. Below is a detailed analysis of the key cost components, price influencers, and practical buyer strategies to ensure cost-efficient sourcing.

Key Cost Components in Top Dresser Rental Pricing

-

Materials

The primary cost driver involves the quality and type of materials used in the top dresser equipment, such as steel alloys, hydraulic components, and wear-resistant parts. Material costs fluctuate with global commodity prices, which can impact rental pricing, particularly when sourcing from regions with supply chain volatility. -

Labor

Labor costs cover the workforce involved in equipment assembly, maintenance, and rental service management. These vary significantly by country and region due to differing wage levels and labor regulations, influencing the rental rates offered by suppliers. -

Manufacturing Overhead

Overhead includes factory utilities, equipment depreciation, and indirect labor. Efficient manufacturing processes and automation can reduce these costs, potentially lowering rental prices. -

Tooling and Maintenance

Tooling costs pertain to the specialized machinery and dies used in manufacturing top dressers. Additionally, ongoing maintenance and refurbishment of rental units contribute to overall costs, ensuring reliability and performance. -

Quality Control (QC)

Rigorous QC processes guarantee equipment safety and performance standards. Certifications and compliance with international quality standards may increase costs but add value by reducing downtime and enhancing operational efficiency. -

Logistics and Transportation

Shipping, customs duties, and inland transportation significantly affect the final rental price, especially for international buyers. Costs vary based on Incoterms, freight modes, and regional infrastructure quality. -

Supplier Margin

Suppliers factor in profit margins, which depend on market competition, demand, and service level agreements. Margins may be higher in regions with limited supplier options or higher operational risks.

Price Influencers to Consider

-

Order Volume and Minimum Order Quantity (MOQ)

Larger rental volumes or longer rental periods often attract discounted pricing. Buyers should negotiate based on total usage forecasts to leverage economies of scale. -

Specifications and Customization

Customized top dressers tailored to specific terrains or operational needs generally cost more due to design complexity and specialized parts. -

Material Grade and Certification Levels

Equipment built with premium materials and certified to international standards (e.g., ISO, CE) commands higher rental prices but offers better durability and compliance, reducing total cost of ownership. -

Supplier Reputation and Service Quality

Established suppliers with strong after-sales support and maintenance services might price higher but provide greater reliability and risk mitigation. -

Incoterms and Delivery Terms

Understanding terms like FOB, CIF, or DDP is essential. Buyers should assess whether logistics costs are included or excluded, as this affects budgeting and supplier comparison.

Buyer Tips for Cost-Effective Sourcing

-

Negotiate Beyond Price

Focus on total value including maintenance, spare parts availability, and rental flexibility. Request detailed cost breakdowns to identify negotiable elements. -

Evaluate Total Cost of Ownership (TCO)

Consider operational costs such as fuel consumption, downtime risk, and maintenance alongside rental fees. Opting for slightly higher-priced equipment with better efficiency can reduce overall expenses. -

Leverage Local and Regional Suppliers

For buyers in Africa, South America, the Middle East, and Europe, sourcing from nearby suppliers can reduce logistics costs and lead times. Regional suppliers often better understand local market conditions and regulatory requirements. -

Understand Currency and Payment Terms

Exchange rate fluctuations can impact final costs. Negotiate payment terms and currency options to minimize financial risk. -

Use Digital Procurement Tools

Employ spend analytics and supplier benchmarking to identify cost-saving opportunities and ensure competitive pricing.

Important Disclaimer

Pricing for top dresser rentals varies widely based on equipment specifications, rental duration, regional market conditions, and supplier capabilities. The figures discussed here are indicative and should be validated through direct supplier engagement and tailored quotations.

This comprehensive understanding of cost components and pricing influencers equips international B2B buyers with the insights needed to make informed sourcing decisions, balancing cost-efficiency with quality and operational reliability.

