Your Ultimate Guide to Sourcing Satin Wedding Guest Dress

Guide to Satin Wedding Guest Dress

- Introduction: Navigating the Global Market for satin wedding guest dress

- Understanding satin wedding guest dress Types and Variations

- Key Industrial Applications of satin wedding guest dress

- Strategic Material Selection Guide for satin wedding guest dress

- In-depth Look: Manufacturing Processes and Quality Assurance for satin wedding guest dress

- Comprehensive Cost and Pricing Analysis for satin wedding guest dress Sourcing

- Spotlight on Potential satin wedding guest dress Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for satin wedding guest dress

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the satin wedding guest dress Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of satin wedding guest dress

- Strategic Sourcing Conclusion and Outlook for satin wedding guest dress

Introduction: Navigating the Global Market for satin wedding guest dress

The global market for satin wedding guest dresses presents a dynamic opportunity for B2B buyers seeking to tap into a fabric that epitomizes elegance and versatility. Satin’s distinctive lustrous finish and smooth texture have made it a preferred choice for wedding attire across diverse cultural landscapes, from the vibrant celebrations in Africa and South America to the sophisticated events in the Middle East and Europe. For international buyers, understanding the nuances of satin fabric types, dress styles, and manufacturing standards is essential to sourcing products that meet both aesthetic and quality expectations.

This guide offers a comprehensive roadmap covering the entire spectrum of satin wedding guest dresses, including an in-depth look at popular styles such as slip dresses, cowl necks, wrap designs, and one-shoulder gowns. It delves into critical material considerations, highlighting fabric blends and finishes that enhance durability and comfort. Additionally, the guide outlines best practices in manufacturing and quality control processes, ensuring buyers can identify reliable suppliers capable of delivering consistent excellence.

Key market insights tailored for regions like Thailand, Egypt, and broader markets across Africa, South America, and Europe provide valuable context on pricing trends, supply chain logistics, and consumer preferences. With a dedicated FAQ section addressing common sourcing challenges, this resource empowers international B2B buyers to make informed decisions, optimize procurement strategies, and ultimately secure satin wedding guest dresses that resonate with their target clientele.

By leveraging this expert knowledge, buyers can confidently navigate the complexities of the global satin dress market, capitalize on emerging trends, and build sustainable partnerships with manufacturers and suppliers worldwide.

Understanding satin wedding guest dress Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Classic Satin Slip Dress | Sleek, minimalist silhouette with smooth drape | Versatile for day and evening weddings | + Timeless appeal, broad market; – May require quality satin for luxury feel |

| Satin Wrap Dress | Adjustable waist wrap design with flowing fabric | Suitable for garden and semi-formal events | + Flexible sizing, flattering fit; – Complexity in pattern making |

| One-Shoulder Satin Gown | Asymmetrical neckline with dramatic silhouette | High-end formal and black-tie wedding markets | + Statement piece, premium appeal; – Higher production cost |

| Satin Cowl Neck Dress | Draped neckline with figure-skimming cut | Evening weddings and formal gatherings | + Elegant drape, comfort; – Limited appeal in conservative markets |

| High-Low Satin Dress | Hemline shorter at front, longer at back | Transitional day-to-evening events | + Fashion-forward, versatile styling; – Niche demand, sizing challenges |

Classic Satin Slip Dress

The classic satin slip dress is characterized by its minimalist, sleek design that emphasizes the natural drape and sheen of satin fabric. This style is highly versatile, fitting both daytime and evening wedding occasions, making it a staple for diverse markets. B2B buyers should prioritize sourcing high-quality satin to ensure the dress maintains its luxurious appeal. Its simple silhouette allows for easier mass production and customization, appealing across various regions including Africa and Europe where understated elegance is favored.

Satin Wrap Dress

Satin wrap dresses feature an adjustable waist tie, offering a flattering fit for a wide range of body types. This style is particularly popular for garden weddings and semi-formal events, making it attractive to buyers targeting outdoor and destination wedding markets in South America and the Middle East. From a B2B perspective, the wrap design requires precise pattern engineering and quality satin that holds structure without compromising fluidity. Its adjustable nature also reduces return rates due to fit issues.

