Your Ultimate Guide to Sourcing Infant Dress Size Chart

Guide to Infant Dress Size Chart

- Introduction: Navigating the Global Market for infant dress size chart

- Understanding infant dress size chart Types and Variations

- Key Industrial Applications of infant dress size chart

- Strategic Material Selection Guide for infant dress size chart

- In-depth Look: Manufacturing Processes and Quality Assurance for infant dress size chart

- Comprehensive Cost and Pricing Analysis for infant dress size chart Sourcing

- Spotlight on Potential infant dress size chart Manufacturers and Suppliers

- Essential Technical Properties and Trade Terminology for infant dress size chart

- Navigating Market Dynamics, Sourcing Trends, and Sustainability in the infant dress size chart Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of infant dress size chart

- Strategic Sourcing Conclusion and Outlook for infant dress size chart

Introduction: Navigating the Global Market for infant dress size chart

Entering the global market for infant dress size charts requires precision and deep understanding, especially for international B2B buyers targeting diverse regions such as Africa, South America, the Middle East, and Europe. Accurate size charts are not merely a tool—they are the foundation for successful product development, inventory management, and customer satisfaction. Variations in sizing standards across countries can lead to costly returns, dissatisfied customers, and damaged brand reputation if not expertly navigated.

This guide delivers a comprehensive roadmap to mastering infant dress size charts, tailored specifically for B2B professionals. It covers the full spectrum—from understanding regional size standards and measurement methodologies to selecting appropriate materials and fabrics that meet safety and comfort requirements. In addition, it explores critical manufacturing and quality control processes that ensure consistency and compliance with international regulations.

Key supplier insights and cost considerations are analyzed to help you negotiate competitive pricing without compromising quality. The guide also highlights emerging market trends and demands within your target regions, providing a strategic advantage in sourcing decisions. A dedicated FAQ section addresses common challenges and questions, equipping you with actionable solutions.

By leveraging this resource, buyers from Africa, South America, the Middle East, and Europe—including markets like France and Italy—will gain the confidence to streamline their sourcing strategies, reduce operational risks, and deliver infant apparel that fits perfectly and meets global standards. This empowers your business to thrive in an increasingly interconnected and competitive global marketplace.

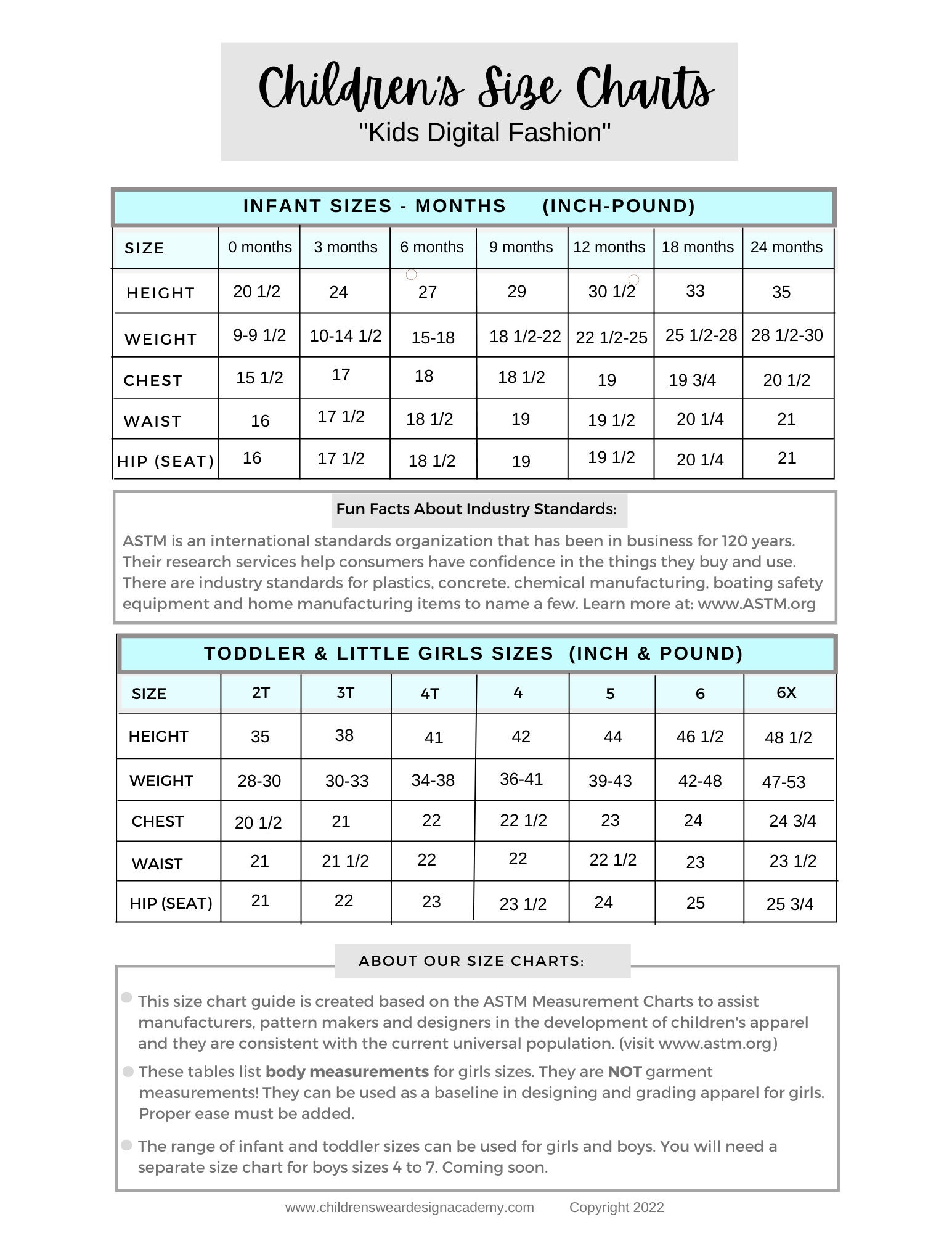

Illustrative Image (Source: Google Search)

