Your Ultimate Guide to Sourcing Shell Dress

Guide to Shell Dress

- Introduction: Navigating the Global Market for shell dress

- Understanding shell dress Types and Variations

- Key Industrial Applications of shell dress

- Strategic Material Selection Guide for shell dress

- In-depth Look: Manufacturing Processes and Quality Assurance for shell dress

- Comprehensive Cost and Pricing Analysis for shell dress Sourcing

- Spotlight on Potential shell dress Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for shell dress

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the shell dress Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of shell dress

- Strategic Sourcing Conclusion and Outlook for shell dress

Introduction: Navigating the Global Market for shell dress

The global market for shell dresses presents a dynamic and lucrative opportunity for B2B buyers seeking to diversify and elevate their product portfolios. As a versatile garment that blends cultural appeal with contemporary fashion trends, the shell dress holds significant potential across diverse regions including Africa, South America, the Middle East, and Europe. For international buyers from countries such as Argentina and Egypt, understanding the complexities of sourcing shell dresses is essential to securing competitive advantage and ensuring supply chain resilience.

This comprehensive guide is designed to equip buyers with actionable insights into every critical aspect of the shell dress market. From detailed overviews of various types and styles, to in-depth analysis of material quality and manufacturing standards, the guide ensures buyers can assess product suitability with confidence. It also covers quality control measures, supplier selection criteria, and cost structures to facilitate transparent and strategic procurement decisions.

Furthermore, the guide explores regional market trends and demand drivers, helping buyers tailor their sourcing strategies to local consumer preferences and logistical realities. A dedicated FAQ section addresses common challenges and clarifies technical considerations, empowering buyers to navigate negotiations and contracts effectively.

By leveraging this guide, international B2B buyers will gain a holistic understanding of the shell dress supply chain, enabling them to optimize supplier partnerships, manage risks, and capitalize on emerging market opportunities with greater agility and confidence.

Understanding shell dress Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Classic A-Line Shell | Flared skirt with fitted bodice, often sleeveless or short sleeves | Corporate events, formal business occasions | Elegant and versatile; may require precise sizing, less suitable for casual wear |

| Peplum Shell Dress | Fitted bodice with a flared ruffle or overskirt at the waist | Fashion retail, boutique collections | Enhances silhouette, adds flair; can be less comfortable for extended wear, sizing complexity |

| Wrap Style Shell Dress | Overlapping front panels secured with ties or buttons | International trade shows, business luncheons | Adjustable fit, flattering for various body types; may require quality fabric to avoid bulkiness |

| Shift Shell Dress | Straight cut, loose fit without waist definition | Office wear, uniform suppliers | Comfortable, easy to produce in bulk; may lack shape appeal, less formal |

| High-Neck Shell Dress | High neckline with clean lines, often sleeveless | Luxury retail, executive corporate gifting | Modern, sophisticated look; limited breathability in warm climates, fabric choice critical for comfort |

Classic A-Line Shell

The classic A-line shell dress features a fitted bodice that flares out gently from the waist, creating an elegant silhouette suitable for formal and semi-formal business occasions. Its versatility makes it a staple for corporate events and international meetings. B2B buyers should consider fabric quality and sizing standards, especially when sourcing for diverse markets such as Africa and South America, where body shapes and climate preferences vary.

Peplum Shell Dress

This style adds a distinctive peplum—a flared ruffle at the waist—offering a fashionable and structured look favored by boutique retailers and fashion-forward business segments. While visually appealing, the peplum shell dress can be more complex to manufacture and size accurately, which requires attention to detail in supplier capabilities. It is ideal for markets emphasizing style, such as European and Middle Eastern luxury retailers.

Wrap Style Shell Dress

The wrap shell dress is characterized by overlapping front panels that allow for an adjustable and flattering fit. This variation suits international trade shows and business luncheons where comfort and adaptability are key. Buyers should prioritize suppliers who use high-quality, wrinkle-resistant fabrics to maintain a polished appearance and ensure the wrap mechanism is durable for repeated use.

Shift Shell Dress

With its straight, loose cut and minimal waist definition, the shift shell dress is popular for office wear and uniform suppliers targeting high-volume orders. Its simplicity supports cost-effective production and easy sizing across regions. However, buyers should balance affordability with fabric quality to avoid a shapeless look that may reduce appeal in markets like Europe and the Middle East.

High-Neck Shell Dress

The high-neck shell dress offers a modern, sophisticated appearance with clean lines and often sleeveless design. It is well-suited for luxury retail and executive gifting, where style and exclusivity are paramount. Buyers must carefully select breathable materials suitable for warm climates such as Egypt or Argentina, ensuring comfort without compromising the dress’s sleek profile.