Spotlight on Potential top dresser rental Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘top dresser rental’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for top dresser rental

Critical Technical Properties for Top Dresser Rental

Understanding the technical specifications of top dressers is crucial for B2B buyers to ensure they select the right equipment that matches operational needs, environmental conditions, and budget constraints. Below are key technical properties to evaluate:

-

Material Grade and Build Quality

Top dressers are typically constructed from high-strength steel alloys or reinforced composites. The material grade affects durability and resistance to wear, especially when spreading abrasive materials like sand or gravel. For buyers in regions with harsh climates (e.g., Egypt’s arid environment or wet European climates), selecting top dressers with corrosion-resistant coatings or stainless steel components extends equipment life. -

Spreading Width and Capacity

This refers to the maximum width (usually in meters or feet) that the top dresser can evenly distribute material and the volume capacity of its hopper or spreader unit. A wider spreading width increases efficiency by covering more ground per pass, critical for large sports fields or golf courses. Capacity impacts how frequently refills are needed, affecting operational downtime. -

Spreading Accuracy and Tolerance

The precision with which a top dresser spreads material influences the quality of turf or soil conditioning. Tolerance levels indicate the allowable deviation in spread thickness and uniformity. For B2B buyers, tighter tolerances mean better control over application rates, reducing waste and ensuring consistent surface conditions. -

Power Source and Compatibility

Top dressers may be self-propelled or tractor-mounted. Understanding the power requirements (e.g., PTO horsepower for tractor attachments) and compatibility with existing fleet machinery is essential to avoid additional investment in new vehicles or adapters. This is especially relevant in markets with diverse agricultural equipment standards, such as South America and Africa. -

Adjustability and Control Features

Modern top dressers often include adjustable spread rates, variable speed controls, and remote operation capabilities. These features allow operators to tailor the application to specific turf types or soil conditions, improving effectiveness and minimizing material usage. -

Maintenance Requirements and Serviceability

Easy access to wear parts, availability of spare components, and simplicity of routine maintenance are key for minimizing downtime. Buyers should consider the local availability of service networks and parts, which can vary significantly across continents.

Common Industry and Trade Terminology for Top Dresser Rental

Navigating the procurement and rental process requires familiarity with certain trade terms and industry jargon. Understanding these terms empowers buyers to negotiate better contracts and manage logistics effectively.

-

OEM (Original Equipment Manufacturer)

Refers to the company that manufactures the top dresser or its key components. OEM parts ensure compatibility and maintain warranty conditions. For international buyers, sourcing OEM-certified rentals or parts guarantees quality and reduces risk of equipment failure. -

MOQ (Minimum Order Quantity)

The smallest quantity of rental units or parts a supplier is willing to provide. While MOQ is more common in purchasing, it can apply to rental fleets during peak seasons. Knowing MOQ helps buyers plan procurement volumes and negotiate flexible terms, especially important for smaller operations in emerging markets. -

RFQ (Request for Quotation)

A formal invitation sent to suppliers asking for price and terms for renting top dressers. RFQs enable buyers to compare offers based on specifications, rental duration, and service agreements. Clear, detailed RFQs reduce misunderstandings and streamline supplier evaluation. -

Incoterms (International Commercial Terms)

Standardized trade terms published by the International Chamber of Commerce that define responsibilities for shipping, insurance, and customs clearance. For international rental agreements, understanding Incoterms like FOB (Free On Board) or DDP (Delivered Duty Paid) clarifies who handles transport risks and costs, crucial for buyers in regions with complex import regulations. -

Depreciation and Usage Limits

Rental contracts may specify limits on operational hours or mileage to protect equipment value. Awareness of these limits helps buyers avoid penalty fees and schedule rentals efficiently. -

Lead Time

The period between placing a rental order and equipment delivery. Lead time impacts project planning and is especially critical for buyers coordinating seasonal activities or working within tight schedules.

By focusing on these technical properties and trade terms, international B2B buyers can make well-informed decisions that optimize operational efficiency, cost-effectiveness, and supply chain reliability when renting top dressers. This understanding also facilitates clearer communication with suppliers and smoother cross-border transactions.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the top dresser rental Sector

Market Overview & Key Trends

The global top dresser rental market is experiencing steady growth driven by increasing demand for turf management and land maintenance across commercial, municipal, and sports sectors. Key growth drivers include urbanization, expansion of golf courses and sports facilities, and the rising importance of landscape aesthetics in commercial real estate. For international B2B buyers from regions such as Africa, South America, the Middle East, and Europe—including markets like Argentina and Egypt—understanding regional infrastructure development and agricultural practices is critical to sourcing suitable top dresser equipment and services.