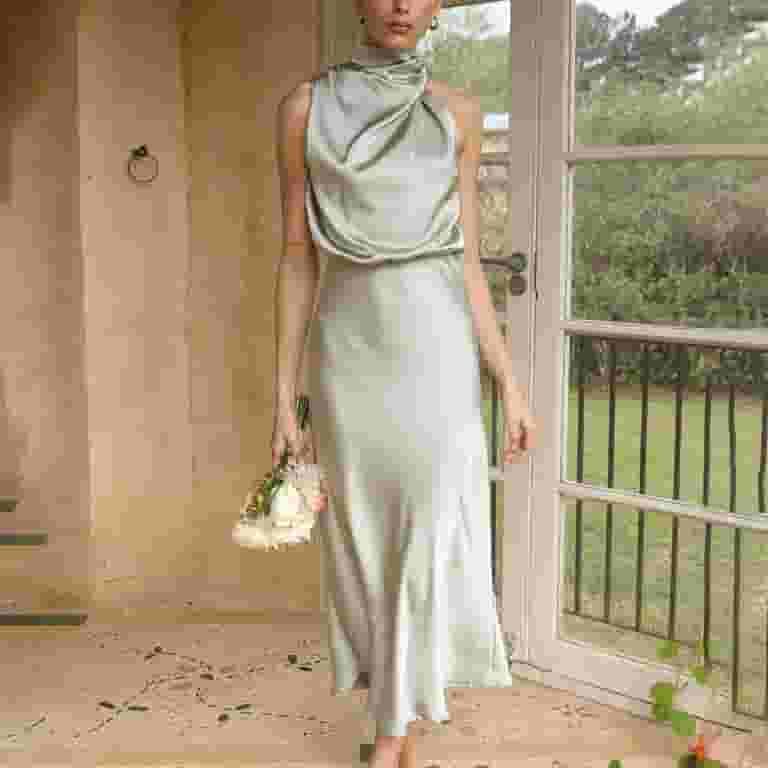

Illustrative Image (Source: Google Search)

One-Shoulder Satin Gown

The one-shoulder satin gown stands out with its asymmetrical neckline and regal silhouette, targeting upscale, black-tie wedding markets. This style appeals strongly in regions with a preference for bold, statement evening wear, such as the Middle East and Europe. For B2B buyers, the complexity of the design often translates to higher production costs and requires skilled craftsmanship. However, the premium positioning allows for higher price points and exclusivity in boutique collections.

Satin Cowl Neck Dress

Featuring a softly draped neckline and a figure-skimming cut, the satin cowl neck dress offers a balance of comfort and sensuality ideal for formal evening weddings. This style resonates well in markets valuing elegance with modest allure, such as certain African and European buyer segments. B2B buyers should consider fabric weight and sheen to optimize the drape effect. While it has broad appeal, conservative markets may require design adaptations to meet modesty preferences.

High-Low Satin Dress

The high-low satin dress combines a playful front hem with a dramatic trailing back, making it a versatile choice for weddings that transition from day to evening. This style suits buyers focused on fashion-forward consumers in urban and destination wedding markets, including South America and Europe. Production involves careful attention to hem finishing and satin fabric weight to maintain shape. Though niche, it can diversify product offerings and attract younger demographics seeking statement pieces.

Related Video: How to Sew a Cowl Dress + PATTERN // Perfect DIY for Prom, Homecoming & Wedding Guest Dresses!

Key Industrial Applications of satin wedding guest dress

| Industry/Sector | Specific Application of satin wedding guest dress | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Fashion Retail & Boutiques | Stocking diverse satin wedding guest dress collections | Attracts upscale clientele seeking elegant, versatile options | Fabric quality, variety in styles, regional sizing preferences |

| Event & Wedding Planning | Providing attire rental or styling services for wedding guests | Enhances client service portfolio with premium dress options | Durability of fabric, ease of maintenance, style adaptability |

| Hospitality & Luxury Hotels | Offering curated wedding guest dress packages for guests | Differentiates venue with all-inclusive wedding experiences | Dress inventory management, cultural style preferences, climate suitability |

| Textile & Apparel Manufacturing | Producing satin wedding guest dresses for export markets | Expands product range into high-demand niche | Compliance with international textile standards, sustainable sourcing |

| Online Fashion Marketplaces | Curating and selling satin wedding guest dresses globally | Access to wide international customer base, increased sales | Efficient logistics, clear product descriptions, multilingual support |

The Fashion Retail & Boutiques sector benefits from incorporating satin wedding guest dresses into their product lines by meeting the demand for luxurious, elegant attire suitable for diverse wedding settings. Buyers from regions such as Africa and South America look for fabric quality that balances sheen and comfort, alongside styles that cater to local fashion sensibilities. For B2B buyers, ensuring a broad range of silhouettes—from classic slip dresses to modern one-shoulder gowns—can significantly boost market appeal.

In Event & Wedding Planning, offering satin wedding guest dresses as part of rental or styling services elevates the client experience. This application addresses the common challenge of guests seeking stylish yet appropriate attire for various wedding formats, from black-tie events to garden ceremonies. Buyers in the Middle East and Europe prioritize dresses that maintain their luxurious look after multiple uses and easy upkeep, making fabric durability and stain resistance critical sourcing factors.

The Hospitality & Luxury Hotels industry increasingly includes curated dress packages for wedding guests as part of premium wedding experiences. This service adds value by simplifying the guest’s preparation process and reinforcing the venue’s reputation for exclusivity. For international buyers, especially in countries like Thailand and Egypt, sourcing dresses that accommodate local climate conditions and cultural modesty norms is essential to ensure guest satisfaction and operational efficiency.

Within Textile & Apparel Manufacturing, producing satin wedding guest dresses for export markets allows manufacturers to tap into a high-demand niche with global appeal. The challenge lies in meeting stringent international quality and sustainability standards while delivering elegant, trend-aligned designs. B2B buyers should prioritize manufacturers with certifications for eco-friendly production and the ability to customize styles for different regional markets, ensuring competitive advantage and compliance.