Key Industrial Applications of shell dress

| Industry/Sector | Specific Application of shell dress | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Oil & Gas | Protective coating for offshore equipment | Enhances corrosion resistance and extends asset life | Compliance with industry standards, resistance to saltwater |

| Automotive | Interior and exterior trim components | Provides durable, aesthetic finishes with wear resistance | Material durability, UV stability, compatibility with adhesives |

| Construction | Surface protection for building materials | Improves weather resistance and reduces maintenance costs | Environmental compliance, ease of application, longevity |

| Electronics | Protective casing for electronic devices | Shields sensitive components from physical and chemical damage | Thermal stability, electrical insulation properties |

| Marine & Shipping | Anti-corrosion layer on ship hulls and parts | Reduces maintenance downtime and protects against harsh marine environments | Saltwater resistance, abrasion resistance, eco-friendly options |

Oil & Gas

In the oil and gas sector, shell dress is predominantly used as a protective coating for offshore drilling and production equipment. The harsh marine environment demands materials that can withstand corrosion caused by saltwater and extreme weather. Shell dress coatings significantly extend the operational life of equipment by providing a robust barrier against rust and physical wear. For international buyers, especially in regions like the Middle East and Africa where offshore exploration is growing, sourcing products that meet API or equivalent certifications is critical to ensure safety and compliance.

Automotive

Shell dress finds application in automotive manufacturing, particularly for interior trims and exterior decorative components. It offers a durable finish that resists abrasion, UV degradation, and chemical exposure from fuels and lubricants. For B2B buyers in South America and Europe, selecting shell dress materials with proven adhesion to various substrates and compatibility with automotive-grade adhesives is essential. This ensures longevity and maintains vehicle aesthetics under diverse climatic conditions.

Construction

Within the construction industry, shell dress is applied as a surface treatment to protect building materials such as metal panels, concrete forms, and wooden structures. This application helps improve resistance to weathering, moisture ingress, and microbial attack, thereby lowering long-term maintenance costs. Buyers from markets like Egypt and Argentina should prioritize sourcing shell dress products that comply with environmental regulations and offer ease of application to optimize onsite efficiency.

Electronics

The electronics sector uses shell dress as a protective casing material for devices and components vulnerable to mechanical damage and chemical exposure. It provides electrical insulation and thermal stability, which are critical for device reliability. International buyers must focus on sourcing shell dress formulations that meet stringent industry standards for electronic safety and performance, especially when supplying to technologically advanced markets in Europe and the Middle East.

Marine & Shipping

In marine and shipping industries, shell dress is employed as an anti-corrosion layer on ship hulls, decks, and mechanical parts. This application is vital for minimizing maintenance downtime caused by corrosion and abrasion in saltwater environments. B2B buyers in coastal regions of Africa and South America should ensure that the shell dress products sourced have proven saltwater resistance, comply with environmental regulations, and offer eco-friendly options to align with global sustainability trends.

Related Video: Uses Of Polymers | Organic Chemistry | Chemistry | FuseSchool

Strategic Material Selection Guide for shell dress

When selecting materials for shell dress components in industrial applications, international B2B buyers must carefully evaluate performance criteria, cost implications, and regional compliance requirements. The choice of material directly affects durability, compatibility with process media, and manufacturing complexity, which are critical for markets in Africa, South America, the Middle East, and Europe.

Carbon Steel

Key Properties: Carbon steel, such as ASTM A216 WCB, offers good mechanical strength and moderate temperature resistance, typically up to 425°C. It has limited corrosion resistance and requires protective coatings or linings for aggressive environments.

Pros & Cons: Carbon steel is widely available and cost-effective, making it a popular choice for general-purpose shell dress applications. However, it is prone to rust and corrosion without adequate protection, which can limit its lifespan in humid or chemically aggressive regions.

Impact on Application: Best suited for non-corrosive fluids and moderate temperatures. It is not recommended for highly acidic or saline environments, common in coastal areas of South America and the Middle East, without additional treatment.

International Considerations: Carbon steel complies with global standards such as ASTM, DIN, and JIS, facilitating easier cross-border trade. Buyers in Africa and Argentina often prefer carbon steel due to its affordability and local availability, but must ensure proper corrosion protection measures are in place.

Stainless Steel (e.g., 304, 316 Grades)

Key Properties: Stainless steel grades 304 and 316 provide excellent corrosion resistance, especially 316 which contains molybdenum for enhanced resistance to chlorides and acidic media. They maintain strength and toughness up to around 870°C.