Understanding infant dress size chart Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Age-Based Size Charts | Sizes categorized by infant age ranges (e.g., 0-3, 3-6 months) | Simplifies inventory planning for age-specific apparel lines | + Easy to understand; – May not account for growth variability |

| Height/Length-Based Charts | Sizes determined by infant height or length measurements | Useful for markets with diverse infant body types | + More precise fit; – Requires accurate measurement from buyers |

| Weight-Based Size Charts | Sizing aligned with infant weight brackets | Popular in regions with varying infant weight norms | + Tailored fit; – Weight can fluctuate, affecting size accuracy |

| Regional Standard Charts | Localized sizing standards (e.g., EU, UK, US, French, Italian) | Essential for international trade and compliance | + Aligns with local consumer expectations; – Complexity in multi-market sales |

| Gender-Specific Charts | Separate sizing guides for boys and girls | Targeted marketing and product development | + Enables gender-tailored designs; – May complicate inventory management |

Age-Based Size Charts

This is the most common type, categorizing infant dress sizes by age brackets such as 0-3 months, 3-6 months, and so forth. It is especially practical for B2B buyers targeting mass-market retailers and baby specialty stores. However, since infant growth rates vary, reliance solely on age can lead to fit inconsistencies. Buyers should consider complementary sizing strategies or offer flexible return policies to accommodate this variability.

Height/Length-Based Charts

These charts use the infant’s height or length to determine the appropriate dress size, providing a more customized fit. This approach is particularly valuable in regions with diverse infant body types, such as Africa and South America, where standard age-based sizing may not be as effective. For B2B buyers, height-based sizing can reduce returns and increase customer satisfaction but requires educating retail partners and end consumers about measurement techniques.

Weight-Based Size Charts

Sizing by weight is another variation that can offer a closer fit, especially in markets where infant weight varies significantly due to nutrition or genetics. This method is often favored in Middle Eastern and some European markets. B2B buyers should note that infant weight can fluctuate rapidly, so weight-based sizing might require flexible inventory strategies and clear communication to avoid confusion.

Regional Standard Charts

These charts conform to localized sizing standards such as US, UK, French, Italian, or broader European systems. For international B2B buyers, understanding and sourcing according to these regional standards is crucial for market entry and regulatory compliance. While regional charts help meet consumer expectations, managing multiple sizing standards can increase supply chain complexity and require robust SKU management systems.

Gender-Specific Charts

Some infant dress size charts differentiate between boys and girls, reflecting slight variations in body shape and market preferences. This segmentation supports targeted product design and marketing, which can enhance brand positioning. However, B2B buyers must balance the benefits of gender-specific inventory with the potential for increased complexity in stock management and forecasting.

Related Video: Baby Dress Measurement Chart For Sewing | 0 to 18 Year age measurement Chart

Key Industrial Applications of infant dress size chart

| Industry/Sector | Specific Application of infant dress size chart | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Baby Apparel Manufacturing | Standardizing product sizing for infant clothing lines | Reduces returns and increases customer satisfaction | Accuracy of size conversion, compliance with regional sizing standards |

| Retail & Wholesale Distribution | Assisting inventory planning and customer guidance | Optimizes stock levels and improves sales efficiency | Availability of multi-region size charts, ease of integration with POS systems |

| E-commerce Platforms | Enhancing online product descriptions and size recommendations | Minimizes size-related purchase errors and returns | Localization of size charts, clarity in measurement units, mobile-friendly format |

| Textile & Fabric Suppliers | Supporting design and production specifications | Ensures fabrics meet dimensional requirements for sizes | Coordination with manufacturers on size-specific fabric needs |

| International Trade & Export | Facilitating cross-border sales with standardized sizing | Simplifies communication and reduces sizing disputes | Harmonization with international standards, multilingual chart availability |

Baby Apparel Manufacturing

In the manufacturing sector, infant dress size charts are critical for creating standardized sizing frameworks that guide production. By adopting accurate size charts, manufacturers can ensure consistency across product lines, which reduces costly returns caused by sizing issues. For international B2B buyers, especially in Africa, South America, the Middle East, and Europe, it is essential to source size charts that align with local sizing conventions to meet consumer expectations and regulatory requirements. This improves brand reputation and streamlines market entry.

Retail & Wholesale Distribution

Retailers and wholesalers rely on infant dress size charts to forecast demand and manage inventory effectively. These charts help in categorizing products correctly, enabling sales teams to guide customers towards the right sizes, thus reducing stock wastage and enhancing turnover rates. For international distributors, sourcing size charts that cover multiple regional standards (e.g., US, EU, UK) is vital to cater to diverse markets and avoid confusion, especially when dealing with cross-border logistics and multi-channel sales.

E-commerce Platforms

Online retailers use infant dress size charts to provide detailed size guidance, which is crucial for reducing returns due to incorrect sizing. Incorporating localized and easy-to-understand size charts improves customer confidence and conversion rates. For B2B buyers serving diverse geographies, ensuring that size charts are available in multiple languages and adaptable to metric or imperial measurements supports a seamless shopping experience for end consumers in regions such as Europe and the Middle East.