Finally, Online Fashion Marketplaces leverage the global demand for satin wedding guest dresses by curating diverse collections that cater to international customers. This application requires efficient supply chain management and precise product information to build trust and reduce returns. Buyers targeting cross-continental regions must emphasize multilingual support, accurate sizing charts, and reliable shipping solutions to capture and retain a broad clientele, particularly from emerging markets in Africa and South America.

Related Video: WEDDING GUEST OUTFIT DOS AND DON’TS | WHAT TO WEAR VS. WHAT TO AVOID

Strategic Material Selection Guide for satin wedding guest dress

When selecting materials for satin wedding guest dresses, international B2B buyers must consider fabric properties that influence comfort, aesthetics, production complexity, and market preferences. Below is an analysis of four common satin materials used in this segment, focusing on their technical and commercial aspects relevant to buyers from regions including Africa, South America, the Middle East, and Europe.

1. Polyester Satin

Key Properties:

Polyester satin is a synthetic fabric known for its smooth, glossy surface and durability. It has good resistance to wrinkles, shrinking, and stretching. Polyester satin typically withstands moderate heat during manufacturing but can melt under excessive temperatures. It is resistant to most chemicals and moisture, making it suitable for humid climates.

Pros & Cons:

Pros include affordability, colorfastness, and ease of maintenance. It is highly durable and less prone to damage during shipping and handling. However, polyester satin lacks the natural breathability of silk and may feel less luxurious, which can affect premium market positioning.

Impact on Application:

Ideal for mass production of satin wedding guest dresses targeting budget-conscious markets or regions with high humidity, such as parts of South America and the Middle East. Polyester satin’s resilience suits climates where moisture and heat are concerns.

Considerations for International Buyers:

Buyers should verify compliance with international textile standards such as OEKO-TEX and ASTM for chemical safety. In regions like Egypt and Thailand, polyester satin is widely accepted due to cost-effectiveness and ease of care. However, European buyers might demand higher-end finishes or blends to meet luxury market expectations.

2. Silk Satin

Key Properties:

Silk satin is a natural fiber with exceptional softness, sheen, and breathability. It performs well in moderate temperatures but requires delicate handling during manufacturing due to its sensitivity to abrasion and chemicals. Silk satin is biodegradable and hypoallergenic.

Pros & Cons:

The key advantage is its luxurious feel and natural elegance, highly valued in upscale markets. Its drawbacks include higher cost, lower durability compared to synthetics, and complex care requirements. Silk satin is prone to water spots and can degrade under prolonged exposure to sunlight.

Impact on Application:

Best suited for premium wedding guest dresses where exclusivity and comfort are paramount. It appeals strongly to European and Middle Eastern markets that prioritize natural fibers and craftsmanship.

Considerations for International Buyers:

Buyers should ensure silk sourcing complies with sustainability certifications (e.g., Sericulture standards) and international trade regulations. In African and South American markets, silk satin may be positioned as a luxury niche product due to cost and care demands.

3. Acetate Satin

Key Properties:

Acetate satin is a semi-synthetic fabric derived from cellulose. It offers a high luster similar to silk but is less durable and more sensitive to heat and moisture. Acetate has moderate breathability and a smooth hand feel.

Pros & Cons:

Acetate satin is valued for its silk-like appearance at a lower price point. However, it tends to wrinkle easily, has poor abrasion resistance, and can degrade with improper laundering. Its manufacturing process is more environmentally taxing compared to polyester.

Impact on Application:

Suitable for mid-range satin wedding guest dresses where visual appeal is important but budgets are moderate. It works well in controlled environments but may not be ideal for humid or very hot climates prevalent in parts of Africa and South America.

Considerations for International Buyers:

Buyers should evaluate environmental regulations and import restrictions, especially in European markets with strict sustainability policies. Acetate satin requires careful quality control to ensure consistent finish and durability.

4. Nylon Satin

Key Properties:

Nylon satin is a synthetic fabric known for high tensile strength, elasticity, and excellent abrasion resistance. It has a smooth surface with moderate sheen and good moisture-wicking properties.

Pros & Cons:

Advantages include strong durability, resistance to mildew and chemicals, and relatively low cost. However, nylon satin can generate static electricity and may feel less breathable compared to natural fibers. It also tends to have a slightly less luxurious drape.

Impact on Application:

Nylon satin is practical for wedding guest dresses designed for active wearers or outdoor events, common in diverse climates such as those in the Middle East and parts of South America. Its durability supports longer garment life cycles.

Considerations for International Buyers:

Buyers should confirm compliance with international standards like ISO and ASTM for textile performance. In markets like Thailand and Egypt, nylon satin may be favored for its balance of cost and durability, though premium segments may prefer silk blends.

Summary Table

| Material | Typical Use Case for satin wedding guest dress | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polyester Satin | Affordable, durable dresses for humid or high-use settings | Cost-effective, wrinkle-resistant | Less breathable, lower luxury perception | Low |

| Silk Satin | Luxury, high-end dresses for premium markets | Natural sheen, breathable, elegant | Expensive, delicate, requires special care | High |

| Acetate Satin | Mid-range dresses emphasizing silk-like appearance | Silk-like luster at moderate price | Prone to wrinkling, less durable | Medium |

| Nylon Satin | Durable dresses for active or outdoor wedding guests | High durability, moisture-wicking | Static buildup, less natural feel | Medium |

This guide assists B2B buyers in making informed material choices aligned with their target markets’ expectations, production capabilities, and regional compliance standards. Selecting the right satin fabric ensures the final wedding guest dress product meets quality, aesthetic, and cost objectives across diverse international markets.