Pros & Cons: Stainless steel offers superior durability and low maintenance costs but comes at a higher price point. Manufacturing complexity is moderate, requiring specialized welding and finishing techniques.

Impact on Application: Ideal for shell dress components exposed to corrosive chemicals, seawater, or high humidity environments. Its resistance to scaling and staining makes it suitable for Middle Eastern and coastal African markets where corrosive conditions prevail.

International Considerations: Stainless steel aligns with ASTM, EN, and JIS standards, ensuring compliance in Europe and other regions. Buyers in Egypt and Europe often specify 316 stainless steel for critical applications due to its reliability and longevity.

Duplex Stainless Steel

Key Properties: Duplex stainless steel combines austenitic and ferritic structures, offering high strength and excellent resistance to stress corrosion cracking and pitting. It performs well in temperatures up to 300°C and aggressive chloride environments.

Pros & Cons: Duplex grades provide a balance of strength and corrosion resistance superior to standard stainless steels but are more expensive and require precise fabrication controls. Welding demands skilled labor and strict quality assurance.

Impact on Application: Particularly suitable for shell dress applications in offshore and chemical processing industries where chloride-induced corrosion is a concern. Its toughness is valuable for regions with fluctuating temperatures and harsh chemical exposure, such as coastal South America and the Middle East.

International Considerations: Duplex stainless steel meets ASTM A240 and EN 1.4462 standards, widely accepted in Europe and increasingly in Africa and South America. Buyers should verify supplier certifications and welding capabilities to ensure compliance.

Alloy Steel (e.g., Chrome-Molybdenum Alloys)

Key Properties: Alloy steels such as chrome-molybdenum (e.g., ASTM A335 P22) offer high strength and excellent resistance to elevated temperatures (up to 600°C) and pressure. They have moderate corrosion resistance but are often used with protective coatings.

Pros & Cons: These alloys are favored for high-temperature, high-pressure shell dress applications due to their mechanical properties. However, they are more costly than carbon steel and require careful heat treatment and fabrication processes.

Impact on Application: Suitable for heavy-duty industrial environments such as power plants and petrochemical facilities. Their temperature and pressure ratings make them ideal for demanding applications common in Europe and industrial hubs in South America.

International Considerations: Alloy steels comply with ASTM, DIN, and JIS standards, facilitating international procurement. Buyers in Egypt and Argentina should consider the availability of local fabrication expertise for heat treatment and welding.

| Material | Typical Use Case for shell dress | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Carbon Steel (e.g., A216 WCB) | General service, non-corrosive fluids for valve bodies | Cost-effective, good strength | Susceptible to corrosion if not protected | Low |

| Stainless Steel (304/316) | Corrosive environments, seawater exposure, chemical processing | Excellent corrosion resistance, durable | Higher cost, requires skilled fabrication | Medium |

| Duplex Stainless Steel | Offshore, chloride-rich environments, high strength applications | Superior corrosion resistance and strength | Expensive, complex welding requirements | High |

| Alloy Steel (Chrome-Molybdenum) | High temperature and pressure applications in petrochemical plants | High strength and temperature resistance | Moderate corrosion resistance, higher fabrication complexity | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for shell dress

Manufacturing Processes for Shell Dress

The production of shell dresses, typically characterized by their unique fabric, structural design, and functional attributes, involves several critical manufacturing stages. Understanding these steps helps B2B buyers from diverse regions such as Africa, South America, the Middle East, and Europe evaluate supplier capabilities and ensure product consistency.

1. Material Preparation

This initial stage focuses on sourcing and preparing raw materials, which may include specialized textiles, linings, and reinforcements that define the shell dress’s durability and aesthetic. Quality fabric selection is crucial—often involving synthetic blends or treated natural fibers for water resistance or breathability. Material inspection occurs here to verify compliance with supplier specifications, ensuring fabrics meet tensile strength, colorfastness, and texture standards before production.

2. Forming and Cutting

Advanced cutting techniques are employed to shape fabric panels accurately. Laser cutting or automated cutting machines are preferred for precision and waste reduction. This stage also includes pattern making, where design templates are translated into cut pieces. For shell dresses, particular attention is given to shaping panels that fit ergonomically and maintain structural integrity.

3. Assembly and Sewing

Assembly involves stitching the cut pieces together using industrial sewing machines. Seam strength and alignment are paramount, especially when incorporating features such as zippers, buttons, or specialized fasteners. Some manufacturers integrate automated sewing technologies for consistency, while others rely on skilled labor for intricate detailing. Reinforcements at stress points and waterproof seam sealing (if applicable) are applied during this phase.