Textile & Fabric Suppliers

Textile suppliers utilize infant dress size charts to align fabric production with the specific dimensional needs of infant clothing. Understanding size gradations allows suppliers to recommend appropriate fabric quantities and types, ensuring efficient material use and reducing waste. International buyers must verify that suppliers can accommodate size-specific fabric requirements, considering regional sizing differences that impact fabric cutting and garment construction.

International Trade & Export

For businesses engaged in cross-border trade of infant apparel, size charts serve as a universal reference to harmonize product sizing and reduce disputes. Standardized charts enable exporters and importers to communicate clearly about product specifications, facilitating smoother customs clearance and market acceptance. B2B buyers from Africa, South America, the Middle East, and Europe should prioritize sourcing size charts compliant with international standards and available in multiple languages to support diverse regulatory environments and consumer preferences.

Related Video: LABORATORY APPARATUS AND THEIR USES

Strategic Material Selection Guide for infant dress size chart

When selecting materials for infant dress size charts, B2B buyers must consider factors such as durability, print clarity, safety, cost, and regional compliance standards. The choice of material impacts not only the product’s lifespan and usability but also how well it meets the expectations of diverse international markets including Africa, South America, the Middle East, and Europe.

Cotton Fabric

Key Properties:

Cotton is a natural fiber known for its softness, breathability, and hypoallergenic qualities, making it ideal for infant-related products. It performs well under normal temperature and humidity conditions but is not resistant to moisture or stains without treatment.

Pros & Cons:

Cotton offers excellent comfort and is widely accepted in global markets for baby apparel and accessories. It is biodegradable and sustainable, aligning with increasing eco-conscious consumer demand. However, cotton can shrink after washing, may wrinkle easily, and is prone to mildew if stored improperly. Manufacturing complexity is moderate, with widespread availability of raw cotton and established processing methods.

Impact on Application:

Cotton’s natural texture ensures that printed size charts are clear and easy to read, especially when using high-quality dyes. It is suitable for direct printing or embroidery. However, buyers must ensure that inks and dyes comply with international safety standards such as OEKO-TEX or REACH to avoid harmful chemicals.

International Considerations:

In Europe (France, Italy), cotton products must meet stringent chemical safety regulations and labeling laws. African and South American buyers often prefer cotton for its local availability and cultural acceptance. Middle Eastern markets may require specific certifications for organic cotton and compliance with halal standards in processing.

Polyester Fabric

Key Properties:

Polyester is a synthetic fiber known for its durability, wrinkle resistance, and moisture-wicking properties. It withstands higher temperatures and resists shrinking and stretching, making it suitable for long-lasting products.

Pros & Cons:

Polyester is cost-effective and maintains print quality over time, especially for size charts requiring vibrant colors. It is less breathable than cotton and can cause discomfort in hot climates unless blended with natural fibers. Manufacturing complexity is relatively low due to mass production capabilities.

Impact on Application:

Polyester supports sublimation printing, which produces sharp, durable graphics ideal for detailed size charts. It resists fading and is easy to clean, beneficial for resale and retail environments. However, its synthetic nature may raise concerns about sustainability among eco-conscious buyers.

International Considerations:

European buyers often demand certifications like GRS (Global Recycled Standard) for polyester products to ensure environmental responsibility. In Africa and South America, polyester’s durability and ease of maintenance are valued, but buyers should verify compliance with local textile import regulations. Middle Eastern markets may require flame-retardant treatments for certain applications.

Bamboo Fabric

Key Properties:

Bamboo fabric is a natural textile derived from bamboo pulp, prized for its softness, antibacterial properties, and moisture-wicking ability. It is naturally UV resistant and environmentally friendly.

Pros & Cons:

Bamboo is hypoallergenic and biodegradable, appealing to markets prioritizing sustainability and infant safety. It is more expensive and less widely available than cotton or polyester, with manufacturing requiring specialized processing. Bamboo fabric can sometimes lack durability compared to synthetics.

Impact on Application:

Bamboo fabric offers a premium feel for infant dress size charts, enhancing brand perception in high-end markets. Print clarity is good but may require specific inks to prevent bleeding. Its antibacterial nature adds value in markets sensitive to hygiene.

International Considerations:

European buyers, especially in France and Italy, appreciate bamboo’s eco-friendly credentials but expect certifications like FSC or OEKO-TEX. African and South American buyers may face supply chain challenges due to limited local production. Middle Eastern buyers may prioritize bamboo blends that meet both comfort and regulatory standards.

Organic Cotton Blend

Key Properties:

An organic cotton blend combines organic cotton with other fibers such as polyester or bamboo to balance softness, durability, and cost. It offers improved strength and reduced environmental impact compared to conventional cotton.

Pros & Cons:

This blend enhances durability and reduces shrinkage while maintaining a natural feel. It is more costly than standard cotton but less expensive than pure bamboo. Manufacturing complexity is higher due to blending processes and certification requirements.

Impact on Application:

Organic cotton blends provide a reliable substrate for size charts with good print fidelity and longevity. They are suitable for markets demanding both sustainability and performance.