In-depth Look: Manufacturing Processes and Quality Assurance for satin wedding guest dress

Overview of Manufacturing Processes for Satin Wedding Guest Dresses

The production of satin wedding guest dresses involves a meticulous sequence of manufacturing stages designed to ensure luxurious finish, durability, and aesthetic appeal. For B2B buyers sourcing from diverse regions such as Africa, South America, the Middle East, and Europe, understanding these stages enables informed supplier evaluation and quality control alignment.

1. Material Preparation

- Fabric Selection: Satin, typically woven from silk, polyester, or acetate, is selected based on quality parameters like thread count, sheen, weight, and drape. Premium suppliers often provide fabric certifications confirming fiber content and performance attributes.

- Inspection & Cutting: Incoming satin rolls undergo Incoming Quality Control (IQC) to detect defects such as snags, color inconsistencies, or weaving faults. Automated cutting machines or skilled cutters then segment the fabric per pattern templates, optimizing fabric utilization and minimizing waste.

2. Forming and Shaping

- Pattern Making & Draping: Using CAD software or manual techniques, patterns are created to accommodate various dress styles (e.g., slip, A-line, cowl neck). Draping on mannequins ensures the satin’s natural flow and fit.

- Sewing & Stitching: High-precision sewing machines with fine needles are employed to stitch delicate satin fabric, often using reinforced seams to prevent fraying. Special techniques such as French seams or double stitching enhance durability while maintaining the garment’s luxurious appearance.

3. Assembly

- Component Integration: This stage involves attaching elements like linings, zippers, hooks, and embellishments (e.g., beads, lace trims). Coordination between stitching and embellishment teams is critical to maintain consistency and prevent fabric damage.

- Quality Control During Production (In-Process Quality Control, IPQC): Continuous monitoring ensures correct seam alignment, color matching, and adherence to design specifications. Defects found here are rectified immediately to reduce waste and rework costs.

4. Finishing

- Pressing & Steaming: Finished dresses are carefully pressed or steamed to eliminate wrinkles and enhance satin’s natural sheen. This step requires experienced operators to avoid fabric scorching or distortion.

- Final Inspection (Final Quality Control, FQC): Garments undergo a comprehensive inspection checking for stitching quality, fabric defects, measurements accuracy, and overall appearance. Packaging is also reviewed to ensure protection during transit.

Quality Assurance and International Standards

For international B2B buyers, especially those from Africa, South America, the Middle East, and Europe, robust quality assurance frameworks aligned with global standards are paramount to mitigate risks associated with fabric defects, manufacturing inconsistencies, or compliance issues.

Relevant International and Industry Standards

- ISO 9001: The cornerstone for quality management systems, ISO 9001 certification by suppliers indicates systematic process control, consistent product quality, and continuous improvement.

- OEKO-TEX Standard 100: Especially relevant for textile products, this certification ensures the satin fabric is free from harmful substances, which is critical for markets with strict chemical safety regulations.

- REACH Compliance (Europe): Ensures the garment’s chemical safety, important for European buyers.

- Country-Specific Certifications: Buyers from regions like the Middle East or South America should verify compliance with local import regulations and textile standards, which may include halal certifications or environmental standards.

Critical Quality Control Checkpoints

- Incoming Quality Control (IQC): Inspection of raw materials (satin fabric, trims) for defects, colorfastness, and tensile strength before production.

- In-Process Quality Control (IPQC): Ongoing checks during cutting, stitching, and assembly to detect and correct defects early.

- Final Quality Control (FQC): Comprehensive final inspection assessing dimensional accuracy, seam strength, color consistency, and overall garment finish.

Common Testing Methods for Satin Wedding Guest Dresses

- Colorfastness Testing: Ensures the satin fabric maintains color when exposed to washing, light, perspiration, and rubbing.

- Tensile and Tear Strength Tests: Verify fabric durability under stress, essential for garments subject to movement during events.

- Dimensional Stability: Checks fabric shrinkage post-washing or steaming to ensure size consistency.

- Seam Strength Testing: Confirms the integrity of stitched seams under strain.

- Visual and Tactile Inspection: Assesses sheen, texture, and absence of defects such as pulls, snags, or pilling.

How B2B Buyers Can Verify Supplier Quality Control

- Factory Audits: Conduct or commission comprehensive audits covering manufacturing processes, quality management systems, worker skill levels, and compliance with certifications like ISO 9001 or OEKO-TEX.

- Reviewing QC Reports: Require detailed inspection reports from IQC, IPQC, and FQC stages, including photographic evidence and test results.

- Third-Party Inspections: Engage independent quality inspection agencies (e.g., SGS, Bureau Veritas) to perform random or batch inspections at various production stages.

- Sample Approvals: Obtain pre-production and pre-shipment samples for physical evaluation to verify quality and design adherence.

- Supplier Capability Assessments: Evaluate supplier experience with satin fabrics and wedding dress manufacturing, including their ability to handle complex designs and embellishments.