4. Finishing

Finishing processes enhance the shell dress’s functionality and appearance. This can include heat pressing, applying coatings for water repellency, or adding embellishments. Quality checks for appearance defects, dimensional accuracy, and functional features occur here. Packaging is also standardized to protect the product during transit and storage.

Quality Assurance and Control (QA/QC) Framework

For international B2B buyers, robust quality assurance and control protocols are essential to mitigate risks and guarantee product standards that align with global expectations.

International and Industry Standards

– ISO 9001: The cornerstone for quality management systems, ISO 9001 certification ensures that suppliers have a consistent process for quality planning, control, and improvement. Buyers should verify supplier certification as it reflects a commitment to quality standards.

– Industry-Specific Standards: Depending on the shell dress application (e.g., protective clothing), compliance with standards such as CE marking (Europe) or relevant ASTM standards may be necessary. For technical or protective shells, certifications like EN (European Norms) or API (American Petroleum Institute) standards could apply.

Quality Control Checkpoints

– Incoming Quality Control (IQC): Raw materials and components are inspected upon receipt to ensure they meet specified criteria. This includes fabric quality, color consistency, and accessory verification.

– In-Process Quality Control (IPQC): Continuous monitoring during manufacturing to detect defects early. IPQC includes checking seam integrity, dimensional accuracy, and assembly quality. Real-time corrective actions reduce waste and rework.

– Final Quality Control (FQC): Post-production inspection covers visual defects, functional testing (e.g., waterproofing efficacy), and packaging verification. Only batches passing FQC proceed to shipment.

Common Testing Methods

– Physical Tests: Tensile strength, abrasion resistance, and tear strength tests confirm material durability.

– Functional Tests: Water repellency, breathability, and seam sealing tests ensure performance criteria are met.

– Chemical Tests: For treated fabrics, testing for harmful substances (e.g., REACH compliance in Europe) is critical.

– Dimensional and Visual Inspections: Measurements and defect detection via manual or automated systems.

Verifying Supplier Quality for International Buyers

For buyers in regions such as Argentina, Egypt, and other parts of Africa, South America, the Middle East, and Europe, due diligence in supplier quality verification is vital.

Audits and Factory Visits

– Conducting on-site audits or virtual inspections helps assess manufacturing capabilities, worker skill levels, and quality system adherence.

– Audits should include reviewing documentation for ISO certifications, process flows, and QC records.

Quality Reports and Documentation

– Request detailed inspection reports, including IQC, IPQC, and FQC data.

– Certificates of compliance and test reports from accredited labs provide assurance of product conformity.

Third-Party Inspections

– Engaging independent inspection agencies (e.g., SGS, Bureau Veritas) adds an unbiased verification layer. Third-party inspections can cover pre-shipment checks, random sampling, and laboratory testing.

– These inspections are particularly valuable for international buyers unfamiliar with local suppliers or when dealing with high-volume or high-value orders.

QC and Certification Nuances for International B2B Buyers

Regional Regulatory Compliance

– Buyers must ensure the shell dress complies with local regulations in their market. For instance, CE marking is mandatory for products sold in the European Economic Area, while other regions might have specific import or safety standards.

– Awareness of import restrictions, labeling requirements, and environmental regulations (such as chemical restrictions) in Africa, South America, and the Middle East is essential.

Cultural and Operational Considerations

– Suppliers in diverse geographic areas may have varying interpretations of quality standards. Clear contractual specifications and quality agreements reduce misunderstandings.

– Time zone differences and language barriers can impact communication; leveraging digital platforms for documentation and real-time updates enhances transparency.

Sustainability and Ethical Sourcing

– Increasingly, buyers prioritize suppliers who demonstrate sustainable manufacturing practices and ethical labor standards, aligning with global ESG (Environmental, Social, Governance) criteria.

– Certifications such as OEKO-TEX or bluesign® for textiles indicate reduced environmental impact and safer chemical use.

Actionable Insights for B2B Buyers

- Define clear quality specifications and contractual obligations upfront to align expectations with suppliers.

- Leverage digital tools and platforms for supplier registration, document exchange, and real-time quality monitoring, following Shell’s example of integrating SAP Ariba and Supplier Sphere.

- Invest in third-party inspections and audits especially when sourcing from new or remote suppliers to mitigate risks.

- Ensure suppliers maintain internationally recognized certifications (ISO 9001, CE, etc.) and provide up-to-date documentation.

- Consider regional compliance and logistical factors when selecting suppliers to avoid delays and ensure smooth customs clearance.

- Foster long-term supplier relationships with continuous quality improvement programs and collaborative problem-solving.