International Considerations:

Buyers in Europe require organic certification (GOTS) and compliance with strict chemical standards. African and South American markets are increasingly adopting organic textiles but may require education on benefits. Middle Eastern buyers look for blends that comply with environmental and safety standards without compromising comfort.

| Material | Typical Use Case for infant dress size chart | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Cotton Fabric | Soft, breathable charts for comfort-focused infant apparel | Natural, hypoallergenic, widely accepted | Prone to shrinkage and mildew | Medium |

| Polyester Fabric | Durable, vibrant printed charts for mass-market distribution | High durability, wrinkle and shrink resistant | Less breathable, environmental concerns | Low |

| Bamboo Fabric | Premium, eco-friendly charts targeting high-end markets | Antibacterial, soft, sustainable | Higher cost, limited availability | High |

| Organic Cotton Blend | Balanced performance and sustainability for diverse markets | Combines softness and durability with eco-credentials | More complex manufacturing, higher cost | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for infant dress size chart

Manufacturing Processes for Infant Dress Size Charts

The production of infant dresses, particularly those aligned with a standardized size chart, involves several critical manufacturing stages to ensure consistent fit, comfort, and safety. Understanding these stages helps B2B buyers evaluate supplier capabilities and product quality.

1. Material Preparation

Raw materials primarily include soft, hypoallergenic fabrics such as cotton, bamboo blends, or organic fibers, chosen for infant skin sensitivity. Material preparation involves fabric inspection for defects, pre-washing (to prevent shrinkage), dyeing or printing (if applicable), and cutting. Precision in cutting according to size templates is essential to maintain accurate size grading aligned with the size chart.

2. Forming (Cutting and Shaping)

After material preparation, fabrics are cut into pattern pieces for various sizes. Advanced techniques such as computer-aided design (CAD) and automatic cutting machines enhance accuracy and reduce fabric waste. This stage ensures each size conforms to specifications in the infant dress size chart, accommodating ease of movement and growth.

3. Assembly (Sewing and Stitching)

Assembly involves stitching the cut pieces together using industrial sewing machines. Key techniques include flatlock seams to avoid irritation, reinforced stitching at stress points (e.g., shoulders, crotch), and incorporation of size-appropriate fasteners like snaps or zippers designed for infant safety. Skilled labor and quality thread selection are crucial to durability and garment integrity.

4. Finishing

Finishing encompasses adding trims, labels (including size chart references), quality checks, ironing, and packaging. Labels must clearly state size information compliant with international standards and any regional adaptations (e.g., EU size labels for European markets). Packaging is designed to protect the garment during transit and often includes size charts for end-user clarity.

Quality Assurance and Control (QA/QC) Frameworks

Quality assurance in infant dress manufacturing is critical due to the sensitive target demographic. B2B buyers should expect suppliers to adhere to robust QA/QC systems that align with international and industry-specific standards.

International Standards

– ISO 9001: The foundational quality management system standard, ensuring consistent processes and continuous improvement. Suppliers certified to ISO 9001 demonstrate a commitment to quality and process control.

– OEKO-TEX Standard 100: Especially relevant for infant clothing, this certifies textiles free from harmful substances.

– EN 14682 (Europe): Safety requirements for cords and drawstrings in children’s clothing to prevent hazards.

– ASTM F2236 (US): Safety standards for children’s sleepwear, often referenced globally for infant garment safety.

– REACH Compliance (EU): Regulation on chemicals used in textile manufacturing.

Industry-Specific Certifications

– CE Marking: Required for products sold in the European Economic Area, indicating conformity with health, safety, and environmental protection standards.

– Global Organic Textile Standard (GOTS): For organic infant dress lines, certifying organic fiber content and sustainable production.

Key Quality Control Checkpoints

B2B buyers should understand the typical QC checkpoints embedded throughout manufacturing:

- Incoming Quality Control (IQC): Inspection of raw materials and components (fabrics, threads, fasteners) before production begins. This includes fabric weight, colorfastness, and chemical residue testing.

- In-Process Quality Control (IPQC): Ongoing monitoring during cutting, sewing, and assembly to catch defects early. Parameters include seam strength, dimension accuracy per size chart, and functional fastener testing.

- Final Quality Control (FQC): Comprehensive inspection after finishing, verifying garment measurements against the size chart, fabric appearance, stitching integrity, labeling accuracy, and packaging condition.

Common Testing Methods

To ensure compliance with size standards and safety, manufacturers employ various testing protocols:

- Dimensional Measurement: Using templates or digital devices to verify garment dimensions for each size against the infant dress size chart.

- Colorfastness Tests: Ensuring dyes do not bleed or fade with washing or exposure to sunlight.

- Tensile and Seam Strength Tests: Guaranteeing durability under normal infant use conditions.

- Chemical Testing: Screening for harmful substances like formaldehyde, heavy metals, and azo dyes in fabrics and accessories.

- Safety Testing: Checking fasteners, cords, and trims for choking or strangulation hazards.

Verifying Supplier Quality Control for B2B Buyers

For international buyers, especially from Africa, South America, the Middle East, and Europe, due diligence in supplier QC verification is essential.

1. Supplier Audits

On-site audits evaluate the supplier’s manufacturing capabilities, QA/QC processes, and compliance with relevant standards. Buyers may conduct these audits themselves or hire specialized third-party firms.

2. Quality Reports and Certifications

Request updated certificates (ISO 9001, OEKO-TEX, CE, GOTS) and detailed QC reports documenting inspection results at each production stage. Transparency in documentation indicates a mature quality management system.

3. Third-Party Inspections

Engaging independent inspection agencies to perform random batch testing and factory audits provides an unbiased assessment of product quality and adherence to size specifications.