QC and Certification Nuances for International B2B Buyers

-

Regional Compliance Variations:

Buyers from Africa or the Middle East might prioritize certifications related to ethical labor practices and environmental sustainability, while European buyers often emphasize chemical safety and traceability. -

Cultural and Climate Considerations:

For buyers in tropical climates (e.g., Thailand, Egypt), quality assurance should confirm fabric breathability and colorfastness under intense sunlight. -

Logistics and Packaging:

Proper finishing and packaging standards must accommodate long shipping durations and varying climatic conditions to prevent satin damage. -

Customs and Import Regulations:

Ensure that suppliers provide all necessary documentation and certifications to facilitate smooth customs clearance in target markets.

Key Takeaways for B2B Buyers

- Prioritize suppliers with certified quality management systems (ISO 9001) and textile safety certifications (OEKO-TEX, REACH).

- Insist on comprehensive QC checkpoints throughout manufacturing to minimize defect rates.

- Use third-party inspections and factory audits to independently verify supplier claims and production consistency.

- Understand regional regulatory nuances and ensure supplier compliance to avoid import delays or rejections.

- Factor in fabric handling and packaging quality to maintain satin dress integrity during international transit.

By thoroughly understanding manufacturing processes and quality assurance protocols, international B2B buyers can confidently source satin wedding guest dresses that meet stringent quality expectations and market-specific requirements.

Related Video: Garments Full Production Process | Order receive to Ex-Factory | Episode 2

Comprehensive Cost and Pricing Analysis for satin wedding guest dress Sourcing

Sourcing satin wedding guest dresses involves a multifaceted cost and pricing structure that international B2B buyers must carefully analyze to optimize procurement decisions. Understanding the core cost components, price influencers, and strategic buyer approaches is essential for buyers from Africa, South America, the Middle East, and Europe aiming to achieve competitive pricing without compromising quality.

Key Cost Components in Satin Wedding Guest Dress Production

-

Materials: Satin fabric quality significantly impacts cost. Variations include polyester satin (more affordable), silk satin (premium), and blends. Additional materials such as lining, thread, zippers, and embellishments (e.g., beads, lace trims) also contribute to the material cost.

-

Labor: Labor costs depend on the manufacturing location and complexity of the dress design. Detailed styles like cowl necks, wrap dresses, or one-shoulder gowns require skilled workmanship, increasing labor expenses. Countries like Thailand offer competitive labor rates, but quality standards should be verified.

-

Manufacturing Overhead: Includes factory utilities, equipment depreciation, and indirect labor. Efficient factories with modern equipment may have higher overhead but deliver better quality and consistency.

-

Tooling & Setup: Initial costs for pattern making, sample production, and mold/tool creation for unique dress components affect unit cost, especially for small orders.

-

Quality Control (QC): Stringent QC processes to ensure fabric finish, stitching quality, and color consistency add to costs but reduce returns and enhance buyer reputation.

-

Logistics: Freight, customs duties, insurance, and handling fees vary by origin and destination. Sea freight is cost-effective for large volumes, whereas air freight suits urgent or smaller shipments.

-

Margin: Supplier margin accounts for profit and risk. Negotiating margins can be possible with larger orders or long-term partnerships.

Major Price Influencers for B2B Buyers

-

Order Volume & Minimum Order Quantities (MOQ): Larger volumes reduce per-unit costs via economies of scale. MOQs vary by supplier but typically range from 100 to 500 pieces for satin dresses. Buyers from emerging markets should balance MOQ against inventory risk.

-

Specifications & Customization: Custom color matching, embroidery, or unique cuts increase costs. Standardized designs are more budget-friendly but may offer less differentiation.

-

Material Quality & Certifications: Buyers demanding OEKO-TEX or REACH certifications for fabrics pay premiums but gain access to discerning markets and comply with import regulations, especially in Europe.

-

Supplier Reliability & Location: Established suppliers in Asia (e.g., Thailand) often offer competitive pricing but require due diligence for compliance and ethical standards. Suppliers closer to Europe or the Middle East may charge more but reduce lead times and logistics complexity.

-

Incoterms: Terms like FOB, CIF, or DDP define responsibility and cost burden. DDP (Delivered Duty Paid) includes all costs to the buyer’s doorstep but is pricier upfront, whereas FOB places shipping responsibility on the buyer, potentially lowering initial price but increasing logistics management.

Practical Buyer Tips for International B2B Procurement

-

Negotiate Beyond Price: Discuss payment terms, lead times, and flexibility on MOQs to improve cash flow and inventory management. Request tiered pricing for volume increases.

-

Focus on Total Cost of Ownership (TCO): Factor in logistics, tariffs, potential rework, and holding costs. Sometimes a lower unit price results in higher overall expenses due to quality issues or delivery delays.

-

Leverage Regional Trade Agreements: Buyers in Africa, South America, or the Middle East should explore preferential tariffs under agreements like the African Continental Free Trade Area (AfCFTA) or Mercosur to reduce import duties.

-

Request Samples & Quality Certifications: Before committing to large orders, obtain physical samples and verify supplier certifications to minimize risk.

-

Consider Long-Term Partnerships: Building relationships with trusted suppliers can lead to better pricing, priority production, and collaborative product development.