By thoroughly understanding the manufacturing and quality assurance processes for shell dresses, international B2B buyers can make informed sourcing decisions that optimize product quality, compliance, and supply chain resilience.

Related Video: Garments Full Production Process | Order receive to Ex-Factory | Episode 2

Comprehensive Cost and Pricing Analysis for shell dress Sourcing

Detailed Breakdown of Cost Components in Shell Dress Sourcing

When sourcing shell dresses, understanding the cost structure is critical for effective negotiation and cost management. The key cost components include:

- Materials: The primary raw materials, such as high-quality shells, fabrics, threads, and embellishments, significantly influence the base cost. Sourcing sustainable or certified materials may increase upfront costs but enhance product appeal in eco-conscious markets.

- Labor: Skilled craftsmanship is essential, especially for intricate shell dress designs. Labor costs vary widely by region, with emerging markets offering competitive rates but potentially longer lead times.

- Manufacturing Overhead: This includes factory utilities, equipment depreciation, and administrative expenses associated with production. Overhead costs fluctuate depending on the factory’s scale, automation level, and location.

- Tooling and Setup: Initial tooling, such as molds for shell components or specialized sewing equipment, involves fixed costs that amortize over production volumes. Custom tooling can raise upfront investment but reduce unit costs in large runs.

- Quality Control (QC): Rigorous QC processes ensure compliance with buyer specifications and certifications, adding to labor and testing expenses. High QC standards are vital for maintaining brand reputation and meeting import regulations.

- Logistics and Freight: Shipping costs encompass inland transportation, customs duties, insurance, and international freight charges. These costs are subject to global fuel price volatility and geopolitical factors.

- Supplier Margin: Suppliers incorporate a profit margin reflecting their risk, operational costs, and market positioning. This margin can be negotiated, especially with volume commitments or long-term contracts.

Primary Price Influencers in Shell Dress Procurement

Several factors drive price variations in shell dress sourcing:

- Order Volume and Minimum Order Quantity (MOQ): Larger orders typically yield better unit pricing due to economies of scale. Buyers from regions like Africa and South America should assess their demand forecasts carefully to leverage volume discounts without overstocking.

- Specifications and Customization: Unique designs, intricate shell arrangements, or bespoke sizing increase production complexity and cost. Buyers targeting premium markets in Europe or the Middle East might prioritize customization despite higher prices.

- Material Quality and Certifications: Certified sustainable or ethically sourced materials command premium pricing but align with global sustainability trends and buyer expectations.

- Quality Standards and Certifications: Compliance with international standards (e.g., ISO, OEKO-TEX) and import regulations affects QC costs and supplier selection.

- Supplier Capabilities and Location: Suppliers with advanced digital procurement platforms and streamlined supply chains, like those integrated with SAP Ariba or Shell Supplier Sphere, offer operational efficiencies but may charge premiums.

- Incoterms and Payment Terms: Shipping terms (e.g., FOB, CIF, DDP) determine which party bears logistics risks and costs. Negotiating favorable Incoterms can reduce total landed cost, especially for buyers unfamiliar with complex import procedures.

Strategic Tips for International B2B Buyers

- Leverage Digital Procurement Tools: Engage suppliers using platforms that offer transparency on pricing, lead times, and compliance. This is especially valuable for buyers in Egypt or Argentina, where supply chain visibility can mitigate risks.

- Negotiate Based on Total Cost of Ownership (TCO): Beyond unit price, consider after-sales service, return policies, and logistics reliability. Sometimes paying a premium upfront reduces long-term costs and risks.

- Optimize Order Size and Frequency: Balance MOQ requirements with inventory carrying costs and market demand volatility. Smaller, frequent orders may reduce capital lock-up but increase per-unit costs.

- Prioritize Sustainable and Certified Suppliers: Align sourcing with environmental and social governance (ESG) goals to enhance brand reputation and meet evolving regulatory demands across Europe and the Middle East.

- Understand Pricing Nuances in Your Region: Import duties, taxes, and customs clearance fees vary significantly. Engaging local logistics experts or customs brokers can uncover hidden costs and streamline delivery.

- Build Long-Term Supplier Relationships: Establishing trust and collaboration can secure better pricing, priority production slots, and flexibility during supply chain disruptions.

Important Pricing Disclaimer

All cost and pricing information provided here is indicative and subject to change based on market conditions, supplier negotiations, currency fluctuations, and specific order details. Buyers should conduct thorough due diligence and request formal quotations tailored to their unique requirements before finalizing sourcing decisions.