QC and Certification Nuances for International Markets

Africa & South America:

These markets often prioritize cost-effectiveness but increasingly demand compliance with international safety and quality standards due to rising consumer awareness. Certifications like OEKO-TEX and ISO 9001 are valuable for market acceptance. Buyers should verify supplier adherence to local import regulations and possible certification requirements.

Middle East:

Regulatory environments vary, but GCC countries increasingly enforce strict import standards. Certifications such as CE and ISO 9001 are essential. Consider cultural preferences affecting size chart adaptations, such as modesty or seasonal clothing variations.

Europe (France, Italy, etc.):

European buyers expect rigorous compliance with EN standards, REACH, and CE marking. Size charts must align precisely with EU norms, and organic certifications like GOTS add competitive advantage. European buyers often require extensive QC documentation and prefer suppliers with transparent supply chains and sustainability practices.

Actionable Recommendations for B2B Buyers

- Demand comprehensive QC documentation aligned with both international and regional standards relevant to your market.

- Incorporate supplier audits and third-party inspections as part of your procurement process to mitigate quality risks.

- Clarify size chart standards upfront and request size conformity reports to avoid costly returns due to sizing discrepancies.

- Evaluate supplier capabilities in textile safety testing to ensure infant-appropriate chemical compliance.

- Consider certifications beyond ISO 9001 that directly impact infant garment safety and comfort, such as OEKO-TEX and GOTS.

- Account for regional market nuances when negotiating size charts and quality requirements to enhance local acceptance.

By thoroughly understanding the manufacturing and quality assurance processes behind infant dress size charts, international B2B buyers can secure reliable suppliers, ensure compliance, and deliver safe, well-fitting products to their markets.

Related Video: Flow Chart of Textile Manufacturing Process

Comprehensive Cost and Pricing Analysis for infant dress size chart Sourcing

When sourcing infant dress size charts, understanding the detailed cost structure and pricing dynamics is critical for international B2B buyers. This analysis delves into the key cost components, price influencers, and strategic buyer tips to optimize procurement, particularly for markets in Africa, South America, the Middle East, and Europe.

Key Cost Components in Infant Dress Size Chart Production

- Materials: The primary costs involve the quality and type of materials used for size charts, such as laminated paper, durable plastics, or fabric. Material choice affects durability and usability, with eco-friendly or certified materials commanding premium prices.

- Labor: Labor costs vary significantly depending on the manufacturing country and the complexity of the size chart (e.g., printed vs. embroidered charts). Skilled labor for precise measurements and printing increases costs.

- Manufacturing Overhead: This includes factory utilities, equipment depreciation, and indirect labor. Overhead rates depend on the production scale and location.

- Tooling: Initial tooling or setup costs for printing plates, molds, or cutting dies can be substantial, especially for customized or branded size charts. These are generally amortized over large order quantities.

- Quality Control (QC): Rigorous QC ensures accuracy in size gradations and print quality. Costs include inspection labor, testing equipment, and possible rework expenses.

- Logistics: Freight, customs duties, and local distribution costs must be factored in. Sourcing from Asia or other distant regions increases logistics expenses and lead times.

- Margin: Suppliers add a margin to cover profit and risk, which varies by supplier reputation, order size, and market demand.

Influencing Factors on Pricing

- Order Volume / Minimum Order Quantity (MOQ): Larger volumes reduce per-unit costs through economies of scale. Buyers should negotiate MOQs that balance cost savings with inventory risks.

- Specifications and Customization: Customized size charts with unique branding, multilingual printing, or special finishes increase tooling and labor costs.

- Material Quality and Certifications: Certifications such as FSC for paper or OEKO-TEX for textiles add credibility but raise input costs.

- Supplier Capabilities and Location: Established suppliers with advanced manufacturing technology may charge more but deliver higher quality and reliability. Sourcing closer to target markets (e.g., European suppliers for France and Italy) can reduce logistics and compliance costs.

- Incoterms: The choice of Incoterms (e.g., FOB, CIF, DDP) affects who bears transportation and customs risks and costs. Buyers should understand these terms to manage total landed costs effectively.

Strategic Buyer Tips for International B2B Procurement

- Negotiate Beyond Price: Engage suppliers on payment terms, lead times, and value-added services such as packaging or quality assurance. Long-term relationships can unlock volume discounts.

- Consider Total Cost of Ownership (TCO): Factor in hidden costs such as import duties, warehousing, and potential delays, especially for buyers in Africa and South America where customs processes may be complex.

- Prioritize Quality and Compliance: For European buyers, compliance with EU labeling and safety regulations is mandatory. Investing in certified products can prevent costly market rejections.

- Leverage Regional Trade Agreements: Utilize trade agreements (e.g., African Continental Free Trade Area, Mercosur) to reduce tariffs and streamline customs.

- Evaluate Supplier Reliability: Choose suppliers with proven track records in infant apparel accessories to minimize risks related to sizing inaccuracies or production delays.

- Be Aware of Pricing Nuances: Seasonal demand fluctuations and raw material price volatility can impact quotes. Request price validity periods and consider forward contracts for stable pricing.

Disclaimer on Pricing

Pricing for infant dress size charts is highly variable and depends on numerous factors outlined above. Buyers should use quoted prices as indicative and conduct thorough due diligence, including requesting samples and detailed cost breakdowns, before finalizing contracts.

By carefully analyzing these cost components and price influencers, international buyers can make informed sourcing decisions that balance cost-efficiency with quality and compliance, ultimately enhancing their competitive advantage in diverse global markets.