Current market dynamics emphasize technological integration and service flexibility. Rental providers are increasingly offering advanced machinery equipped with GPS, automated spreading controls, and IoT-enabled monitoring to improve precision and operational efficiency. These innovations enable buyers to optimize application rates and reduce waste, critical in regions with resource constraints or regulatory pressures.

Sourcing trends reveal a shift toward digital procurement platforms and collaborative supplier relationships. Buyers benefit from transparent pricing models, real-time equipment availability, and flexible rental terms tailored to seasonal demand fluctuations. In emerging markets, where capital expenditure on machinery may be limited, rental solutions provide cost-effective access to high-quality equipment without long-term ownership risks.

Supply chain resilience is a growing concern, especially amid global disruptions. Buyers should prioritize suppliers with diversified sourcing networks and robust logistics capabilities, ensuring timely delivery and maintenance support. Additionally, local partnerships and regional service hubs enhance responsiveness, an important factor for buyers in geographically dispersed or infrastructure-challenged areas.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a core consideration in the top dresser rental sector, reflecting broader environmental and social governance (ESG) commitments by businesses worldwide. The environmental impact of top dressing relates primarily to soil health, resource consumption, and emissions from machinery operations. Ethical sourcing and sustainable practices help mitigate these impacts, aligning with buyers’ corporate responsibility goals and regulatory compliance.

For B2B buyers, prioritizing rental providers who use eco-friendly materials—such as organic or recycled top dressing compounds—and maintain equipment with low-emission engines can significantly reduce the carbon footprint of turf maintenance operations. Certifications like ISO 14001 (Environmental Management) or adherence to local green standards provide assurance of supplier commitment to sustainability.

Ethical supply chains also encompass fair labor practices, transparent sourcing of raw materials, and community engagement. Buyers should evaluate providers on these criteria, particularly when sourcing from regions with diverse labor regulations. Sustainable partnerships often translate into long-term cost savings through improved operational efficiencies and enhanced brand reputation.

Investing in rental solutions that incorporate demand-driven planning—minimizing overuse and optimizing inventory—further supports sustainability. Digital tools that track usage patterns and enable predictive maintenance reduce waste and extend equipment life cycles, crucial for resource-conscious buyers in markets facing environmental challenges.

Brief Evolution and Historical Context

Top dressing as a turf management practice has evolved from manual soil and sand spreading to sophisticated mechanized applications. Initially confined to golf courses and elite sports fields, the demand for top dressing expanded into municipal parks, commercial landscapes, and agricultural sectors as awareness of soil health and turf quality grew.

The rental market for top dressing equipment emerged as a response to the high capital costs and maintenance challenges of owning specialized machinery. Over the past two decades, advances in equipment technology and the rise of flexible rental models have democratized access, enabling a broader range of businesses and governments—especially in developing regions—to adopt top dressing practices.

This evolution reflects broader trends in industrial equipment rental, where digitalization, sustainability, and service customization are reshaping procurement strategies. For international B2B buyers, understanding this trajectory helps in identifying suppliers who combine historical expertise with modern operational excellence.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of top dresser rental

-

How can I effectively vet suppliers when sourcing top dresser rentals internationally?

To ensure reliability, start by verifying the supplier’s business credentials, including licenses and registrations relevant to their country. Request references or case studies from previous international clients, especially within your region (Africa, South America, Middle East, Europe). Evaluate their equipment maintenance records and rental fleet quality. Utilize third-party audits or inspection services to validate claims. Also, check their compliance with international standards and certifications. Engaging suppliers with transparent communication and clear service level agreements (SLAs) mitigates risks and fosters long-term partnerships. -

Can top dressers be customized to suit specific turf or soil conditions in my region?

Yes, many suppliers offer customization options to adapt top dressers for different turf types, soil compositions, and environmental conditions common in regions like Egypt or Argentina. Custom features may include adjustable spread widths, variable drop rates, or specialized hopper designs. Communicate your precise agronomic needs and site conditions upfront. Collaborate with suppliers who provide technical consultation and tailor equipment settings accordingly. Customized equipment enhances application precision, efficiency, and ultimately turf health, delivering better ROI for your rental investment. -

What are typical minimum order quantities (MOQs), lead times, and payment terms for international top dresser rentals?