Spotlight on Potential shell dress Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘shell dress’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for shell dress

Critical Technical Properties of Shell Dress

When sourcing shell dress materials or finished products, understanding key technical specifications is essential for ensuring product quality, compatibility, and supplier alignment. Here are the most critical properties buyers should evaluate:

-

Material Grade

Shell dress fabric is often categorized by its fiber content and quality grade, such as 100% cotton, cotton blends, or synthetic fibers. The grade affects durability, comfort, and price. For B2B buyers, specifying the correct material grade ensures the end product meets performance and customer expectations. -

Thread Count and Weave

Thread count refers to the number of threads per square inch, impacting fabric density and texture. The weave type (e.g., plain, twill) influences strength and drape. Higher thread counts and specific weaves typically signal premium quality, affecting the garment’s feel and longevity. -

Tolerance Levels

This defines acceptable variations in measurements such as fabric weight, width, and garment dimensions during production. Clear tolerance specifications minimize disputes and returns, ensuring consistency across bulk orders, which is crucial for international buyers managing large shipments. -

Color Fastness

The resistance of the shell dress fabric to fading or bleeding when exposed to washing, light, or perspiration. Specifying color fastness ratings helps maintain product appearance and brand reputation, especially important in markets with warm climates like Africa and the Middle East. -

Finish and Treatment

Treatments such as anti-wrinkle, water repellency, or flame retardancy may be applied depending on end-use requirements. Buyers should clarify if such finishes are needed to meet local regulations or consumer preferences. -

Certification and Compliance

Certifications like OEKO-TEX Standard 100 or ISO quality management demonstrate adherence to safety and environmental standards. For buyers in Europe and South America, such certifications can be mandatory or provide competitive differentiation.

Common Trade and Industry Terms for Shell Dress Procurement

Navigating international shell dress procurement requires familiarity with essential trade terminology to facilitate smooth transactions and supplier communications:

-

OEM (Original Equipment Manufacturer)

Refers to suppliers who produce shell dresses or fabrics that are branded and sold by another company. OEM partnerships allow buyers to customize designs while leveraging supplier manufacturing capabilities. -

MOQ (Minimum Order Quantity)

The smallest quantity a supplier is willing to sell. Understanding MOQ helps buyers plan inventory and negotiate pricing, especially for emerging markets or smaller businesses. -

RFQ (Request for Quotation)

A formal inquiry sent to suppliers asking for price, lead time, and terms for shell dress orders. Well-prepared RFQs lead to more accurate and comparable supplier offers, streamlining the sourcing process. -

Incoterms (International Commercial Terms)

Standardized trade terms that define responsibilities for shipping, insurance, and tariffs between buyers and sellers. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, Freight). Knowing Incoterms reduces misunderstandings and clarifies cost allocation. -

Lead Time

The total time from order placement to product delivery. Accurate lead time estimates are critical for supply chain planning and meeting market demand cycles. -

Batch Consistency

The uniformity of product quality and specifications across production batches. Ensuring batch consistency is vital for brand reliability and customer satisfaction, particularly in large-scale orders.

For international B2B buyers, especially in diverse regions like Africa, South America, the Middle East, and Europe, mastering these technical properties and trade terms will empower more informed negotiations, reduce risks, and foster successful sourcing relationships in the shell dress market.

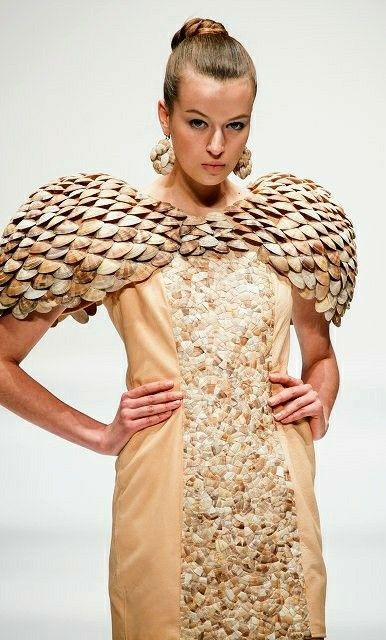

Illustrative Image (Source: Google Search)

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the shell dress Sector

Market Overview & Key Trends

The global market for shell dresses is witnessing dynamic growth, driven by increasing demand for versatile, stylish, and functional apparel across diverse regions such as Africa, South America, the Middle East, and Europe. International B2B buyers from countries like Egypt and Argentina are capitalizing on rising consumer interest in fashion that combines aesthetic appeal with practicality. Key market drivers include urbanization, growing middle-class populations, and digital commerce expansion, which facilitate access to broader consumer bases.