Spotlight on Potential infant dress size chart Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘infant dress size chart’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Essential Technical Properties and Trade Terminology for infant dress size chart

Key Technical Properties for Infant Dress Size Charts

When sourcing infant dresses internationally, especially for markets in Africa, South America, the Middle East, and Europe, understanding the critical technical properties of size charts is essential. These properties ensure product consistency, customer satisfaction, and smooth cross-border trade.

-

Size Measurement Standards

Infant dress sizes are primarily based on age, height (cm/inches), and weight. Different regions use varying standards—US sizes often use months (0-24 mos), while Europe (including France and Italy) relies on height in centimeters. Accurate measurement standards prevent sizing disputes and returns, making it crucial for buyers to specify the exact sizing system required. -

Tolerance and Fit Allowance

Tolerance refers to the acceptable variation in garment dimensions (e.g., ±1 cm in chest width). For infants, small deviations can affect comfort and fit significantly. Buyers must clarify tolerance levels in contracts to ensure consistent sizing across batches and maintain brand reputation. -

Material Grade and Safety Compliance

Infant clothing materials must comply with strict safety and hygiene standards (e.g., OEKO-TEX certification, REACH compliance in Europe). Material grade affects softness, breathability, and allergen potential, impacting buyer decisions for quality assurance and compliance with regional regulations. -

Shrinkage Rate

Fabric shrinkage after washing can alter dress sizes, misleading size charts. Suppliers should provide shrinkage data based on standard laundering tests. Buyers need this information to adjust size charts accordingly and avoid customer dissatisfaction. -

Labeling and Marking Accuracy

Size labels must correspond exactly to the size chart specifications. Mislabeling causes confusion in retail and e-commerce, leading to returns and brand damage. Buyers should verify that suppliers follow clear labeling protocols aligned with the size chart. -

Size Conversion Compatibility

Since buyers often sell across multiple markets, size charts should include clear conversion tables (e.g., US to EU to UK sizes). This compatibility helps streamline inventory management and marketing, reducing errors in order fulfillment.

Common Trade Terms and Industry Jargon

Navigating international B2B transactions for infant dress size charts requires familiarity with key trade terms. Understanding these terms enhances communication and streamlines procurement.

-

OEM (Original Equipment Manufacturer)

OEM refers to suppliers who manufacture infant dresses or size charts based on the buyer’s specifications and branding. OEM partnerships allow buyers to customize sizing and labels, critical for brand differentiation in competitive markets. -

MOQ (Minimum Order Quantity)

MOQ is the smallest number of units a supplier is willing to produce or ship. For infant dresses, MOQ impacts pricing and inventory decisions. Buyers from emerging markets should negotiate MOQs that balance cost efficiency with market demand. -

RFQ (Request for Quotation)

An RFQ is a formal inquiry sent to suppliers requesting detailed pricing, production timelines, and terms for infant dress size charts or garments. Clear RFQs specifying size standards and tolerances help suppliers provide accurate quotes, reducing negotiation cycles. -

Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers regarding shipping, insurance, and customs clearance. Common terms include FOB (Free On Board) and CIF (Cost, Insurance, Freight). Understanding Incoterms ensures buyers from diverse regions can manage logistics and costs effectively. -

Lead Time

Lead time is the period from order confirmation to delivery. For infant dress procurement, lead time affects inventory planning and seasonality. Buyers should confirm lead times upfront to align stock availability with market demand. -

Tech Pack

A tech pack is a comprehensive document detailing design, measurements, materials, and quality standards for infant dresses. Supplying an accurate tech pack minimizes errors and ensures the size chart and garment meet buyer expectations.

By mastering these technical properties and trade terms, international B2B buyers can optimize procurement processes, ensure product quality, and enhance cross-border collaboration in the infant dress market.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the infant dress size chart Sector

Market Overview & Key Trends

The infant dress size chart sector is a critical enabler in the global baby apparel market, serving as a foundational tool for manufacturers, wholesalers, and retailers to streamline product sizing and reduce returns. For international B2B buyers—especially in regions such as Africa, South America, the Middle East, and Europe—understanding local and global sizing standards is essential to ensure product-market fit and customer satisfaction.

Global Drivers:

– Rising Birth Rates and Urbanization: Emerging markets in Africa and South America are experiencing steady population growth and urban middle-class expansion, driving demand for infant apparel and standardized sizing solutions.

– Increasing Cross-border Trade: The growth of e-commerce platforms and improved logistics infrastructure enable suppliers from Europe (notably France and Italy) and the Middle East to export infant clothing more efficiently, necessitating harmonized size charts to cater to diverse markets.

– Digitalization & Data Integration: Advanced B2B platforms now integrate AI-driven size recommendation tools and interactive digital size charts that improve buyer confidence and reduce sizing errors. This is a growing trend, particularly in technologically progressive European markets.

Current and Emerging Sourcing Trends:

– Localization of Size Standards: Buyers are increasingly seeking suppliers who provide size charts adapted to regional anthropometric data to reduce mismatch risks, e.g., European buyers favoring EN 13402 standards, while Middle Eastern and African buyers prefer size charts accommodating local body proportions.

– Customization and Modular Sizing: Manufacturers offer modular size charts that allow buyers to customize sizing increments or incorporate adjustable fits, appealing to markets with diverse infant growth patterns.

– Supply Chain Transparency: B2B buyers prioritize suppliers with transparent sourcing and manufacturing processes, often verified by third-party audits or certifications.