-

Understand Pricing Nuances by Region: For example, buyers in Egypt or South America may face higher shipping costs or customs delays, influencing landed costs. European buyers should ensure compliance with EU textile regulations to avoid penalties.

Indicative Pricing Disclaimer

Due to variations in fabric quality, labor markets, order sizes, and shipping routes, satin wedding guest dress prices can range broadly. Indicative FOB prices might start from approximately USD 15-30 per piece for standard polyester satin dresses in bulk, escalating to USD 50+ for premium silk satin and intricate designs. Buyers should conduct direct supplier inquiries and market research for precise quotations tailored to their specifications.

By dissecting the cost structure and understanding the influencing factors, international B2B buyers can strategically source satin wedding guest dresses that align with their budgetary constraints, quality expectations, and market demands. This comprehensive approach empowers buyers to negotiate effectively and optimize their procurement outcomes in a competitive global marketplace.

Spotlight on Potential satin wedding guest dress Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘satin wedding guest dress’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for satin wedding guest dress

Key Technical Properties of Satin Wedding Guest Dresses

Understanding the technical properties of satin wedding guest dresses is crucial for international B2B buyers to ensure product quality, consistency, and market fit. Here are the primary specifications to focus on:

-

Material Composition and Grade

Satin is commonly made from silk, polyester, acetate, or blends. The choice affects sheen, durability, and price. For luxury markets (Europe, Middle East), silk satin with high-grade long fibers is preferred for its natural luster and breathability. Polyester satin offers cost efficiency and wrinkle resistance, popular in bulk sourcing for African and South American markets. Confirming fiber content and grade ensures the dress meets buyer expectations for feel and longevity. -

Fabric Weight (GSM – Grams per Square Meter)

The weight of the satin fabric influences drape, comfort, and seasonality. Typical wedding guest dress satin ranges from 80 to 150 GSM. Lighter weights (80-100 GSM) provide fluidity and coolness, ideal for tropical climates like Egypt or Brazil. Heavier satin (120-150 GSM) offers structure and warmth, suitable for European or Middle Eastern formal events. Buyers should specify GSM tolerance (±5%) to maintain fabric consistency across production batches. -

Colorfastness and Dye Quality

Satin’s vibrant sheen can fade or bleed if dyes are inferior. High colorfastness (rated 4-5 on the Grey Scale) ensures the dresses retain brilliance after washing or exposure to sunlight. For international shipping and diverse climates, stable dyes prevent product returns and maintain brand reputation. Request supplier test reports on dye fastness and adherence to environmental standards (e.g., Oeko-Tex certification). -

Fabric Finish and Surface Smoothness

Satin’s characteristic smoothness and gloss depend on finishing techniques such as calendaring or mercerizing. A uniform finish enhances the luxury appeal and tactile experience. In B2B contracts, specifying minimum smoothness levels or surface defect tolerances helps avoid uneven sheen or pilling issues, critical for upscale markets demanding flawless aesthetics. -

Dimensional Stability (Shrinkage and Stretch)

Satin fabrics can be prone to shrinkage after washing or stretching during wear. Buyers should require shrinkage limits (usually under 3%) and elasticity specifications to ensure garment fit remains true to size. This is particularly important for online wholesale buyers serving regions with varying laundry habits or climate conditions. -

Seam and Stitching Quality

While not a fabric property, the technical quality of seams and stitching impacts durability and appearance. High-quality satin dresses feature fine, tight stitches with reinforced seams to prevent puckering on slippery satin fabric. Buyers should define minimum stitch counts per inch and thread types to guarantee long-lasting finished garments.

Common Trade Terms and Industry Jargon for B2B Buyers

Navigating international trade and manufacturing requires familiarity with specific terminology. Below are essential terms for buyers of satin wedding guest dresses:

-

OEM (Original Equipment Manufacturer)

Refers to suppliers who produce dresses according to the buyer’s designs and specifications. OEM partnerships allow customization of fabric, style, labels, and packaging, crucial for brands wanting exclusive collections or private labels. -

MOQ (Minimum Order Quantity)

The smallest batch size a supplier will produce or sell in one order. MOQs can vary widely depending on fabric type, complexity, and supplier capacity. Buyers from emerging markets should negotiate MOQs that balance inventory risk and cost efficiency. -

RFQ (Request for Quotation)

A formal inquiry sent by the buyer to suppliers asking for detailed pricing, lead times, and terms based on specified requirements. A clear, comprehensive RFQ reduces misunderstandings and accelerates supplier evaluation. -

Incoterms (International Commercial Terms)

Standardized trade terms defining responsibilities for shipping, insurance, and customs between buyer and seller. Common terms include FOB (Free On Board), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). Selecting the right Incoterm affects total landed cost and supply chain control. -

Lead Time

The total time from order confirmation to delivery. For fashion products like satin dresses, lead time includes fabric sourcing, production, quality control, and shipping. Buyers should factor seasonal demand and customs clearance to avoid stockouts. -

Quality Control (QC) and Inspection

Procedures to verify that dresses meet agreed specifications before shipment. QC may involve fabric tests, fit samples, and final product inspections. Buyers often hire third-party inspectors to ensure impartiality and reduce risk of defective goods.