From a sourcing perspective, the shell dress sector is increasingly influenced by technological advancements and integrated digital platforms. Buyers benefit from enhanced transparency and efficiency through the adoption of e-sourcing tools such as SAP Ariba, which streamline supplier qualification, contract management, and procurement workflows. This digital transformation supports cross-border collaborations, enabling buyers in emerging markets to connect with vetted global manufacturers while mitigating risks related to supply chain disruptions.

Moreover, regional market dynamics highlight the importance of localized sourcing strategies that consider geopolitical factors, tariffs, and logistical infrastructure. For instance, African and Middle Eastern buyers often prioritize suppliers with flexible delivery capabilities and regional distribution hubs to overcome infrastructural challenges. In Europe, sustainability and innovation lead the trend, with buyers seeking suppliers capable of integrating eco-friendly materials and circular economy practices into production.

Emerging trends shaping the sector include the integration of AI-driven demand forecasting and supplier performance analytics, which empower B2B buyers to optimize inventory and reduce lead times. Additionally, the rise of omni-channel retailing drives demand for shell dresses that cater to diverse consumer touchpoints, from physical stores to online marketplaces. For international buyers, understanding these evolving trends is crucial for strategic sourcing and maintaining competitive advantage.

Sustainability & Ethical Sourcing in B2B

Sustainability has become a cornerstone in the shell dress supply chain, reflecting a broader shift toward environmentally responsible and ethically managed procurement practices. For international B2B buyers, especially in regions increasingly sensitive to ecological impacts such as Europe and parts of South America, integrating sustainability criteria into sourcing decisions is essential to meet regulatory demands and consumer expectations.

Environmental impact considerations in shell dress production focus on reducing carbon footprints, minimizing water usage, and decreasing waste through circularity initiatives. Suppliers adopting sustainable materials such as organic cotton, recycled polyester, and biodegradable fabrics contribute significantly to lowering environmental harm. Certifications like Global Organic Textile Standard (GOTS), OEKO-TEX Standard 100, and Bluesign serve as credible benchmarks for verifying the eco-friendliness of materials and processes.

Ethical sourcing also encompasses fair labor practices, transparency in supply chains, and compliance with international human rights standards. Buyers from Africa and the Middle East are increasingly scrutinizing suppliers for adherence to these principles to mitigate reputational risks and foster long-term partnerships. Leveraging digital tools that track supplier compliance and performance in real-time enhances accountability and supports continuous improvement.

Illustrative Image (Source: Google Search)

Investing in suppliers with robust sustainability credentials not only aligns with global net-zero emission targets but also opens opportunities for premium pricing and brand differentiation. Additionally, circular economy models — emphasizing product lifecycle extension through reuse, recycling, and remanufacturing — are gaining traction, allowing buyers to reduce waste and increase resource efficiency across the shell dress sector.

Evolution and History of the Shell Dress in B2B Context

The shell dress, originally inspired by natural motifs and simple, elegant silhouettes, has evolved from a niche garment into a mainstream fashion staple with significant B2B relevance. Historically, its design roots trace back to classic minimalism, emphasizing clean lines and adaptability, which appeals to a wide demographic.

In recent decades, the shell dress has transitioned into a versatile product category embraced by global fashion manufacturers and retailers for its scalability and adaptability to various markets. The evolution has been marked by innovations in fabric technology, sustainable material incorporation, and modular design elements that cater to changing consumer preferences.

For B2B buyers, understanding this evolution is key to sourcing shell dresses that balance tradition with innovation. This knowledge supports strategic decisions around supplier selection, product development, and market positioning, particularly in regions where cultural nuances and fashion trends intersect with sustainability and technological advancement.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of shell dress

-

How can I verify the credibility and reliability of shell dress suppliers in international markets?

When sourcing shell dresses internationally, especially from regions like Africa, South America, the Middle East, or Europe, it’s essential to conduct thorough supplier vetting. Start by requesting business licenses, certifications, and references from previous clients. Utilize global trade platforms and supplier databases that offer verified supplier status. Additionally, consider suppliers’ compliance with international quality and ethical standards, such as ISO certifications or adherence to sustainability practices. Engaging with suppliers through digital procurement tools and requesting product samples before committing to large orders can further mitigate risk. -

Is it possible to customize shell dresses according to specific design or material requirements?

Yes, many manufacturers and suppliers of shell dresses offer customization options to meet your market demands. Customization can include fabric selection, color, size range, and additional embellishments or packaging. When negotiating, clarify minimum order quantities (MOQs) for customized products, as these often differ from standard offerings. Request detailed product specifications and ensure clear communication about design expectations to avoid misunderstandings. Working with suppliers who use digital platforms can facilitate real-time collaboration on design and production adjustments. -

What are typical minimum order quantities (MOQs), lead times, and payment terms for international shell dress purchases?