Market Dynamics:

– Price Sensitivity vs Quality Expectations: African and South American markets often balance cost-effectiveness with quality, while European buyers tend to prioritize premium materials and precise sizing adherence.

– Seasonality and Cultural Preferences: Seasonal climates and cultural dress norms influence size chart requirements—for example, layered clothing sizing in colder European regions versus lightweight sizing in Middle Eastern markets.

– Regulatory Compliance: Understanding regional regulations on labeling and safety standards (such as REACH in Europe or GCC standards in the Middle East) is paramount for B2B buyers when sourcing infant dress size charts and related garments.

Sustainability & Ethical Sourcing in B2B

Sustainability is increasingly shaping sourcing decisions in the infant dress size chart sector, with B2B buyers demanding environmentally responsible and ethically produced products. The infant apparel segment is particularly sensitive, as parents and retailers seek assurance that products are safe, non-toxic, and sustainably manufactured.

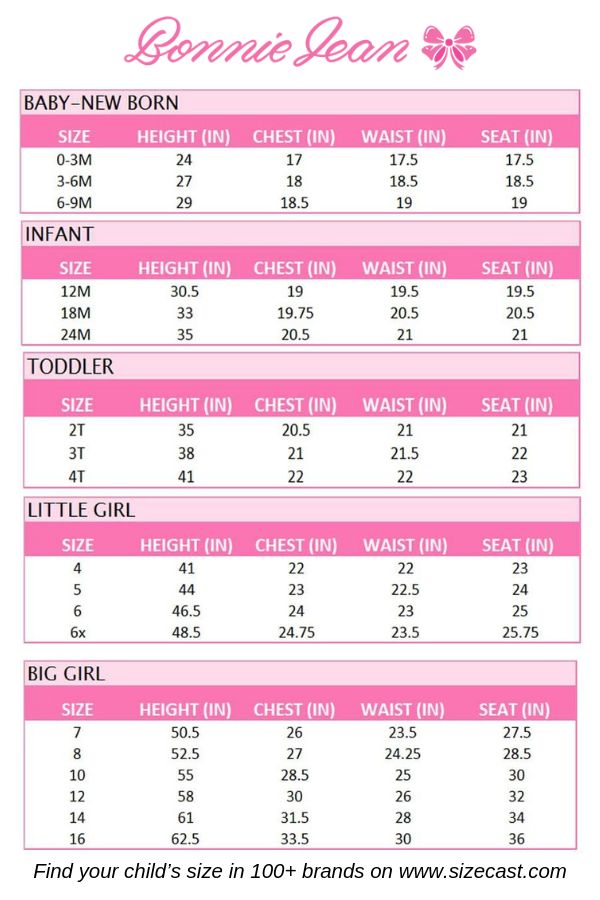

Illustrative Image (Source: Google Search)

Environmental Impact Considerations:

– Material Selection: Organic cotton, bamboo fibers, and recycled textiles are gaining traction as preferred materials due to their lower water footprint and reduced pesticide use compared to conventional cotton. Buyers from Europe and the Middle East often require suppliers to demonstrate sustainable sourcing of raw materials.

– Waste Reduction: Implementing precise size charts reduces overproduction and unsold inventory by improving fit accuracy, directly contributing to waste minimization in the supply chain. Modular sizing also supports longer product lifecycle through adjustable garments.

– Carbon Footprint of Supply Chains: International buyers emphasize sourcing from suppliers who optimize logistics to reduce carbon emissions, including local sourcing where feasible and consolidated shipping.

Ethical Supply Chain Importance:

– Fair Labor Practices: B2B buyers in Europe and South America increasingly demand adherence to fair labor standards, including safe working conditions and fair wages, supported by certifications such as Fair Trade or SA8000.

– Certifications and Green Labels: Certifications like GOTS (Global Organic Textile Standard), OEKO-TEX Standard 100, and bluesign® are critical benchmarks verifying that infant dress size charts and associated garments meet stringent environmental and safety criteria. These certifications facilitate trust and simplify compliance for international buyers.

– Transparency & Traceability: Digital tools enabling end-to-end supply chain visibility are becoming essential, enabling buyers to verify sustainable claims and ethical sourcing in real time.

By integrating sustainability and ethical sourcing into procurement strategies, B2B buyers not only mitigate reputational risks but also tap into growing consumer demand for responsible infant apparel.

Evolution of Infant Dress Size Charts: A B2B Perspective

Infant dress size charts have evolved significantly from rudimentary, one-size-fits-all approaches to sophisticated, data-driven tools integral to global apparel supply chains. Historically, sizing was regionally fragmented—U.S., European, and Asian markets each developed independent standards, often causing confusion and inefficiencies in cross-border trade.

Illustrative Image (Source: Google Search)

The rise of international trade and e-commerce catalyzed harmonization efforts, with standards like EN 13402 in Europe and ASTM guidelines in the U.S. providing frameworks for consistent measurement units and size labeling. For B2B buyers, this evolution means easier comparison of supplier offerings and reduced sizing errors across diverse markets.

Technological advancements now enable dynamic and interactive size charts, incorporating growth data analytics and customizable sizing options tailored to regional anthropometric profiles. This evolution supports more accurate inventory planning and product development, empowering B2B buyers worldwide to better meet market demands while optimizing supply chain efficiency.

By comprehensively understanding these market dynamics, sourcing trends, and sustainability imperatives, international B2B buyers can strategically navigate the infant dress size chart sector to secure competitive advantage and foster long-term partnerships.