By mastering these technical properties and trade terms, international B2B buyers—especially those in Africa, South America, the Middle East, and Europe—can make informed purchasing decisions that optimize quality, cost, and market appeal of satin wedding guest dresses.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the satin wedding guest dress Sector

Market Overview & Key Trends

The global satin wedding guest dress market is experiencing steady growth driven by rising wedding expenditures and evolving fashion preferences. Key markets in Africa, South America, the Middle East, and Europe display distinct consumer behaviors shaped by cultural nuances and climate considerations. For instance, Middle Eastern buyers often seek luxurious, modest designs with intricate detailing, while South American markets favor vibrant colors and flowy silhouettes suited for warmer climates. Europe and African markets show increasing demand for versatile satin dresses that can transition from formal to semi-formal occasions.

From a B2B perspective, sourcing flexibility and responsiveness are critical. International buyers are prioritizing suppliers who can offer a range of styles—such as classic slip dresses, cowl necks, and wrap designs—tailored to regional tastes. The rise of digital platforms has accelerated direct factory-to-buyer relationships, reducing lead times and enabling real-time customization. Additionally, tech-enabled sourcing tools such as AI-driven trend forecasting and virtual sampling are gaining traction, allowing buyers to anticipate shifts in consumer preferences and optimize inventory accordingly.

Market dynamics also reflect growing emphasis on cost-efficiency paired with quality assurance. Buyers from emerging markets, particularly in Africa and South America, seek competitive pricing without compromising on fabric quality and finishing. European and Middle Eastern buyers increasingly demand premium-grade satin blends, often requiring certifications to validate fabric origin and durability. Seasonal fluctuations also influence order volumes, with peak demand aligned to wedding seasons and regional festivities, necessitating agile supply chain management.

Sustainability & Ethical Sourcing in B2B

Sustainability is becoming a decisive factor in the procurement of satin wedding guest dresses. The textile industry’s environmental footprint—particularly from synthetic satin fabrics derived from petroleum-based fibers—has prompted B2B buyers to seek greener alternatives. Environmentally conscious buyers are increasingly requesting satin blends that incorporate recycled polyester, organic silk, or sustainably sourced viscose, which reduce reliance on non-renewable resources.

Ethical sourcing is equally crucial. Buyers are emphasizing transparent supply chains where workers’ rights, fair wages, and safe working conditions are guaranteed. This is particularly relevant for sourcing hubs like Thailand and Egypt, where labor standards vary significantly. Certifications such as OEKO-TEX Standard 100, Global Organic Textile Standard (GOTS), and Bluesign® have become important benchmarks for verifying sustainable and ethical production processes.

Illustrative Image (Source: Google Search)

Furthermore, B2B buyers are advocating for closed-loop manufacturing practices and water-efficient dyeing technologies to minimize environmental impact. These sustainability initiatives not only address regulatory compliance in stringent markets like the European Union but also enhance brand reputation among end consumers who are increasingly eco-conscious. Collaborative partnerships between buyers and manufacturers focusing on sustainability innovations are emerging as a competitive advantage in the satin wedding dress sector.

Brief Evolution and Historical Context

Satin’s legacy as a luxurious fabric dates back to ancient China, where it was prized for its smooth texture and glossy finish, originally woven from silk fibers. Over centuries, satin evolved into a symbol of elegance and opulence, widely adopted in European royal courts and ceremonial attire. The modern satin wedding guest dress inherits this heritage of sophistication but adapts to contemporary fashion trends and functional needs.

Historically, satin was exclusive due to the labor-intensive silk weaving process. Today, advances in textile technology have introduced synthetic and blended satin fabrics, democratizing access while maintaining the signature sheen and drape. For international B2B buyers, understanding satin’s evolution helps in selecting fabric types that balance traditional appeal with modern performance, such as wrinkle resistance and breathability—qualities vital for diverse climates across Africa, South America, the Middle East, and Europe.

Key Takeaways for B2B Buyers:

- Prioritize suppliers with flexible design capabilities aligned to regional preferences.

- Leverage digital sourcing tools for trend prediction and sample visualization.

- Demand certifications for fabric quality, sustainability, and ethical labor practices.

- Explore sustainable satin fabric blends and eco-friendly manufacturing processes.

- Understand satin’s historical prestige to better position products in luxury and mid-market segments.

By integrating these insights, international B2B buyers can navigate the satin wedding guest dress market with strategic foresight, ensuring supply chain resilience, market relevance, and sustainability leadership.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of satin wedding guest dress

-

How can I effectively vet suppliers of satin wedding guest dresses from diverse regions like Africa, South America, the Middle East, and Europe?

To vet suppliers, start by verifying business licenses and certifications relevant to textile and garment production. Request samples to assess fabric quality, stitching, and finish. Use third-party audits or factory visits where possible, focusing on compliance with labor standards and production capabilities. Check references or client testimonials, especially from other international buyers. Utilize platforms that specialize in B2B trade with verified suppliers. For regions like Egypt or Thailand, consider local trade shows or chambers of commerce to identify reputable manufacturers. -

What customization options are typically available for satin wedding guest dresses in B2B orders, and how should I communicate these requirements?