MOQs vary but often depend on rental duration and volume of equipment required. Smaller orders or short-term rentals are generally accepted but may incur higher per-unit costs. Lead times range from 2 to 8 weeks depending on supplier location, equipment availability, and shipping logistics. Payment terms usually include a deposit upfront (30-50%), with balance due before delivery or upon receipt. Negotiate terms to align with your cash flow cycles and consider escrow or letter of credit arrangements to secure transactions and build mutual trust. -

What quality assurance (QA) measures and certifications should I expect from a top dresser rental supplier?

Top dresser rental suppliers should adhere to ISO 9001 quality management standards or equivalent certifications to ensure equipment reliability and service quality. QA measures include routine equipment inspections, calibration of spreading mechanisms, and maintenance logs. Request documentation on equipment condition and performance tests before shipment. Confirm that suppliers comply with environmental and safety standards relevant to your country to avoid regulatory issues. Transparent QA practices reduce downtime and guarantee consistent top dressing results. -

How do logistics and customs considerations impact the international rental of top dressers?

Logistics complexity depends on the supplier’s location, your country’s import regulations, and rental duration. Coordinate with suppliers experienced in international freight forwarding to handle packaging, shipping, and customs clearance efficiently. Understand import duties, taxes, and temporary import permits for rental equipment to avoid unexpected costs. Plan for potential delays in customs by building buffer times into your schedule. Utilizing Incoterms clearly in contracts helps define responsibilities and risk allocation between buyer and supplier. -

What should I do if there is a dispute regarding equipment performance or delivery timelines?

First, refer to the signed contract and SLAs outlining performance benchmarks and delivery commitments. Document all communications and discrepancies in writing. Engage in direct dialogue with the supplier to seek resolution, focusing on corrective actions or compensation terms. If unresolved, consider involving a neutral third-party mediator familiar with international trade law. Ensure contracts include clear dispute resolution clauses specifying jurisdiction and arbitration mechanisms to protect your interests and maintain business relationships.

Illustrative Image (Source: Google Search)

-

Are there specific considerations for renting top dressers in emerging markets like Africa or South America?

Yes, infrastructure limitations such as port capacity, road conditions, and local handling facilities can affect delivery and equipment condition. Supplier selection should prioritize those with local partnerships or regional hubs to streamline logistics and support. Currency fluctuations and payment system reliability also influence transaction security; consider using stable currencies or hedging strategies. Additionally, ensure compliance with local environmental and operational regulations to avoid fines or equipment impoundment. -

How can I ensure ongoing support and maintenance during the rental period?

Choose suppliers offering comprehensive rental agreements that include preventive maintenance and on-site technical support or rapid spare parts delivery. Establish clear communication channels and escalation procedures for service requests. For international rentals, verify the availability of local technicians or authorized service centers. Proactive maintenance minimizes downtime and extends equipment life, ensuring your top dressing projects remain on schedule and within budget. Contractually require response time guarantees to secure reliable support.

Strategic Sourcing Conclusion and Outlook for top dresser rental

Strategic sourcing in the top dresser rental market unlocks significant value by enabling businesses to optimize cost, quality, and supply reliability. For international B2B buyers across Africa, South America, the Middle East, and Europe, a disciplined approach to supplier evaluation, spend analysis, and contract negotiation is essential. Leveraging data-driven insights and collaborative supplier partnerships can mitigate risks related to price volatility and equipment availability, ensuring operational continuity and budget control.

Key takeaways for buyers include prioritizing suppliers with proven service excellence, embracing flexible rental terms tailored to project cycles, and integrating digital procurement tools to streamline sourcing workflows. Additionally, understanding regional logistics and regulatory environments is critical for seamless equipment deployment and compliance.

Looking ahead, the top dresser rental sector is poised to benefit from advancements in predictive maintenance and smart equipment technologies, which will enhance asset utilization and reduce downtime. Buyers who adopt strategic sourcing frameworks today will position their organizations to capitalize on these innovations, achieving sustainable competitive advantage.

International B2B buyers are encouraged to engage proactively with rental providers, invest in comprehensive sourcing diagnostics, and build resilient supply chains. This strategic focus will drive cost-efficiency, operational agility, and long-term growth in an increasingly dynamic global marketplace.