MOQs for shell dresses vary widely depending on the supplier and customization level but typically range from 100 to 500 units per style or design. Lead times depend on production complexity and logistics but often fall between 30 to 90 days. Payment terms usually involve a deposit upfront (commonly 30-50%) with the balance due before shipment or upon delivery. For buyers in regions like Egypt or Argentina, it’s advisable to negotiate terms that consider currency fluctuations and local banking constraints. Using digital payment platforms can enhance security and transparency. -

What quality assurance measures and certifications should I expect from reputable shell dress suppliers?

Reputable suppliers implement stringent quality control processes, including raw material inspection, in-process checks, and final product audits. Certifications such as ISO 9001 (quality management), OEKO-TEX Standard 100 (textile safety), and compliance with local or international labor standards add credibility. Request detailed quality assurance reports and consider third-party inspections or audits if necessary. Especially for B2B buyers targeting eco-conscious markets, verifying sustainable sourcing certifications or compliance with circular economy principles can be a significant differentiator. -

How can I optimize logistics and shipping when importing shell dresses internationally?

Effective logistics management starts with choosing suppliers that provide clear lead times and reliable shipping options. Opt for suppliers familiar with international freight forwarding and customs clearance processes, reducing the risk of delays. Consolidating shipments and selecting suitable incoterms (e.g., FOB, CIF) tailored to your regional import regulations helps control costs. For buyers in Africa or South America, partnering with freight forwarders experienced in your region ensures smoother transit. Additionally, tracking systems and digital documentation streamline customs compliance and inventory planning. -

What steps should I take to resolve disputes or quality issues with shell dress suppliers?

Establish clear contractual terms upfront covering product specifications, delivery schedules, payment conditions, and dispute resolution mechanisms. In case of disputes, communicate promptly and document all correspondence. Use digital procurement platforms where possible to maintain transparent records. If quality issues arise, request corrective action plans or replacements per the contract terms. For international disputes, consider mediation or arbitration clauses to avoid costly litigation. Building strong relationships with suppliers through regular communication can preempt many issues before escalation. -

Are there specific considerations for sourcing shell dresses from emerging markets like Egypt or Argentina?

Emerging markets often offer competitive pricing and unique design influences but may present challenges such as variable production capacity or regulatory complexities. Familiarize yourself with local trade regulations, import/export restrictions, and currency exchange policies. Establish relationships with local agents or trade offices to navigate regional business customs and logistics. Assess suppliers’ technological capabilities, as digital readiness can impact communication efficiency and order tracking. Additionally, consider the sustainability and ethical standards prevalent in these markets to align with global buyer expectations. -

How can digital tools and platforms enhance the shell dress procurement process for international B2B buyers?

Digital procurement platforms like SAP Ariba or specialized supplier relationship management tools enable seamless supplier onboarding, real-time collaboration, and transparent sourcing events. They facilitate electronic document exchange, contract management, and compliance tracking, reducing administrative overhead. For B2B buyers across continents, these tools help overcome time zone challenges by providing 24/7 access to supplier information and status updates. Incorporating AI-driven analytics can optimize supplier selection and risk management, ensuring more informed decision-making and stronger supply chain resilience.

Strategic Sourcing Conclusion and Outlook for shell dress

Strategic sourcing of shell dress products offers international B2B buyers a distinct competitive edge by optimizing supplier selection, enhancing cost efficiency, and ensuring supply chain resilience. Leveraging digital tools and platforms—such as supplier management systems and global procurement networks—enables buyers from Africa, South America, the Middle East, and Europe to access reliable quality and sustainable sourcing options. Prioritizing suppliers who align with environmental and social governance (ESG) standards not only mitigates risks but also strengthens brand reputation in increasingly conscious markets.

Key takeaways for buyers include:

- Embrace digital procurement platforms for streamlined supplier collaboration and transparency.

- Focus on sustainability and circular economy principles to future-proof sourcing strategies.

- Utilize global networks and regional hubs to mitigate supply disruptions and optimize logistics.

- Engage proactively with suppliers to foster innovation and responsiveness to market changes.

Looking ahead, the shell dress market is poised for growth driven by technological advances and heightened sustainability demands. Buyers who adopt strategic sourcing frameworks, supported by digital transformation and ethical procurement, will unlock new value and ensure long-term success. International B2B buyers are encouraged to explore integrated sourcing solutions and deepen partnerships with forward-thinking suppliers to capitalize on emerging opportunities in this dynamic sector.

Illustrative Image (Source: Google Search)