Most manufacturers offer customization in dress design, fabric color, sizing, embellishments, and packaging. Clearly specify your requirements using detailed tech packs, including measurements, fabric swatches, color codes (Pantone), and design sketches. Communicate expectations on embroidery, lace, or beadwork if needed. Confirm the supplier’s capability to handle custom orders and request prototypes before bulk production. For international buyers, clarify language and timezone differences to ensure precise communication and timely feedback. -

What are common minimum order quantities (MOQs) and lead times for satin wedding guest dresses, and how do they vary by region?

MOQs typically range from 50 to 300 pieces per design, depending on the supplier’s scale and region. Suppliers in Europe may offer lower MOQs with higher costs, while factories in Asia or South America often require larger MOQs but at competitive prices. Lead times vary from 30 to 90 days, influenced by order size, customization, and shipping method. Negotiate lead times upfront and consider buffer periods for customs clearance. For Africa and Middle Eastern buyers, factor in regional holidays and logistics delays. -

What payment terms and methods are safest for international B2B transactions involving satin wedding guest dress suppliers?

Secure payment methods include irrevocable letters of credit, escrow services, and verified payment platforms like Payoneer or Alibaba Trade Assurance. Avoid full upfront payments; negotiate deposits (e.g., 30-50%) with balance upon delivery or after quality inspection. Confirm supplier banking details independently to prevent fraud. For new suppliers, consider smaller initial orders with safer payment terms to build trust. Always ensure payment terms are clearly outlined in the contract, specifying currency, deadlines, and penalties for late payment. -

How can I ensure quality assurance and compliance with international standards when sourcing satin wedding guest dresses?

Request certificates such as OEKO-TEX Standard 100 for fabric safety and ISO certifications for manufacturing processes. Implement quality control protocols including pre-production samples, in-line inspections, and final random inspections by third-party agencies. Specify acceptable defect rates and testing methods for seam strength, colorfastness, and fabric sheen. For international shipments, ensure compliance with import regulations and labeling standards in your target markets. Establish clear communication channels for reporting and resolving quality issues promptly. -

What logistics considerations should I prioritize when importing satin wedding guest dresses from multiple regions?

Evaluate shipping options (air freight for speed, sea freight for cost-efficiency) based on order size and urgency. Confirm supplier packaging meets international transport standards to prevent damage. Plan for customs clearance requirements, including documentation like commercial invoices, packing lists, and certificates of origin. Factor in local import duties and taxes in total landed cost calculations. Collaborate with experienced freight forwarders familiar with your sourcing regions, and consider warehousing solutions for inventory consolidation to optimize distribution. -

How should disputes related to quality, delivery, or contract terms be handled with international satin dress suppliers?

Establish dispute resolution mechanisms within contracts, such as mediation or arbitration in a neutral jurisdiction. Maintain detailed records of all communications, agreements, and quality inspections. In case of quality disputes, use third-party inspection reports as evidence. Negotiate remedies such as partial refunds, re-production, or discounts. Proactively address issues with a solution-oriented approach to preserve supplier relationships. For persistent problems, consider terminating contracts and switching to suppliers with stronger reputations and references. -

What cultural and market preferences should I consider when selecting satin wedding guest dress styles for buyers in Africa, South America, the Middle East, and Europe?

Understand regional preferences for color, modesty, and dress silhouette. For example, Middle Eastern markets may favor modest designs with sleeves or higher necklines, while South American buyers might prefer vibrant colors and form-fitting styles. European customers often seek minimalist elegance with high-quality fabric finishes, whereas African markets may value bold prints and statement accessories. Collaborate with local fashion consultants or market research firms to tailor your product range. Offering flexible customization can help cater to diverse tastes and increase market acceptance.

Illustrative Image (Source: Google Search)

Strategic Sourcing Conclusion and Outlook for satin wedding guest dress

Satin wedding guest dresses represent a lucrative niche blending timeless elegance with versatile styling options, ideal for diverse wedding formats from black-tie galas to intimate garden ceremonies. For international B2B buyers, particularly in emerging and established markets such as Africa, South America, the Middle East, and Europe, strategic sourcing is crucial to capitalize on this demand. Prioritizing suppliers who balance quality craftsmanship with sustainable fabric sourcing can differentiate your offerings and meet the rising consumer expectations for luxury and ethical production.

Key sourcing considerations include supplier reliability, fabric authenticity, and adaptability to regional fashion preferences—such as modest cuts favored in Middle Eastern markets or vibrant color palettes popular in South America. Leveraging partnerships with manufacturers in textile hubs like Thailand and Egypt can optimize cost-efficiency while ensuring access to premium satin fabrics. Additionally, aligning product assortments with trending dress styles—such as slip dresses, cowl necks, and wrap designs—enables buyers to respond dynamically to market shifts.

Looking ahead, buyers who integrate data-driven insights and cultivate agile supply chains will be best positioned to navigate evolving global wedding trends. Embrace strategic collaborations, invest in quality assurance, and focus on consumer-centric innovation to unlock growth potential in the satin wedding guest dress segment. Now is the time to forge partnerships that combine tradition with modernity, delivering exquisite satin apparel to discerning wedding guests worldwide.