Related Video: International Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of infant dress size chart

-

How can I verify the reliability of suppliers offering infant dress size charts internationally?

To vet suppliers effectively, request samples of their size charts and infant garments to assess accuracy and quality. Check for certifications like ISO or compliance with international textile standards. Verify their export history, client references, and responsiveness. Utilize third-party inspection services or sourcing agents in supplier countries (e.g., China, India) to conduct factory audits. This is especially crucial when sourcing from diverse regions such as Africa or South America, where manufacturing standards may vary. Transparent communication and documented quality assurance processes are key to minimizing risks. -

Is it possible to customize infant dress size charts to align with local market standards?

Yes, customization is often feasible and recommended to meet regional sizing preferences and cultural nuances. Many suppliers offer tailored size charts based on age, height, weight, and country-specific sizing norms (e.g., French or Italian sizes for Europe). Collaborate closely with your supplier to provide precise measurement parameters or local sizing data. Customization helps reduce returns and improves buyer satisfaction. Always clarify minimum order quantities (MOQs) and lead times for customized charts, as these may differ from standard offerings. -

What are typical minimum order quantities (MOQs) and lead times for infant dress size chart orders?

MOQs vary widely depending on the supplier and customization level, commonly ranging from 500 to 5,000 units per size or style. Standard size charts without customization generally have lower MOQs. Lead times average between 30 to 90 days, factoring in production, quality checks, and shipping. For buyers in regions like the Middle East or Africa, consider additional transit times and customs clearance. Negotiate MOQs and lead times upfront to align with your inventory strategy and cash flow, and explore flexible payment terms such as deposits or letters of credit to manage financial risk. -

What quality assurance measures and certifications should I expect from infant dress size chart suppliers?

Suppliers should comply with international safety standards such as OEKO-TEX Standard 100, which certifies textiles free from harmful substances, and ISO 9001 for quality management. Additionally, compliance with regional regulations like the EU’s REACH or CPSIA in the US is essential for infant clothing. Request documentation of these certifications and conduct random product inspections. A robust QA process includes pre-production samples, in-line inspections during manufacturing, and final audits before shipment to ensure size chart accuracy and garment safety. -

How do logistics and shipping considerations impact international orders of infant dress size charts?

Infant garments are generally lightweight but can be voluminous, affecting shipping costs. Choose between air freight for speed or sea freight for cost-efficiency, depending on urgency and order size. Be aware of import duties, taxes, and customs regulations in your country; for example, EU countries often have strict labeling and documentation requirements. Coordinate with freight forwarders experienced in cross-border shipments to optimize packaging and minimize delays. Tracking and insurance are recommended to safeguard against loss or damage during transit. -

What payment methods are most secure and practical for international B2B transactions in this sector?

Common payment methods include wire transfers (T/T), letters of credit (L/C), and escrow services. Letters of credit offer strong security by ensuring payment only upon meeting agreed shipment terms, beneficial for first-time supplier relationships. Wire transfers are faster but carry higher risk if the supplier is unverified. Consider payment platforms offering trade protection or partial upfront deposits combined with balance on delivery. Negotiating payment terms that balance risk and cash flow—such as 30% deposit and 70% after inspection—can protect your interests in diverse markets. -

How should I handle disputes related to discrepancies in infant dress size charts or product quality?

Establish clear contractual terms detailing size chart specifications, acceptable tolerances, and quality standards before placing orders. Include clauses for inspection rights, dispute resolution mechanisms, and penalties for non-compliance. In case of disputes, leverage third-party inspection reports and documented communications to support claims. Mediation or arbitration under international trade laws can be effective, especially when dealing with suppliers from different legal jurisdictions. Maintaining strong relationships and transparent dialogue often facilitates amicable resolutions. -

Are there regional sizing differences I should be aware of when importing infant dress size charts from Europe, Africa, or South America?

Yes, sizing standards vary significantly across regions. For example, European infant sizes often use height in centimeters, whereas South American sizes may follow age or weight-based metrics. African markets might have less standardized sizing, requiring more customization. Understanding these differences is critical to avoid mismatched inventory and returns. Collaborate with suppliers who provide multi-regional size conversion charts or offer flexible sizing solutions. Conduct market research or partner with local distributors to ensure your size charts align with end-customer expectations.

Strategic Sourcing Conclusion and Outlook for infant dress size chart

Strategic sourcing of infant dress size charts presents a critical opportunity for international B2B buyers to enhance market responsiveness and customer satisfaction. Understanding regional sizing variations—particularly across Africa, South America, the Middle East, and Europe—enables buyers to tailor procurement strategies that align with local consumer expectations and reduce returns or dissatisfaction. Leveraging standardized and adaptable size charts fosters stronger supplier relationships and streamlines inventory management, contributing to operational efficiency.

Key takeaways for buyers include prioritizing suppliers who offer clear, region-specific sizing data and flexibility in product customization. Incorporating comprehensive size guides that reflect the nuanced differences in infant growth patterns across target markets will differentiate offerings and build trust with end customers. Additionally, embracing digital tools and data analytics can optimize sizing accuracy and forecasting, reducing waste and enhancing profitability.

Looking ahead, international buyers should actively pursue partnerships with manufacturers and designers who demonstrate agility in sizing standardization and innovation. Investing in strategic sourcing that integrates global size insights will position businesses to capitalize on emerging trends and expanding infant apparel markets worldwide. Buyers are encouraged to initiate dialogues with suppliers now to co-develop sizing solutions that meet diverse market demands and drive sustainable growth.